Business Purchase Deposit Agreement Template free printable template

Show details

This document outlines the terms and conditions for placing a deposit for the purchase of a business. It details the responsibilities of both the Buyer and Seller, including financial terms, due diligence

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

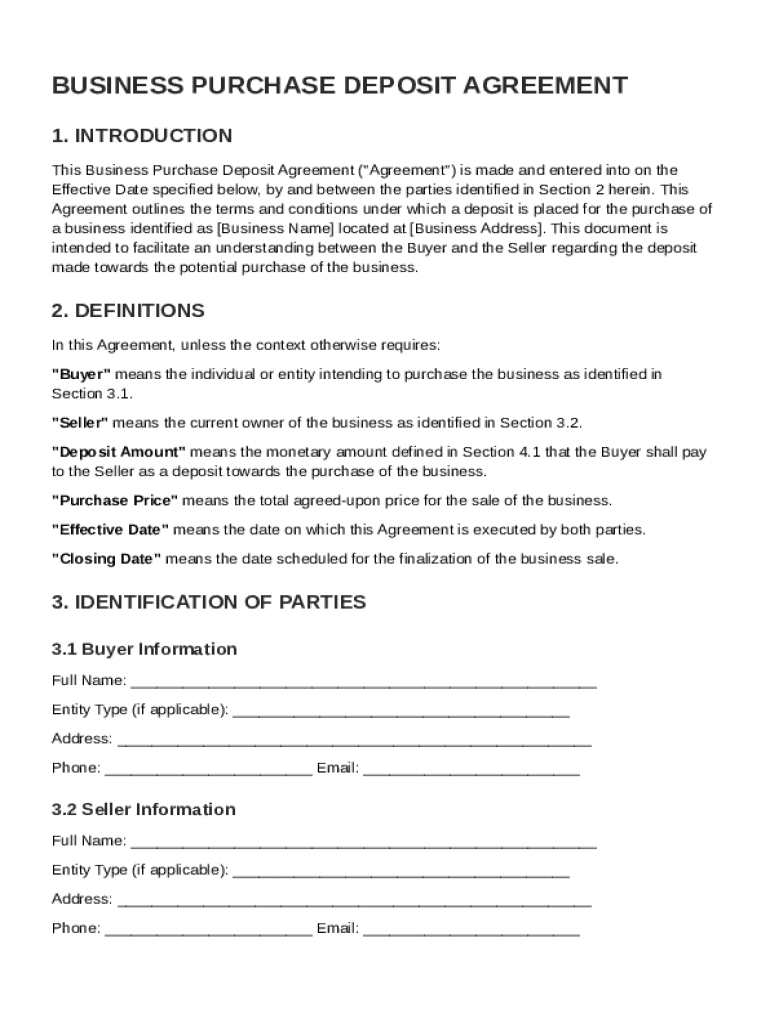

What is Business Purchase Deposit Agreement Template

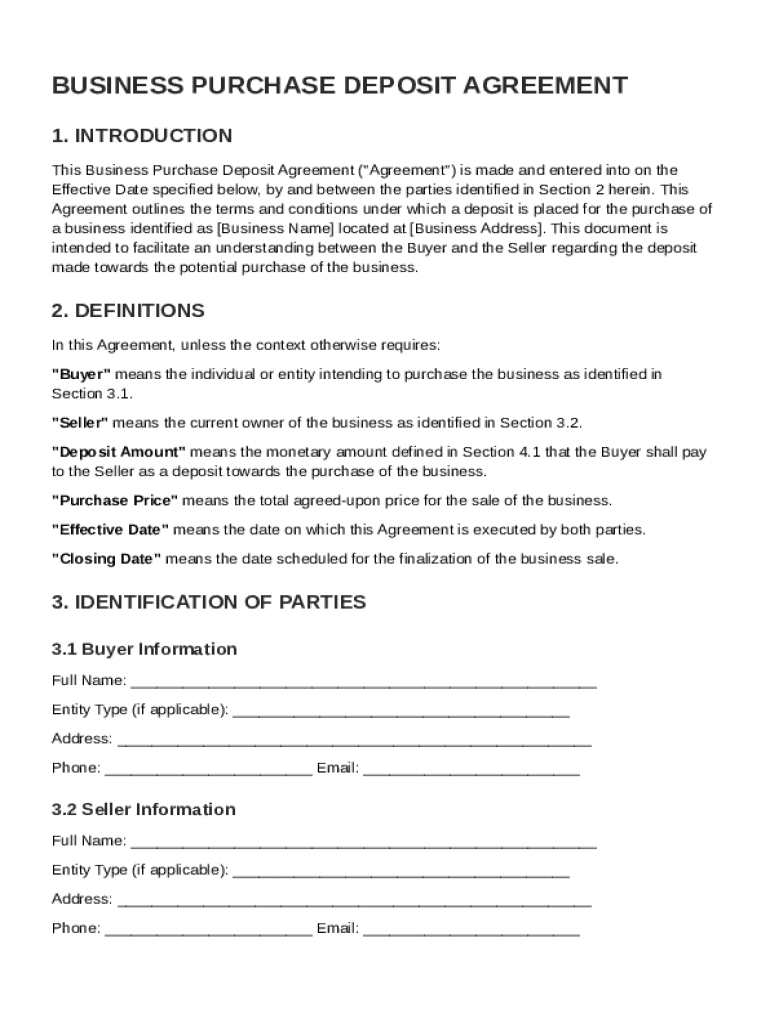

The Business Purchase Deposit Agreement Template is a legal document that outlines the terms and conditions regarding the deposit made by a buyer when purchasing a business.

pdfFiller scores top ratings on review platforms

Easy user interface

ALL FINE

I have not used this tool before.

Splendid

;,';,

l

][[]

[]]

=

seemed easy enough.

Who needs Business Purchase Deposit Agreement Template?

Explore how professionals across industries use pdfFiller.

Business Purchase Deposit Agreement Guide on pdfFiller

How to fill out a Business Purchase Deposit Agreement form

To fill out a Business Purchase Deposit Agreement form, first identify the parties involved—the buyer and the seller. Next, outline the deposit amount and payment terms. Specify the effective and closing dates, and ensure both parties sign the document. Utilize pdfFiller for seamless editing and electronic signing.

Understanding the Business Purchase Deposit Agreement

A Business Purchase Deposit Agreement is a crucial document that outlines the terms of a deposit made by a buyer to secure a business purchase. This agreement serves as a formal commitment for both parties and is fundamental in establishing trust in business transactions. Common scenarios requiring this agreement include sales of ongoing businesses, franchises, or partnerships requiring a business asset transfer.

-

The agreement protects both the buyer and seller by clearly outlining the terms of the deposit.

-

A well-drafted agreement prevents misunderstandings and secures transactions.

-

Scenarios include purchasing established businesses, entering joint ventures, or franchising.

Who needs a Business Purchase Deposit Agreement?

The Business Purchase Deposit Agreement is essential for various parties involved in business transactions. Primarily, buyers need this document to formalize their interest and secure their investment. Sellers utilize the agreement to ensure commitment from the buyer and to protect their interests in the transaction process.

-

Individuals or entities looking to purchase a business must ensure the deposit is legally secured.

-

Current business owners require the agreement to evaluate the buyer’s serious intent.

-

These professionals play a vital role in facilitating the sale and must ensure that all parties are compliant.

What are the key components of the agreement?

A comprehensive Business Purchase Deposit Agreement must include several critical components to protect both the buyer and seller. These components facilitate a clear understanding of responsibilities and expectations from the onset of the business transaction.

-

Clearly state the names and contact information of both buyer and seller.

-

Specify the amount of the deposit and how it will be applied towards the purchase.

-

Outline the total price of the business and how the deposit affects it.

-

Highlight these key dates to ensure all parties understand the timeline of the agreement.

What are the deposit terms explained?

Deposit terms are vital in a Business Purchase Deposit Agreement, specifying how and when the deposit is to be made. Clear terms help in avoiding disputes later on about the financial commitment involved.

-

The deposit amount should reflect a percentage of the purchase price, which can vary based on industry norms.

-

Different payment types, such as Bank Transfers or Certified Checks, have implications for security and traceability.

-

Detail consequences if payment is made late which could involve penalties or loss of deposit.

How do payment methods and processing work?

The choice of payment methods in a Business Purchase Deposit Agreement can significantly affect the transaction's efficiency and security. It's crucial to select a method that works best for both parties while ensuring safety against fraud.

-

Understanding the differences between bank transfers and certified checks is essential for a secure transaction.

-

Utilizing an escrow account can provide an additional layer of security for both parties by holding funds until the transaction is finalized.

-

Evaluating the security of different payment methods is critical to prevent financial loss.

What does navigating the agreement signing process entail?

Signing the Business Purchase Deposit Agreement should be a streamlined process, especially when using tools like pdfFiller. This allows for efficient collaboration while ensuring all parties are on the same page.

-

Utilize pdfFiller's easy-to-follow eSigning steps for a swift signing experience.

-

Engagement from all involved parties enhances transparency throughout the process.

-

Utilizing real-time tracking ensures everyone is aware of document changes and signing statuses.

What legal considerations and compliance issues should be noted?

Navigating the legal landscape concerning a Business Purchase Deposit Agreement can be complex, especially with varying regulations by region. Hence, understanding these legal obligations is paramount in avoiding pitfalls during the purchasing process.

-

It is vital to be aware of any local laws that may influence the structure of your agreement.

-

Ensure both parties are cautious about legal norms to avoid future disputes.

-

Seek professional advice when uncertainties arise during the process.

How to utilize pdfFiller for document management?

pdfFiller offers exceptional features for managing a Business Purchase Deposit Agreement, simplifying the creation and editing process. With access to various document management tools, users are equipped for seamless collaboration.

-

Customizing the agreement template is a straightforward process with pdfFiller's user-friendly interface.

-

Cloud-based services provide flexibility and access from anywhere, facilitating remote collaboration.

-

Utilize collaborative tools on pdfFiller to enhance teamwork and document efficiency.

How to fill out the Business Purchase Deposit Agreement Template

-

1.Download the Business Purchase Deposit Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Begin by filling in the names and contact information of both the buyer and seller at the top of the document.

-

4.Specify the business to be purchased, including its name and a brief description.

-

5.Indicate the deposit amount being paid by the buyer and outline any conditions attached to this deposit.

-

6.Include the timeframe for the deposit and any terms for its return if the sale does not go through.

-

7.Review the entire document for accuracy and legal completeness.

-

8.Finally, save your completed document and share it with all parties involved for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.