Convertible Loan Startup Agreement Template free printable template

Show details

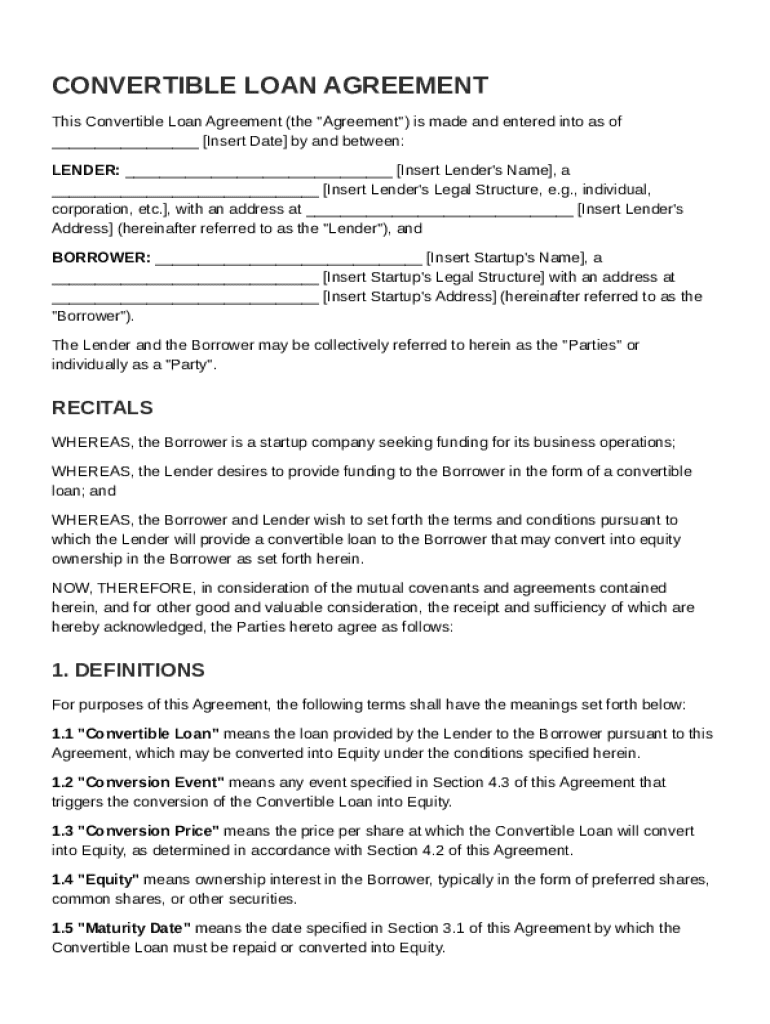

This document outlines the terms and conditions of a convertible loan provided by the Lender to the Borrower, detailing how the loan may convert into equity ownership in the Borrower.

We are not affiliated with any brand or entity on this form

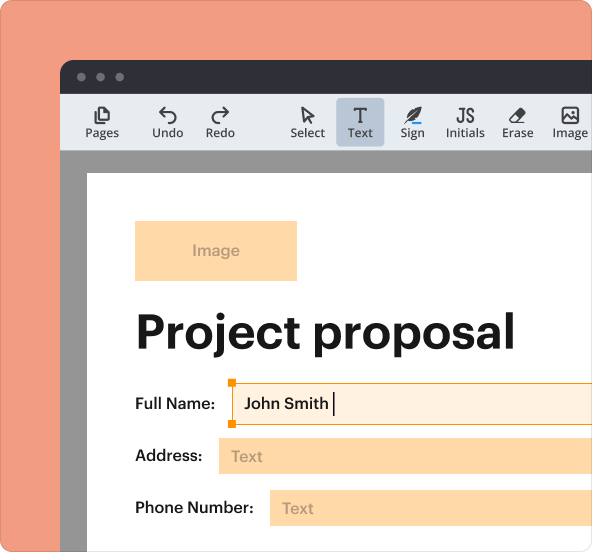

Why pdfFiller is the best tool for managing contracts

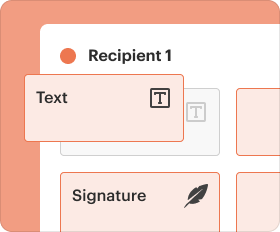

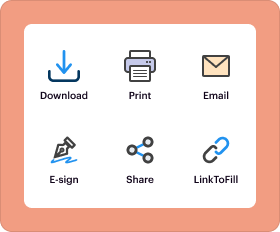

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

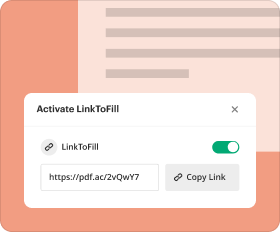

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Convertible Loan Startup Agreement Template

A Convertible Loan Startup Agreement Template is a legal document that outlines the terms of a loan to a startup, which can later be converted into equity in the company.

pdfFiller scores top ratings on review platforms

inexperienced with it taught me something

A little confusing at first. That's why I'm interested in a webinar.

What do you like best?

Let's me search for forms with ease. Great to correct PDFs.

What do you dislike?

Printing can take multiple times to work

What problems are you solving with the product? What benefits have you realized?

It's helpful in filling a form that you can do with Adobe.

What do you like best?

Very easy to use. Super helpful. I have to complete so many forms this is an amazing addition so I dont have to hand write everything.

What do you dislike?

I would say the price, but even that isn't bad. So nothing at all.

What problems are you solving with the product? What benefits have you realized?

Like mentioned above, I often have so many forms I need to fill out. I love being able to just write and fill in the things I need. To make them look very clean and professional.

Great job

SO FAR, SO GOOD

Who needs Convertible Loan Startup Agreement Template?

Explore how professionals across industries use pdfFiller.

Convertible Loan Startup Agreement: The Comprehensive Guide

Understanding how to fill out a convertible loan startup agreement template is crucial for both investors and startups. This guide will assist you in navigating the intricate details, ensuring you manage this essential document effectively.

What are convertible loans?

A convertible loan is a type of financing where the debt can be converted into equity at a later stage. These loans are designed to allow startups to obtain necessary capital while delaying the company valuation until a more favorable time.

-

Convertible loans enable startups to access capital by offering investors the option to convert their loan into equity at a determined future date.

-

For lenders, these loans offer a potential for significant returns if the startup succeeds. For borrowers, they provide essential funds without the immediate pressure of converting debt into equity.

-

Convertible loans are advantageous in early-stage investments where valuation is uncertain and in scenarios where startups want to delay fund dilution.

What are the key components of a convertible loan agreement?

A convertible loan agreement includes important sections that outline the roles of both the lender and the borrower, setting the framework for the transaction.

-

The agreement identifies the lender and borrower, defining their respective roles and responsibilities.

-

This section provides context and background for the agreement, clarifying its intent and significance.

-

Key terms such as 'Convertible Loan' and 'Conversion Event' are defined to avoid misunderstandings.

-

The document typically follows a structured format that includes section headings, making it easy to navigate.

How do fill out a convertible loan agreement?

Filling out a convertible loan agreement requires careful attention to detail, ensuring all relevant information is accurately captured.

-

Begin by following a structured approach, filling in critical areas like names, addresses, and loan amounts.

-

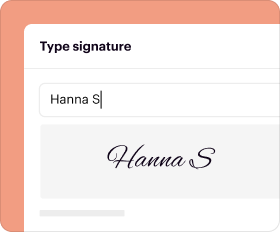

Utilize platforms like pdfFiller to edit, sign, and manage your documents seamlessly online.

-

Be vigilant with important sections, particularly deadlines and any clauses that could affect the agreement's execution.

What legal frameworks govern convertible loans?

Compliance with existing legal frameworks is essential when drafting a convertible loan agreement, especially in light of local regulations.

-

Familiarize yourself with relevant laws that govern lending practices and convertible securities in your jurisdiction.

-

Understand regional laws that might affect your agreement, including disclosures or reporting requirements.

-

Incorporate best practices to ensure clear, compliant legal documentation that minimizes risks.

What are conversion terms?

Conversion terms are vital in determining when and how a convertible loan will turn into equity.

-

Clarify what triggers conversion, such as future financing rounds or acquisition events.

-

Explore how factors like company valuation and investor agreements impact the conversion price.

-

Understand how post-conversion equity stakes affect both the startup's ownership structure and investor return potentials.

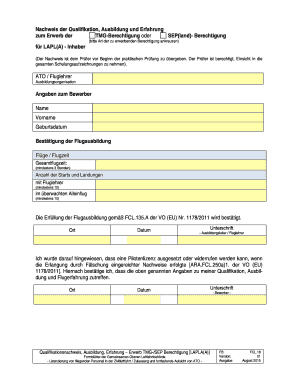

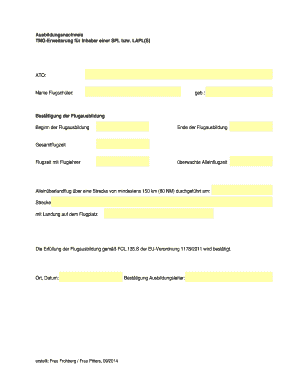

How to fill out the Convertible Loan Startup Agreement Template

-

1.Begin by downloading the Convertible Loan Startup Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller and ensure you have editing capabilities.

-

3.Fill in the date of the agreement at the top of the document.

-

4.Add the names and addresses of the lender and the startup in the designated sections.

-

5.Specify the loan amount that the lender is providing to the startup.

-

6.Outline the interest rate for the loan, if applicable, in the appropriate field.

-

7.Detail the repayment terms, including the maturity date of the loan.

-

8.Include clauses about the conditions under which the loan can be converted to equity.

-

9.Review the document for accuracy and completeness, ensuring all necessary sections are filled out.

-

10.Sign the document electronically or print it out for physical signatures before finalizing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.