Commercial Loan Broker Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a broker acts on behalf of a lender to facilitate commercial loans, including responsibilities, fees, and confidentiality provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

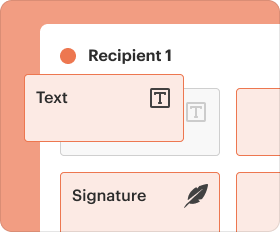

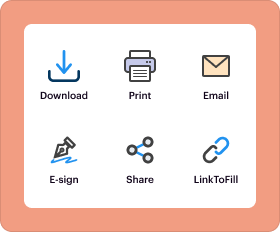

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

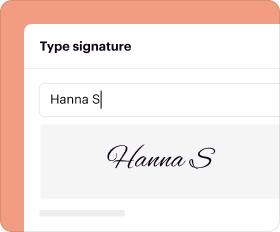

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Commercial Loan Broker Agreement Template

A Commercial Loan Broker Agreement Template is a legal document that outlines the relationship and terms between a borrower and a loan broker facilitating commercial loans.

pdfFiller scores top ratings on review platforms

PDF filler solved my small business billing issues! I am able to prepare CMS Form 1500 online and fax directly to the insurance company! It stores all my documents for future reference too and allows me to edit and resend if there is a problem. Awesome tool for a small business like mine!!!

I love how easy PDFfiller is. It is a real life saver for me as a musician who needs to handle contracts all the time.Thank you. Tom Hoy.

Mostly user friendly. Filling in multiple of the same form is not available, or finding that option is impossible. So I used same form over and over - using tab you also have to back space or use mouse to remove previous data and then fill in.

Good software to have, but not that easy to use.

A LITTLE CONFUSING TO FOLLOW. SEEMS NOT AN EASY SEARCH FOR DOCS

We just really started using this system, so far so good.

Who needs Commercial Loan Broker Agreement Template?

Explore how professionals across industries use pdfFiller.

Commercial Loan Broker Agreement Guide

Filling out a Commercial Loan Broker Agreement Template form involves understanding its components and following specific steps to ensure accuracy. This guide simplifies that process, providing you with detailed insights into each part of the agreement, preparing you for effective interactions whether you're a broker, lender, or borrower.

What is a Commercial Loan Broker Agreement?

A Commercial Loan Broker Agreement is a formal document that outlines the relationship and responsibilities between a broker, lender, and borrower. Having a clear agreement is crucial as it protects all parties involved and sets expectations for the loan process. The agreement typically includes essential components like terms and conditions, fees, and the duration of the relationship.

-

A legal framework that describes how a broker will operate in facilitating loans between lenders and borrowers.

-

Helps prevent misunderstandings and legal issues by clarifying responsibilities.

-

Includes broker fees, commission structures, and service expectations.

What are the key terms in a Commercial Loan Broker Agreement?

Understanding the vocabulary used in Commercial Loan Broker Agreements is essential for effective communication and operation within the industry. Here are the key terms typically found in these agreements:

-

The intermediary who helps facilitate loans. Brokers must understand both lender requirements and borrower needs.

-

The financial institution or individual offering the loan. Different lenders have unique rules and regulatory obligations.

-

Individuals or businesses seeking loans; they must meet particular criteria to be considered creditworthy.

-

Funds provided to a borrower that must be repaid under agreed terms, including interest and duration.

-

Fees earned by the broker for successfully closing a loan, which can vary based on services provided.

How is a broker appointed?

The appointment of a broker is a formal process that necessitates careful consideration of agreement types. Brokers may be engaged under either exclusive or non-exclusive arrangements, affecting their operational flexibility.

-

Typically involves a written contract that delineates the broker's authority and scope of work.

-

Exclusive agreements limit the broker to one lender, while non-exclusive arrangements allow for broader representation.

-

Specifies the length of the agreement and the conditions under which it can be terminated by either party.

What services does a broker provide?

Commercial loan brokers are tasked with various responsibilities that help streamline the loan acquisition process. By understanding what services brokers offer, stakeholders can better utilize their expertise.

-

Brokers locate and pre-qualify potential borrowers based on lending criteria.

-

Essential documents such as credit history and business plans are reviewed to ensure suitability.

-

Brokers use their knowledge to achieve favorable loan terms for borrowers.

-

Acts as a liaison between lenders and borrowers to ensure clarity and efficiency.

-

Services may include helping with loan applications and overall financial advice.

How to fill out the Commercial Loan Broker Agreement Template form?

When completing a Commercial Loan Broker Agreement Template form, attention to detail is necessary. Following a structured approach can result in better outcomes.

-

Review each section of the form carefully, including demographics, loan details, and terms to ensure clarity.

-

Double-check all information against relevant documents for accuracy before submission.

-

The platform allows users to create, edit, and sign documents easily, streamlining the form-filling process.

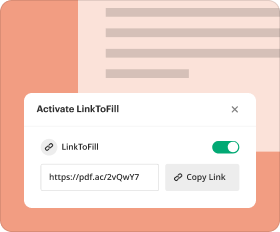

How to manage agreements with pdfFiller?

Managing Commercial Loan Broker Agreements can be simplified using pdfFiller's features. Users can leverage its tools for editing and signing documents conveniently.

-

pdfFiller provides a variety of tools to edit PDFs, ensuring that all necessary information is updated.

-

Utilizing the eSigning feature speeds up the process of sending and receiving signed agreements.

-

Manage multiple signatures efficiently, minimizing delays in the agreement process.

What compliance and legal considerations should be followed?

Compliance with state and federal regulations is essential in the commercial lending space. Brokers must stay informed about relevant laws to protect themselves and their clients.

-

Various laws govern commercial loans, and brokers must understand their responsibilities under these statutes.

-

Maintaining detailed documentation helps ensure compliance and serves as a defense in case of disputes.

-

Regularly reviewing changes in legislation can help brokers remain compliant and adjust practices accordingly.

What are the best practices for effective commercial loan brokerage?

Implementing best practices in commercial loan brokerage fosters strong relationships and successful outcomes. This process includes understanding various components motivating different stakeholders.

-

Strong networks with lenders and borrowers provide better opportunities for loan placements.

-

Understanding client needs helps tailor solutions that foster good relationships and repeat business.

-

Using digital platforms and tools increases efficiency and enhances service delivery.

How to fill out the Commercial Loan Broker Agreement Template

-

1.Open the Commercial Loan Broker Agreement Template in pdfFiller.

-

2.Begin with the header section, entering the date and parties involved in the agreement.

-

3.Fill in the loan broker's full name and business address accurately.

-

4.Provide the borrower's full name and address, ensuring all details are current.

-

5.Specify the loan amount being requested and the purpose of the loan in the designated sections.

-

6.Review the terms and conditions outlined in the agreement, filling in any required specific details according to your negotiation.

-

7.If necessary, include any additional clauses or agreements that are specific to your situation or newly negotiated terms.

-

8.Check all filled information for accuracy and completeness before finalizing.

-

9.Save the document once all fields are filled and you have confirmed its correctness.

-

10.Print and sign the agreement where indicated, ensuring both parties do the same for valid documentation.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.