Last updated on Feb 17, 2026

Debt Transfer Agreement Template free printable template

Show details

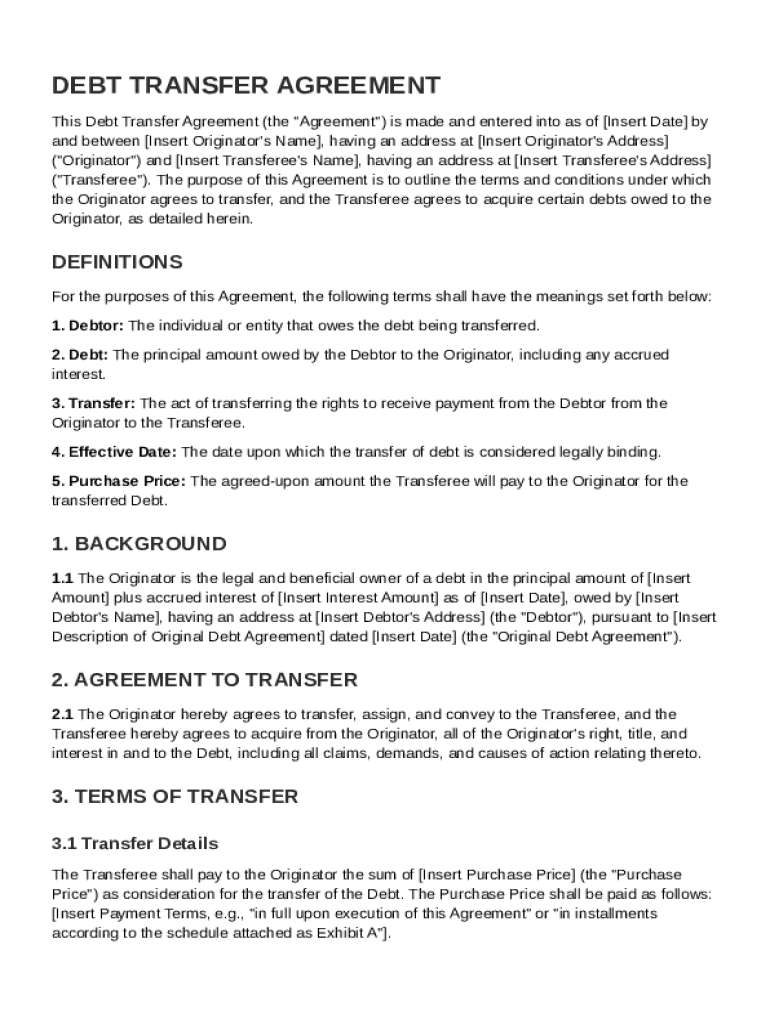

This document outlines the terms and conditions under which a debt is transferred from the Originator to the Transferee.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Debt Transfer Agreement Template

A Debt Transfer Agreement Template is a legal document that outlines the terms and conditions under which a creditor can transfer the rights to collect a debt to another party.

pdfFiller scores top ratings on review platforms

no compliants

Good support

The support is really fast and very effective.

Easy to follow ,edit

Easy to follow ,edit , amend and save

I'm very happy with the mid-priced…

I'm very happy with the mid-priced version so far. (However, as Yogi Berra famously said, "It's a bit too early to tell the future.")LOL

At first it wouldn't let me upload a…

At first it wouldn't let me upload a file, it kept saying unsupported file.

nice and easy to use

Who needs Debt Transfer Agreement Template?

Explore how professionals across industries use pdfFiller.

Guide to Debt Transfer Agreements: Understanding and Utilizing the Template Form

How do you understand a Debt Transfer Agreement?

A Debt Transfer Agreement is a legal document that facilitates the transfer of debt from one party to another. This arrangement is crucial in various financial transactions, allowing businesses and individuals to manage their debt obligations effectively. Recognizing when to consider a Debt Transfer Agreement can save time and minimize conflicts in the future.

-

This agreement outlines the terms and conditions for transferring a debt, ensuring legal protection for both parties.

-

Properly documenting debt transfers can prevent disputes and protect parties in case of defaults.

-

Enter into this agreement when you need to transfer financial obligations due to a sale, restructuring, or asset acquisition.

What are the key components of the Debt Transfer Agreement?

Effective Debt Transfer Agreements must include several critical components. These elements define the agreement's scope, explain the roles of each party, and outline financial implications.

-

Familiarize yourself with terms like 'Originator' (the current creditor) and 'Transferee' (the new creditor) for clarity.

-

This section confirms who holds the debt prior to and after the transfer.

-

Clearly define the responsibilities and rights of each party involved in the transaction.

-

Include the financial amounts, payment schedules, and any liabilities assumed by the Transferee.

How can you fill out the Debt Transfer Agreement?

Filling out a Debt Transfer Agreement might seem daunting, but with a structured approach, it can be straightforward. Follow these essential steps to complete your form accurately.

-

Follow each section's instructions carefully to avoid confusion.

-

Include dates, names, and addresses to ensure all parties are correctly identified.

-

Double-check entries for accuracy, paying special attention to numerical values.

-

pdfFiller simplifies the completion, allowing users to edit, sign, and manage agreements digitally.

What are best practices for managing your Debt Transfer Agreement?

Managing a Debt Transfer Agreement effectively can minimize legal risks and ensure compliance. Following best practices will foster a clear understanding between parties and maintain alignment with legal standards.

-

Don't rush the signing process. Take time to review terms and negotiate if necessary.

-

Understand applicable laws governing debt transfers in your jurisdiction.

-

Utilize tools for tracking the agreement's terms and any necessary changes.

-

Involving a legal professional can provide insights into obligations and rights under the agreement.

When should you consider using a Debt Transfer Agreement Template?

Using a Debt Transfer Agreement Template can significantly reduce time spent drafting a custom agreement. Templates are especially beneficial in typical scenarios.

-

Consider using a template when transferring business debt, selling a debt portfolio, or in bankruptcy proceedings.

-

Companies often transfer their receivables to maintain liquidity or get better cash flow.

-

A well-drafted agreement ensures that both the seller and buyer of the debt are aware of their rights and obligations.

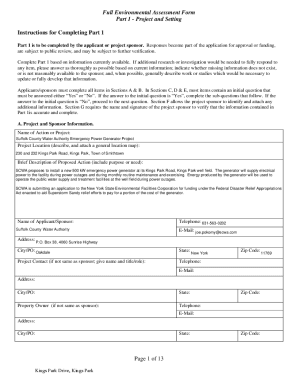

How to fill out the Debt Transfer Agreement Template

-

1.Download the Debt Transfer Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller environment.

-

3.Begin by filling out the date at the top of the document.

-

4.Identify the original creditor by entering their name and address in the designated fields.

-

5.Specify the debtor's name and address next to the relevant section.

-

6.Clearly state the amount of the debt being transferred and any relevant account numbers.

-

7.Detail any terms and conditions associated with the debt transfer, if applicable.

-

8.Include the new creditor's name and address to ensure clarity about who will collect the debt.

-

9.Add a signature line for both the original creditor and the new creditor, ensuring a space for the date of signing.

-

10.Review all entered information for accuracy and completeness before saving the document.

How to write a debt settlement agreement?

The letter should typically explain why you can't pay the full debt, how much you're willing to pay right now, and the exact action you want in return from the creditor. A debt settlement letter is, in effect, a written legal contract. So it's important to make direct, explicit, and detailed statements.

Can debt be transferred to another person?

Generally speaking, debt can't usually be transferred to another person. If you're not named on the credit agreement and you didn't sign it, or put your name down as a guarantor, then in most cases, the debt can't be transferred to you.

How do you write a debt agreement?

Include: the type of debt (credit card, line of credit, personal loan, etc.) who it is owed to (which bank or financial institution, or person) how much is owed on the debt as of a specific date.

What is a debt exchange agreement?

A debt/equity swap is a transaction in which the obligations or debts of a company or individual are exchanged for something of value, namely, equity. In the case of a publicly-traded company, this generally entails an exchange of bonds for stock.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.