Customer Payment Agreement Template free printable template

Show details

This agreement outlines the payment terms and conditions between a Customer and a Provider for goods and services.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Customer Payment Agreement Template

A Customer Payment Agreement Template is a legal document that outlines the payment terms and obligations between a business and its customer.

pdfFiller scores top ratings on review platforms

This has been a lifesaver!!! I have been able to download all the forms that I have needed and PDF filler has worked with every single one of them. I really cannot give it another praise!

not a bad app for price, wont edit some applications thou

This product is full of features that are easy to use!!

Great alternative to Adobe for me. I use the tool form simple purposes and it works great.

You made a very difficult situation bearable and easy to maneuver! Thank you!

It is very user friendly. Great to have for documents.

Who needs Customer Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Customer Payment Agreement Template Form

How to fill out a Customer Payment Agreement Template form

Filling out a Customer Payment Agreement Template form involves defining key terms, identifying both parties, and specifying payment conditions. Begin by entering the names and contact information of both the Creditor and Debtor, then clearly state the amount due, payment schedule, and methods of payment. Utilize tools like pdfFiller for editing and signing your document.

What is a customer payment agreement?

A Customer Payment Agreement is a formal document that outlines the terms and conditions related to payment for goods or services. This agreement serves to protect both the customer and service provider by ensuring transparency and accountability regarding financial obligations. Establishing clearly defined payment terms can prevent disputes in the future.

-

This refers to a legal contract detailing the payment obligations between a debtor (customer) and a creditor (provider).

-

Clear terms minimize misunderstandings and provide a legal framework for enforcing payments.

-

The customer is responsible for making timely payments, while the provider must deliver goods or services as per the agreement.

What are the key elements of a well-structured payment agreement?

A well-structured payment agreement includes essential definitions and clear terms. These elements are crucial for avoiding ambiguity that could lead to disagreements. Each party must understand their obligations, including payment terms, conditions for default, and any late fees applicable.

-

Define roles (Customer, Provider), Payment Terms, Default, and Late Fee to establish clarity.

-

Precise language helps all parties understand their responsibilities and rights, helping prevent disputes.

-

Different types of goods or services may have varying payment obligations or timelines, which should be clearly articulated.

How to detail the parties involved in the agreement?

Accurate identification of both parties is key to a valid agreement. The customer must provide their name, address, and contact details, while the provider should include business information and any legal compliance required for payment handling. This ensures that all parties can be easily identified if any disputes arise.

-

Include name, address, and contact details to avoid confusion.

-

Outline business details and legal compliance to establish credibility.

-

Correct information prevents future disputes over identities or responsibilities.

What is the scope of goods and services?

Laying out a clear description of the goods or services to be provided is essential in any payment agreement. This includes pricing details and availability, ensuring that customers know exactly what they will receive for their payment. Transparency in this regard can enhance trust and reduce potential conflicts.

-

Clearly articulate what is being provided, including quantities and specifications.

-

List pricing details directly in the agreement to avoid misunderstandings later.

-

Transparent agreements foster better relationships between customers and providers.

How to define payment terms?

Defining the payment terms clearly is critical in a Customer Payment Agreement Template form. This includes specifying the total amount due, the payment schedule, and accepted payment methods. By setting clear standards, you can help ensure consistency in payments.

-

Specify the complete amount owed along with a timeline for payments to reduce delays.

-

Clarify what forms of payment will be accepted, including details on transaction fees if necessary.

-

If applicable, provide details on how different currencies will be managed in transactions.

What are the policies for late payments and associated fees?

Late payments can cause significant issues, but having a clear policy can mitigate this risk. In your agreement, you should define what constitutes a late payment, the timeline for such payments, and the structure of any late fees that may apply. Ensuring all this information is clearly laid out will improve compliance.

-

Define what a late payment is, including grace periods if applicable.

-

Explain how late fees will be calculated and applied if payments are not made on time.

-

Outline potential repercussions for failing to adhere to the payment agreement.

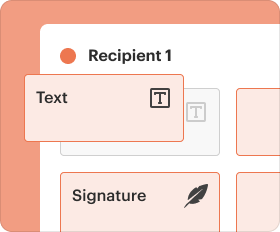

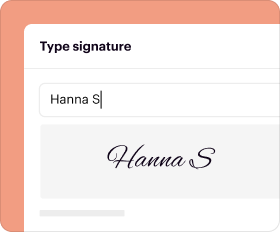

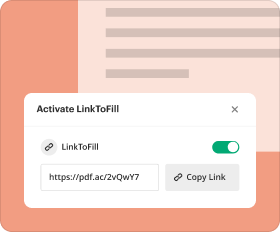

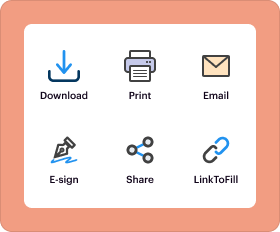

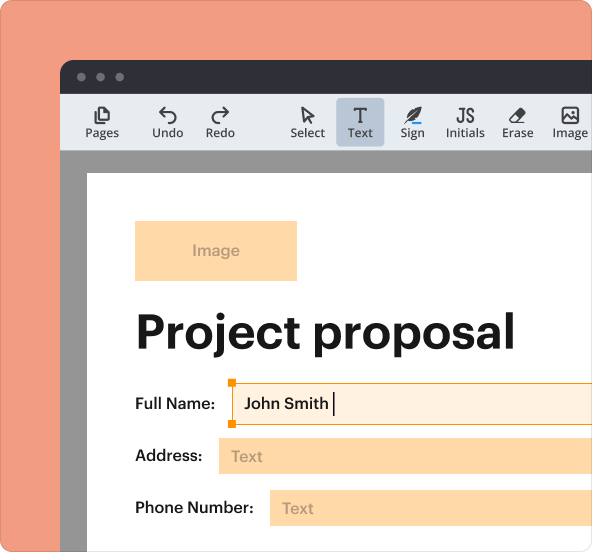

How to utilize pdfFiller for your payment agreement needs?

pdfFiller offers a user-friendly platform to create, edit, and electronically sign your Customer Payment Agreement Template form. This cloud-based service enables collaborative tools for document management, ensuring everyone involved can access real-time updates. Leveraging such features can significantly improve your experience with document handling.

-

Follow pdfFiller’s tools to easily create and modify your payment agreement as needed.

-

Utilize features that allow multiple users to work on the document simultaneously.

-

Access your documents from anywhere, allowing for real-time updates and modifications.

How to fill out the Customer Payment Agreement Template

-

1.Download the Customer Payment Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Fill in the full name and contact details of the customer in the designated fields.

-

4.Enter your business name and contact information at the top of the document.

-

5.Specify the details of the goods or services being provided.

-

6.Outline the payment amount, due dates, and any interest or late fees if applicable.

-

7.Review the terms and conditions section, and modify it to fit your specific agreement needs.

-

8.Sign the document electronically or print it out for handwritten signatures from both parties.

-

9.Save the completed document in your pdfFiller account or download it for distribution.

How do I make a simple payment agreement?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

What is an example of a payment arrangement?

What to Include (7) Date: The date the agreement is being completed should be clearly listed at the top of the document. Parties Involved: The names and addresses of the lender and borrower. Amount: The balance ($) the lender owes to the creditor. Reason for Loan: Why the lender owes money to the creditor.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.