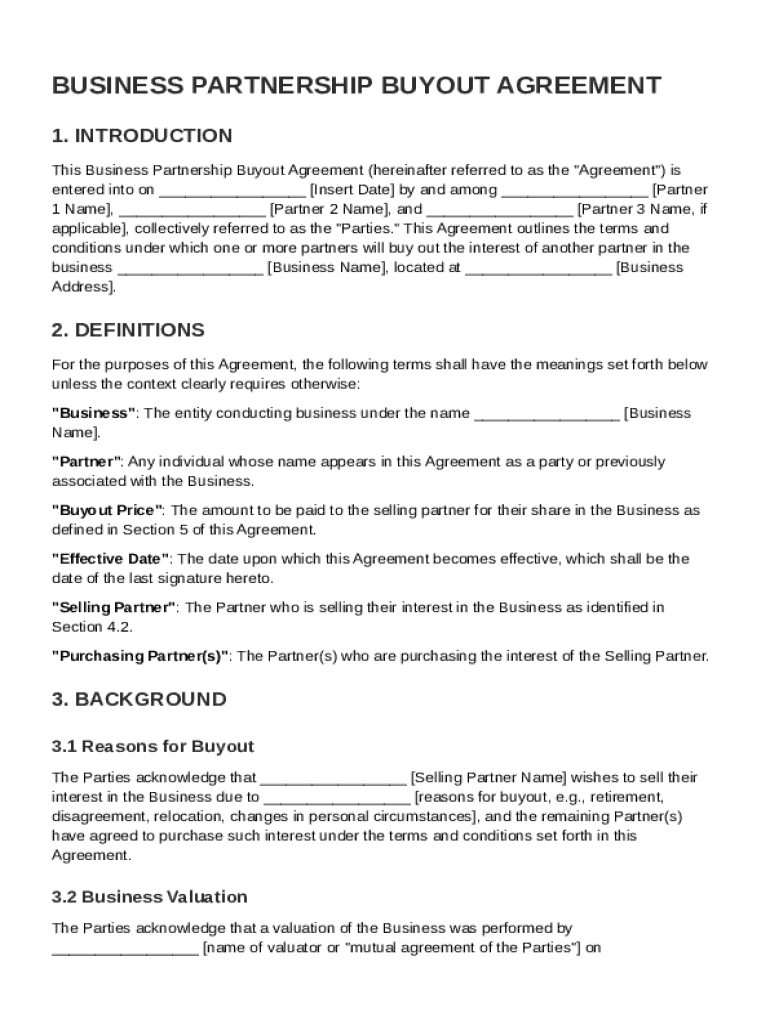

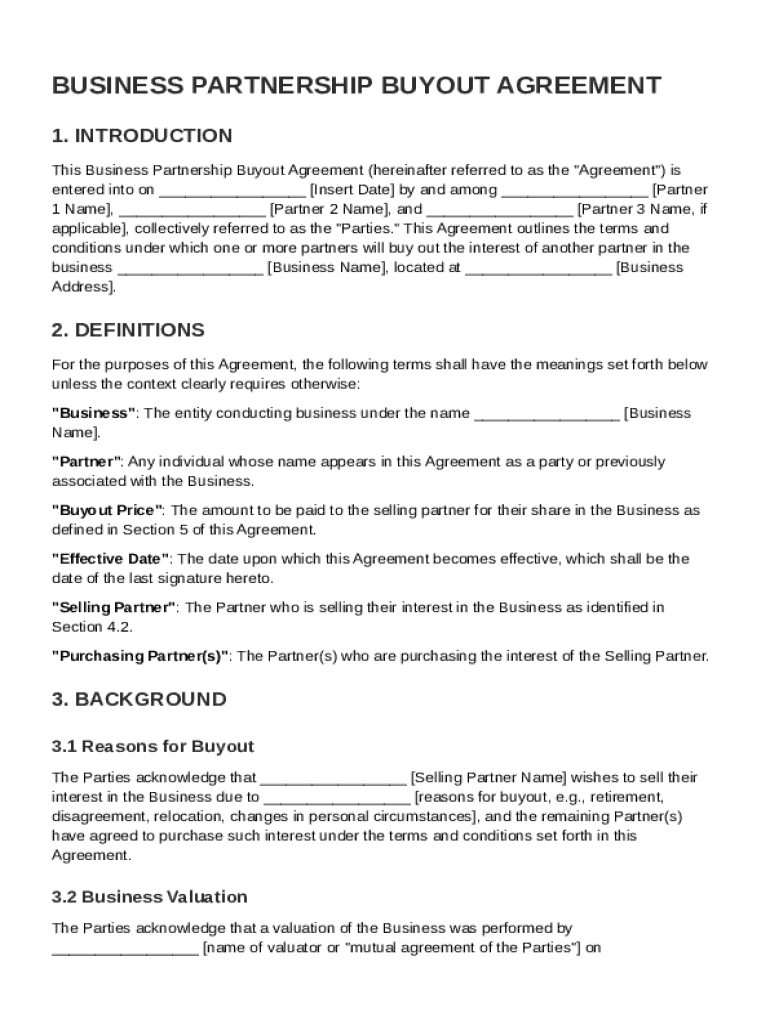

Business Partnership Buyout Agreement Template free printable template

Show details

This document outlines the terms and conditions under which partners can buy out the interest of another partner in a business, including valuation, payment schedule, and confidentiality provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Business Partnership Buyout Agreement Template

A Business Partnership Buyout Agreement Template is a legal document outlining the terms and conditions under which a partner may buy out another partner's share in a business partnership.

pdfFiller scores top ratings on review platforms

good

love their editing program, not hard to use

Its great

Great service

Everything was great

Excellent tool

Excellent tool, easy to use and navigate. Great features and UI!

Very usefull.

Very usefull.

Who needs Business Partnership Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a business partnership buyout agreement template

Understanding the Business Partnership Buyout Agreement

A business partnership buyout agreement is a legally binding document that delineates the terms under which a partner can exit a partnership. Having a formal agreement is crucial as it defines the process, terms, and conditions for the buyout. Without a buyout agreement, partners risk misunderstandings or disputes about valuation, payment terms, and responsibilities.

-

This agreement serves as a contract that outlines how a partner's interest in the business will be handled in the event of a buyout.

-

A formal buyout agreement helps ensure clarity and protects the financial interests of all parties.

-

Without the agreement, partners may face legal disputes, loss of business value, and difficulties in finding mutually agreeable buyout terms.

What are the key components of the buyout agreement?

Every business partnership buyout agreement should clearly outline the essential components to avoid future issues. These components include parties involved, effective dates, buyout price determination, and other specific provisions.

-

Identifies all partners in the agreement and their respective roles in the buyout process.

-

The effective date marks when the terms of the agreement become legally binding.

-

This section outlines how the business will be valued when calculating the buyout price.

-

Describes the methodology for determining the buyout price, ensuring fairness.

-

Clarifies which partners are selling their interest and which are purchasing, to avoid confusion.

Why might a partner initiate a buyout?

Partners might seek a buyout for various reasons, including personal circumstances such as retirement, financial distress, or disputes with other partners. Understanding these motivations is crucial for creating an effective buyout agreement.

-

Illich partners may wish to exit the partnership due to personal circumstances, differing visions for the business, or financial needs.

-

Life events like divorce, illness, or career changes can necessitate a buyout.

-

Options include mediation, restructuring the partnership, or drafting a buy-sell agreement to preemptively address conflicts.

How is fair buyout price determined in valuation process?

Valuing a business accurately is essential to ensure all partners feel satisfied with the buyout price. The valuation process may include different methodologies, each with varying impacts on the final price.

-

Common methods include asset-based, earning value, and market value approaches.

-

Factors to consider include the business type, industry standards, and whether partners agree on the preferred approach.

-

Including the valuation report in the agreement provides transparency and supports the agreed-upon buyout price.

-

Using neutral third-party evaluators can add credibility to the valuation process.

How do you fill out the buyout agreement template?

Filling out a buyout agreement template requires attention to detail to ensure all necessary information is included accurately. This includes following a structured process to capture essential data.

-

Begin by clearly identifying all parties and inserting effective dates, followed by specific terms related to valuation.

-

Filling in these fields is vital for clarity and legality, as they identify who is involved and how the business value was assessed.

-

PDFfiller provides tools to simplify document completion and allow easy collaboration among partners.

-

Ensure you use compatible formats and have the right security settings for signing.

What legal compliance & considerations should be made?

Legal compliance is critical in ensuring that a buyout agreement stands up to scrutiny in court. Variations in state laws can significantly affect the validity and enforceability of the agreement.

-

Different states may have specific regulations impacting partnership agreements and buyouts.

-

Neglecting to cover all scenarios can lead to loopholes that may be exploited in the future.

-

Consulting with a legal expert helps ensure that all potential risks are mitigated.

How can you manage post-buyout scenarios?

Managing the transition after a buyout is critical for the ongoing success of the business. It involves preparing remaining partners for the changes and planning for operational continuity.

-

Establishing a clear plan for duties and responsibilities assists in smooth operations post-buyout.

-

Implementing structured communication can reduce uncertainty and maintain morale among employees.

-

Understanding how a buyout affects future operations, partnership dynamics, and strategic direction is essential.

How can pdfFiller streamline the buyout process?

pdfFiller provides several features designed to simplify the document management process throughout the business partnership buyout journey. This includes detailed editing tools and signing capabilities.

-

pdfFiller allows users to edit, e-sign, and collaborate on documents in real-time.

-

With cloud-based access, partners can collaborate seamlessly, regardless of location, making the buyout process more flexible.

-

Follow the easy upload instructions provided by pdfFiller to ensure your document is ready for review and collaboration.

What are the final thoughts on buyout agreements?

In conclusion, a well-prepared business partnership buyout agreement template is crucial for partners looking to navigate a buyout successfully. Utilizing platforms like pdfFiller can simplify this process, making document completion and management more efficient.

-

A solid understanding of the agreement’s components, motivations for buyouts, and valuation processes are essential.

-

Online tools can considerably enhance the efficiency of generating and managing documents.

-

Regular reviews ensure the agreements remain relevant and effective as the business evolves.

How to fill out the Business Partnership Buyout Agreement Template

-

1.Begin by downloading the Business Partnership Buyout Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller platform.

-

3.Fill in the names of the partners involved in the agreement at the top of the document.

-

4.Specify the details of the partnership, including the date established and the nature of the business.

-

5.Outline the terms of the buyout, including the buyout price, payment method, and any relevant financial details.

-

6.Include any conditions to the buyout, such as non-compete clauses or confidentiality agreements.

-

7.Review the document to ensure all necessary information is included and accurately stated.

-

8.Once completed, save the document and return to pdfFiller to either print it or send it for electronic signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.