Last updated on Feb 17, 2026

Credit Line Agreement Template free printable template

Show details

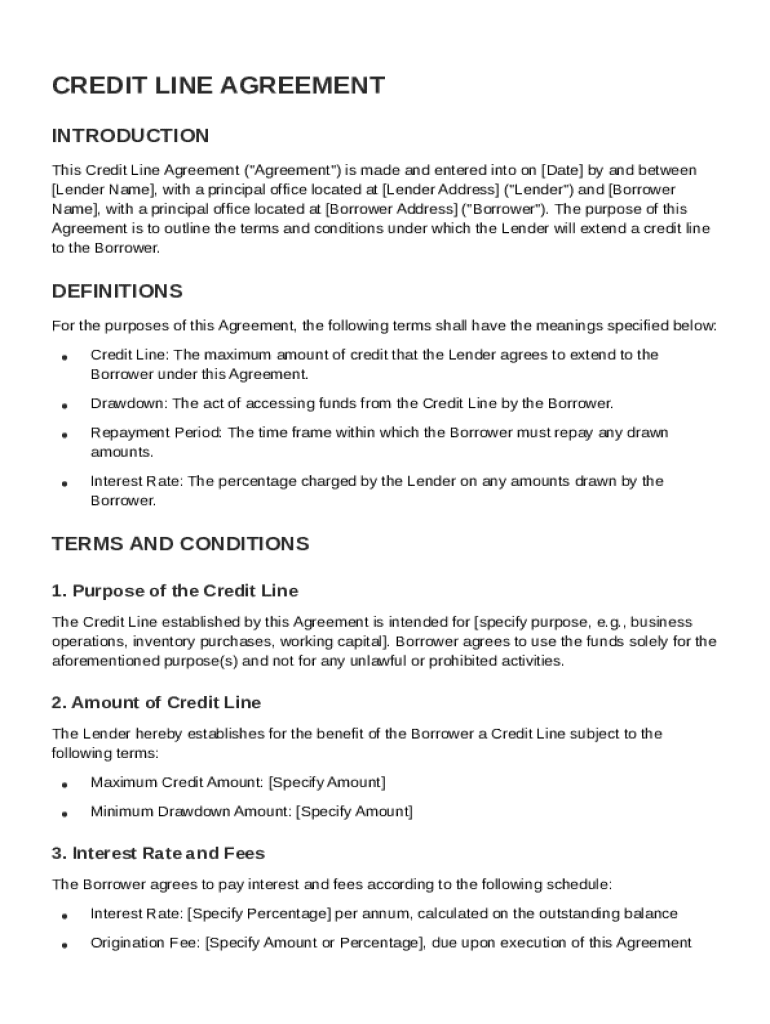

This document outlines the terms and conditions under which a lender will extend a credit line to a borrower, including definitions, repayment terms, default provisions, and legal considerations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Credit Line Agreement Template

A Credit Line Agreement Template is a legal document outlining the terms under which a lender extends credit to a borrower.

pdfFiller scores top ratings on review platforms

I like the fact that I can type on a PDF file that is "non-fill-able". This helps make the document look professional

I just started but I'm beginning to think this program was definitely designed for me!

I've only used it twice, but it is very easy to navigate.

I am using it to send preliminary notices for out plumbing contractors business. It works great.

I love the fact that all my documents look neat and professional

I like it. wish there were more font options but its still great

Extremely easy to use and provides the basics for filling out pre-designed PDF forms.

Who needs Credit Line Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Complete Guide to the Credit Line Agreement

How to fill out a credit line agreement form

Filling out a Credit Line Agreement Template form is a strategic step towards securing funding. You'll need to provide detailed information about both the lender and the borrower, including the purpose of the loan, terms of repayment, and any associated fees. Follow this guide to ensure a comprehensive and compliant agreement.

Understanding the credit line agreement

A credit line agreement is a financial document that outlines the terms under which a lender provides funds to a borrower. This agreement ensures clarity and protects both parties by detailing responsibilities, repayment schedules, and associated costs. Having a formal credit line agreement not only facilitates trust between the parties but also stipulates key components necessary for ongoing communication.

-

It is a formal contract that allows the borrower to access funds up to a specified limit.

-

It minimizes misunderstandings and securely defines the terms of borrowing.

-

Includes credit limits, interest rates, repayment terms, and permissible uses of borrowed funds.

Who are the key parties involved?

In any credit line agreement, two key parties are essential: the lender and the borrower. Their roles need to be distinctly defined in the agreement to avoid potential conflicts and ensure accountability.

-

The lender provides the funds and defines the terms of the agreement, including interest rates and repayment expectations.

-

The borrower is responsible for repaying the borrowed amount under the agreed terms.

-

Acknowledging who the parties are reduces ambiguity and clarifies responsibilities.

What essential definitions should you include?

Understanding key definitions within your credit line agreement is crucial to navigating your financial obligations effectively. These terms help clarify the responsibilities of both parties and outline the framework of the agreement.

-

This refers to the maximum amount that the borrower can draw upon from the lender.

-

This term describes the process by which the borrower accesses funds from the credit line.

-

It refers to the timeline allotted for the borrower to repay the borrowed funds.

-

Charged by the lender; understanding how it's calculated is vital for the borrower's financial planning.

What are the terms and conditions of the credit line agreement?

The terms and conditions outline essential parameters governing the borrower-lender relationship. Understanding these allows borrowers to make informed decisions about their credit line usage and obligations.

-

Clarifies what the funds can be used for, ensuring funds are allocated appropriately.

-

Specifies the maximum and minimum amounts that can be drawn.

-

Details the costs associated with borrowing, which are crucial for managing financial expectations.

How do you fill out your credit line agreement?

Utilizing resources like pdfFiller, you can easily fill out your Credit Line Agreement Template form. This platform guides you through the process, ensuring accuracy and efficiency.

-

Follow the prompts to enter lender and borrower information, specifying terms and conditions clearly.

-

These tools allow you to adjust the agreement to fit specific needs, ensuring greater flexibility.

-

Errors such as incorrect figures or missing signatures can lead to disputes.

How can you edit and manage your credit line agreement on pdfFiller?

Post-completion, having the ability to edit and manage your Credit Line Agreement is vital. pdfFiller's platform enables seamless modifications and collaborations.

-

Access the document to make necessary changes, ensuring compliance with any evolving agreements.

-

This feature allows rapid sign-off on agreements, streamlining the process.

-

Engage with involved parties to ensure everyone is aligned with the terms of the agreement.

What are compliance considerations?

Adhering to region-specific laws and industry standards is crucial in formulating a compliant Credit Line Agreement. This ensures legal validity and protects both parties.

-

Local regulations can introduce specific requirements or prohibitions that must be acknowledged.

-

Compliance with accepted practices within your industry can mitigate risks.

-

Regular consultations with legal experts can prevent potentially costly mistakes.

What are the final steps in securing your credit line?

Once the Credit Line Agreement is prepared, a thorough review process is essential. This decreases the likelihood of disputes later on and strengthens the relationship between lender and borrower.

-

Consider all terms and conditions to avoid misunderstandings.

-

Engaging in open discussions can yield better conditions for your credit line.

-

Maintain communication with your lender to ensure ongoing compliance.

How to fill out the Credit Line Agreement Template

-

1.Open the Credit Line Agreement Template in pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names and addresses of both the lender and the borrower in the designated fields.

-

4.Specify the credit limit amount that the lender is willing to extend.

-

5.Include the interest rate terms and any applicable fees associated with the credit line.

-

6.Define the repayment terms clearly, including the schedule and any penalties for late payments.

-

7.Add any additional clauses that are unique to your agreement, such as security interests or guarantees.

-

8.Review all filled information for accuracy and ensure compliance with applicable laws.

-

9.Once complete, save the document, then either print it for signatures or send it electronically for digital signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.