Consumer Credit Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender extends credit to a borrower, including repayment obligations, interest rates, and other related covenants.

We are not affiliated with any brand or entity on this form

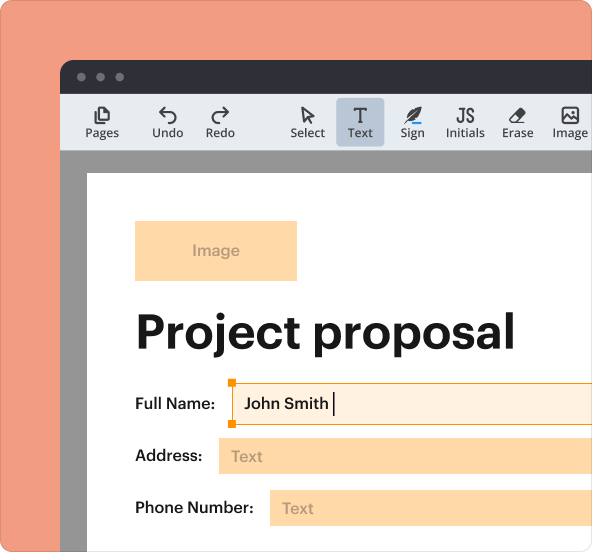

Why pdfFiller is the best tool for managing contracts

End-to-end document management

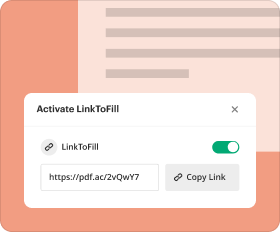

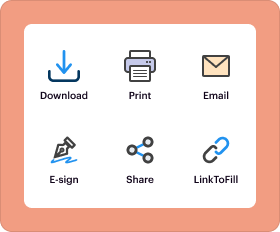

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Consumer Credit Agreement Template

A Consumer Credit Agreement Template is a legal document outlining the terms and conditions of a loan provided to a consumer by a lender.

pdfFiller scores top ratings on review platforms

easy to use. great to be able to recreate important docs, great customer service also

I get my work done--I appreciate the quality of my documents.

Being looking on the net for a good PDF- word convertor, never found a good one, tell i landed on PDF Filler, such an amazing web-base solution im loving it, and im using it daily, good job guys

great product. a bit pricy for the monthly subscription. charging by the document would be better for a person like me who only needs to use the service occasionally.

it's been very helpful in the preparation of reports that require submission with the government

love it except it doesn't toggle in the natural order of the document

Who needs Consumer Credit Agreement Template?

Explore how professionals across industries use pdfFiller.

Consumer Credit Agreement Template Guide

This guide provides a comprehensive overview of a Consumer Credit Agreement Template, detailing the necessary steps for preparing and utilizing this document effectively. Follow this structured approach to understand and fill out your credit agreement accurately.

What is a Consumer Credit Agreement?

A Consumer Credit Agreement is a legal document that outlines the terms between a lender and a borrower. It serves to protect both parties by clearly specifying the responsibilities, loan amount, and repayment terms. This structured agreement is crucial for ensuring mutual understanding and compliance with the loan's stipulations.

-

A formal agreement outlining borrowing terms.

-

Defines responsibilities and expectations for both parties.

-

Prevents disputes and facilitates clear communication.

What are the essential components of the agreement?

A well-crafted Consumer Credit Agreement contains several crucial components. Each element addresses specific aspects of the loan to ensure clarity and enforceability.

-

Identifies the roles of each party, preventing misunderstandings.

-

Specifies the total amount borrowed, essential for clarity.

-

Clarifies whether the rate is fixed or variable, impacting repayment.

-

Defines payment frequency and structure to avoid missed payments.

-

Outlines conditions under which the borrower is considered in default.

-

Specifies collateral types that secure the loan, enhancing lender safety.

How to fill out the Consumer Credit Agreement?

Filling out a Consumer Credit Agreement requires careful preparation. Clear instructions help ensure that every section is completed correctly to avoid future complications.

-

Compile necessary financial and personal information beforehand.

-

Accurately input details of both parties to establish roles.

-

Clearly state the total loan, ensuring both parties agree.

-

Identify whether the rate will remain constant or vary over time.

-

Include clear terms on repayment timing to avoid confusion.

-

Clearly define what actions lead to default for both parties.

-

List collateral types that could be claimed in the event of default.

How to edit and customize your Consumer Credit Agreement?

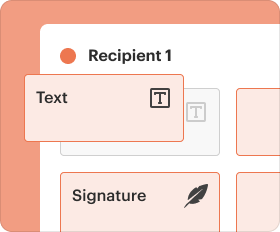

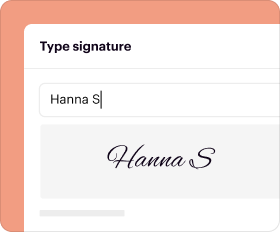

Utilizing pdfFiller’s features makes it easy to edit your Consumer Credit Agreement for personalized use. These tools allow for seamless customization and collaboration.

-

Start by importing any pre-existing agreements directly into pdfFiller.

-

Utilize pdfFiller's suite of editing tools to modify text and fields.

-

Insert signature areas for all relevant parties, ensuring quick completion.

-

Invite other stakeholders to contribute or review the agreement.

What are the legal compliance and best practices?

Legal compliance is critical to the enforceability of any Consumer Credit Agreement. Understanding local regulations and adherence to best practices helps avoid pitfalls.

-

Stay informed about local laws governing credit agreements to ensure validity.

-

Watch for unclear language or missing information that could lead to disputes.

-

Use clear, precise terms to bolster the contract’s standing in legal contexts.

How to fill out the Consumer Credit Agreement Template

-

1.Open the Consumer Credit Agreement Template in pdfFiller.

-

2.Begin by filling in the borrower's full name and contact information in the designated fields.

-

3.Enter the lender's name and address in the corresponding section.

-

4.Specify the loan amount and interest rate clearly, ensuring accuracy in numerical entries.

-

5.Outline the repayment terms including the duration of the loan and payment frequency.

-

6.Include any fees or penalties associated with late payments, as relevant to your agreement.

-

7.Review the terms for clarity and completeness before proceeding to the signature section.

-

8.Allow both parties to review the agreement before signing electronically or physically as per preference.

-

9.Save the completed document securely and consider sending copies to all parties involved.

What is a consumer credit agreement?

What does Consumer credit agreement mean? It is an agreement between an individual (the 'debtor') and any other person (the 'creditor') by which the creditor provides the debtor with credit of any amount.

How to write a credit agreement?

The Lender agrees to loan (total amount of the credit) to the Borrower. The Borrower agrees to repay the total amount in full before , along with any interest incurred on the unpaid monies at the rate of _% per year, beginning on (date).

What is an CCA request example?

I require you to provide me with a true copy, or reconstituted copy of the credit agreement relating to any account you deem to be mine, together with any other documentation the Act requires you to provide. I expect you to comply fully and properly with this request, within the statutory time limit.

What is a consumer credit contract?

A consumer credit contract is a contract between a consumer and a lender. If you take out a mortgage, sign up for a credit card, arrange an overdraft or take out a personal or cash loan – you have entered a consumer credit contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.