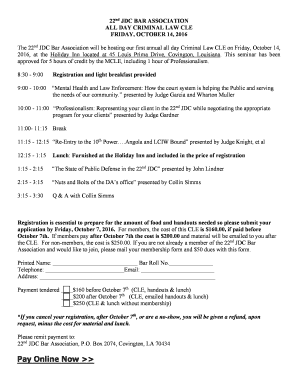

Currency Exchange Agreement Template free printable template

Show details

This document outlines the terms and conditions for currency exchange transactions between two parties, including definitions, responsibilities, fees, and dispute resolution mechanisms.

We are not affiliated with any brand or entity on this form

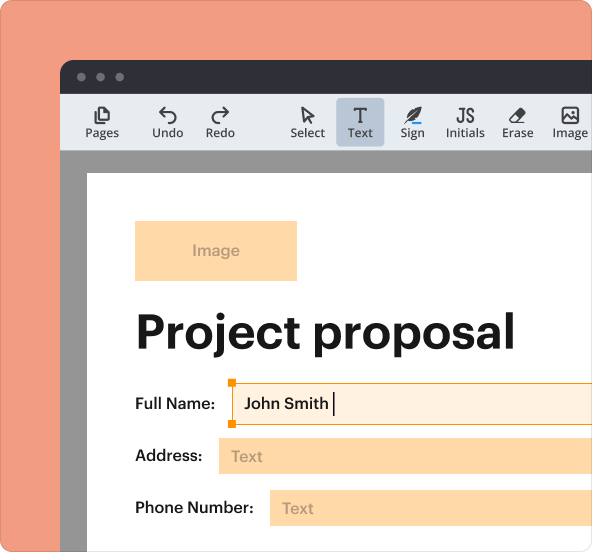

Why pdfFiller is the best tool for managing contracts

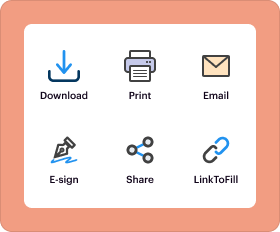

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Currency Exchange Agreement Template

A Currency Exchange Agreement Template is a legal document that outlines the terms and conditions for exchanging one currency for another between parties.

pdfFiller scores top ratings on review platforms

Great and easy to use! I am glad I paid the 76 for this.

An excellent resource. Quite easy to use and makes information provided so much easier to read.

Easy to use, creates clean, professional looking documents, allows you to upload any form or document that needs to be filled out and fill it in as if you typed it, without needing the typewriter! Whether you scan a form, upload a text or spreadsheet document, even image files, you can fill in any information needed and customize fonts, size, color, highlight sections, even verified signatures and PDFfiller will align your input horizontally and vertically. You can even create templates of your forms. Easy to use intuitive interface. A definite value for the money.

I just started and it's been great! Easy and quick to use!

Very good. Still trying to figure out if I cac scan a document and find it to fax to some one Can you help?

i wish the information on one page would automataically fill on the next 5 pages

Who needs Currency Exchange Agreement Template?

Explore how professionals across industries use pdfFiller.

Currency Exchange Agreement Template: A Comprehensive Guide

How to effectively fill out a Currency Exchange Agreement Template form?

To fill out a Currency Exchange Agreement Template form, start by clearly identifying the parties involved, including their names and jurisdictions. Next, define the exchange rate and the currencies involved, ensuring you include accurate information. Review the document for any specific clauses or requirements prior to execution, and ensure that all parties sign and date the agreement correctly.

What is a Currency Exchange Agreement?

A Currency Exchange Agreement is a contract that outlines the terms under which one currency can be exchanged for another. It is significant in financial transactions as it mitigates risks associated with fluctuating exchange rates and helps ensure transparency between parties.

-

The money used in transactions, which can vary depending on the agreement.

-

The rate at which one currency will be exchanged for another, critical to the agreement's functions.

-

The date on which the exchange occurs, marking the completion of the transaction.

In various jurisdictions, legal frameworks and compliance requirements vary, affecting how these agreements are structured and executed.

What are the essential elements of a Currency Exchange Agreement?

Key elements of a Currency Exchange Agreement include the parties involved, the purpose of the agreement, and clear definitions of terms used. It's crucial for both parties to understand fees associated with the transaction, the types of transactions permitted, and the payment methods allowed.

-

Identify all entities participating in the agreement, ensuring clarity on who is responsible for what.

-

Define why the agreement is being made, such as for investment or trade.

-

Include clear definitions for all relevant terms to avoid misunderstandings.

How to create a Currency Exchange Agreement?

Creating a Currency Exchange Agreement involves several steps. Initially, identify the parties and provide basic information, including the date, party names, and their jurisdictions.

-

Outline the agreed exchange rate that both parties will adhere to.

-

Clearly define the services being exchanged or the obligations of each party.

-

Incorporate standard clauses such as liability, termination, and dispute resolution.

What are best practices for managing Currency Exchange Agreements?

To ensure effective management of Currency Exchange Agreements, compliance with local laws and regulations is paramount. Businesses should maintain thorough records of all transactions and communication related to these agreements to guard against disputes.

-

Implement strategies that ensure the agreement adheres to local regulations.

-

Keep detailed records of all transactions to provide clarity and protection.

-

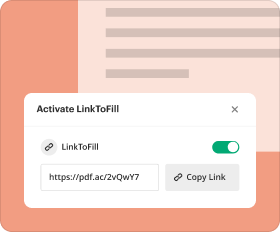

Leverage platforms like pdfFiller for document management, including editing and collaboration.

What common pitfalls should be avoided in Currency Exchange Agreements?

When preparing Currency Exchange Agreements, frequent errors can lead to significant problems. Miscalculating exchange rates or failing to disclose fees can result in disputes down the line.

-

Ensure accurate calculations to reduce the risk of financial loss.

-

Be upfront about any transaction fees to promote trust between parties.

-

Incorporate mechanisms for resolving disputes directly within the agreement.

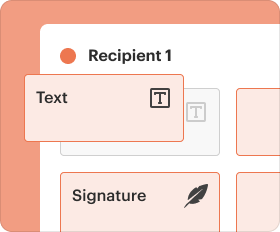

What digital tools are available for Currency Exchange Agreements?

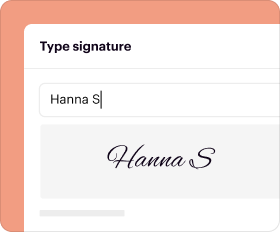

Digital tools such as those available on pdfFiller can greatly enhance the management of Currency Exchange Agreements. These tools enable users to create, edit, and manage documents efficiently.

-

Facilitate faster and more secure signing processes.

-

Allow multiple parties to work on a document simultaneously, improving efficiency.

-

Utilize pdfFiller functionalities to easily access and manage your agreements.

What are the final steps in executing a Currency Exchange Agreement?

Before executing a Currency Exchange Agreement, it's essential to perform a thorough review of the document. Verify that all required clauses are included and that party details are accurate.

-

Create a checklist to ensure all elements are present and correct.

-

Confirm that all parties have signed and dated the document appropriately.

-

Utilize pdfFiller to save and securely store the final document.

How to fill out the Currency Exchange Agreement Template

-

1.Obtain the Currency Exchange Agreement Template from a trusted source or pdfFiller.

-

2.Open the template document in pdfFiller and review the sections provided.

-

3.Fill in the date at the top of the agreement.

-

4.Enter the particulars of the parties involved, including names and contact information.

-

5.Specify the currencies to be exchanged and their amounts, ensuring clarity on the conversion rates used.

-

6.Detail the terms of the exchange, including any fees, commissions, or conditions that apply.

-

7.Include the effective date of the agreement and any expiration terms.

-

8.Review the agreement thoroughly for accuracy and completeness.

-

9.Sign the document, ensuring both parties have a copy of the signed agreement for their records.

What is an FX agreement?

A foreign exchange contract, also called a “forward transaction”, is the purchase or sale of a currency at a predefined rate in the future. It allows the exchange rate for currency conversion to be set in advance, essentially eliminating the risks associated with market fluctuations.

How do you write currency exchange?

An exchange rate is commonly quoted using an acronym for the national currency it represents. USD represents the U.S. dollar. EUR represents the euro. It would be EUR/USD if you were quoting the currency pair for the dollar and the euro.

What is a currency swap agreement with an example?

A currency swap is an agreement in which two parties exchange the principal amount of a loan and the interest in one currency for the principal and interest in another currency. At the inception of the swap, the equivalent principal amounts are exchanged at the spot rate.

What is an exchange agreement?

An exchange agreement allows products to be traded between companies. The partners often agree to exchange specific quantities of product for a given time period. Exchanges involve different products or multiple products and often include a differential that one party pays per unit of product exchanged.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.