Cash Deposit Agreement Template free printable template

Show details

This Agreement formalizes the terms and conditions for cash deposits accepted by a financial institution, detailing the rights and responsibilities of both the depositor and the financial institution.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Cash Deposit Agreement Template

A Cash Deposit Agreement Template is a formal document outlining the terms and conditions under which cash deposits are made between parties.

pdfFiller scores top ratings on review platforms

I like best that it's free, but I also like to be able to edit my documents

Quick and easy. Alignment of text is great.

Awesome, please increase the 5 file upload and print limit!

Just learning. Fairly intuitive.

perfect.

Very very useful!

Who needs Cash Deposit Agreement Template?

Explore how professionals across industries use pdfFiller.

Cash Deposit Agreement Template Form Guide

How to fill out a cash deposit agreement template form

To fill out a Cash Deposit Agreement template form, gather necessary information about the parties involved, specify the details of the cash deposit, and ensure understanding of all terms before finalizing the document. Use a platform like pdfFiller for easy editing and eSign capabilities.

Understanding the cash deposit agreement

A Cash Deposit Agreement is a legally binding document that outlines the terms and conditions regarding a cash deposit made by an individual or entity. This agreement is essential to formalize the conditions under which the deposit is made, safeguarding both the depositor and the financial institution.

-

The Cash Deposit Agreement serves to clarify the expectations and responsibilities of both parties involved in the deposit.

-

Formalizing terms helps to prevent misunderstandings and conflicts that might arise in the future.

-

Understanding terms like Depositor, Financial Institution, Deposit Amount, and related definitions is crucial for filling out the agreement correctly.

Identifying the parties involved

Every Cash Deposit Agreement requires accurate details about the parties involved. This ensures that all contact information is correct and reflects the respective individuals or organizations treated in the agreement.

-

Include full name, company name, and complete contact details including address, city, state, zip code, phone number, and email address.

-

Record the name of the financial institution along with branch location and contact information to facilitate future communication.

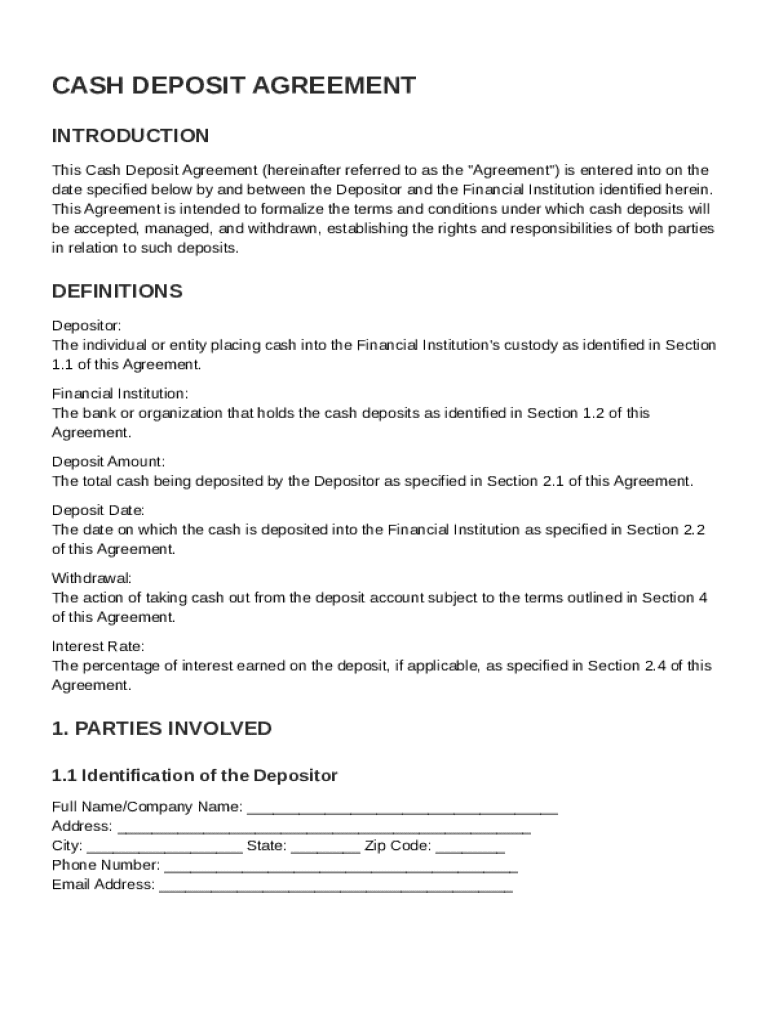

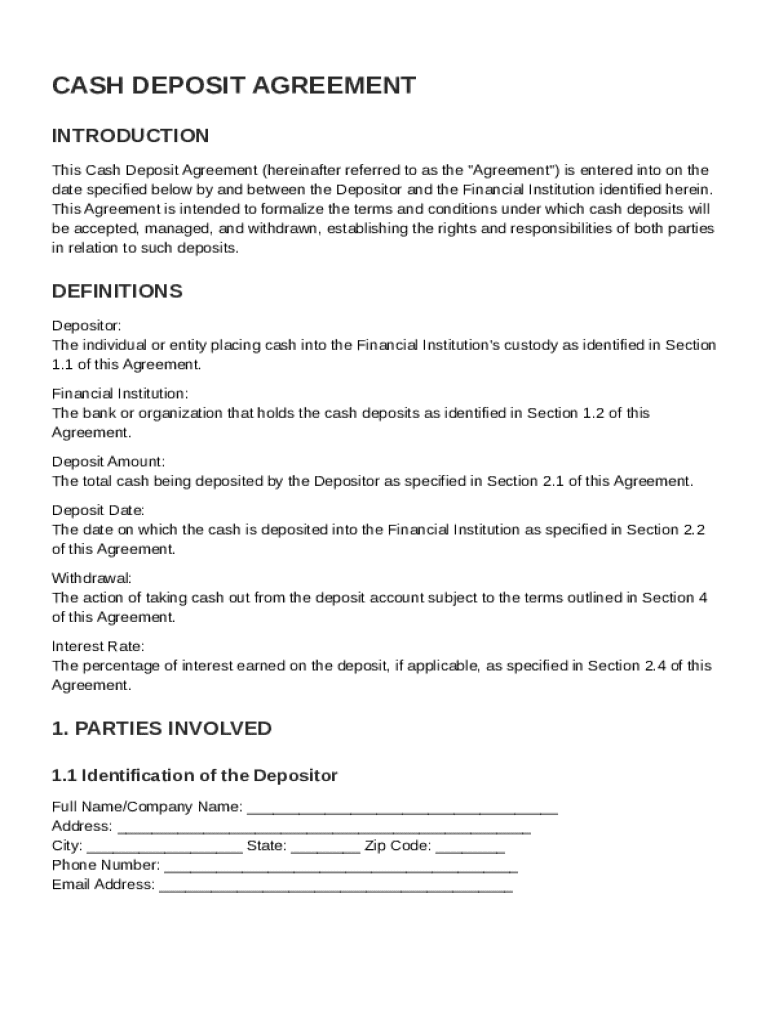

Details of the cash deposit

The details of the cash deposit are fundamental to the agreement. It dictates the amount deposited as well as associated terms of the deposit.

-

It's essential to specify the deposit amount, as it is foundational for the agreement.

-

Clearly state the date when the deposit is made, as this begins the timeline for account activity.

-

Understanding the maturity period of the deposit can influence future financial decisions.

-

Summarizing potential interest rates associated with the deposit enhances financial literacy.

Completing the cash deposit agreement

Successfully completing the Cash Deposit Agreement requires careful attention to detail and a thorough understanding of how to fill out the template.

-

Follow guided steps for filling out the template accurately, ensuring all necessary information is included.

-

Utilize tools like pdfFiller for effective customization and editing of the agreement.

-

Implement best practices for signing and deploying the Agreement to maintain its legality and significance.

Managing your cash deposits

Post-agreement management is crucial for optimizing the benefits of your cash deposit. Knowing how to navigate withdrawal procedures and amend your agreement is integral.

-

Understanding how to properly withdraw from your cash deposits can facilitate effective cash management.

-

Guidelines for managing both types of deposits should be clearly defined.

-

Knowing when and how to amend your Agreement can be beneficial as financial circumstances change.

Helpful guides and tools for users

Accessing additional resources can significantly enhance your understanding and efficiency when working with cash deposits.

-

Navigate to resources and guides that explain cash deposit processes in depth.

-

Utilize interactive tools that assist in document management and streamline workflows.

-

Explore other forms/templates related to cash deposits available on the pdfFiller site.

Contact information for further assistance

When in doubt, having access to customer service and support resources is invaluable for users.

-

Understand how to contact customer service for inquiries regarding the cash deposit agreement form.

-

Access to resources on pdfFiller's platform can help users find answers to frequently asked questions.

-

Inquire about feedback methods to receive personalized assistance.

How to fill out the Cash Deposit Agreement Template

-

1.Obtain the Cash Deposit Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editing interface.

-

3.Begin by entering the date at the top of the document.

-

4.Fill in the names and contact information of both parties involved in the agreement.

-

5.Specify the amount of cash being deposited in the designated field.

-

6.Clearly outline the purpose of the deposit, such as rental security or advance payment.

-

7.Include any additional terms and conditions agreed upon by both parties.

-

8.Review all entered information for accuracy and completeness.

-

9.Save your changes and download the filled-out agreement as a PDF or print it directly from pdfFiller.

What is a cash deposit agreement?

Cash Deposit Agreement . ' means the agreement dated on or about the Closing Date between the Issuer and the Cash Deposit Bank in relation to the establishment and operation of the Cash Deposit Account.

How do you write a deposit agreement?

How To Create a Deposit Agreement? Define the General Purpose. The first section for any agreement should be the statement of purpose. Identify the Parties. Describe the Purchase/Lease/Investment. Provide Payment Specifications. Make a Termination Clause. Protect Privacy.

How do you write a cash deposit?

Write the date of the deposit. Mention the deposit amount in both words and numbers. Add denomination details (like how many notes of ₹500, ₹100, etc). If you're filling deposit slip for a cheque deposit, mention the cheque number and bank name.

How to justify a cash deposit?

Cash receipts may be on account of withdrawals which are previously made by the assessee or on account of exempted income earned by the assessee in such cases if the assessee is receiving notice from income tax then the assessee can present that cash deposited is on account of previous unutilised withdrawals or from

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.