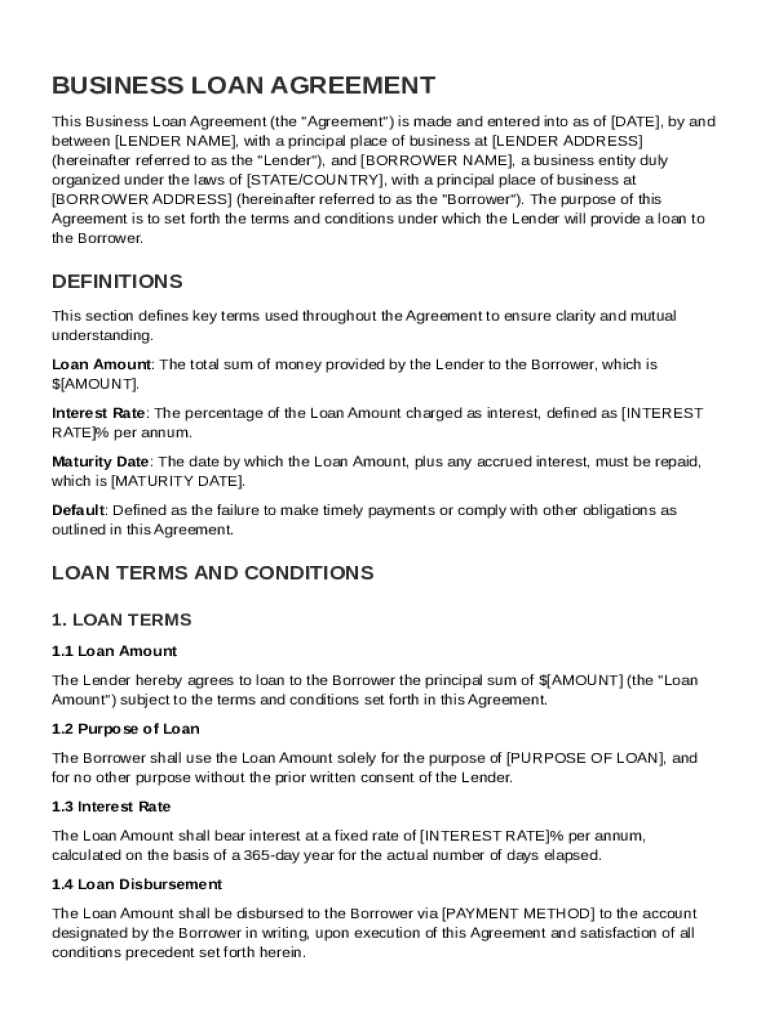

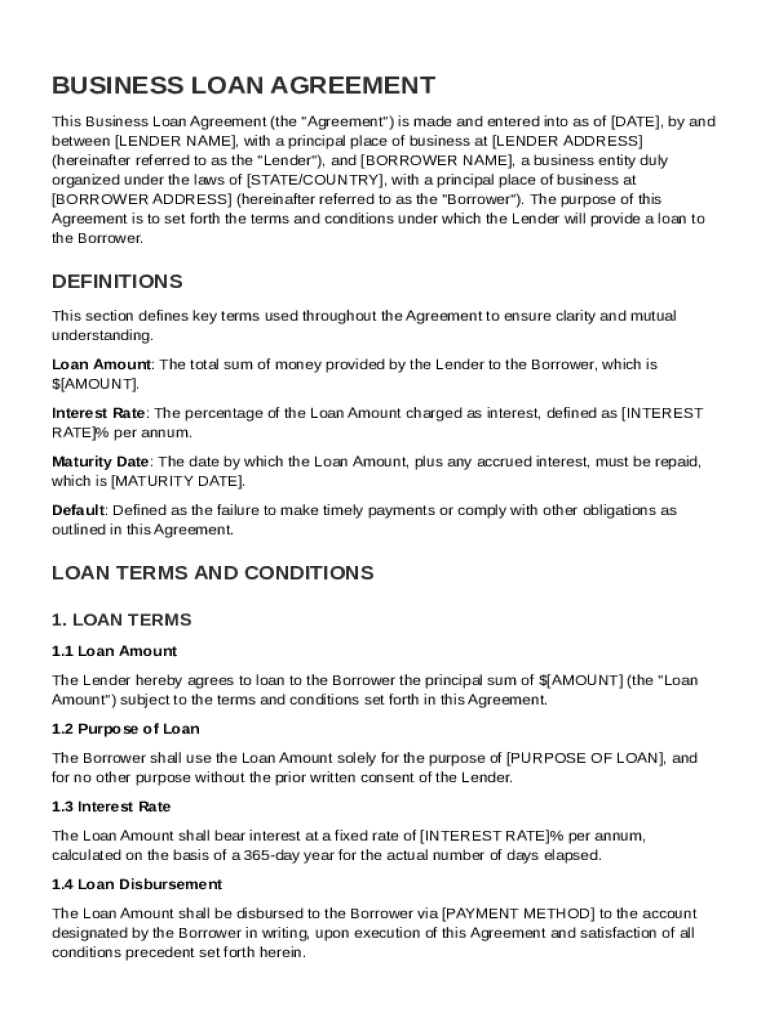

Business Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides a loan to a borrower, including definitions, loan terms, repayment schedule, representations and warranties, and events

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Business Loan Agreement Template

A Business Loan Agreement Template is a formal document that outlines the terms and conditions between a lender and a borrower for a business loan.

pdfFiller scores top ratings on review platforms

great

Easy to use.

Best Software ever!!

Very good

Easy, convenient

hands on and easy.....try it... you will be thoroughly satisfied

Who needs Business Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Business Loan Agreement Template on pdfFiller

What is a Business Loan Agreement?

A Business Loan Agreement is a formal contract between a lender and a borrower that outlines the terms under which a loan is provided. It holds significant importance as it helps safeguard the interests of both parties involved. A well-structured agreement minimizes misunderstandings by clearly stating the loan amount, interest rate, and maturity date.

Why is it important to have a structured loan agreement?

Having a structured loan agreement is paramount for both lenders and borrowers. It ensures that expectations are set and understood, helping avoid disputes that may arise due to ambiguity over terms. Additionally, it serves as a legal document that can be referred back to in case of disagreements.

What are common terms used in business loan agreements?

-

Refers to the total amount of money that is borrowed.

-

The percentage charged on the loan amount, which determines how much the borrower will pay back.

-

The date on which the loan must be fully repaid.

What are the key components of a Business Loan Agreement?

Understanding the fundamental elements of a Business Loan Agreement is crucial for effectively navigating its terms. Notably, the loan amount and purpose should be clearly defined, along with the applicable interest rate that reflects the agreement between the lender and borrower.

Another important component is the maturity date, which marks the deadline for repayment. Clear definitions of what constitutes a default in the agreement are also essential; this includes delays or failures to meet payment obligations.

How to fill out the Business Loan Agreement Template?

Filling out a Business Loan Agreement Template requires careful attention to detail. Follow a step-by-step approach to accurately complete the form, starting with the lender's and borrower's names and addresses, which must be clearly stated in the template.

-

Enter the full legal name of the lending institution or individual.

-

Include the name of the individual or entity borrowing the funds.

-

Provide the correct addresses for both parties to ensure legal correspondence.

Utilizing pdfFiller’s features can simplify the process of editing and signing the template, allowing for a streamlined experience when completing your agreement.

How to customize your agreement?

Customizing the template ensures that it meets the specific needs of your business. This may involve adding clauses or conditions tailored to the unique aspects of the loan, ensuring that the contract reflects agreed terms accurately.

pdfFiller’s editing tools facilitate modifications, providing a seamless way to update content while maintaining the document's integrity.

What are the benefits of eSigning and document management?

Electronic signatures have become crucial in business agreements, ensuring that documents are signed efficiently and securely. Utilizing pdfFiller allows users to manage and collaborate on documents in real time, tracking changes effectively.

What are the legal considerations for business loan agreements?

When drafting or utilizing a Business Loan Agreement, being aware of legal considerations is vital. Ensure compliance with local laws and regulations to avoid complications down the line.

Best practices include promoting clarity and mutual understanding in all agreements to reduce the likelihood of disputes. Recognizing and avoiding common pitfalls is also essential for achieving successful loan transactions.

What should you know about local regulations?

Understanding the legal framework governing loan agreements in your region is crucial for compliance. Loans may be subject to a variety of local laws that alter the terms or procedures involved in the agreement.

pdfFiller adapts to regional needs by providing templates and editing capabilities that comply with localized rules and regulations.

Where can find a sample business loan agreement?

Having a sample loan agreement as a reference can be beneficial. It can provide a generic structure from which to understand how clauses function within the agreement.

Examining sector-specific adaptations can further help clarify how different industries handle loan agreements, ensuring relevant terms are included in your document.

What other templates are available on pdfFiller?

pdfFiller offers a variety of related document templates beyond the Business Loan Agreement. These include various forms that assist in business financing and agreements.

Exploring pdfFiller’s toolkit provides users access to additional resources for comprehensive document management and editing solutions.

How to fill out the Business Loan Agreement Template

-

1.Download the Business Loan Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editing tool.

-

3.Begin by entering the lender's name and contact information in the designated fields.

-

4.Follow with the borrower's name and business details, including address and business structure.

-

5.Specify the loan amount requested in the appropriate section.

-

6.Clearly outline the loan terms, including interest rate, repayment schedule, and any collateral requirements.

-

7.Review the default terms and conditions stated in the agreement.

-

8.Include any additional clauses or stipulations relevant to the loan.

-

9.Finalize the document by adding signatures for both parties and the date of agreement.

-

10.Save the completed agreement and download it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.