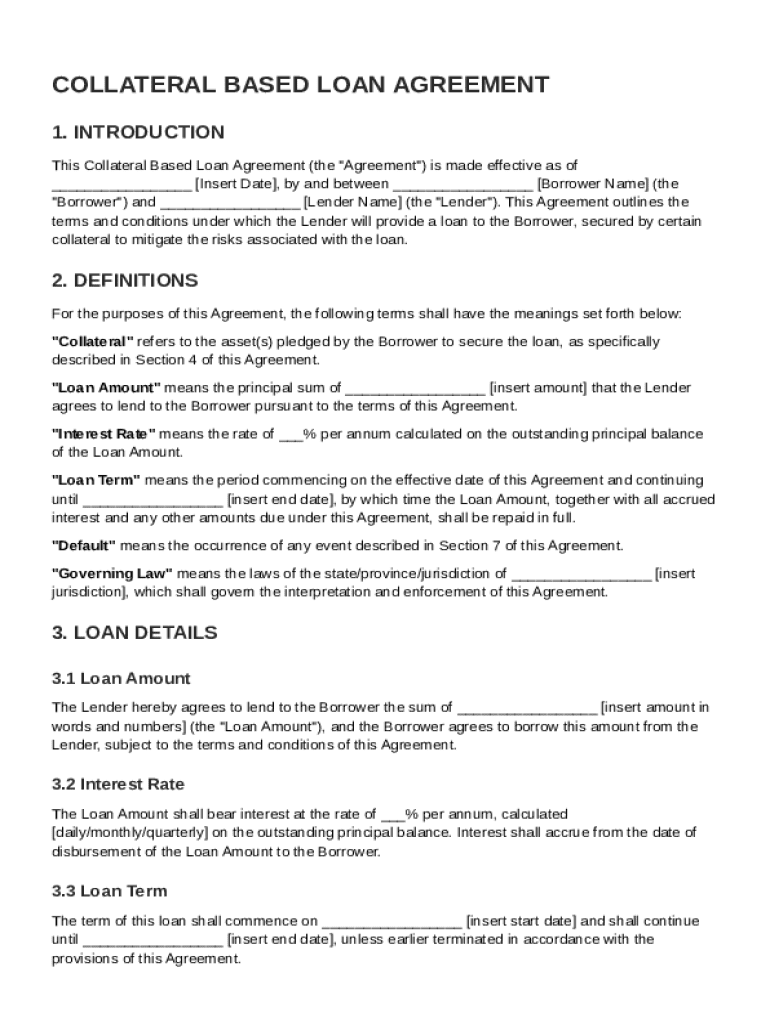

Collateral Based Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a Lender provides a loan to a Borrower, secured by collateral to mitigate risks.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Collateral Based Loan Agreement Template

A Collateral Based Loan Agreement Template is a legal document outlining the terms and conditions for a loan secured by collateral to guarantee repayment.

pdfFiller scores top ratings on review platforms

ty

easy to use

easy to use at this time

Great Customer Service!

I had a billing/subscription issue and it was fixed in less than one minute. I had Sam as a support and he was very pleasant to work with. Thank you for having great customer service.

Excelente ayuda para el trabajo

Very fine and excellent un to now. Before rating I would like to check my paperwork if it was sent correctly. Thanks.

Who needs Collateral Based Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Collateral Based Loan Agreement Template

What is a collateral based loan agreement?

A collateral based loan agreement is a legal document that outlines the terms and conditions under which a borrower can secure a loan presented with collateral. This form is crucial for both borrowers and lenders, as it defines the rights and responsibilities of each party involved. The primary purpose of such agreements is to provide security to lenders by using a borrower's asset as collateral.

-

Definition and purpose: The agreement serves to protect the lender's interests by outlining the acceptable terms for using collateral to secure a loan.

-

Importance of securing loans: Collateral reduces the risk for lenders and can lead to lower interest rates for borrowers.

-

Differences between secured and unsecured loans: Secured loans are backed by collateral, while unsecured loans are not, generally resulting in a higher interest rate.

What are the key components of a collateral based loan agreement?

Understanding the components of such agreements ensures that both parties know their obligations. A comprehensive agreement includes various details that clearly define the relationship between the borrower and lender, as well as the specifics regarding the collateral.

-

Parties involved: Clearly identify the borrower and lender to establish who is entering the agreement.

-

Collateral description: Specify the asset being used as collateral, including its value and ownership.

-

Loan amount: Detail the total amount being borrowed and how that figure will be determined.

-

Interest rate: Outline the interest rate applicable to the loan and common practices related to it.

-

Loan term: Define the period for loan repayment, including specific conditions tied to payments.

-

Default clause: Clearly state what would constitute a default on the loan and the consequences.

How to fill out your collateral based loan agreement template?

Filling out a collateral based loan agreement template correctly is crucial for ensuring that both parties are protected legally. The following steps provide a straightforward approach to filling out the template accurately.

-

Step 1: Enter the effective date and names of the parties involved to formalize the agreement.

-

Step 2: Specify the details of the collateral to clarify what asset is securing the loan.

-

Step 3: Outline the total loan amount and corresponding interest to ensure transparency.

-

Step 4: Clearly define the loan term along with any repayment conditions that apply.

-

Step 5: Understand default conditions to mitigate risks associated with loan repayment.

What legal considerations come with collateral based loan agreements?

Legal compliance is a significant aspect of drafting collateral based loan agreements. Ensuring that the agreement adheres to governing law can ultimately protect both parties involved in the agreement.

-

Governing law: It's vital to select the appropriate governing law that will influence how the agreement is interpreted.

-

Local laws: Be aware that local laws can greatly affect the terms and enforceability of loan agreements.

-

Legal advice: Consulting with legal professionals when drafting agreements ensures compliance with all relevant laws and regulations.

How can you manage your collateral based loan agreement?

Managing a collateral based loan agreement requires ongoing attention and organization. Utilizing tools like pdfFiller can streamline this process, making it easier to collaborate and maintain important documents.

-

Monitoring loan terms: Regularly reviewing the terms helps ensure compliance and prompt updates.

-

Document management tools: pdfFiller offers tools that facilitate editing, signing, and sharing documents securely.

-

Collaboration opportunities: Effective communication between borrowers and lenders is key for ongoing management.

What are common scenarios in collateral based loans?

Collateral based loans can present various scenarios that may require different solutions. Understanding how to react in these situations is imperative for both parties.

-

Payment defaults: Knowing the steps to take in case of defaults can mitigate financial losses.

-

Renegotiating loan terms: Flexibility in negotiations can often benefit both parties, especially in challenging circumstances.

-

Recovering collateral: Understanding the legal process for recovering collateral can be crucial if the borrower defaults.

How to fill out the Collateral Based Loan Agreement Template

-

1.Open the Collateral Based Loan Agreement Template in pdfFiller.

-

2.Begin by entering the names and addresses of both the borrower and lender at the top of the document.

-

3.Fill in the loan amount being requested and the interest rate agreed upon.

-

4.Specify the repayment terms, including the duration of the loan and payment schedule (monthly, quarterly, etc.).

-

5.Outline the collateral being offered as security for the loan, detailing its nature and value.

-

6.Include any additional terms or conditions relevant to the loan agreement, such as late fees or governing laws.

-

7.Review the completed document for accuracy and completeness.

-

8.Save the document or print it for signatures from both parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.