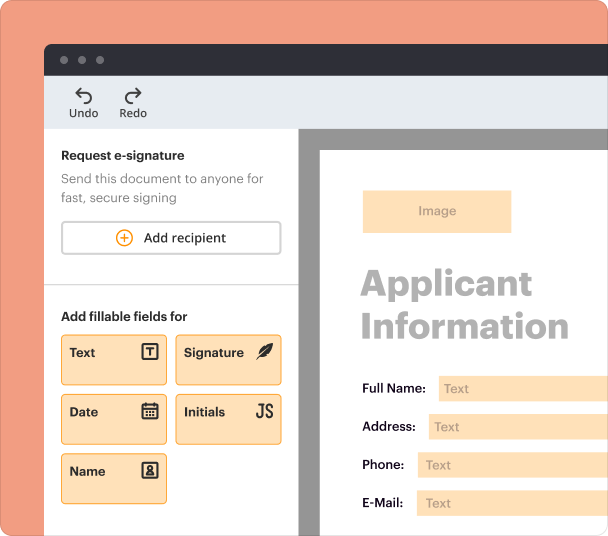

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Company to Company Loan Agreement Template free printable template

Show details

This Loan Agreement outlines the terms and conditions under which one company lends money to another company, detailing aspects such as loan amount, interest rate, repayment schedule, and default

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

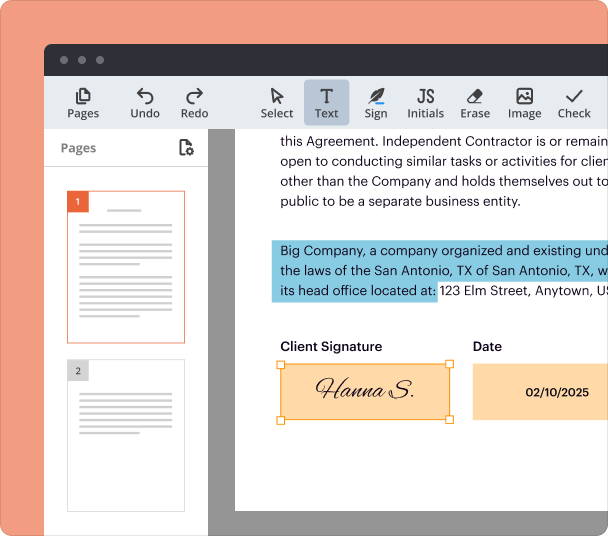

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

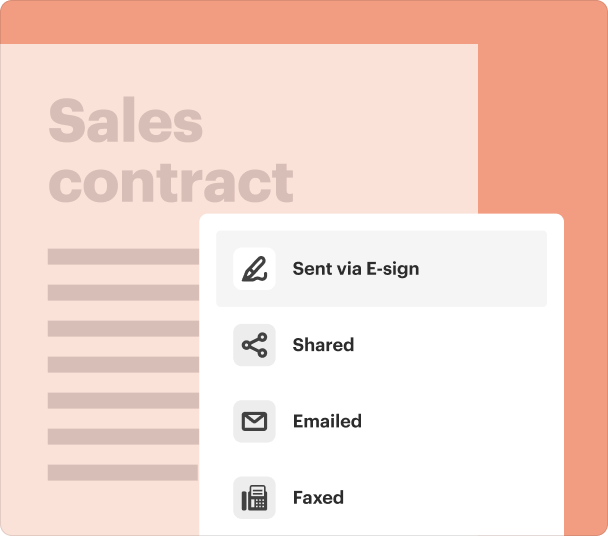

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

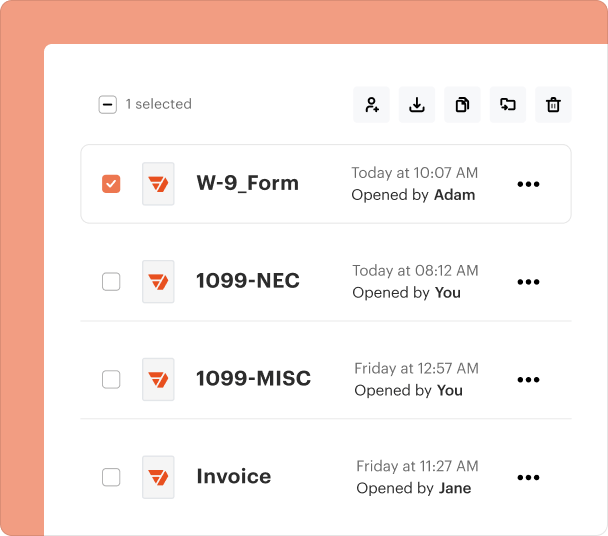

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Company to Company Loan Agreement Template

Understanding how to effectively edit and fill out the Company to Company Loan Agreement Template is essential for ensuring a smooth process between businesses. Below, you will find detailed information on editing the form and guidance on filling it out accurately.

How to edit Company to Company Loan Agreement Template

pdfFiller makes the process of editing the Company to Company Loan Agreement Template seamless. Follow these steps:

-

1.Click the ‘Get form’ button on this page to access the form.

-

2.Create a free account on pdfFiller by entering your details or using your existing social media account.

-

3.Once logged in, upload the Company to Company Loan Agreement Template or select it from the document library.

-

4.Use the intuitive editing tools to modify text, add or remove sections, and make any required adjustments to the document.

-

5.Save your changes and download the edited form in your preferred format or share it directly from pdfFiller.

How to fill out Company to Company Loan Agreement Template

Filling out the Company to Company Loan Agreement Template correctly is crucial for ensuring mutual agreements are clear and legally valid. The best way to obtain and fill out this form is by following these steps:

-

1.Click the ‘Get form’ button on this page to access the template.

-

2.Download the template or open it in pdfFiller for convenient editing.

-

3.Read through the document to understand the structure and required information.

-

4.Fill in your business name, the name of the other company, and relevant details of the loan terms, including amounts and payment schedules.

-

5.Include any specific conditions, such as interest rates or collateral requirements.

-

6.Review the filled document to ensure all information is accurate and complete.

-

7.Consult with a legal advisor if necessary to confirm all provisions are appropriately worded.

-

8.Save and share the completed form as needed for signatures and filing.

All you need to know about Company to Company Loan Agreement Template

The Company to Company Loan Agreement Template is an essential document that formalizes the terms of a loan between two businesses, providing clarity and protection for both parties. Here’s what you should know about it.

What is a Company to Company Loan Agreement Template?

A Company to Company Loan Agreement Template is a legally binding document that outlines the terms under which one company lends money to another. It details the responsibilities of each party and ensures that both sides agree to the terms of the loan.

Definition and key provisions of a Company to Company Loan Agreement

This section will cover the main aspects and conditions included in such agreements to guarantee clarity and enforceability:

-

1.Loan amount

-

2.Interest rate

-

3.Repayment schedule

-

4.Loan term (duration)

-

5.Collateral (if applicable)

-

6.Default provisions

-

7.Governing law and dispute resolution

When is a Company to Company Loan Agreement used?

A Company to Company Loan Agreement is typically used when one business needs to borrow money from another for various purposes, such as expansion, operational costs, or purchasing equipment. This agreement clarifies the terms to prevent misunderstandings and legal issues.

Main sections and clauses of a Company to Company Loan Agreement

Understanding the key sections will help you navigate the agreement more effectively. The main sections typically include:

-

1.Parties involved

-

2.Loan details (amount, interest, and term)

-

3.Terms of repayment

-

4.Conditions and covenants

-

5.Default and remedies

-

6.Governing law and jurisdiction

What needs to be included in a Company to Company Loan Agreement?

To create a comprehensive agreement, it’s important to include the following elements:

-

1.Identifying information of each party (names, addresses)

-

2.Exact loan amount and disbursement details

-

3.Specific interest rates and calculation methods

-

4.Clear repayment schedule with due dates

-

5.Consequences of default and related penalties

-

6.Signatures of authorized personnel from both companies

How do you write a loan agreement between companies?

A well-structured loan agreement should follow established practice and include these key sections in order: parties' details (names and addresses), loan amount and purpose, interest rates and calculation method, repayment schedule, security provisions (if applicable), and default conditions.

What is an intercompany loan agreement?

An intercompany loan is a financial arrangement between two or more related companies. These loans are often used to manage cash flow, finance operations, or transfer funds within a corporate group.

How do I write a loan to a company?

A well-written loan request letter should include basic details of the business, a clear explanation of the loan's purpose, evidence of a feasible repayment plan, and a professional and courteous closing.

How to structure a loan agreement?

A written loan agreement should include details of: the full names and addresses of the parties. the principal amount of the loan. the term of the loan, for example 12 months. the amount and frequency of repayments. the rate of interest payable, if interest is being charged.

pdfFiller scores top ratings on review platforms

Helped me to purchase home and maintain my rental agreement.

Not now but sometime in the future. I find it easy to use and it is going to make my work life much more organized and easier.

Always able to find a document needed. Customer service very helpful. I recommend this service to all my family & friends. Very easy to use.

I like it and it is much easier to use that Adobe Acrobat

Very easy to use, to the point, even for a 72 year old!! -keep up the good work!

Generally is an excellent product. I have had a few problems with the system hanging and haven't figured out the best way to use signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.