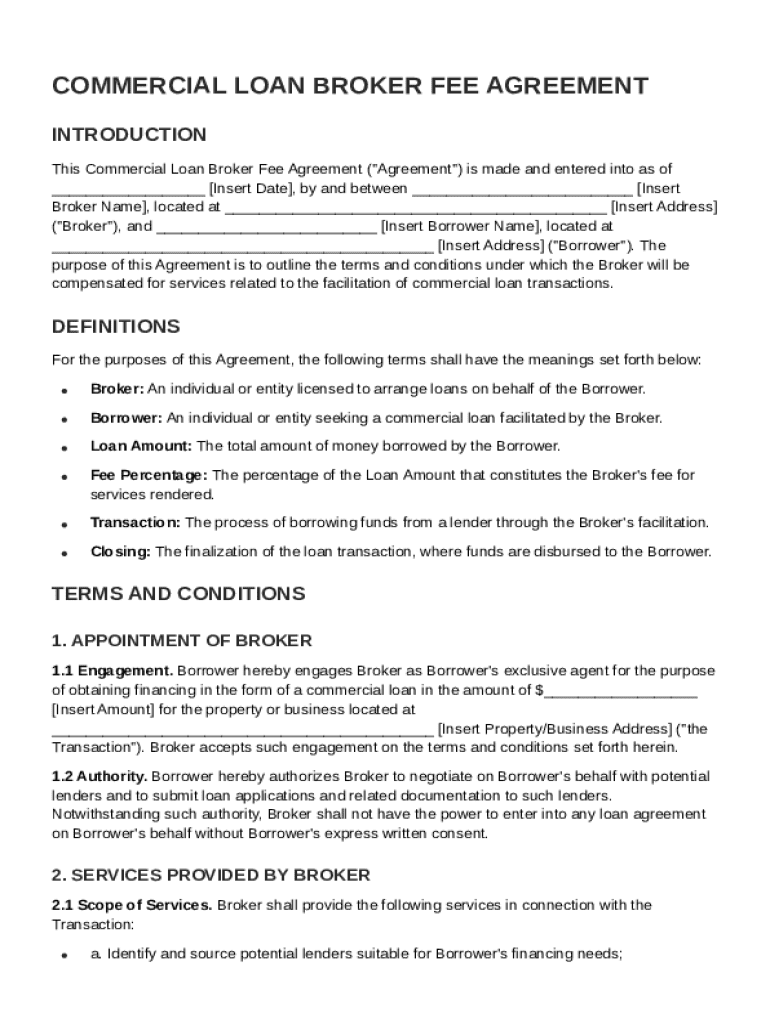

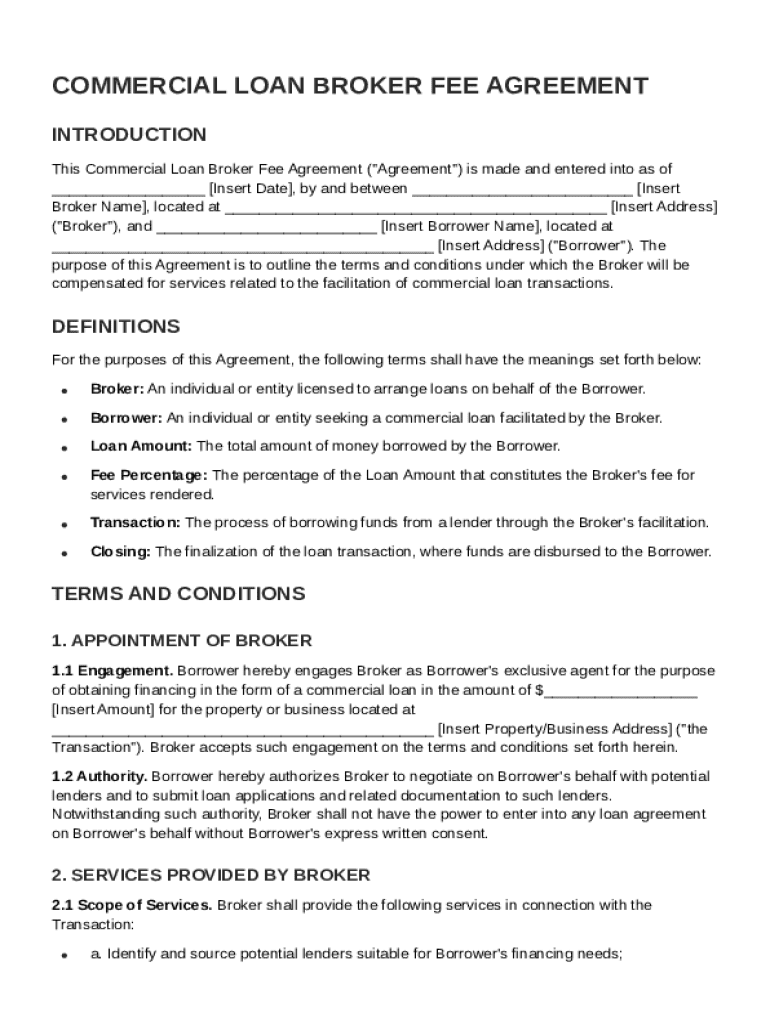

Commercial Loan Broker Fee Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a Broker will be compensated for services related to the facilitation of commercial loan transactions between Borrower and Broker.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Commercial Loan Broker Fee Agreement Template

The Commercial Loan Broker Fee Agreement Template outlines the terms and conditions for fee arrangements between a broker and a client seeking a commercial loan.

pdfFiller scores top ratings on review platforms

Great Work

Great Work. Love all the files available.

good efficient product

Great Site!

Great site, very comprehensive, and user-friendly!

Really great product

great app

great app. thank you

This program is all good.

Who needs Commercial Loan Broker Fee Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Commercial Loan Broker Fee Agreement on pdfFiller

Filling out a Commercial Loan Broker Fee Agreement form is a crucial step in securing a loan through a broker. This guide will outline the essential components, provide practical tips, and offer resources available on pdfFiller for a smooth process.

What is a Commercial Loan Broker Fee Agreement?

A Commercial Loan Broker Fee Agreement is a formal document defining the relationship and terms between the borrower and the broker. This agreement clarifies how broker fees are calculated and outlines the responsibilities of each party involved in the loan process.

-

The primary purpose is to detail the fees and the services provided, ensuring transparency and establishing trust.

-

Understanding these fees is vital for borrowers to evaluate the overall cost of securing a loan.

-

The agreement is commonly used when acquiring commercial properties, refinancing existing loans, or consolidating debts.

What are the key terms in the agreement?

Key terms in the Commercial Loan Broker Fee Agreement include definitions regarding roles and expectations of both the broker and the borrower.

-

Refers to the intermediary responsible for finding and negotiating loans on behalf of the borrower.

-

The individual or business seeking to obtain a loan and is responsible for repaying it.

-

Specifies the total sum being borrowed, which can impact the fee structure.

-

Indicates the commission the broker earns based on the loan amount.

-

Describes the entire borrowing process, from application to closing.

-

The final stage where all terms are finalized and the loan is officially secured.

What should you know about the terms and conditions?

Understanding the terms and conditions of the Commercial Loan Broker Fee Agreement is essential for avoiding potential pitfalls.

-

Specifies how a broker is engaged, outlining their rights, responsibilities, and limits on their authority.

-

Details what the broker will do, such as identifying lenders, negotiating terms, and providing guidance throughout the process.

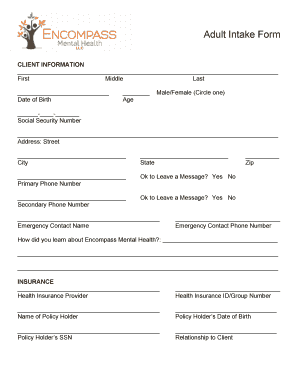

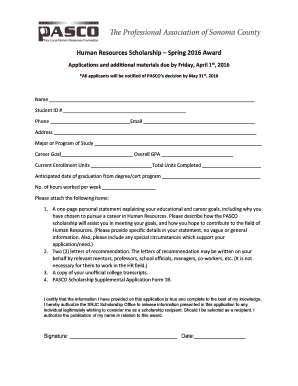

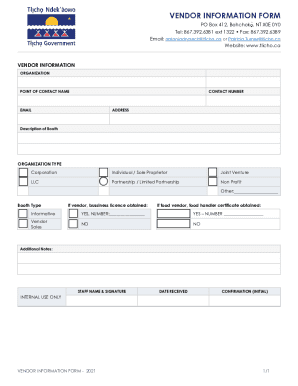

How to fill out the Commercial Loan Broker Fee Agreement?

Filling out the agreement accurately is crucial to avoid disputes. Below is a guide on essential fields and tips for completion.

-

Ensure you complete all required fields, including personal information, loan details, and broker information.

-

Double-check entries for accuracy to prevent issues during the closing process.

-

Leverage pdfFiller’s editing and management tools for an efficient experience when managing your form.

What are the risks and considerations?

While the advantages of using a broker are notable, there are risks and considerations to keep in mind.

-

Broker fees can add up, so assess your overall financial situation before proceeding.

-

Be cautious of hidden fees or unclear terms that may arise during negotiations.

-

Do not hesitate to engage in negotiation to secure the best possible terms for your agreement.

Are there state-specific regulations?

Compliance requirements can vary significantly by region, making it crucial to adapt agreements accordingly.

-

Understanding local laws and how they apply to your agreement is fundamental.

-

Stay informed about regulations affecting commercial loans in your state to ensure compliance.

-

Tailor your Commercial Loan Broker Fee Agreement to reflect these local regulations.

How does pdfFiller enhance document management?

pdfFiller offers tools to streamline the editing and signing process, allowing for efficient management of your documents.

-

Seamlessly edit your documents with integrated collaboration tools to ensure all parties are aligned.

-

Utilize eSigning features for instant approvals, expediting the loan process.

-

Access your forms from anywhere, making it convenient to manage and update documents as needed.

How to fill out the Commercial Loan Broker Fee Agreement Template

-

1.Download the Commercial Loan Broker Fee Agreement Template from the pdfFiller website.

-

2.Open the document in pdfFiller and select 'Edit' to begin filling in the required fields.

-

3.Enter the broker's name and contact information in the designated fields at the top of the form.

-

4.Provide the client's name and business details as specified in the agreement template.

-

5.Fill in the loan amount being brokered and any associated fees according to the agreement terms.

-

6.Review the section detailing the services provided by the broker to ensure accuracy.

-

7.Include the duration of the agreement by specifying the start and end dates.

-

8.Carefully read through all clauses and ensure mutual agreement on the terms.

-

9.Sign the document electronically using pdfFiller's signing tools.

-

10.Save the completed agreement and send it to all parties involved for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.