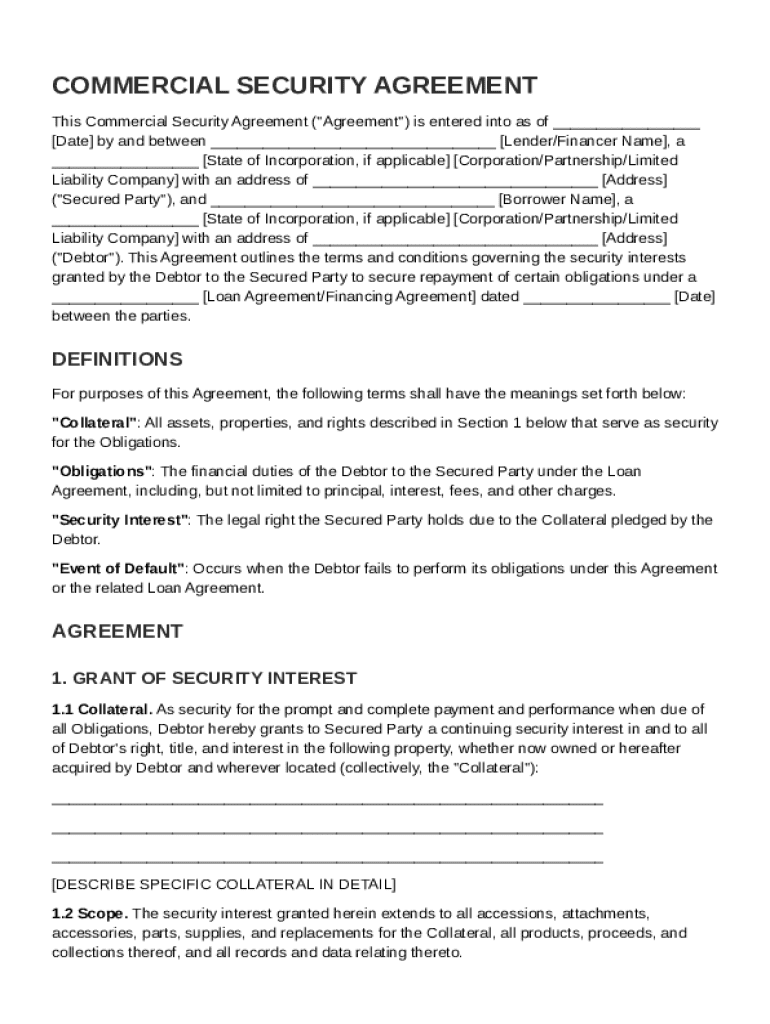

Commercial Security Agreement Template free printable template

Show details

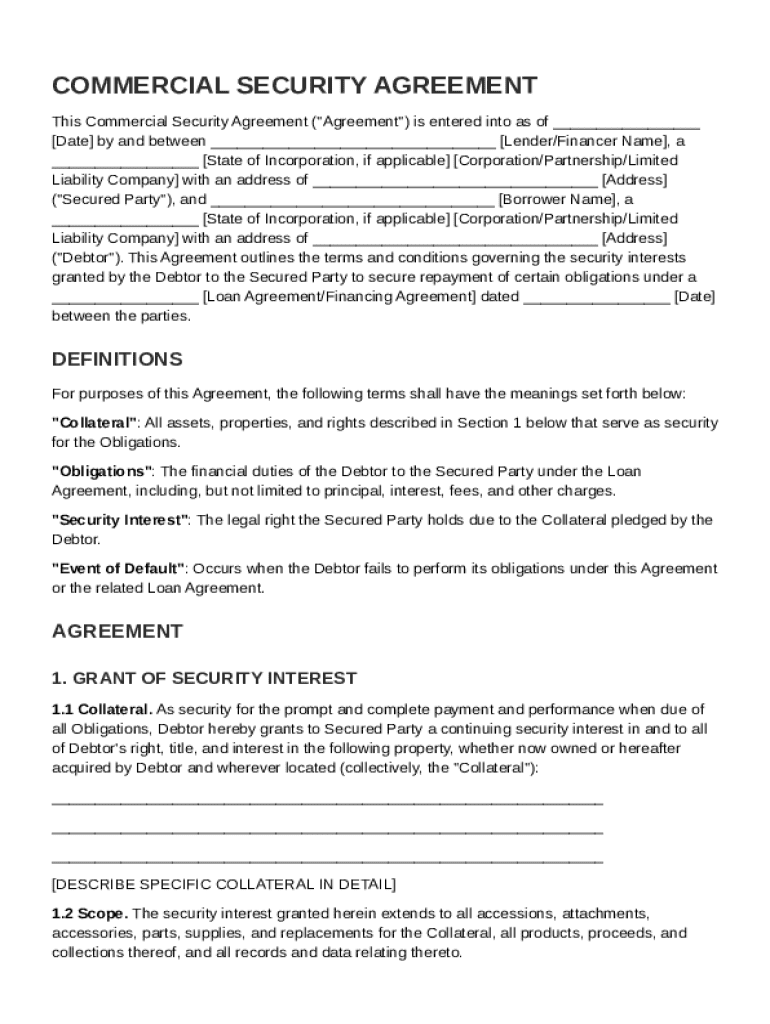

This document outlines the terms and conditions governing the security interests granted by the Debtor to the Secured Party to secure repayment of obligations under a loan agreement.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Commercial Security Agreement Template

A Commercial Security Agreement Template is a legal document that outlines the terms under which a borrower provides collateral to secure a loan or credit facility.

pdfFiller scores top ratings on review platforms

helped save me so much time and frustration

excelent

Love it! I really appreciate how easy it is to use!

I love using pdfFiller, except for the rather exorbitant price.

Excellent

very good service

Who needs Commercial Security Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Commercial Security Agreement Template Form

A Commercial Security Agreement Template form is essential for any lending or borrowing scenario. This template serves as a structured document to outline the terms and conditions related to the security interests, ensuring both lender and borrower clearly understand their obligations. This guide provides a step-by-step approach to understanding and filling out this important document.

What is a Commercial Security Agreement?

A Commercial Security Agreement is a legal document that outlines the terms under which a borrower pledges collateral to a lender. The main purpose of this agreement is to protect the lender's interests by creating a security interest in the collateral, hence ensuring the lender has a claim on the assets if the borrower defaults. Understanding this document is vital to secure financing.

-

It establishes the rights and obligations of both parties involved in a lending transaction.

-

The agreement provides legal recourse for lenders to reclaim funds from collateral in the event of non-payment.

What are the key components of the agreement?

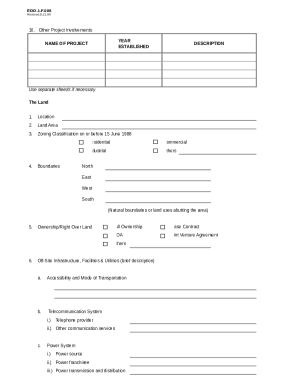

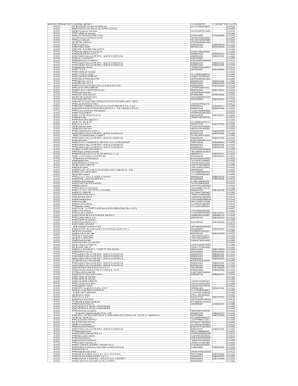

A Commercial Security Agreement comprises several critical components that outline essential information and terms. These include identifying the lender and debtor along with their corporate structures and addresses. Terms related to collateral, obligations, security interest, and events of default are also covered, ensuring clarity regarding each party's responsibilities.

-

Includes full names, corporate addresses, and identification numbers, ensuring accurate legal representation.

-

Defines what assets are offered as collateral and the conditions under which they can be seized.

-

Details the responsibilities of both parties regarding payment and adherence to the agreement terms.

-

Specifies what constitutes a default and the subsequent actions that the lender may take.

How do you fill out the Commercial Security Agreement?

Filling out a Commercial Security Agreement template can be straightforward if approached methodically. Begin by detailing the lender and borrower information, followed by accurately describing the collateral involved. Ensure clarity in the obligations, and stay mindful of legal requirements.

-

Accurately enter full legal names, addresses, and other relevant identifying information.

-

Provide a detailed description of the collateral being secured, including any serial numbers where applicable.

-

Clearly state the terms of repayment and any other responsibilities of the borrower.

-

Double-check all entries for accuracy and completeness to prevent legal issues later.

How to describe the collateral?

Properly describing collateral is critical in a Commercial Security Agreement. Each asset listed as collateral should be detailed with specificity to avoid ambiguity. For instance, when discussing inventory, list out specific types and quantities, including distinguishing features.

-

Provide a clear characterization of each collateral item, which may include condition, location, and valuation.

-

Common types of collateral include real estate, vehicles, equipment, and inventory.

-

Ensure all collateral types are relevant to the transaction and clearly understood by both parties.

What are the legal implications and considerations?

Legal implications of a Commercial Security Agreement are significant. The agreement must comply with both state and federal regulations to ensure enforceability. Failure to adhere to applicable laws can result in disputes or voiding of the security interest.

-

Ensure that the agreement meets all statutory requirements for validity under local laws.

-

Remain aware of regional regulations affecting collateral types, particularly in regulated industries such as finance.

How to edit and manage your agreement?

Utilizing tools like pdfFiller makes editing and managing your Commercial Security Agreement straightforward. The platform allows users to easily change details, sign digitally, and share documents securely. It enhances document management through cloud-based capabilities, ensuring accessibility and backup.

-

Use pdfFiller's features to modify the agreement as needed without starting from scratch.

-

The digital signature feature ensures secure validation of the document without physical presence.

-

Storing documents in the cloud protects against data loss and fosters easy access across devices.

What are the common questions and troubleshooting tips?

Navigating the complexities of Commercial Security Agreements can present challenges. Common inquiries revolve around the filling process, legal compliance, and financial implications. Being aware of common pitfalls and knowing troubleshooting strategies can streamline document management.

-

Seek clarity on legal terms used within the agreement to avoid misunderstandings.

-

Review your document for missing or incorrect information that could lead to disputes.

What is the conclusion?

Accurate completion of the Commercial Security Agreement Template form is crucial for safeguarding the interests of all parties involved. Utilizing tools like pdfFiller not only simplifies the process of document management but also ensures that your agreements are compliant and secure. Always prioritize thoroughness and clarity to avoid potential legal issues.

How to fill out the Commercial Security Agreement Template

-

1.Download the Commercial Security Agreement Template from pdfFiller’s website.

-

2.Open the document in pdfFiller’s editor to begin filling it out.

-

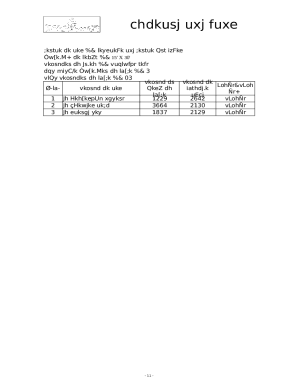

3.Start with the 'Parties' section by entering the names and addresses of the borrower and lender.

-

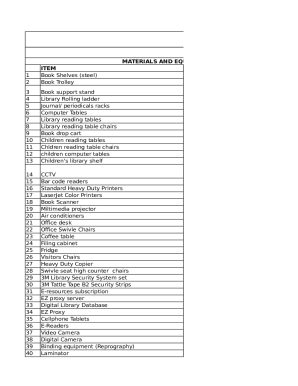

4.In the 'Collateral' section, describe the assets or property being used as security for the loan.

-

5.Specify the loan amount and interest rate in the appropriate sections of the template.

-

6.Add clauses related to default, remedies, and governing law as required by the agreement.

-

7.Review all entered information for accuracy and completeness before finalizing.

-

8.Once finalized, electronically sign the document or prepare it for printing and physical signatures.

-

9.Save a copy of the completed agreement for your records and provide one to the other party.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.