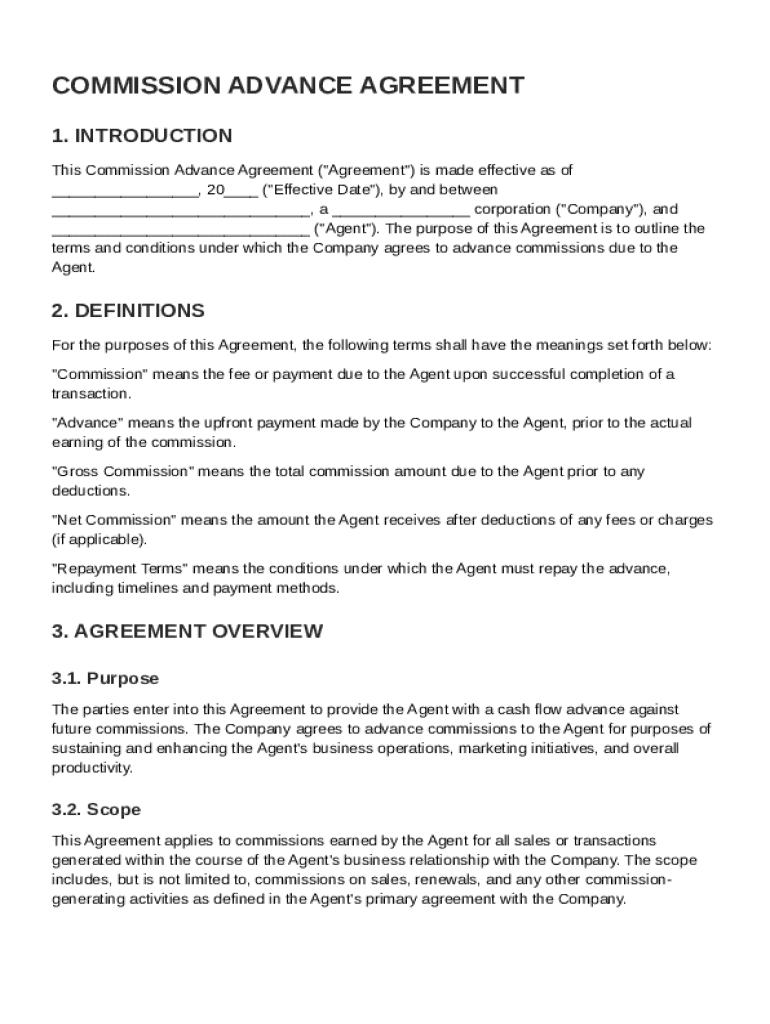

Commission Advance Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a company agrees to advance commissions to an agent, including definitions, advance payment terms, commission structure, repayment obligations,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Commission Advance Agreement Template

A Commission Advance Agreement Template is a formal document that allows real estate agents to receive their commission advances before the actual closing of a property sale.

pdfFiller scores top ratings on review platforms

Excellent source of documents

Excellent source of documents. Thank you

It took some time to familiarize myself…

It took some time to familiarize myself with how to navigate through the program, almost 6 hours.

This has been a great website

This has been a great website, With my wife and I moving and having to sign all these documents this has helped out so much with filling out and signing them.

It is great thank you for letting me…

It is great thank you for letting me try it out

Love it

Love it. Super easy to use and convenient

Great Service

Great Service, works like a charme

Who needs Commission Advance Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the Commission Advance Agreement Template form

How does a Commission Advance Agreement function?

A Commission Advance Agreement allows Agents to receive an upfront payment against future commissions they expect to earn. This type of agreement can be crucial for cash flow management, particularly in industries where sales cycles can be lengthy. It essentially provides financial support to sales professionals, enabling them to cover immediate costs while waiting for commissions.

What are the key components of a Commission Advance Agreement?

-

A Commission Advance Agreement is a legal document outlining the terms under which an Agent receives early payment for pending commissions.

-

In the agreement, the Company refers to the organization that owes the commission, while the Agent is the individual responsible for making sales.

When should you consider a Commission Advance Agreement?

This type of agreement can be particularly beneficial during slow sales months or when unexpected expenses arise. Agents who may be experiencing cash flow issues are prime candidates for such arrangements. Furthermore, understanding the timing and market conditions is essential to leveraging a Commission Advance Agreement effectively.

How can you craft an effective Commission Advance Agreement?

-

Gather necessary information such as commission structure and expected amounts to be advanced.

-

Outline terms and conditions including repayment timelines, interest rates, and penalties for late payments.

What are the different commission structures and payment terms?

Organizations can implement various commission structures such as flat fees, percentages of sales, or tiered commissions based on performance. Understanding these structures helps in identifying the right advance amount and repayment terms. It’s crucial to align the payment terms with both the Agent's financial needs and the Company's cash flow.

How can you manage commissions effectively post-agreement?

-

Implement systems to monitor commissions earned against advances to avoid discrepancies.

-

Educate Agents on their responsibilities and the importance of adhering to repayment schedules.

What compliance considerations should you be aware of?

Adhering to local laws and regulations is critical when drafting a Commission Advance Agreement. Failure to comply can lead to legal complications and financial penalties. Knowledge of these regulations ensures protection for both the Company and the Agent, fostering a transparent working relationship.

How can pdfFiller assist in managing your Commission Advance Agreement?

pdfFiller offers tools to simplify the process of creating and managing a Commission Advance Agreement. With features like eSign, collaboration capabilities, and integrated cloud storage, users can streamline their document management efficiently. This empowers individuals and teams to focus on their core tasks rather than getting caught up in paperwork.

What are real-world examples of effective Commission Advance Agreements?

Several businesses have benefited from using Commission Advance Agreements. For instance, a marketing agency faced cash flow issues during off-seasons but managed to stabilize by implementing such agreements. This example underlines the importance of adaptability and forward-thinking within sales strategies.

How to fill out the Commission Advance Agreement Template

-

1.Grab a copy of the Commission Advance Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller’s editor.

-

3.Fill in the agent's full name and contact details in the designated fields.

-

4.Enter the brokerage's name and address as it appears legally.

-

5.Specify the property address for which the advance is being requested.

-

6.Indicate the total commission amount expected from the sale.

-

7.Fill out the requested advance amount section carefully, ensuring it's within allowable limits.

-

8.Review any specific terms and conditions included in the template, and ensure compliance with them.

-

9.Add signatures where required, including the agent's and a witness if needed.

-

10.Save the completed document and download or print it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.