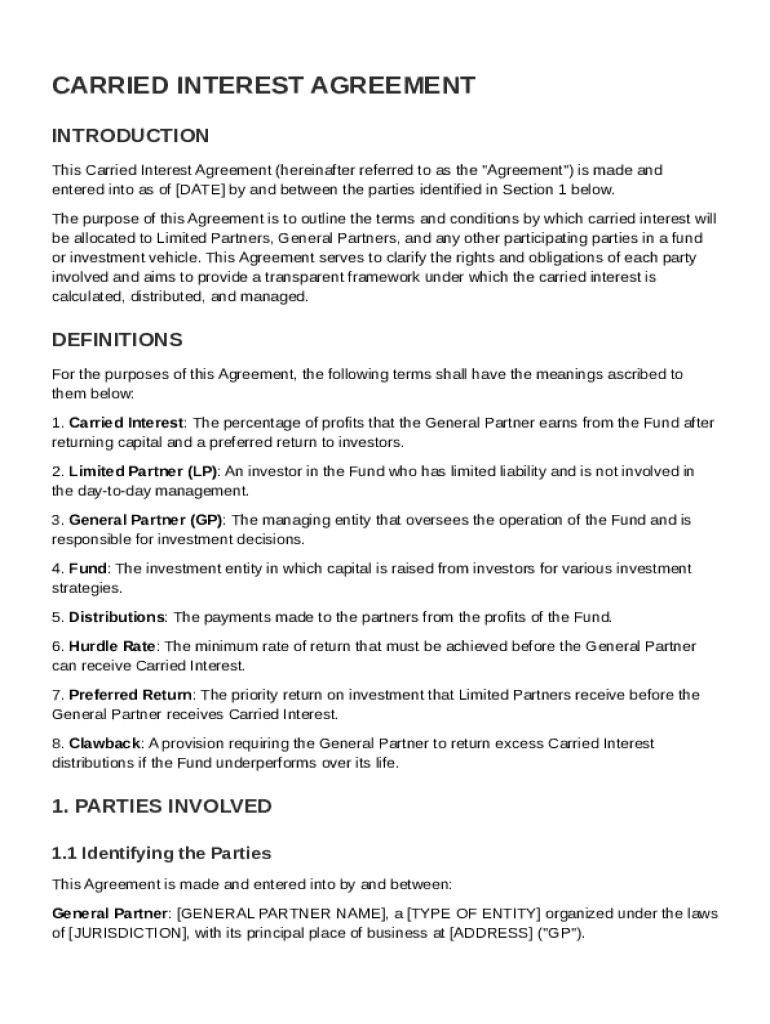

Carried Interest Agreement Template free printable template

Show details

This document outlines the terms and conditions for the allocation of carried interest to Limited Partners, General Partners, and other parties involved in an investment fund.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

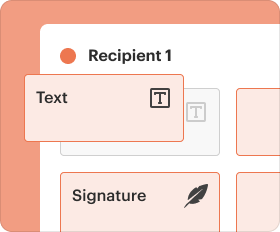

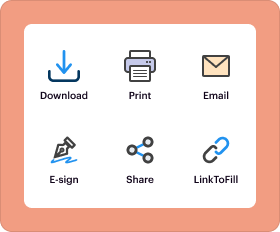

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Carried Interest Agreement Template

A Carried Interest Agreement Template is a legal document outlining the distribution of profits among partners or investors in a business venture.

pdfFiller scores top ratings on review platforms

So Far So Good

Easy to use

Very easy to use

Practical

PDFfiller makes finding and editing a document easy, useful, and practical. It also keeps these important documents in one location for a trouble free experience.

Very easy to use

Very easy to use, didnt expect it to be this good

FINE

IT TOOK FOREVER TO FIRGURE OUT HOW TO PRINT

Who needs Carried Interest Agreement Template?

Explore how professionals across industries use pdfFiller.

Carried Interest Agreement Guide on pdfFiller

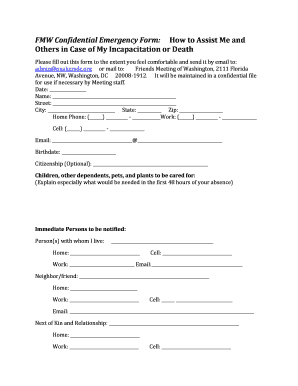

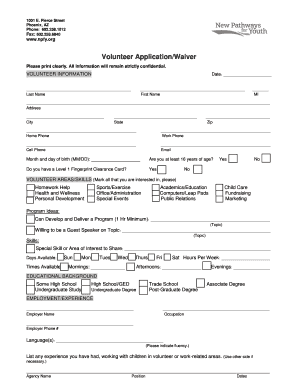

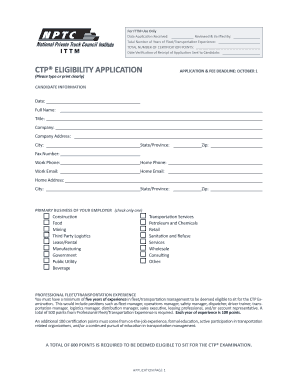

How to fill out a Carried Interest Agreement form

Filling out a Carried Interest Agreement is essential for defining the profit-sharing structure between General Partners and Limited Partners in an investment fund. Ensure to include all essential details like party names and their roles, specifics on profit distributions, and signature requirements. Utilize pdfFiller's tools for seamless completion.

What are the fundamentals of Carried Interest Agreements?

Carried Interest Agreements are critical in the realm of investment funds as they outline how profits are shared. This agreement not only defines the financial incentives for General and Limited Partners but also brings much-needed clarity to investment operations.

-

Carried interest refers to the share of profits that the fund managers, known as General Partners (GPs), receive as compensation after returning the initial capital to investors.

-

These agreements significantly influence the motivation and performance of fund managers, aligning their interests with those of the investors.

-

A well-drafted agreement helps mitigate disputes by clearly defining roles and profits, promoting trust among users.

What key terminology should be understood?

Understanding the specific terms involved in Carried Interest Agreements is crucial for all parties. These terms lay the foundation for their rights and responsibilities.

-

The earnings that GPs receive after the capital has been returned to investors.

-

The investors in the fund who have limited liability and are only financially responsible up to their investment amount.

-

The manager of the fund responsible for making investment decisions and managing fund operations.

-

A collective pool of capital created to invest in various financial assets.

-

The process of sharing profits among GP and LP as described in the agreement.

-

The minimum return investors must receive before GPs are entitled to share profits.

-

A set return rate that pays LP before any profits are given to GPs.

-

A provision that allows LP to reclaim overpayments due to excess distributions.

How to identify parties involved?

Accurately identifying the General Partner and Limited Partners in a Carried Interest Agreement is vital for legal compliance. Clear identification mitigates potential conflicts and ensures all parties understand their roles.

-

Each party must be explicitly named and described in the agreement to establish their legal rights and responsibilities.

-

Ensure the identification meets local regulations and reflects the parties' full legal names.

-

Take advantage of interactive forms on pdfFiller to input and check necessary details seamlessly.

How can the agreement be structured?

Structuring a Carried Interest Agreement requires a clear understanding of its components. A well-organized structure not only aids clarity but also enhances enforceability.

-

Essential sections include dates, involved parties, and signature lines.

-

Incorporate clauses related to profit sharing, management responsibilities, and compliance obligations.

-

Enhance the agreement's structure and formatting through pdfFiller, which offers editing functionalities.

What editing and customization options are available?

pdfFiller provides comprehensive tools for editing Carrried Interest Agreements, making it easy to customize the document as per legal and personal requirements. Regular updates ensure compliance with local laws.

-

Users can edit templates directly, allowing adjustments to be made quickly.

-

Adhering to local jurisdictional requirements is crucial to avoid future disputes.

-

Always have legal professionals review edited agreements to safeguard against legal pitfalls.

How to fill out the Carried Interest Agreement correctly?

Filling out your Carried Interest Agreement accurately is fundamental to ensure all parties agree on the investment structure. Mistakes can lead to disputes down the line.

-

Follow clear instructions provided within the form to ensure that all necessary fields are completed.

-

Common mistakes include failing to define profit-sharing percentages or not including relevant dates.

-

pdfFiller offers various templates tailored to different investment structures to simplify the submission process.

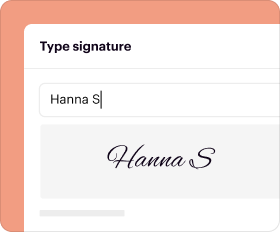

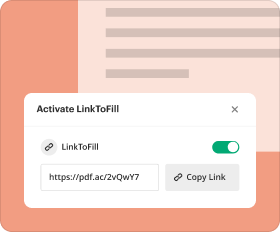

How to sign and manage the Agreement via pdfFiller?

Signing the Carried Interest Agreement electronically through pdfFiller simplifies collaboration and ensures all parties can access the agreement anytime. This feature makes management efficient.

-

Utilize pdfFiller's eSigning capability to formalize the agreement quickly.

-

Keep track of document versions through pdfFiller, ensuring everyone has access to the latest updates.

-

Use pdfFiller's collaboration tools for real-time review and comment among stakeholders.

What are the best practices and compliance considerations?

Best practices in drafting a Carried Interest Agreement ensure its longevity and enforceability. Pay attention to legal nuances that can heavily impact the agreement.

-

Consult legal expertise while drafting to prevent issues related to amendment and enforcement.

-

Many teams face challenges related to profit distribution fairness; proactive planning helps mitigate these.

-

Document regularly to ensure compliance with evolving regulations and practices.

How to fill out the Carried Interest Agreement Template

-

1.Access the Carried Interest Agreement Template on pdfFiller.

-

2.Begin by entering the names of the parties involved in the agreement, ensuring accurate spelling and full legal names.

-

3.Fill in the date of the agreement at the designated section to establish when the terms began to take effect.

-

4.Specify the percentage of carried interest that each party will receive, making sure it aligns with the agreed terms.

-

5.Indicate any conditions for distribution, such as profit thresholds or timelines for payout.

-

6.Review any sections regarding capital contributions to ensure that all monetary inputs are correctly detailed.

-

7.Include terms related to termination of the agreement, such as conditions under which the agreement can be rescinded.

-

8.Once all sections are filled out accurately, proofread the document for any missing information or errors.

-

9.Save your completed document, and if necessary, share it with all involved parties for their review and signature.

-

10.Finalize the agreement by collecting signatures, which can be done electronically through pdfFiller if preferred.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.