Debt Restructuring Agreement Template free printable template

Show details

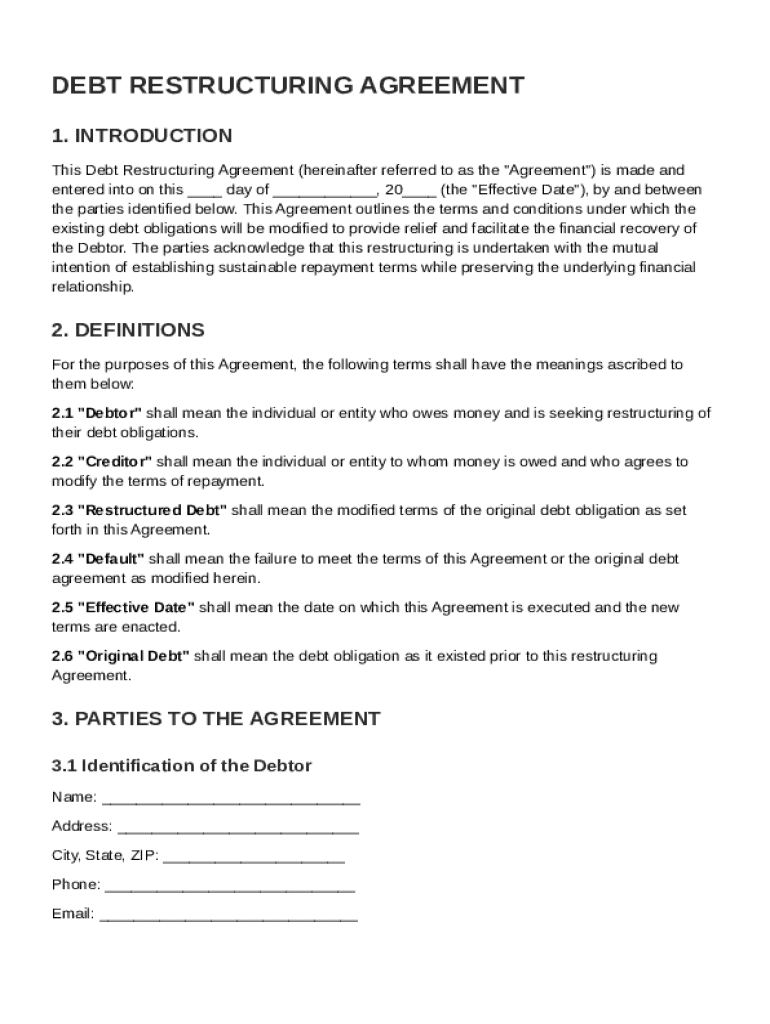

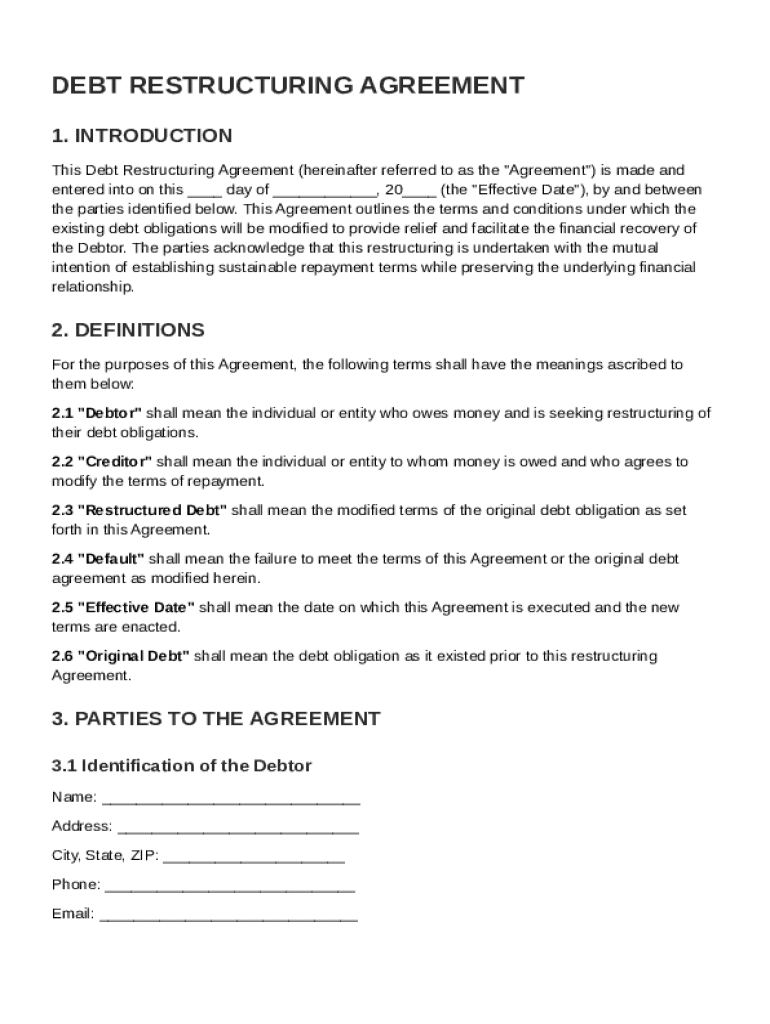

This document outlines the terms and conditions for modifying existing debt obligations to provide relief and facilitate financial recovery of the Debtor while preserving the financial relationship

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Debt Restructuring Agreement Template

A Debt Restructuring Agreement Template is a legal document outlining the terms under which a debtor reorganizes or renegotiates their debt obligations with creditors.

pdfFiller scores top ratings on review platforms

no comment

its been an excellent tool that has allowed me to do paper work and edit documents in an easy manner.

FORMS NEEDED ARE AVAILABLE

Easy to use and download from online.

Superb!!!

Great experience!

Who needs Debt Restructuring Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a debt restructuring agreement template form

Filling out a debt restructuring agreement template form involves understanding the essential components, identifying the parties involved, and ensuring compliance with legal standards. This guide will simplify the process for you.

Understanding debt restructuring agreements

A Debt Restructuring Agreement (DRA) is a contract between debtors and creditors that aims to modify the terms of existing debt obligations. The purpose of such agreements is to help debtors avoid default and manage their financial situations more effectively.

-

The individual or entity that owes money.

-

The individual or entity that has extended credit to the debtor.

-

The modified terms of the original debt that the parties agree upon in the new agreement.

-

The failure to meet the legal obligations or conditions of the debt.

-

The date from which the new terms of the agreement apply.

-

The initial amount of money that was borrowed.

Identifying the parties involved

Accurately identifying the parties in a debt restructuring agreement is essential for the document's validity. The criteria include respective names, addresses, and contact details to ensure clear communication and legal effectiveness.

-

Ensure both parties have valid identifiers like legal names and addresses.

-

Include comprehensive contact details to facilitate communication.

-

Errors in identifying parties can lead to disputes or the invalidation of the agreement.

Recitals: establishing context

Recitals play a crucial role in establishing context within the agreement. They provide background information and help clarify the intentions and previous agreements of the parties involved, which is vital for interpreting the new terms.

-

They outline the context for the agreement, including reasons for debt restructuring.

-

Provide a complete history of past debt agreements to ensure transparency.

-

Include loans, credit lines, and other financial instruments related to the original debt.

-

Facilitate trust by maintaining a complete record of the financial interactions.

Crafting the terms of the agreement

Legal considerations in restructuring terms are critical in creating a viable agreement. Common modifications often involve alterations in payment schedules, interest rates, and settlement amounts.

-

Ensure all changes comply with current legislation and protect the rights of all parties.

-

Adjustments may include extended payment periods or reduced interest rates.

-

Set realistic payment terms to avoid future defaults and ensure sustainability.

-

Utilize clear and concise language to express the modified payment terms.

Filling out the debt restructuring agreement form

Filling out a debt restructuring agreement form requires attention to detail. Follow a systematic approach to ensure that all necessary fields are completed accurately.

-

Follow a structured method to fill out the form, ensuring no fields are overlooked.

-

Utilize tools available on pdfFiller to make the document editing process simpler.

-

Double-check all entries and manage documents effectively to avoid errors.

Managing and modifying the agreement post-execution

Once the agreement is executed, ongoing management is essential. Best practices include regular assessments and processes for handling modification requests.

-

Adopt a systematic approach for the management of restructured debts to maintain clarity.

-

Develop a clear method for evaluating and implementing further adjustments.

-

Utilize pdfFiller’s tools to facilitate real-time updates and communication between parties.

Considerations for legal compliance and best practices

Ensuring legal compliance in debt restructuring agreements is paramount. Local regulations must be observed to prevent potential legal disputes.

-

Be aware of jurisdiction-specific regulations governing debt restructuring agreements.

-

Avoid vague language and ensure clarity to reduce misunderstandings.

-

Seek legal oversight during the drafting process to safeguard interests.

How to fill out the Debt Restructuring Agreement Template

-

1.Open the Debt Restructuring Agreement Template in pdfFiller.

-

2.Identify the parties involved and fill in their legal names and contact information at the top of the document.

-

3.Specify the date on which the agreement is being made.

-

4.Detail the existing debt obligations, including amounts owing and terms, in the relevant section.

-

5.Outline the proposed restructuring terms, including any changes to interest rates, repayment schedules, or principal amounts.

-

6.Ensure clarity by defining necessary terms and conditions for both parties in the provided fields.

-

7.Review the sections regarding defaults and consequences to ensure they meet your needs.

-

8.Fill in the signatures and date lines for all parties to acknowledge their agreement to the terms, ensuring spaces for witnesses if required.

-

9.Final review before submitting or printing the completed document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.