Charge Account Agreement Template free printable template

Show details

This document outlines the terms and conditions for the extension of credit from a Creditor to a Customer, detailing responsibilities, payment terms, and processes for account management and termination.

We are not affiliated with any brand or entity on this form

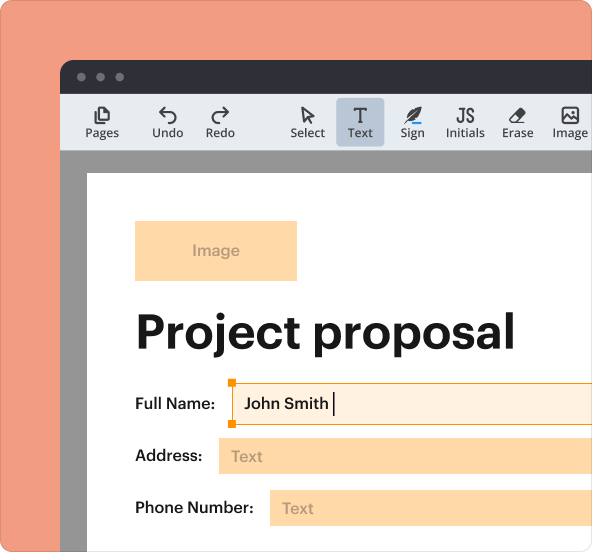

Why pdfFiller is the best tool for managing contracts

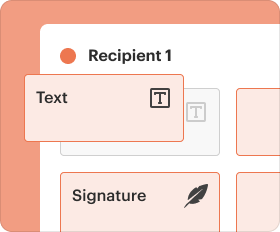

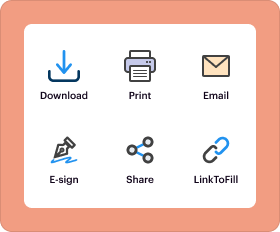

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Charge Account Agreement Template

A Charge Account Agreement Template is a formal document outlining the terms and conditions under which a customer can charge purchases to an account.

pdfFiller scores top ratings on review platforms

Have used the service once so far, but it has been easy to use and I am very satisfied with the results so far

I love it

excelent

BEST

its good

Convenient and informative

It's nice to know that there is some help I can ask when it comes to files, it can be complicated sometimes.

Who needs Charge Account Agreement Template?

Explore how professionals across industries use pdfFiller.

Charge Account Agreement Guide

What is a charge account agreement?

A Charge Account Agreement is a legal document between a creditor and customer that outlines the terms of credit extended to the customer. It serves to define repayment obligations, interest rates, and credit limits, ensuring both parties understand their rights and responsibilities.

This agreement is vital for establishing a formal relationship between the creditor, who provides the goods or services on credit, and the customer, who incurs the debt. Understanding this agreement is crucial for managing financial health and avoiding defaults.

What are key definitions in a charge account agreement?

-

A Charge Account is a line of credit provided by a creditor, allowing customers to purchase goods or services and pay for them later.

-

The creditor is the entity that provides the credit and holds the right to receive payments for outstanding debts.

-

The customer is the individual who borrows money or credit from the creditor, agreeing to repay under specified terms.

-

The interest rate represents the cost of borrowing, expressed as a percentage of the borrowed amount, which impacts total repayment due.

-

The billing cycle denotes the time period between statement generations, detailing purchases, payments, and the amount owed.

-

Default occurs when the customer fails to meet repayment terms, potentially leading to penalties or legal action.

How do you qualify for a charge account?

-

Complete a formal credit application, including personal and financial information.

-

Demonstrate creditworthiness by showing good credit history and low debt-to-income ratios.

-

Provide necessary financial documents, such as income statements and credit histories, to support your application.

-

Some creditors may have additional specific criteria based on their risk assessment processes.

What is the application process for a charge account?

-

Begin by submitting your application online or at specified locations as indicated by the creditor.

-

Ensure all required supporting documents are included to avoid delays.

-

Be prepared for the creditor to request additional information or clarification during their review.

-

Expect a notification regarding approval or denial typically within a few business days.

What terms of credit should you understand?

-

Understand your credit limit, which is the maximum amount you can charge on your account.

-

Know how interest rates are calculated and how they affect the total cost of your purchases.

-

Familiarize yourself with the payment schedule, including due dates and minimum payment requirements.

-

Be aware of the consequences of defaulting on your account, which may include increased interest rates and collection actions.

How can pdfFiller help manage your charge account agreement?

-

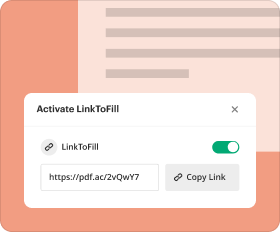

Easily access the Charge Account Agreement Template through pdfFiller's platform.

-

Use pdfFiller’s intuitive editing tools to modify your agreement with step-by-step guidance.

-

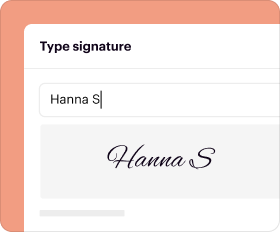

Securely eSign your charge account agreement directly in pdfFiller, facilitating a quick turnaround.

-

Utilize collaboration tools within pdfFiller to work with team members on the agreement in real-time.

How to fill out the Charge Account Agreement Template

-

1.Download the Charge Account Agreement Template from pdfFiller's library.

-

2.Open the template in pdfFiller.

-

3.Begin filling out the form by entering the name and address of the customer in the designated fields.

-

4.Provide the account number that will be associated with this agreement.

-

5.Specify the terms of the charge account, including the credit limit and payment due dates.

-

6.Fill in any applicable fees or interest rates relevant to the charge account.

-

7.Include signatures from both the customer and an authorized representative from the business to validate the agreement.

-

8.Review all entered information for accuracy.

-

9.Save the completed agreement to your device or share it directly through pdfFiller's sharing options.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.