Last updated on Feb 17, 2026

Cosigner Agreement Template free printable template

Show details

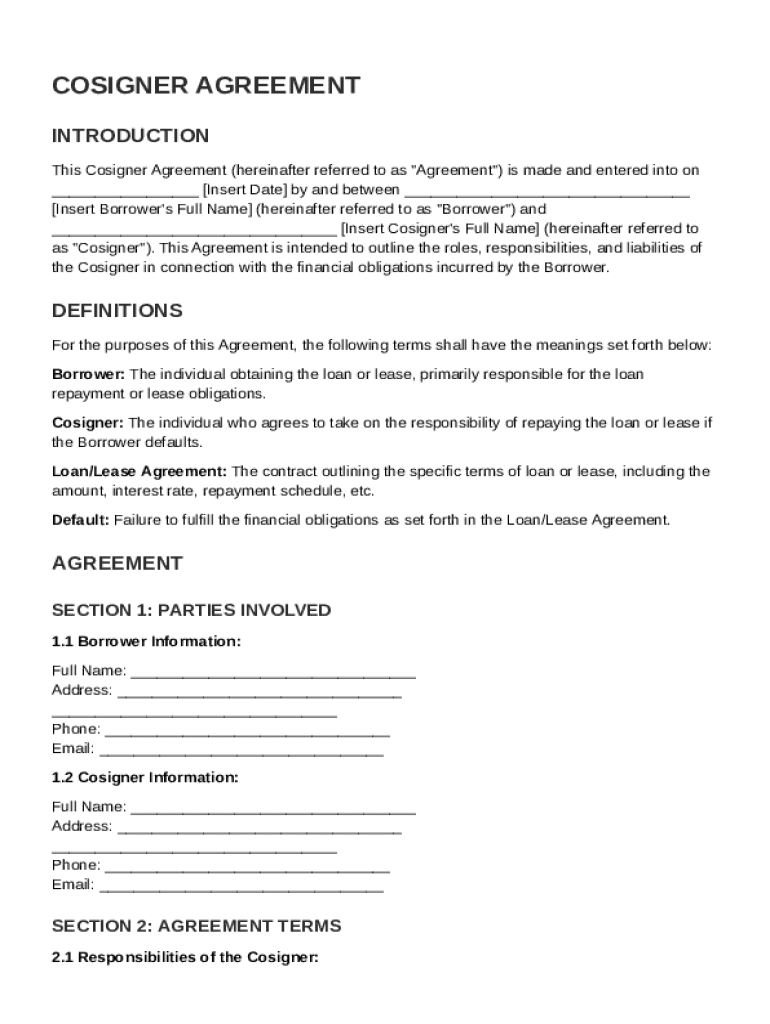

This document outlines the roles, responsibilities, and liabilities of a cosigner in relation to a borrower\'s financial obligations under a loan or lease agreement.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Cosigner Agreement Template

A Cosigner Agreement Template is a legal document that outlines the responsibilities and obligations of a cosigner in a financial arrangement, typically regarding loans or rental agreements.

pdfFiller scores top ratings on review platforms

still learning & its kind of interesting

filing a form its really easy and most convent this is excellent

The Site is very helpful, it is good not to have to go looking for forms that I need.

PDF Filler allows me to create fillable forms for my business. It's quick, easy and the final product looks very professional.

Very good program. Just don't need at this time.

I needed PDF Filler (or something like it) for a specific purpose and for a short time. It got the job done.

I was surprised to see the Annual Fee ($72.00) show up on my credit card statement, instead of the monthly fee ($6.00).

I cancelled my subscription on 4/11/2016, and have been checking my statements for a refund. Am I waiting in vain?

Who needs Cosigner Agreement Template?

Explore how professionals across industries use pdfFiller.

Cosigner Agreement Template Guide

How to fill out a Cosigner Agreement form

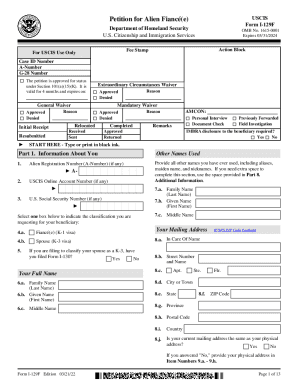

Filling out a Cosigner Agreement Template is a straightforward process that involves understanding key components and terms. You'll need to provide essential details about both the borrower and the cosigner to ensure the document is legally binding. Follow the step-by-step instructions to complete the form accurately and in compliance with legal requirements.

What is a Cosigner Agreement?

A Cosigner Agreement is a legal document that allows a third party, known as the cosigner, to take responsibility for a loan or lease if the primary borrower defaults. This agreement serves to protect the lender by ensuring that, in the event the borrower fails to meet their financial obligations, the cosigner will step in to fulfill these obligations.

-

It's an agreement made voluntarily between a borrower and a cosigner, outlining the obligations of both parties.

-

It helps borrowers with limited credit history secure loans by providing additional security to lenders.

-

Such agreements are often needed for student loans, auto loans, and rental agreements.

Who are the parties involved in a Cosigner Agreement?

There are typically two main parties involved in a Cosigner Agreement: the borrower, who is seeking financial assistance, and the cosigner, who lends their financial credibility and stability. Each party has defined roles and responsibilities that must be understood to ensure compliance with the agreement.

-

The borrower primarily benefits from the loan or lease and is responsible for making timely payments.

-

The cosigner provides a guarantee to the lender, sharing the financial responsibility for the loan.

-

Cosigners are legally responsible for the debt if the borrower defaults, which can impact their credit score.

What are the terms and conditions of the Cosigner Agreement?

The terms and conditions outlined in a Cosigner Agreement detail the obligations of both parties, including payment responsibilities, consequences of default, and definitions of key terms. Understanding these terms is crucial to avoid misunderstandings and potential legal issues.

-

Both parties must understand their exact financial commitments as stipulated in the agreement.

-

Terms like 'Default' refer to failing to make payments, while 'Loan Agreement' details the nature of the financial product.

-

Defaulting can lead to financial penalties and a negative impact on the cosigner's credit.

How can you fill out the Cosigner Agreement Template?

Filling out the Cosigner Agreement Template requires attention to detail to ensure accuracy. It's essential to use a reliable platform like pdfFiller, which provides interactive tools for a seamless experience.

-

Start by entering the necessary personal information for both the borrower and the cosigner in the designated interactive fields.

-

This platform allows users to fill out forms digitally, saving time and reducing errors.

-

Double-check all entries against required documentation to avoid mistakes and ensure compliance.

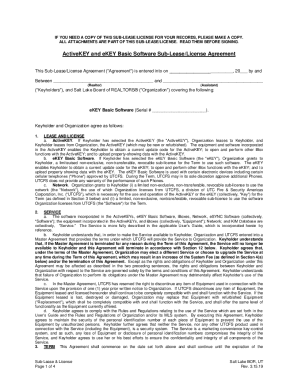

How to edit and manage your Cosigner Agreement?

Editing and managing your Cosigner Agreement is crucial to keep the document up-to-date. Using pdfFiller facilitates easy modifications, collaborative efforts, and efficient organization of important documents.

-

pdfFiller provides users with tools to edit text, add comments, and make revisions directly on the document.

-

Utilize features for file organization and sharing to collaborate with other parties involved.

-

Ensure that your Cosigner Agreement is stored securely with PDF platform’s options for private cloud storage.

How do you sign the Cosigner Agreement?

Signing the Cosigner Agreement must comply with state-specific laws regarding eSignatures. Utilizing the eSignature features available on pdfFiller ensures a valid and secure signing process.

-

Different states have specific requirements for eSigning documents; make sure to comply accordingly.

-

The platform includes user-friendly eSignature tools that simplify the signing process.

-

pdfFiller supports obtaining necessary signatures from multiple parties efficiently.

What are your rights and responsibilities as a cosigner?

As a cosigner, it is crucial to understand your rights, especially regarding the borrower’s default. It is also important to recognize your responsibilities after signing.

-

You have the right to be informed about payment status and any defaults that occur after signing.

-

The borrower is primarily responsible for fulfilling the payment obligations per the loan terms.

-

There are legal protections available to cosigners that may include notification of defaults and the right to take action.

What local considerations should be taken into account for Cosigner Agreements?

Understanding local laws is vital when entering a Cosigner Agreement. Each state may have different regulations that impact how these agreements are structured and enforced.

-

Each state has specific legislation that can affect cosigning, including limits on interest rates and borrower protections.

-

Consult local resources, such as legal aid or housing services, to understand rights and requirements.

-

There are situations and documents that demonstrate how cosigning plays out based on local regulations.

How to fill out the Cosigner Agreement Template

-

1.Download the Cosigner Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the date at the top of the document.

-

4.Fill in the full legal names of the primary borrower and the cosigner in the designated fields.

-

5.Provide the address of both parties, ensuring accuracy for future reference.

-

6.Specify the loan or rental amount that the cosigner is agreeing to back.

-

7.Clearly state the terms of the agreement regarding payment responsibilities and any conditions.

-

8.Include signatures for both the primary borrower and cosigner at the end of the document.

-

9.Review the filled document for any errors or omissions before saving.

-

10.Download or print the completed agreement for both parties to keep a copy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.