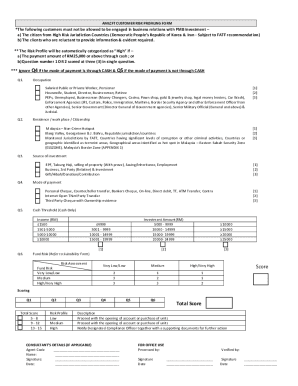

Debt Payment Agreement Template free printable template

Show details

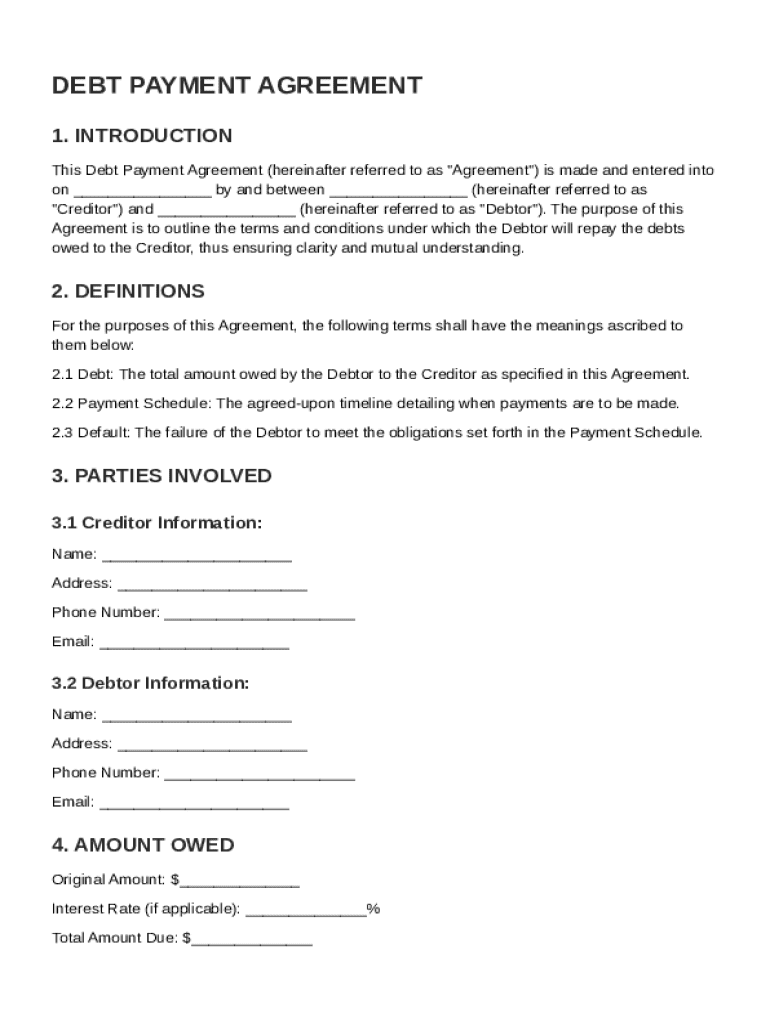

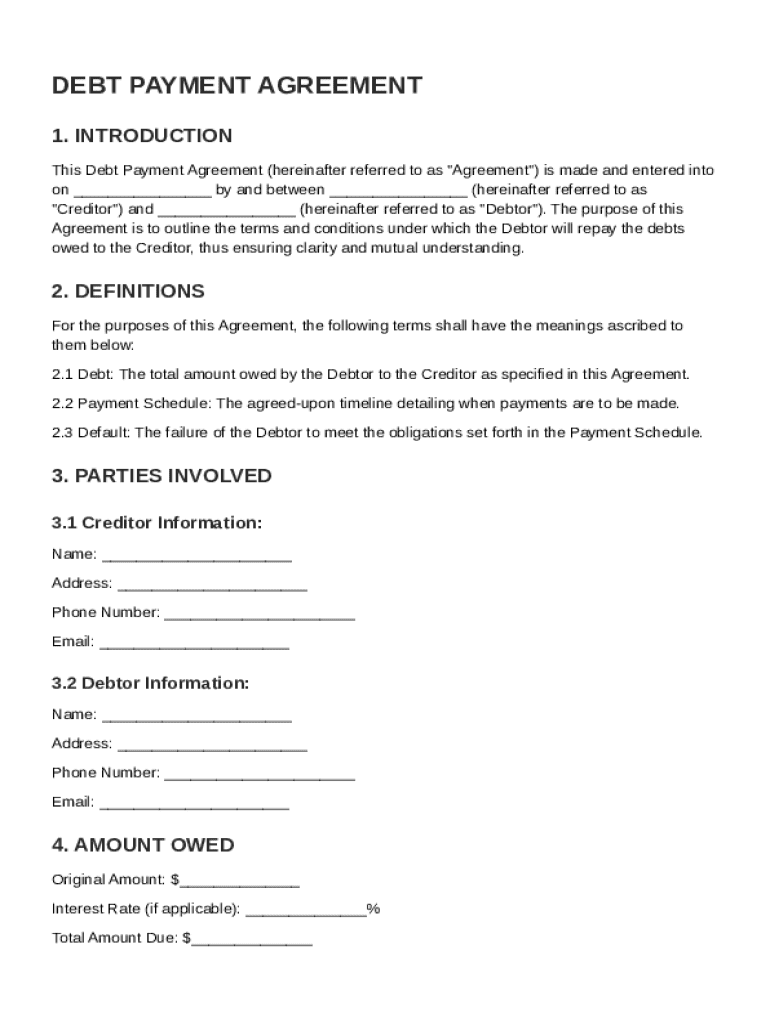

This document outlines the terms and conditions under which a Debtor will repay the debts owed to a Creditor, detailing payment schedules, amounts owed, and consequences of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Debt Payment Agreement Template

A Debt Payment Agreement Template is a formal document that outlines the terms and conditions for repaying a debt.

pdfFiller scores top ratings on review platforms

I like the functionality of it and it was easy to get started, but I was thrown off by the price when it was advertised as free.

It is so easy to use and convenient. I love it.

Effective system, would like cleaner formatting

Ease of use. Will try "Share" today and see if it works easily for those I send it to

Outstanding!.... makes working from home so much easier. Really enjoying the software. Thx!

Easy to use and excellent presentation.

Online video help makes any issues easy to understand

Who needs Debt Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

Debt Payment Agreement Guide

How to fill out a Debt Payment Agreement form

To effectively fill out a Debt Payment Agreement Template form, start by clearly defining the debtor and creditor information. Next, specify the debt amount and establish a payment schedule. Finally, choose an appropriate payment method and ensure all parties sign the document.

What is a Debt Payment Agreement?

A Debt Payment Agreement is a formal arrangement between a debtor and a creditor outlining payment terms for an outstanding debt. It plays a vital role in clarifying expectations and protecting the interests of both parties involved.

-

It serves as a legally binding contract that details how and when the debtor will repay their debt.

-

This agreement helps both parties maintain clear communication and provides a structured payment approach, reducing misunderstandings.

What are the key components of a Debt Payment Agreement?

A comprehensive Debt Payment Agreement includes critical information that ensures clarity and legality. Each component should be carefully considered and clearly stated to avoid future disputes.

-

Accurate details of both parties are crucial for enforceability and accountability.

-

Clearly state the original amount of debt and the total amount due to provide transparent expectations.

-

An effective timeline outlines when payments are due, helping to organize the repayment process.

-

It’s essential to detail how payments will be made, whether via bank transfer, cheque, or another method.

How do you create your Debt Payment Agreement Template?

Creating a Debt Payment Agreement Template is straightforward yet requires attention to detail. It involves clearly following a structured guide that includes best practices for drafting terms.

-

Start with the basic details of each party and the debt before listing payment terms.

-

Use clear language and avoid ambiguous terms to ensure both parties understand their obligations.

-

Provide options such as weekly, bi-weekly, or monthly payments to cater to different financial situations.

-

Utilize the platform’s features for seamless document creation and management.

What happens in case of a default?

Defaulting on a Debt Payment Agreement leads to several potential consequences for the debtor, which can include legal actions initiated by the creditor.

-

Failure to comply with the agreed payment schedule or terms.

-

Potential repercussions can include additional fees, legal action, or damage to credit scores.

-

Creditors may pursue legal remedies or renegotiate terms, depending on the severity of the default.

What legal considerations should be kept in mind?

It’s essential to recognize the legal frameworks governing Debt Payment Agreements to ensure compliance and enforceability. Choosing the correct jurisdiction can impact the agreement's validity.

-

Identify which laws are applicable to your agreement, as this influences how disputes are resolved.

-

Understand different requirements across jurisdictions to ensure your agreement is legally binding.

-

Both parties should sign the document, possibly in the presence of a witness or notary.

How can pdfFiller help with your Debt Payment Agreement?

pdfFiller’s comprehensive platform simplifies the management of your Debt Payment Agreement, enabling users to edit, sign, and collaborate on documents easily.

-

Streamline the process using pdfFiller’s user-friendly editing tools.

-

Invite legal advisors or partners to review and finalize the agreement.

-

Employ robust security features to protect your sensitive financial documents.

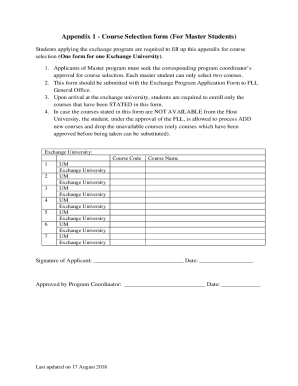

How to fill out the Debt Payment Agreement Template

-

1.Open the Debt Payment Agreement Template in pdfFiller.

-

2.Identify the parties involved: both the debtor and creditor should be clearly stated at the beginning of the document.

-

3.Fill in the total amount of debt that is being repaid in the appropriate field.

-

4.Specify the repayment schedule, including due dates and the amount to be paid in each installment.

-

5.Detail any interest rates or fees that may apply to the debt.

-

6.Include provisions for late payments or defaults to protect both parties.

-

7.Review the agreement for completeness and accuracy, ensuring all terms are clearly defined.

-

8.Once satisfied, save the filled document and share it with the other party for their signature.

-

9.Both parties should sign and date the agreement to make it legally enforceable.

-

10.Keep a copy of the signed agreement for your records and send a copy to the other party.

How do you write a debt agreement?

Include: the type of debt (credit card, line of credit, personal loan, etc.) who it is owed to (which bank or financial institution, or person) how much is owed on the debt as of a specific date.

How to write a debt settlement agreement?

The letter should typically explain why you can't pay the full debt, how much you're willing to pay right now, and the exact action you want in return from the creditor. A debt settlement letter is, in effect, a written legal contract. So it's important to make direct, explicit, and detailed statements.

How do I make a simple payment agreement?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

How to make a debt payment plan?

Paying off debt Figure out how much you owe. Write down how much you owe to each creditor. Focus on one debt at a time. Start with the credit cards or loans with the highest interest rate and make the minimum payments on your other cards. Put any extra money toward your debt. Embrace small savings.

How do you write a debt agreement?

Include: the type of debt (credit card, line of credit, personal loan, etc.) who it is owed to (which bank or financial institution, or person) how much is owed on the debt as of a specific date.

How to write a debt settlement agreement?

The letter should typically explain why you can't pay the full debt, how much you're willing to pay right now, and the exact action you want in return from the creditor. A debt settlement letter is, in effect, a written legal contract. So it's important to make direct, explicit, and detailed statements.

How to write a written agreement for payment?

How to Write a Simple Contract Agreement for Payment Step-by-Step Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

How to fill an agreement form?

How to write a contract agreement in 7 steps. Determine the type of contract required. Confirm the necessary parties. Choose someone to draft the contract. Write the contract with the proper formatting. Review the written contract with a lawyer. Send the contract agreement for review or revisions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.