Credit Repair Agreement Template free printable template

Show details

This document outlines the terms and conditions for credit repair services provided by a company to a client, detailing obligations, services, fees, and confidentiality.

We are not affiliated with any brand or entity on this form

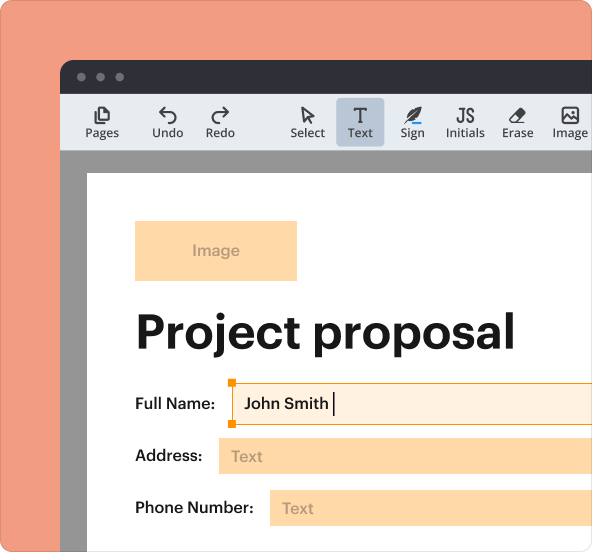

Why pdfFiller is the best tool for managing contracts

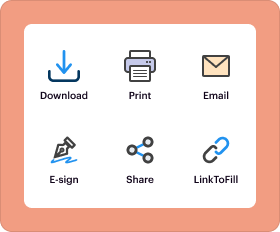

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

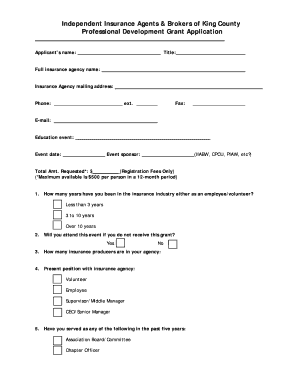

What is Credit Repair Agreement Template

A Credit Repair Agreement Template is a legal document outlining the services and rights related to credit repair between a credit repair company and its client.

pdfFiller scores top ratings on review platforms

Great site! Very user-friendly, and saves me so much time. The template feature is awesome!

WORKS EXCELLENT, SAVES A LOT OF TIME INSTEAD OF WRITING

Works pretty good, but I'm learning the software

I love it!!! i paid an accountant twice this amount the do exactly what I've done here. it suits my needs perfectly.

great site worth the money most def the best customer service I ever received dealing with anything

Just in the nick of time...PDF filler has saved me multiple times. Thank you.

Who needs Credit Repair Agreement Template?

Explore how professionals across industries use pdfFiller.

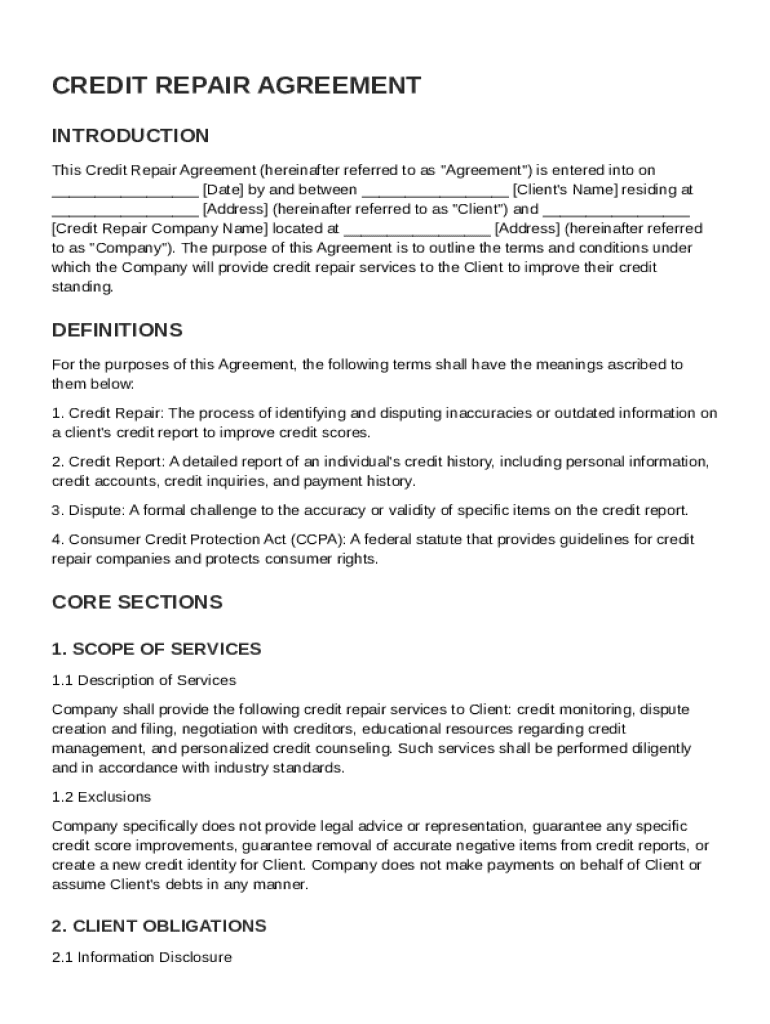

Credit Repair Agreement Template Guide

A Credit Repair Agreement Template form is a crucial document for individuals seeking professional assistance in improving their credit scores. This guide will walk you through the entire process, including key definitions, client obligations, and effective utilization of the agreement.

What is the credit repair process?

The credit repair process involves reviewing and disputing inaccuracies on a consumer's credit report to improve their credit score. It's essential to understand the significance of this process, especially when applying for loans or mortgages. Misreported data can lead to higher interest rates or denial of credit.

-

Credit repair is the process of improving a consumer's creditworthiness by correcting errors in their credit report.

-

The Consumer Credit Protection Act (CCPA) plays a pivotal role in protecting consumers and regulating credit repair companies.

-

These companies aid consumers in navigating the complexities of credit repair, offering services that may include consultation, dispute resolution, and monitoring.

What are the core components of the credit repair agreement?

A well-structured credit repair agreement should contain vital information pertaining to both the client and the company. This ensures clarity regarding the services offered and the expectations of both parties.

-

Details such as names, addresses, and contact information for both the credit repair agency and the client.

-

An outline of the services provided, which helps in setting clear expectations.

-

Essential definitions for terms like Credit Repair, Credit Report, and Dispute help avoid misunderstandings.

What services do credit repair companies provide?

Credit repair companies offer a range of services designed to assist clients in improving their credit profiles. It's crucial to also understand the limitations of these services.

-

These can range from credit monitoring to personalized counseling tailored to the client's specific needs.

-

It's important to clarify what services are not included, ensuring clients have realistic expectations.

-

Diligently following up on disputes and monitoring progress can significantly impact the overall effectiveness of the service.

What are client obligations under the credit repair agreement?

Clients have specific responsibilities to ensure the credit repair process proceeds effectively. Understanding these obligations is paramount for success.

-

Clients must provide accurate information related to their financial situation, as this is crucial for the credit repair process.

-

It's essential for clients to share complete information to avoid delays or complications.

-

Failure to comply with the agreement's terms can hinder service delivery and ultimately affect credit improvement.

How can you effectively use the credit repair agreement?

Utilizing the credit repair agreement efficiently ensures that both parties understand their roles and responsibilities clearly.

-

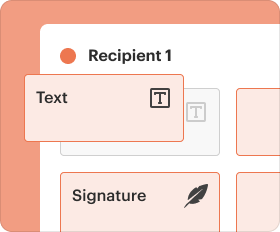

pdfFiller provides interactive tools for editing, making it easier to customize your agreement.

-

Follow a structured approach for filling out the agreement, ensuring that all critical information is captured.

-

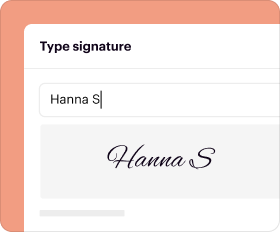

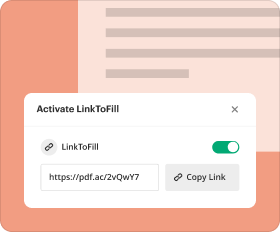

Utilize eSigning and cloud collaboration features within pdfFiller to manage the agreement efficiently.

What legal considerations are involved in credit repair?

Understanding legal guidelines is fundamental for anyone involved in credit repair, ensuring compliance and protection of consumer rights.

-

Compliance with the Consumer Credit Protection Act is necessary for all credit repair transactions.

-

Consumers should be educated about their rights in the credit repair process to safeguard themselves.

-

Companies should adhere to ethical guidelines and best practices to ensure transparency and trust.

What sets pdfFiller apart for credit repair agreements?

pdfFiller stands out with unique functionalities that enhance document management and streamline workflows for credit repair agreements.

-

An all-in-one document management solution that simplifies the creation and editing of contracts.

-

pdfFiller provides unmatched features and user experience for creating and managing credit repair agreements.

-

Efficient document creation and management optimize the user's workflow.

How to fill out the Credit Repair Agreement Template

-

1.Open the Credit Repair Agreement Template in pdfFiller.

-

2.Start by entering the date at the top of the document.

-

3.Fill in the client's full name and contact information in the designated fields.

-

4.Provide the credit repair company's name, address, and contact information.

-

5.Clearly outline the scope of services to be provided in the agreement.

-

6.Specify the duration of the agreement and any applicable fees.

-

7.Include a section for the client's agreement to the terms by adding a signature line.

-

8.Ensure to review all filled sections for accuracy and completeness before saving.

-

9.Finally, download or print the completed agreement for both parties' records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.