Cash Pooling Agreement Template free printable template

Show details

This document establishes the terms and conditions for cash pooling among a Parent Company and its subsidiaries, aimed at optimizing cash management, improving liquidity, and reducing interest expenses.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

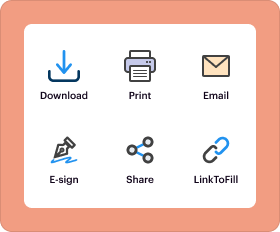

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Cash Pooling Agreement Template

A Cash Pooling Agreement Template is a legal document that outlines the terms and conditions for managing pooled cash resources among multiple accounts within an organization.

pdfFiller scores top ratings on review platforms

DE9 was cumbersome, but was able to complete it with my limited knowledge

Needed two W-2 forms for our employees, PDFfiller took care of us. Great forms, great service, thanks!

it okay but i have trouble lining my text into the form

OK. Was not clear that filling out the red form would automatically update to remaining forms.

Graphic arrows in the pdf are represented by the letter U. Can't move inserted text to new location. Circle is useless, odd shape, can't resize without border getting too thick and covering item to circle.

IF I WERE MORE EXPERIENCED ON MY MAC, IT WOULD HAVE BEEN MUCH EASIER. ONCE I LEARND MY WAY AROUND YOUR SITE THE NEXT FILE WAS EASY.

Who needs Cash Pooling Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to cash pooling agreements

TL;DR: How to fill out a Cash Pooling Agreement Template form

To fill out a Cash Pooling Agreement Template form, gather essential details such as participant information and terms relevant to cash pooling. Specify the structure of the cash pooling arrangement and ensure compliance with legal requirements. Use pdfFiller to edit, eSign, and manage the document efficiently.

What are cash pooling agreements?

Cash pooling agreements are strategic financial arrangements among companies, allowing them to manage their liquidity more effectively. They centralize cash resources, facilitating optimal cash management and reducing costs associated with borrowing. Understanding how cash pooling works can empower businesses to leverage their assets more strategically.

-

Cash pooling is the practice of consolidating cash balances from multiple accounts into a single master account for more efficient cash management.

-

The primary goal is to optimize liquidity, reduce banking fees, and enhance interest yield for corporations.

-

Essential components include participant details, definitions, terms, and compliance confirmations.

What does a Cash Pooling Agreement include?

-

Information about each participating company, including names and addresses, is crucial for establishing the agreement.

-

Clear definitions of terms related to cash pooling help avoid ambiguity in the agreement's interpretation.

-

A detailed explanation of why the agreement is being established grounds its legal validity.

-

Confirmation that all terms comply with regulatory requirements is vital for the agreement's enforceability.

How do cash pooling structures operate?

Cash pooling structures can either be physical or notional, each serving different corporate needs. Understanding their dynamics can help companies select the best option for their liquidity management.

-

Physical pooling involves transferring funds between accounts, while notional pooling allows for tracking cash balances without actual transfers.

-

The master account is pivotal in managing the overall cash balance, simplifying transfers and fund management.

-

Sweep transactions regularly move funds between accounts to optimize interest earnings.

-

Settlement periods refer to the time frame for transferring funds among participants, impacting liquidity.

What are the strategic goals of cash pooling arrangements?

Strategically, cash pooling arrangements are designed to enhance liquidity and lower costs associated with borrowing. Companies can maximize interest earnings and streamline their treasury management processes through effective cash pooling.

-

Cash pooling can significantly improve the availability of cash when needed.

-

By centralizing excess funds, companies can minimize their need for external financing.

-

Pooling funds optimally can lead to better interest returns on cash deposits.

-

A centralized approach allows for better control of cash mobilization and risk management.

What legal and regulatory considerations must be addressed?

Legal and regulatory frameworks significantly impact how cash pooling agreements are structured. Ensuring compliance is not just about law; it safeguards companies from potential financial penalties.

-

The legal context dictates how cash pooling can be legally executed in each jurisdiction.

-

Companies must adhere to the specific laws regarding intercompany transactions and cash management.

-

Properly drafted intercompany agreements are crucial for maintaining regulatory compliance.

What are the implementation steps for corporates?

Establishing a cash pooling arrangement involves several key steps. Corporates must proceed methodically, ensuring each detail is meticulously planned and documented.

-

Identify participants, define terms, and draft the agreement based on needs.

-

Ensure clarity in each clause, and double-check for compliance with laws.

-

Assess the financial health and strategic goals of each candidate before inclusion.

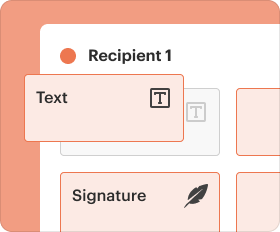

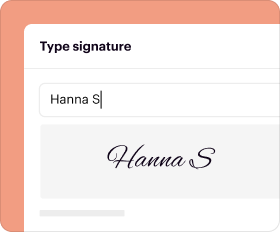

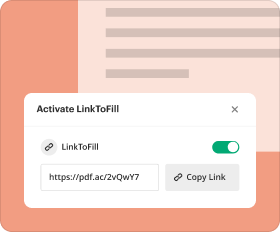

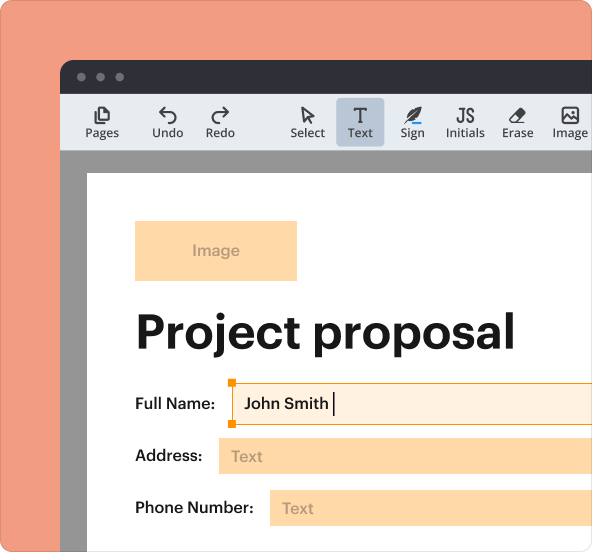

How can you manage your cash pooling agreement with pdfFiller?

Managing cash pooling documents is streamlined through pdfFiller, a cloud-based platform designed to enhance document management. With tools for editing and collaboration, pdfFiller truly empowers users.

-

Users can easily update critical details and obtain electronic signatures, simplifying the agreement process.

-

Accessing documents on the cloud means you can work from anywhere, anytime.

-

Leveraging tools for reminders and tracking can greatly enhance document lifecycle management.

What are some case studies and real-world examples?

Analyzing real-world examples of companies utilizing cash pooling can yield valuable insights. Each case highlights strategies, outcomes, and best practices to consider.

-

Case studies demonstrate how major corporations effectively managed their cash flow through pooling.

-

Different pooling strategies lead to distinct outcomes, elucidating best practices.

-

Companies share their experiences, detailing both successes and challenges in cash pooling.

How to fill out the Cash Pooling Agreement Template

-

1.Open the Cash Pooling Agreement Template on pdfFiller.

-

2.Start by entering the parties involved in the agreement, including their names and addresses.

-

3.Specify the type of cash pooling arrangement (notional or physical).

-

4.Fill in the details regarding the individual accounts that will be part of the cash pooling structure.

-

5.Include terms on how funds will be transferred between accounts and any conditions for withdrawal or deposits.

-

6.State the interest calculations, if applicable, and how surpluses will be managed.

-

7.Review all entered information for accuracy and completeness before finalizing the document.

-

8.Apply any necessary signatures from authorized representatives to validate the agreement.

-

9.Save the completed document in your preferred format or print it directly from pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.