Convertible Debt Agreement Template free printable template

Show details

This document outlines the terms and conditions for a convertible debt arrangement between a company and an investor, including loan amounts, interest rates, conversion terms, and default provisions.

We are not affiliated with any brand or entity on this form

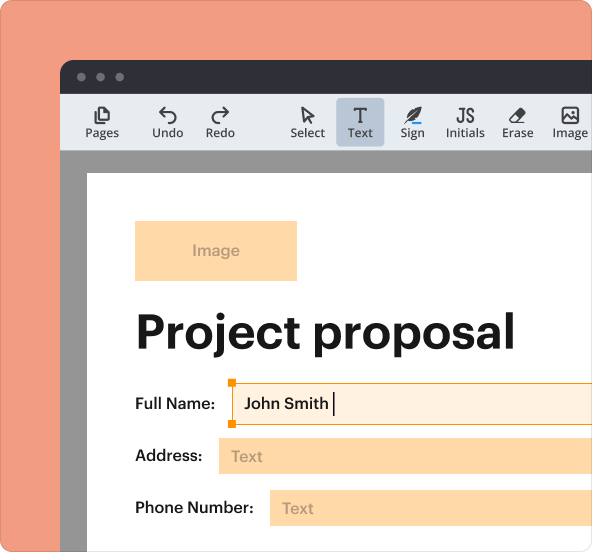

Why pdfFiller is the best tool for managing contracts

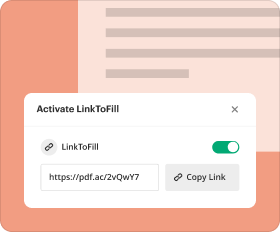

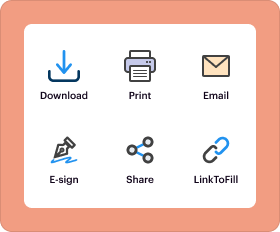

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Convertible Debt Agreement Template

A Convertible Debt Agreement Template is a legal document outlining the terms under which a company can issue debt that can be converted into equity at a later date.

pdfFiller scores top ratings on review platforms

This program worked very well for us.

This program worked very well for us.

Very convenient and it's a…

Very convenient and it's a state-of-the-art platform to deal with all PDF documents.

it was easy to navigate through

it was easy to navigate through

i reaaly love this program

i reaaly love this program

Still learning and having a few…

Still learning and having a few problems, but probably user-error related. Would undoubtably help if I had slowed down enough to watch the video, but just had to get this done.

Wonderful

Who needs Convertible Debt Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Convertible Debt Agreement Templates

What is a convertible debt agreement?

A convertible debt agreement is a financial contract between a startup and an investor, allowing the investor to loan money to the startup with the option to convert the debt into equity at a predetermined point, usually during a future financing round. This type of agreement is vital in startup financing as it provides a bridge for companies that may not have a strong enough valuation to attract investors seeking equity stakes. Typically used by startups and their investors, it creates an opportunity for funding without the need for immediate equity dilution.

What are the key components of a convertible debt agreement?

-

Include essential information such as the date of the agreement, names of the company and investor, and relevant contact information.

-

Clarify definitions for key terms like Convertible Debt, Conversion Price, and Maturity Date to avoid confusion later.

-

Include provisions for the valuation cap—a limit on the valuation at which the debt converts—and specify what qualifies as a financing round.

How do you fill out a convertible debt agreement?

Filling out a convertible debt agreement involves several critical steps. Begin by entering fundamental contract details such as the date, company name, and investor name. Next, you will define important terms like the convertible debt amount, conversion price, and maturity date. It is crucial to be meticulous to avoid common mistakes, such as incorrect investor names or missing key definitions. Utilize pdfFiller’s editing features to ensure clarity and correctness in your document.

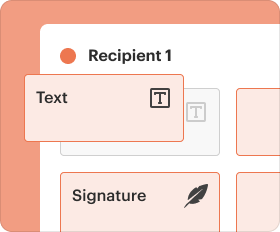

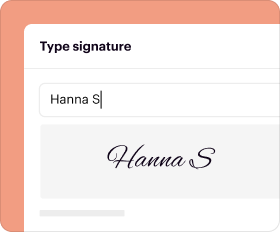

What interactive tools can help manage your convertible debt agreement?

-

Use pdfFiller’s cloud-based platform to collaborate with team members or legal advisers, ensuring everyone is on the same page.

-

eSign your Convertible Debt Agreement securely directly within the pdfFiller platform, which preserves the integrity of your document.

-

Manage versions and track changes through pdfFiller, which allows easy reverting to previous versions if necessary.

What legal considerations should you keep in mind?

Legal requirements for convertible debt agreements can vary significantly by region. It's crucial to understand local regulations regarding financing and securities to ensure compliance. This may include disclosures specific to your industry, such as investor qualifications or offering materials. For comprehensive guidance, consider consulting legal experts or resources specializing in convertible debt agreements.

What are strategies for effective negotiation?

-

Research the market and prepare to negotiate terms that best suit your financial needs and future funding strategy.

-

Evaluate investor offers based on the terms of your Convertible Debt Agreement, including interest rates and potential equity dilution.

-

Utilize data from your financial story to strengthen your position during negotiations and to justify your valuation and terms.

How to manage your convertible debt post-agreement?

Once the agreement is in place, managing convertible debt effectively is crucial. It's essential to know what actions to take before the maturity date, whether that involves securing additional financing or preparing your startup for a future equity conversion. Analyzing the options available upon reaching the maturity date, such as repayment or conversion into equity, will be beneficial in planning your next steps.

How to fill out the Convertible Debt Agreement Template

-

1.Download the Convertible Debt Agreement Template from pdfFiller.

-

2.Open the PDF file in the pdfFiller editor.

-

3.Begin by filling out the parties' information, including names and addresses of the issuer and the investor.

-

4.Specify the principal amount of the convertible debt in the designated field.

-

5.Next, enter the interest rate and payment schedule, detailing when payments are due, if applicable.

-

6.Include the conversion terms, specifying how and when the debt can be converted into equity, including necessary conditions.

-

7.Highlight any events that trigger conversion, such as financing rounds or company sale.

-

8.Review and customize any additional clauses relevant to your agreement, such as default provisions or governing law.

-

9.Once all information is accurately filled, proofread for any errors or omissions.

-

10.Save the filled document and share it with all parties for review and signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.