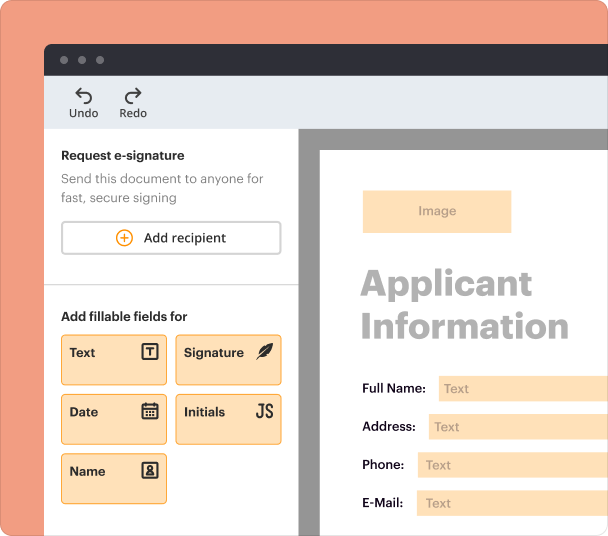

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Debt Cancellation Agreement Template

Show details

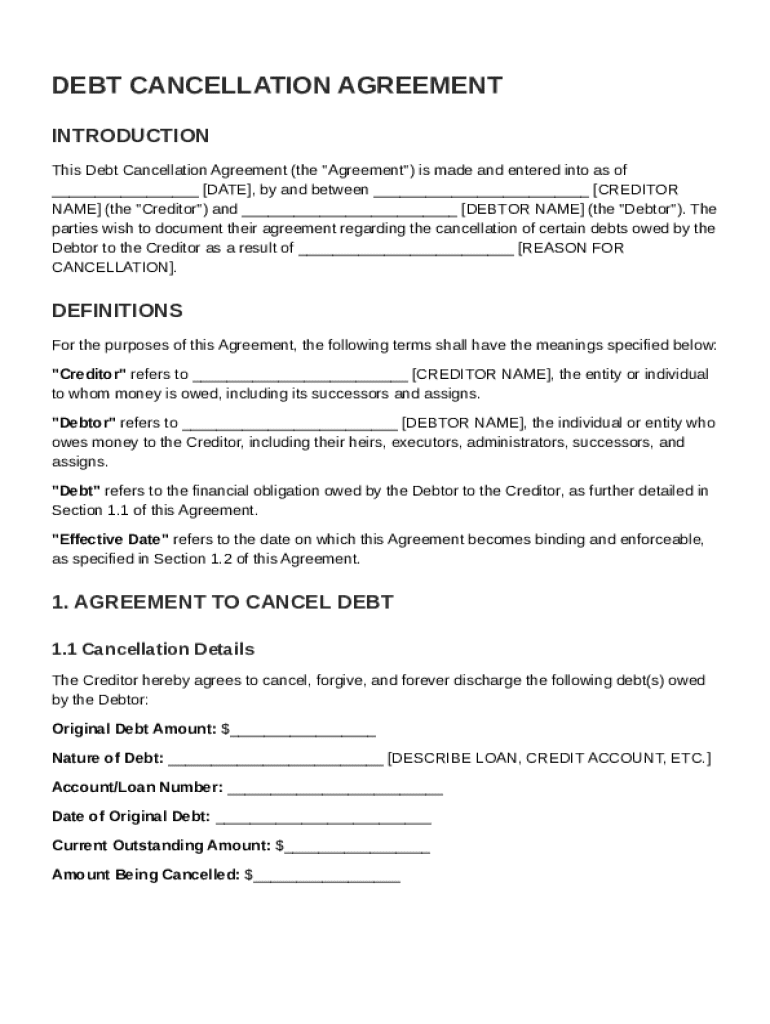

This document is an agreement between a creditor and a debtor regarding the cancellation of debts owed by the debtor to the creditor.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

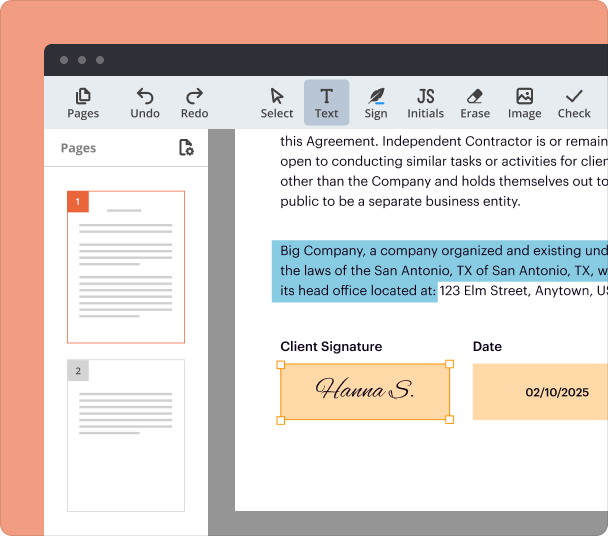

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

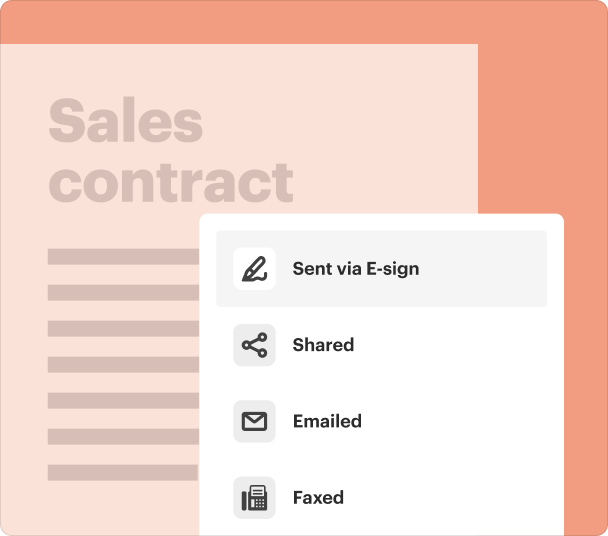

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

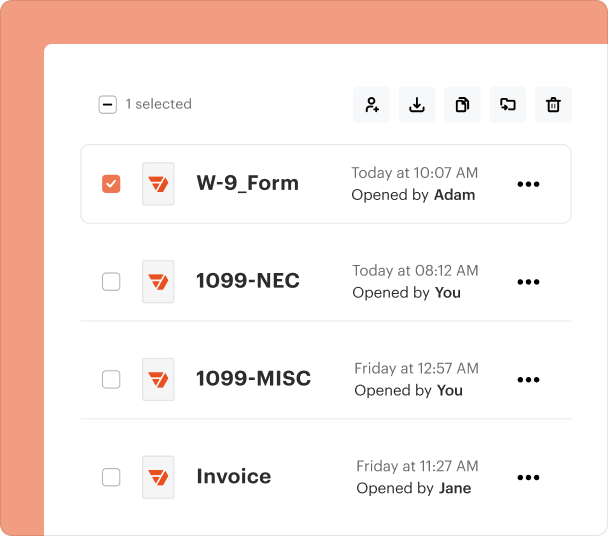

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Debt Cancellation Agreement Template

This section provides essential guidance on how to effectively edit and fill out the Debt Cancellation Agreement Template using pdfFiller, ensuring a smooth experience for users.

How to edit Debt Cancellation Agreement Template

Using pdfFiller for editing your Debt Cancellation Agreement Template is straightforward and efficient. Follow these steps to make the necessary modifications:

-

1.Click ‘Get form’ on this page to access the Debt Cancellation Agreement Template.

-

2.If you don't have a pdfFiller account, create one by filling out the registration form or signing in using your existing credentials.

-

3.Once logged in, the template will open in an interactive editor. Here you can easily click on any text field to make changes.

-

4.Use the editing tools provided to add, delete, or modify text according to your needs.

-

5.After completing your edits, review the document for accuracy, then save your changes securely in the cloud.

How to fill out Debt Cancellation Agreement Template

Filling out the Debt Cancellation Agreement Template is crucial for ensuring the terms of cancellation are clearly outlined. Here's how you can obtain and complete the form seamlessly:

-

1.Click ‘Get form’ on this page to obtain the Debt Cancellation Agreement Template directly from pdfFiller.

-

2.Review the pre-filled information if available, or start filling in your details where required.

-

3.Provide your name, contact information, and any relevant financial details that apply to the agreement.

-

4.Include specific terms regarding the debt being canceled, ensuring both parties understand their responsibilities.

-

5.Double-check all entries for accuracy to avoid potential misunderstandings.

-

6.Once completed, you can sign the document electronically using pdfFiller’s easy eSigning feature.

-

7.Download or share the finalized document directly from the platform.

-

8.Store a copy for your records to ensure you have access to the agreement when needed.

All you need to know about Debt Cancellation Agreement Template

This section covers everything you need to understand about the Debt Cancellation Agreement Template, from its definition to essential sections.

What is a Debt Cancellation Agreement Template?

The Debt Cancellation Agreement Template is a legally binding document that outlines the terms under which one party agrees to cancel a debt owed by another party. It serves to protect both parties by clearly stating the conditions and agreements made regarding the cancellation.

Definition and key provisions of a Debt Cancellation Agreement Template

This document includes several key provisions that outline the rights and obligations of both the debtor and creditor. Key provisions often include:

-

1.Identification of the parties involved.

-

2.Description of the debt being canceled.

-

3.Explicit terms of cancellation.

-

4.Implications of cancellation on both parties.

-

5.Signatures from both parties to validate the agreement.

When is a Debt Cancellation Agreement used?

A Debt Cancellation Agreement is typically used when a creditor agrees to forgive a debt that a debtor owes. This may occur in situations such as financial hardship, negotiation settlements, or when a debt is deemed uncollectible.

Main sections and clauses of a Debt Cancellation Agreement Template

The Debt Cancellation Agreement Template comprises several main sections, including:

-

1.Preamble: Identifying the parties.

-

2.Definitions: Clarifying terms and concepts used within the agreement.

-

3.Cancellation Terms: Detailed clauses related to the cancellation of the debt.

-

4.Mutual Releases: Statements ensuring both parties release each other from future claims.

-

5.Governing Law: Specification of the jurisdiction under which the agreement is governed.

What needs to be included in a Debt Cancellation Agreement Template?

To ensure the Debt Cancellation Agreement is effective and legally binding, the following elements must be included:

-

1.Names and addresses of both parties.

-

2.Exact amount of the debt being canceled.

-

3.Clear and precise cancellation terms.

-

4.Date of the agreement.

-

5.Signature lines for both parties to authorize the cancellation.

What is an example of debt cancellation?

Here's a very simplified example. You borrow $10,000 and default on the loan after paying back $2,000. If the lender is unable to collect the remaining debt from you, there is a cancellation of debt of $8,000, which generally is taxable income to you.

What is the process of debt cancellation?

How to get your debts cancelled Credit counseling. A credit counselor can help you navigate debt cancellation. Negotiation with creditors. If you feel comfortable negotiating with your creditors directly, you don't need to go through a credit counselor. Debt settlement. Bankruptcy. Student loan cancellation.

What qualifies as cancellation of debt?

Cancellation of debt is the forgiveness of debt obligations by a creditor. Debt relief can be achieved through direct negotiations, debt relief programs, or bankruptcy. Canceled debt is generally considered taxable income that must be reported, but there are many exceptions.

What is the debt cancellation policy?

In general, debt cancellation eliminates your loan if you die, or cancels the monthly payment if you become disabled, unemployed, or suffer some other hardship. Debt suspension may temporarily postpone all or part of your monthly payment while you are facing a hardship.

pdfFiller scores top ratings on review platforms

works well

Where have you been all my life? I love it!

AWESOME user friendly software!

Learn fast. Easy to use.

Impressive!

Mostly user friendly/easy to figure out/the Notary service is too expensive considering this is a paid product but other than that, like the product

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.