Last updated on Feb 17, 2026

Co Sign Agreement Template free printable template

Show details

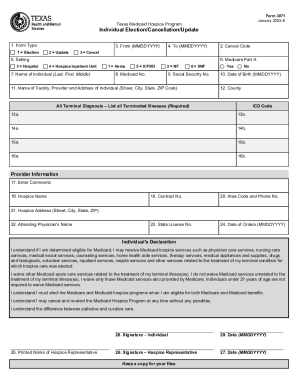

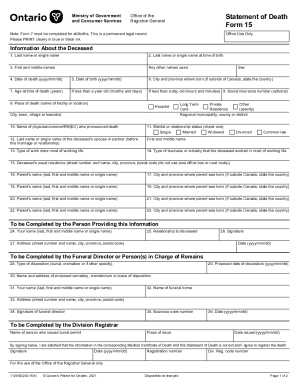

This document outlines the responsibilities and obligations of the CoSigner in relation to the financial agreement for a loan or credit that the Borrower is seeking from a Lender.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Co Sign Agreement Template

A Co Sign Agreement Template is a legal document that outlines the responsibilities and obligations of co-signers for a loan or lease agreement.

pdfFiller scores top ratings on review platforms

So far so good....I would like to learn how to use this feature better.

great

I had seen this software is really useful and helpful, i like to know more about it all can be done for my benefit to learn from it.

Good. I Like that ability to alter and erease

Great product, easy to use. Really helps. Makes filling out forms a pleasure....

Great platform for businesses on the go!!

Who needs Co Sign Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Co Sign Agreement Template form effectively

Understanding the Co-Sign Agreement

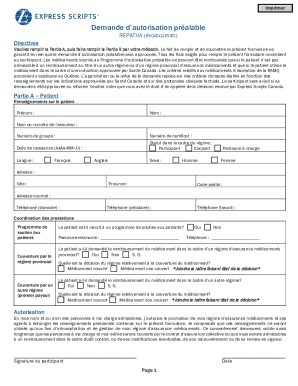

A co-sign agreement is a legal document that allows a co-signer to assume a portion of responsibility for a borrower's loan or credit obligation. The primary purpose of this agreement is to provide assurance to lenders that they can recover their funds in case the borrower defaults. In financial transactions, co-signing can unlock better lending terms for the borrower, making it a significant tool in facilitating loans.

-

A co-sign agreement serves to bind a co-signer to the financial obligations of a borrower, thereby enhancing the borrower's creditworthiness.

-

Co-signing helps individuals with lower credit scores secure loans by involving a financially stable partner to back their obligations.

-

The primary parties in a co-sign agreement are the co-signer, borrower, and lender, each with unique roles and responsibilities.

Who are the parties involved in the Co-Sign Agreement?

In a co-sign agreement, there are typically three main parties involved: the borrower, the co-signer, and the lender. Each party has specific roles that impact the financial transaction and the obligations attached to it.

-

The co-signer agrees to share the debt burden, meaning they are responsible for the loan if the borrower defaults.

-

The borrower must make timely payments and fulfill the loan obligations to avoid financial consequences for both parties.

-

The lender provides the loan and relies on the co-signer's financial accountability to mitigate their risk.

What are the financial obligations in a Co-Sign Agreement?

A clear understanding of the financial obligations outlined in the co-sign agreement is critical for all parties involved. This includes identifying the terms of the loan and any specific arrangements tied to the borrower's repayment plan.

-

The agreement should detail the nature of the loan, including its purpose and the amount being borrowed.

-

Terms should enumerate the principal sum due, interest rates, and payment schedules.

-

Highlighting the purpose of the loan, such as education or housing, helps clarify how the funds will be utilized.

Essential definitions in the Co-Sign Agreement

Legal documents like co-sign agreements often include specific terms that must be understood in order to minimize misunderstandings. Knowing these definitions can help protect both the co-signer's and borrower's interests.

-

Default is when the borrower fails to make payments, resulting in potential legal or financial repercussions affecting both parties.

-

Understanding the roles of a co-signer, borrower, and obligor is crucial for success and compliance in financial transactions.

-

Familiarity with legal terms is essential for ensuring all parties acknowledge and understand their roles and responsibilities.

How to fill out the Co-Sign Agreement Template

Completing a co-sign agreement template may seem daunting, but it can be done efficiently with clear instructions. Using resources like pdfFiller can simplify the process.

-

Follow each prompt carefully, ensuring that all required information is accurately provided.

-

Utilize editing tools on pdfFiller to make adjustments and personalize the form before submitting.

-

Include essential information such as names, addresses, and loan terms to ensure the agreement is valid.

Best practices for co-signing agreements

Co-signing can be a valuable way to assist someone in need of a loan, but it's essential to approach it with caution. Following certain practices can help protect your financial interests.

-

Always assess the borrower's financial situation and only co-sign if you are comfortable with the potential risk.

-

Avoid co-signing for excessive amounts, and never do so without understanding the underlying loan terms.

-

Stay informed about laws and compliance requirements in your region so you understand your responsibilities.

Managing and modifying Co-Sign Agreements

Flexibility in managing a co-sign agreement is crucial as circumstances change. Knowing how to amend the document or work with others can make transitions easier.

-

Use pdfFiller to amend the document when necessary, ensuring all parties approve changes.

-

Implement eSigning options and security features to keep sensitive information safe.

-

Utilize collaborative tools to streamline document management for teams, helping maintain transparency.

How to fill out the Co Sign Agreement Template

-

1.Access the Co Sign Agreement Template on pdfFiller.

-

2.Review the document to understand its sections including borrower, co-signer, and loan details.

-

3.Fill in the borrower's name and address in the designated fields.

-

4.Enter the co-signer's name and address next, ensuring accuracy.

-

5.Specify the amount of the loan or lease and its terms, including interest rates if applicable.

-

6.Outline any responsibilities that the co-signer will take on, such as payment obligations.

-

7.Provide both parties' consent by signing and dating the document in the appropriate sections.

-

8.Download the completed agreement or share it directly from pdfFiller with involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.