Charitable Gift Agreement Template free printable template

Show details

This document outlines the terms and conditions of a charitable gift made by a Donor to an Organization, detailing the gift description, purpose, donor representation, acknowledgment, tax considerations,

We are not affiliated with any brand or entity on this form

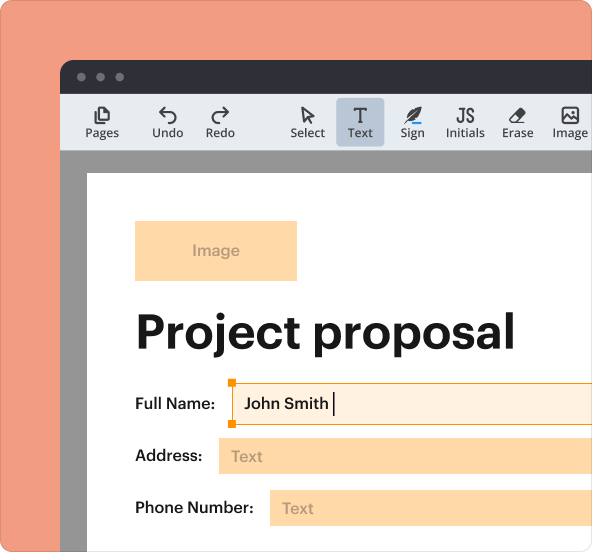

Why pdfFiller is the best tool for managing contracts

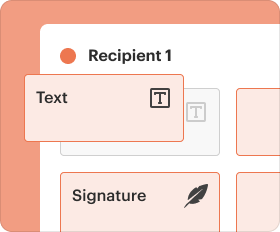

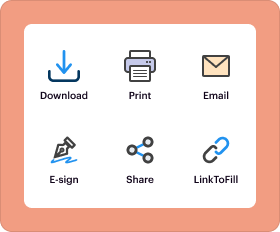

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

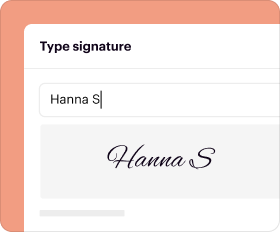

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Charitable Gift Agreement Template

A Charitable Gift Agreement Template is a legal document outlining the terms and conditions of a donation made to a charitable organization.

pdfFiller scores top ratings on review platforms

It has been a great asset to me and has allowed me to communicate with my employer which is located in CT.

So far it has been good. I am still new and learning so once I use it more I will be happy to review again.

PDF Filler save time and easy to use. I would recommend this to a friend.

Exceptional ease of use and a fast learning curve

I enjoy the flexibility. I only wish that there were fonts available with the ability to chose your own font size.

Easy to use, and very useful, but some symbols are not explained. They have a very large number of forms, but some are not the latest version. Nevertheless, it is addictive and once you get used to PDFfiller you will always come back for more.

Who needs Charitable Gift Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Charitable Gift Agreement Template form

Filling out a Charitable Gift Agreement Template is a structured yet flexible process. This guide will walk you through the essential components such as who is involved, the types of donations you can make, and the clauses that are often included to safeguard both parties.

What is a Charitable Gift Agreement?

A Charitable Gift Agreement is a legal document that formalizes the donation of goods, services, or funds to a charitable organization. Without a written agreement, both donors and charities may face misunderstandings about the terms, which can lead to complications in the donation process.

-

This document outlines the expectations and responsibilities of both the donor and the charitable organization.

-

Such agreements ensure clarity and protect both parties' interests, while also providing a legal framework for the donation process.

-

These agreements often have tax benefits for donors, which can affect their overall estate and tax planning.

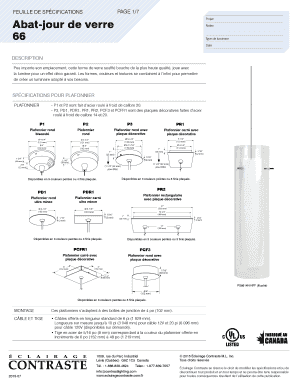

What are the core components of the Charitable Gift Agreement?

-

This section identifies the donor and the charitable organization, providing context for the agreement.

-

Important terms like 'gift', 'beneficiary', and 'tax-deductible contribution' are defined for clarity.

-

Details about the type and valuation of the gift are outlined here, ensuring both parties understand what is being donated.

-

This section outlines how the donated funds are to be used or designated, ensuring intended purposes are clear.

How do you fill out the Charitable Gift Agreement?

Filling out the Charitable Gift Agreement requires attention to detail and understanding of the specific type of gift being made. Each section of the template should be completed carefully to avoid any legal issues later on.

-

Follow the template's prompts, ensuring each section is filled out systematically.

-

Clearly articulate the type and amount of gift to avoid confusion between the donor and the organization.

-

Be aware of appraisal requirements for non-cash gifts to ensure donors receive the appropriate tax deductions.

What special considerations and clauses should you look for?

Including specific clauses in your Charitable Gift Agreement can offer additional protections and clarifications.

-

This clause stipulates that the donor must be acting ethically and in good faith when making the gift.

-

The agreement should specify how to handle any changes regarding the use of donated funds.

-

Consider adding further clauses that ensure comprehensive coverage for both parties.

What are some examples and scenarios?

Understanding real-world applications of the Charitable Gift Agreement can provide valuable insights.

-

Reviewing a sample template with annotations helps clarify common practices in charitable agreements.

-

Explore successful charitable agreements to see how they have effectively benefited both donors and organizations.

-

Identifying typical mistakes in such agreements can help avoid future issues.

Where can you find resources for Charitable Gift Agreements?

Having access to resources can simplify the process of creating a Charitable Gift Agreement.

-

Many online resources offer free templates and useful guidelines to assist in the process.

-

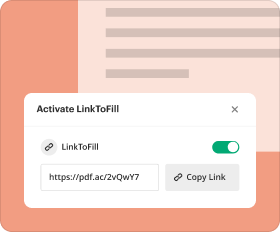

Look for recommended tools for document management and eSigning, integrating seamlessly with pdfFiller functionalities.

-

It’s prudent to have access to legal professionals who can provide advice specific to gift agreements.

How do engagement and collaboration tools enhance the process?

Using pdfFiller offers unique advantages when working with charitable documents.

-

PdfFiller makes it easier for multiple parties to collaborate on the charitable gift documents.

-

Utilizing cloud-based management features allows for easy edits and seamless electronic signing of agreements.

-

Cloud storage also ensures that you can easily access and update documents from anywhere.

How to fill out the Charitable Gift Agreement Template

-

1.Open the Charitable Gift Agreement Template in pdfFiller.

-

2.Begin by entering the donor's full name and address at the top of the document.

-

3.Next, fill in the charitable organization's name, address, and tax identification number.

-

4.Specify the type of gift being donated, whether it is cash, property, or other assets.

-

5.Include the amount or value of the gift in the designated section.

-

6.Outline any specific terms or conditions related to the gift, such as restrictions on use or timing of the donation.

-

7.Provide the date on which the agreement is being executed.

-

8.Both the donor and a representative from the charitable organization should sign and date the document at the bottom.

-

9.Finally, save the completed agreement and consider sending copies to both parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.