Debt Repayment Agreement Template free printable template

Show details

Este acuerdo establece los trminos y condiciones para la devolucin de una deuda entre el prestamista y el prestatario, incluyendo detalles sobre el monto de la deuda, la tasa de inters y el calendario

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

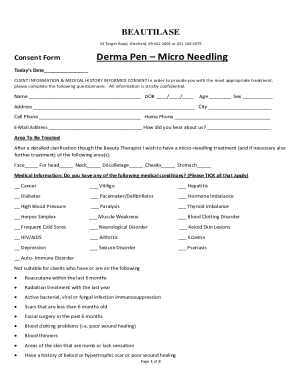

What is Debt Repayment Agreement Template

A Debt Repayment Agreement Template is a formal document outlining the terms of repayment for a debt owed by one party to another.

pdfFiller scores top ratings on review platforms

Does a great job of turning a regular document into a PDF document. Highly recommend this program

The filler works great, but saving and navigating are a bit confusing. Needs simplification.

It has been simple, quick and easy thus far.

had a misunderstanding with my subscription but live chat was so helpful in helping me resolve so thank you so much

Very easy to use. Decided to buy it after filling in one form without assistance!

PDFiller has been essential in helping me develop forms on the go, that have been critical in my job assignment.

Who needs Debt Repayment Agreement Template?

Explore how professionals across industries use pdfFiller.

Debt Repayment Agreement Template Guide at pdfFiller

How to fill out a Debt Repayment Agreement Template form

Filling out a Debt Repayment Agreement Template form involves carefully filling in essential details such as the parties involved, the debt amount, and payment terms. Use an interactive tool to simplify the process, ensuring clarity and compliance with legal standards.

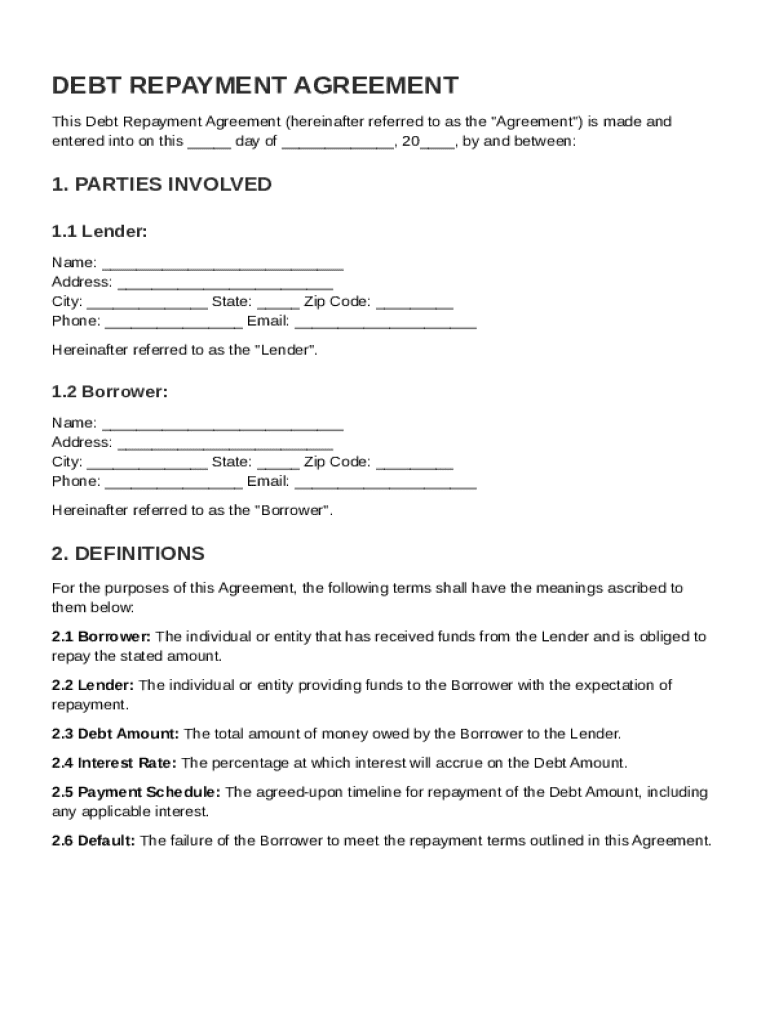

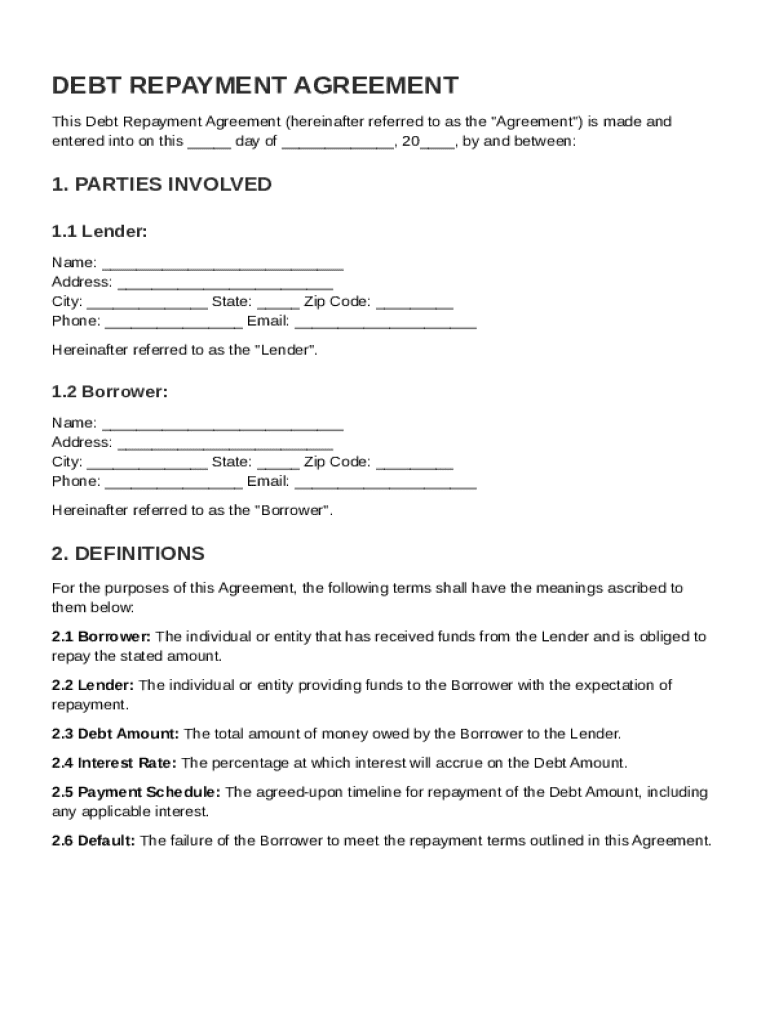

What is a Debt Repayment Agreement?

A Debt Repayment Agreement is a formal arrangement between a borrower and lender that outlines repayment terms for a specific debt. It serves to protect both parties by clearly defining expectations and responsibilities, thus minimizing potential disputes.

-

A Debt Repayment Agreement provides clarity on financial obligations, ensuring that both the lender and borrower are on the same page regarding repayment expectations.

-

Understanding terms such as Borrower (the individual or entity receiving the funds), Lender (the entity providing the funds), Debt Amount (the total money owed), Interest Rate (the charge for borrowing), Payment Schedule (the timeline for payments), and Default (failure to fulfill the agreement) is crucial.

Who are the parties involved in the agreement?

The primary parties involved in a Debt Repayment Agreement are the Lender and the Borrower. Both parties must provide accurate information to ensure the validity and enforceability of the agreement.

-

The lender is the person or organization that provides the funds. It is essential they have clear terms for repayment.

-

The borrower is the recipient of the funds. They have a responsibility to repay according to the agreed terms.

-

Both parties should include their names, addresses, phone numbers, and emails in the agreement for proper identification and contact.

What are the key components of a Debt Repayment Agreement?

Key components of a Debt Repayment Agreement include the total debt amount, interest rate, payment schedule, and terms governing consequences for late payments. Ensuring clarity on these components is vital to prevent future disagreements.

-

Clearly state the total amount owed to avoid misunderstandings.

-

Define the percentage applied to the principal amount, influencing total repayments.

-

Mention why the loan is being taken to clarify the context and terms of repayment.

How do you fill out the Debt Repayment Agreement Template?

Filling out the Debt Repayment Agreement Template involves thorough review and accurate input of required data. Use pdfFiller's interactive tools to simplify the process, making edits and collaborating with others seamless.

-

Follow guidelines provided in the template carefully to ensure no details are missed.

-

Utilize pdfFiller’s features for ease of editing, eSigning, and collaboration.

What repayment terms should you know?

Repayment terms dictate how and when the borrower must repay the debt. This includes specifying the payment schedule, methods of payment, and due dates, which are essential for both parties’ financial planning.

-

Outline when payments are due, whether weekly, bi-weekly, or monthly.

-

Clearly specify when the borrower’s first payment is expected to commence.

-

Define how often payments will be made after the first due date.

How can you manage repayment through pdfFiller?

pdfFiller offers numerous features to help users manage their debt repayment documents effectively. With options for eSigning, collaboration, and document tracking, managing agreements becomes less cumbersome.

-

Sign documents electronically to expedite the process and maintain records securely.

-

Share documents easily among stakeholders to ensure transparency and communication.

-

Monitor changes and the status of your agreement to stay informed throughout the repayment term.

What common mistakes should you avoid?

Mistakes made during the drafting of a Debt Repayment Agreement can lead to complications. Awareness of common pitfalls can help ensure compliance and enhance the agreement's validity.

-

Omitting critical details or miswriting terms can create ambiguous situations.

-

Make sure to understand and adhere to local regulations governing repayment agreements.

What compliance considerations are there?

Different regions may have specific legal requirements that a Debt Repayment Agreement must meet. Knowing these can prevent future disputes and ensure both parties' rights are protected.

-

Be aware of laws affecting agreements in your locale, which may include consumer protection laws.

-

Draft the agreement with reference to applicable regulations to ensure enforceability.

How to fill out the Debt Repayment Agreement Template

-

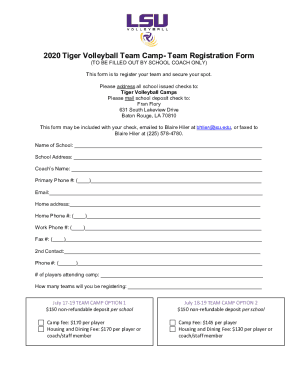

1.Download the Debt Repayment Agreement Template from pdfFiller.

-

2.Open the template using the pdfFiller editor.

-

3.Begin by entering the debtor's full name and contact information in the designated fields.

-

4.Next, fill in the creditor's name and contact details accurately.

-

5.Specify the total amount of debt being repaid in the corresponding section.

-

6.Outline the repayment terms, including the interest rate, if applicable, and the payment schedule (e.g., monthly, bi-weekly).

-

7.Include any late payment penalties or fees in the relevant section.

-

8.If applicable, add any collateral or guarantees to secure the repayment.

-

9.Review all entered information for accuracy and completeness.

-

10.Save the document and send it for signatures if needed, ensuring both parties retain a copy of the signed agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.