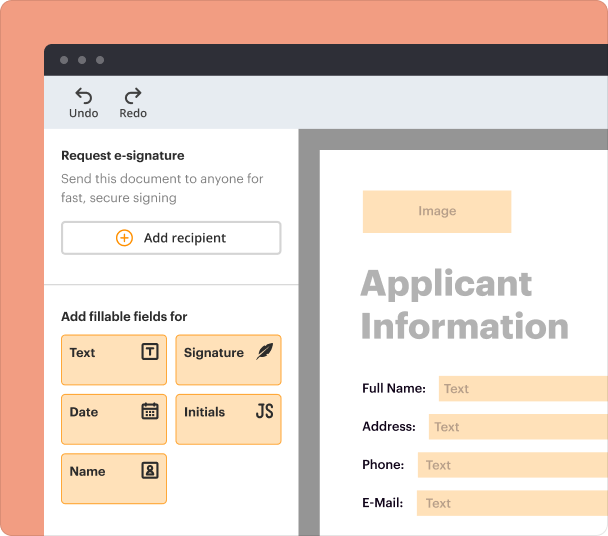

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Credit Agreement Template free printable template

Show details

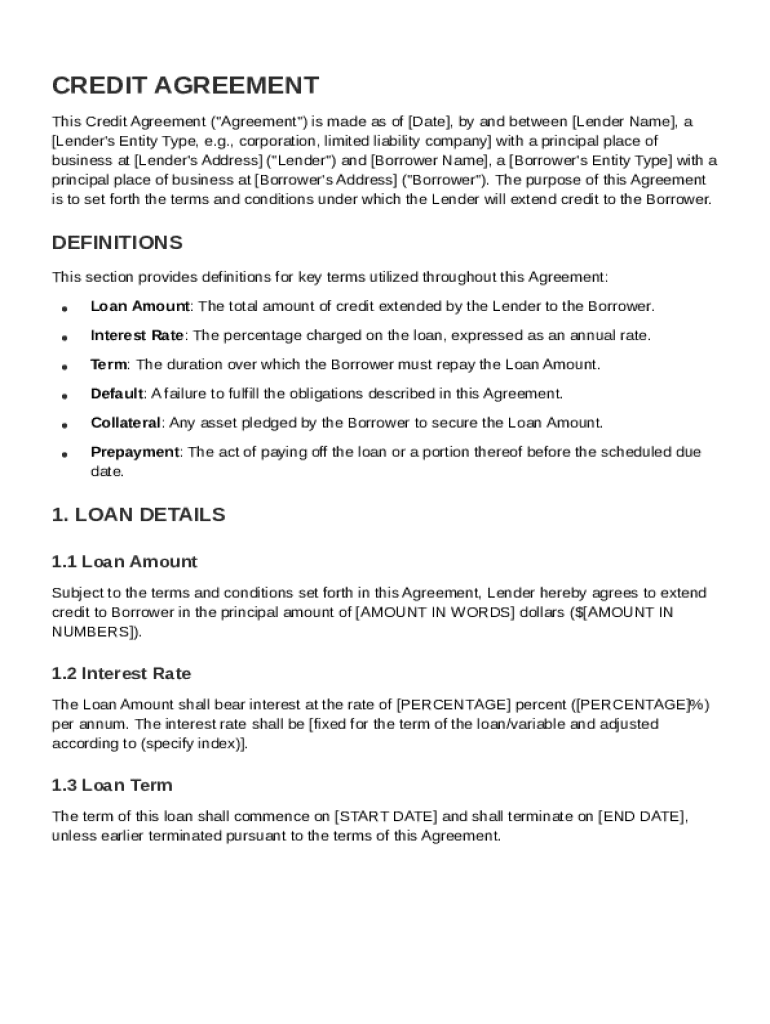

This document outlines the terms and conditions under which a lender will extend credit to a borrower, including loan details, payment terms, representations, covenants, events of default, and governing

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

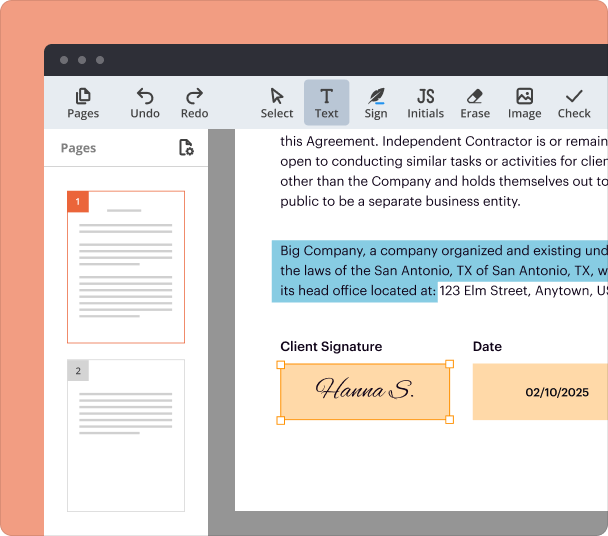

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Credit Agreement Template

Follow these steps for detailed guidance on editing and filling out the Credit Agreement Template efficiently.

How to edit Credit Agreement Template

Experience seamless editing with pdfFiller, the all-in-one solution for your document needs. Start by clicking 'Get form' and follow the steps below to edit your Credit Agreement Template.

-

1.Click the 'Get form' button on this page to access the Credit Agreement Template.

-

2.If you don't have a pdfFiller account, click 'Sign Up' to create one; you can also sign in using your Google or Facebook account for quick access.

-

3.Once logged in, your Credit Agreement Template will open in the pdfFiller editor.

-

4.Use the editing tools on the sidebar to modify text, add or remove sections, and adjust formatting as needed.

-

5.Once you're satisfied with your edits, click 'Save' to keep your changes and ensure your document is ready for use.

How to fill out Credit Agreement Template

Completing the Credit Agreement Template is essential for clear and effective communication of terms. The easiest way to obtain this form is by clicking ‘Get form’ on this page.

-

1.Click 'Get form' to access the Credit Agreement Template directly.

-

2.Review the template thoroughly to understand the sections that require your input.

-

3.Fill in the necessary information, ensuring accuracy in details such as names, addresses, and loan terms.

-

4.Add any additional clauses or modifications that relate to your specific agreement, as needed.

-

5.Make sure to read the entire agreement after filling it out to verify its completeness and correctness.

-

6.If required, have someone review the agreement before finalizing it for signatures.

-

7.Once completed, save a copy of the Credit Agreement Template for your records.

-

8.Share the document with all relevant parties for their acknowledgment and eSignatures, if necessary.

All you need to know about Credit Agreement Template

This section covers everything important related to the Credit Agreement Template, including its definition, provisions, and common use cases.

What is a Credit Agreement Template?

A Credit Agreement Template is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as an essential tool to ensure that both parties are clear on their obligations and rights regarding the borrowing and repayment of funds.

Definition and key provisions of a Credit Agreement Template

This template typically includes key provisions that protect both parties in a lending arrangement. Common elements include:

-

1.Loan amount and purpose

-

2.Interest rate and payment schedule

-

3.Default conditions and remedies

-

4.Governing law and dispute resolution

-

5.Collateral requirements (if applicable)

When is a Credit Agreement Template used?

A Credit Agreement Template is commonly used when an individual or business borrows money from a financial institution or private lender. It is essential whenever large sums are involved, or formal agreements are needed to ensure clarity and accountability in financial transactions.

Main sections and clauses of a Credit Agreement Template

The key sections of a Credit Agreement Template are crucial for outlining the responsibilities and rights of the parties involved. The main sections typically include:

-

1.Parties to the agreement

-

2.Loan details (amount, interest rate, duration)

-

3.Repayment terms

-

4.Conditions under which the loan can be called due

-

5.Rights upon default

-

6.Miscellaneous clauses (amendments, notices)

What needs to be included in a Credit Agreement Template?

For a Credit Agreement Template to be effective, the following essential elements should always be included:

-

1.Identification of the lender and borrower

-

2.The total amount of the loan

-

3.Detailed repayment terms, including frequency and amount

-

4.Consequences of missed payments

-

5.Any fees or penalties associated with the loan

-

6.Signature lines for both parties

pdfFiller scores top ratings on review platforms

Very easy to use

Very easy to use, the layout is easy to navigate.

Takes some getting use to

Takes some getting use to. Not as User friendly as I had hoped.

quick and easy to use

quick and easy to use. has a ton of features that really help me get my job done faster!

Great tool!

Great tool works like a charm and easy to navigate!

With help I was able to access the…

With help I was able to access the forms I needed! Thanks!

easy to use

Does everything I need it to do and very easy to use

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.