Corporate Credit Card Agreement Template free printable template

Show details

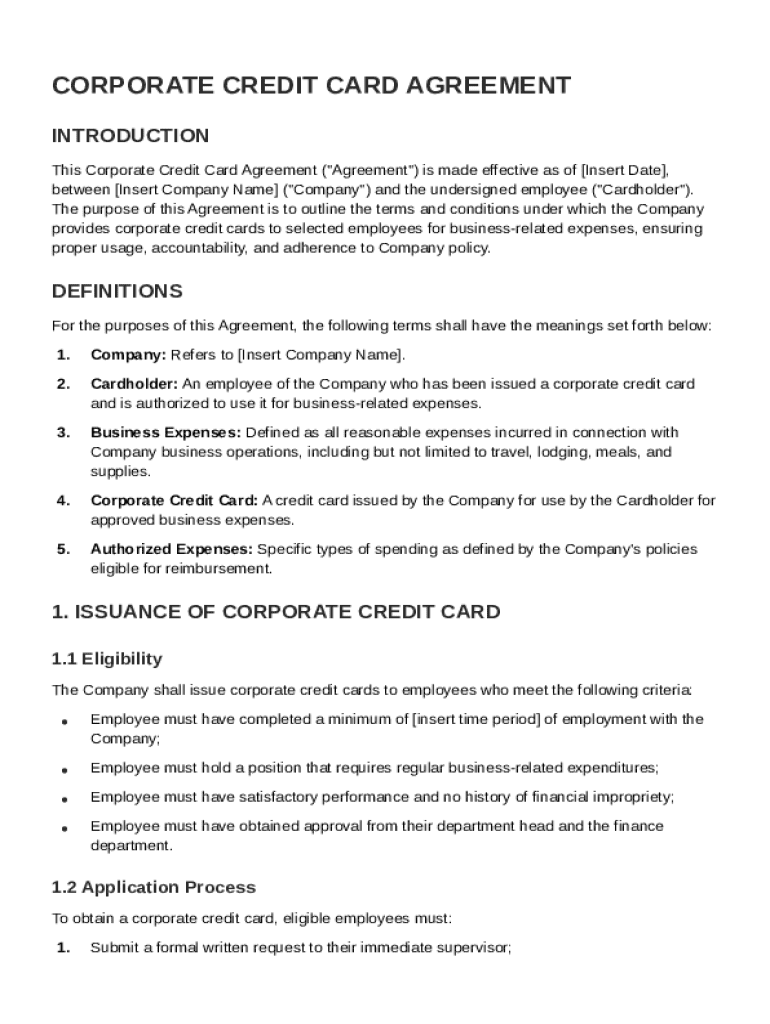

This Agreement outlines the terms and conditions under which the Company provides corporate credit cards to selected employees for businessrelated expenses.

We are not affiliated with any brand or entity on this form

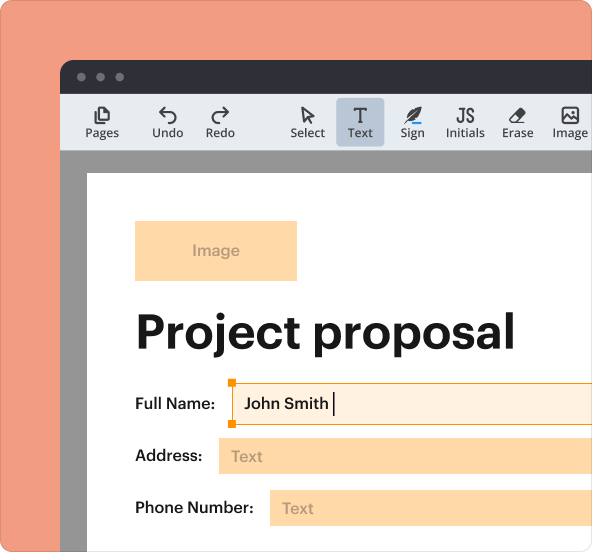

Why pdfFiller is the best tool for managing contracts

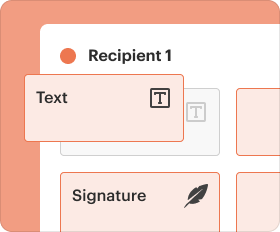

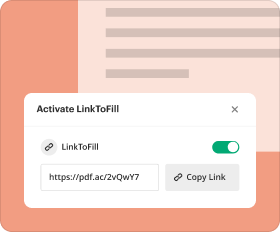

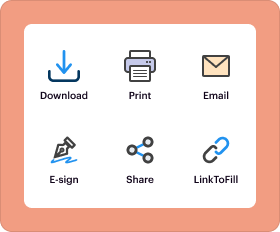

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

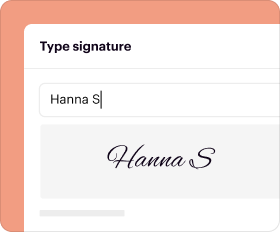

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Corporate Credit Card Agreement Template

A Corporate Credit Card Agreement Template is a formal document outlining the terms and conditions for issuing credit cards to employees for business expenses.

pdfFiller scores top ratings on review platforms

very good

excellent resource, very easy to use

I love the work i have completed thus…

I love the work i have completed thus far. This is a great resource.

Excellent!!!

Excellent!!!

Good

Super easy, greatly appreciated

very good

very good........

AWESOME PROGRAM

AWESOME PROGRAM

Who needs Corporate Credit Card Agreement Template?

Explore how professionals across industries use pdfFiller.

Corporate Credit Card Agreement Template form: A Comprehensive Guide

Navigating the complexities of a corporate credit card agreement can be challenging, but understanding its elements is essential for both cardholders and companies. This guide provides detailed insights into the Corporate Credit Card Agreement Template form, essential for managing employee spending effectively.

What is a Corporate Credit Card Agreement?

A Corporate Credit Card Agreement is a legal document that outlines the terms and conditions between a company and its employees (cardholders) regarding the use of corporate credit cards. It specifies the rights, responsibilities, and expectations for both parties, ensuring that business expenses are managed appropriately.

-

This is a formal contract that governs the use of corporate credit cards for business-related expenses.

-

The agreement primarily involves the company issuing the card and the employee using the card.

-

It aims to outline spending limits, eligible expenses, and accountability to manage business finances effectively.

What are the core definitions in the agreement?

-

The organization that provides the corporate credit card to its employees, defining their roles and responsibilities.

-

An employee who qualifies for a corporate credit card and is responsible for its usage.

-

These are expenses incurred for company purposes, such as travel or office supplies, that the card can be used for.

-

A credit card issued to employees for business expenses, often with specific limits and conditions.

-

Details regarding what spending is allowed, such as transportation, lodging, and meals during business trips.

What are the eligibility criteria for issuance?

To qualify for a corporate credit card, employees must meet specific criteria set by the company. This includes considerations such as employment duration, job role, and performance history.

-

Typically, employees need to have been with the company for a certain period, often six months or more.

-

Certain roles, particularly those that require frequent travel or outside sales, may be prioritized for card issuance.

-

Employees with strong performance records are more likely to be approved for a card.

-

This involves managerial review and sign-off, confirming that the employee meets all the criteria.

How is the application process for a corporate credit card?

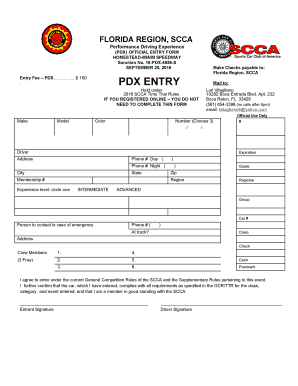

The application process involves several steps that employees must follow to secure their corporate cards. It is vital to fill out the Corporate Credit Card Application Form accurately.

-

Employees must submit the application form along with any necessary documentation to their HR or Finance department.

-

This form captures personal and employment details as well as justifications for needing the card.

-

Applicants may need to explain how the card will facilitate their work and benefit the company.

-

Approvals from both the Finance department and executive management are necessary before the card is issued.

What are the usage guidelines for the corporate credit card?

Understanding how to use the corporate credit card appropriately is crucial for cardholders. Clear guidelines help in managing and tracking spending effectively.

-

Business-related expenses such as travel, meals, and supplies are generally allowed.

-

Employees should regularly track their expenses to stay within company guidelines.

-

Cardholders must keep receipts and other documentation to substantiate their business expenses.

-

Misuse of the card can lead to disciplinary action, including revocation of card privileges.

What are the cardholder responsibilities?

As a corporate credit card user, an employee has specific responsibilities to ensure proper usage and compliance with company policies.

-

Cardholders must be responsible for all transactions made on the card and ensure they comply with the agreement.

-

Understanding and adhering to the organization's policies regarding spending is crucial.

-

Improper use may lead to personal financial consequences, including debt or legal action.

-

Timely and accurate reporting of expenses is essential for compliance and audit purposes.

How do employee credit cards impact personal credit?

Employees often worry about how corporate credit cards may affect their personal credit scores. It is essential to clarify these impacts and mitigate risks.

-

Generally, corporate credit cards are not reported on personal credit reports, but misuse could affect personal finances.

-

Payment history on corporate cards doesn't directly affect personal credit, but late payments by the employer can sometimes reflect poorly.

-

Cardholders should limit personal usage and report any issues promptly to maintain a clear boundary between corporate and personal expenses.

What tips should be considered?

Success in managing a corporate credit card relies heavily on understanding best practices and maintaining a systematic approach.

-

Use apps or spreadsheets to track expenses regularly, ensuring compliance with corporate policies.

-

Maintain careful records of all transactions to facilitate reconciliation and audits.

-

Be thorough in preparing justifications and fulfill all requirements to speed up the approval process.

How to fill out the Corporate Credit Card Agreement Template

-

1.Download the Corporate Credit Card Agreement Template from pdfFiller's website.

-

2.Open the downloaded template in pdfFiller’s editor.

-

3.Enter the company name in the designated field at the top of the document.

-

4.Fill in the contact information of the employee receiving the card.

-

5.Specify the spending limit for the credit card next to the appropriate section.

-

6.Review the terms and conditions section to ensure all policies are accurately listed.

-

7.Add any additional clauses relevant to your business policies, if necessary.

-

8.Include the date of issuance and the effective period for the agreement.

-

9.Ensure that both the employee and an authorized company representative sign the document.

-

10.Save the completed agreement and share it with the concerned parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.