Corporate Buy Sell Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions for the buying and selling of shares among shareholders of a corporation, detailing definitions, trigger events, valuation methodologies, purchase

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Corporate Buy Sell Agreement Template

A Corporate Buy Sell Agreement Template is a legal document that outlines the terms and conditions under which business partners can buy and sell each other's shares in a company.

pdfFiller scores top ratings on review platforms

So far, so good...

So far, so good - seems to be exactly what I've been looking for

nmnk

Satisfied Totally happy so far

Quick and Easy

I needed it to quickly fill out some forms. Inserting text so it lines up with lines on the form is a little tricky, but other than that, pretty straightforward. Would definitely recommend!

Very helpful and attentive!

The best software for editing pdf proposals and signing signatures on original documents. Helps you to truly be paperless!

Huge time saver for my business!

Who needs Corporate Buy Sell Agreement Template?

Explore how professionals across industries use pdfFiller.

Corporate Buy Sell Agreement Template Guide

A corporate buy sell agreement template serves as a crucial legal document outlining the terms and conditions under which a business owner can buy or sell shares of their company. This guide will help you understand its significance, key provisions, and the drafting process.

What is a corporate buy-sell agreement?

A corporate buy-sell agreement is a legally binding contract designed to govern the eventual sale of an owner's interest in a business. It outlines how and when shares can be bought or sold, ensuring continuity and stability in corporate ownership. Establishing these agreements is crucial for protecting both the interests of the existing shareholders and the integrity of the business.

-

Definition and purpose: It defines the circumstances that trigger share sales and the procedures associated with those sales.

-

Importance in corporate structures: Helps mitigate disputes and ensure stability by clarifying ownership transfer terms.

-

Facilitates smooth transitions: This aspect ensures that ownership changes do not disrupt business operations.

What are the key provisions in a buy-sell agreement?

A well-structured buy-sell agreement contains several key provisions that help streamline the sale of shares. This clarity ensures that all parties know what to expect during the share transfer process, reducing the likelihood of legal disputes.

-

Clarifies essential terms used throughout the document.

-

Outlines definitions and roles of involved parties, helping clarify responsibilities.

-

Details the specific events that permit a sale, such as death or retirement.

-

Describes how share value will be determined to ensure fairness.

-

Stresses the importance of written communication when initiating share sales.

What information is needed in the agreement?

Assembling accurate information is essential when drafting a buy-sell agreement. The effectiveness of the agreement hinges on the details provided, which serve as the backbone of the document.

-

Names, addresses, and ownership stakes of shareholders must be clearly stated.

-

Essential details like incorporation data and core business activities should be included.

-

pdfFiller can streamline this process by digitally collecting and organizing required information.

How to draft your buy-sell agreement?

Drafting a buy-sell agreement does not have to be an arduous task. With the right approach and tools, like the templates available on pdfFiller, you can create an effective agreement tailored for your business.

-

Follow a structured process, starting with the basic template that outlines necessary elements.

-

Utilize the provided rules and procedures directly from the template.

-

Every business is unique; therefore, tailor the template to reflect your specific company needs.

-

Take advantage of pdfFiller’s user-friendly tools to draft and edit the agreement efficiently.

What are the different types of buy-sell agreements?

Different business structures necessitate different types of buy-sell agreements. Understanding which agreement suits your company can help maximize tax benefits and align with your business strategy.

-

In this structure, remaining shareholders buy the departing owner's shares.

-

Here, the business itself buys back the shares, which can simplify tax implications.

-

Considerations include business size, structure, and future plans, helping determine the most advantageous type.

-

Different agreement types can have varying tax implications affecting the overall business health.

What are the best practices for managing buy-sell agreements?

Effective management of buy-sell agreements can enhance compliance and align them with changing business laws and structures. Regular attention to these agreements ensures they remain relevant.

-

Schedule frequent evaluations to ensure the agreement remains aligned with company needs and laws.

-

Ensure that the agreement is consistent with the company’s bylaws and operating agreements for legal clarity.

-

Involve legal and financial experts to ensure comprehensive oversight and compliance with regulations.

-

Leverage pdfFiller's digital tools to maintain updated records and facilitate easy version control.

How can pdfFiller assist in document management?

Navigating document management can be simplified through the features offered by pdfFiller. From electronic signing to real-time collaboration, pdfFiller provides a robust platform for enhancing agreement processes.

-

Easily sign and share buy-sell agreements without needing physical copies.

-

Access interactive features that facilitate smoother management of agreements.

-

Store and manage documents online, ensuring they are accessible from anywhere at any time.

-

The platform maximizes efficiency in creating, signing, and securely storing business documents.

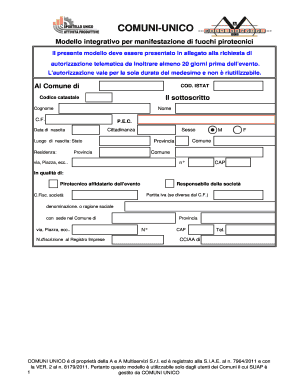

How to fill out the Corporate Buy Sell Agreement Template

-

1.Obtain the Corporate Buy Sell Agreement Template in a PDF format.

-

2.Open the document in pdfFiller or your preferred PDF editing software.

-

3.Begin with filling out the company information, including the full legal name and address.

-

4.Next, enter the names and details of all partners involved in the agreement.

-

5.Specify the ownership percentages for each partner, detailing the shares held.

-

6.Clearly outline the buy-sell agreement provisions including trigger events for buyout, appraisal process, and payment terms.

-

7.Include any conditions or restrictions on shares that partners may have.

-

8.Review all entered information for accuracy and completeness.

-

9.Save the filled document and consider having it reviewed by a legal expert before finalizing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.