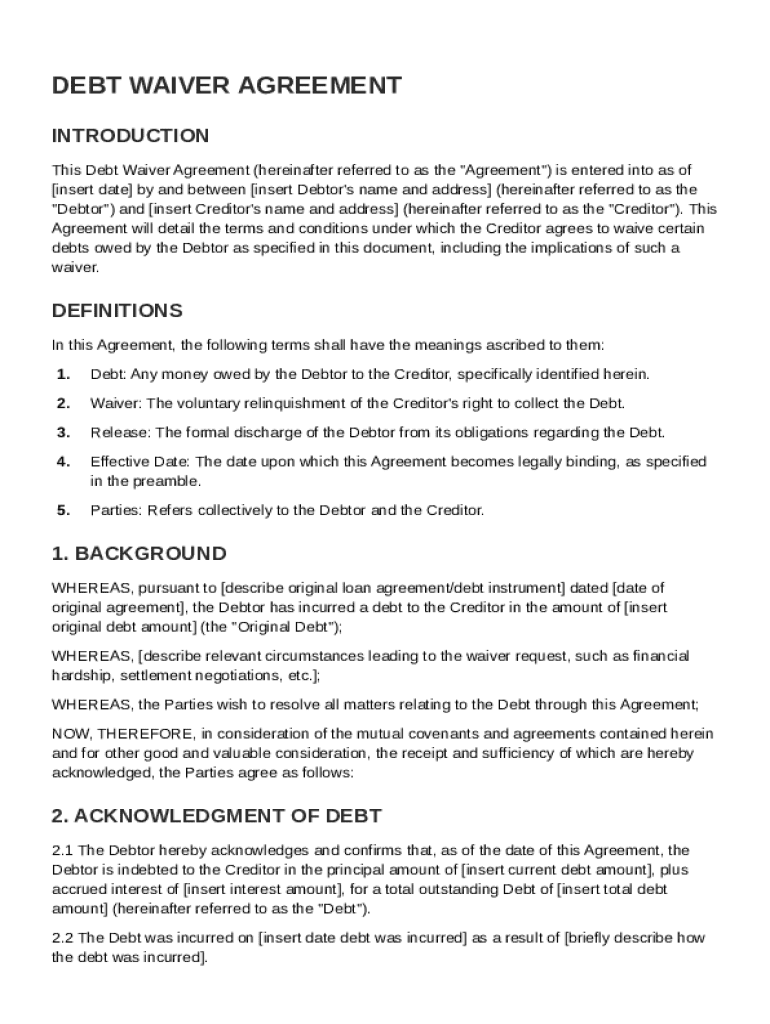

Debt Waiver Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a creditor agrees to waive certain debts owed by a debtor, detailing the acknowledgment of debt, terms of the waiver, and release of liability.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Debt Waiver Agreement Template

A Debt Waiver Agreement Template is a legal document used to formally forgive a portion or all of a debtor's obligations to repay a loan.

pdfFiller scores top ratings on review platforms

Had some trouble with billing and the customer service was right on it and took care of the problem. Software is good and being able to access various pre-made docs is very nice.

This program has made converting locked PDF files more manageable.

this program is the answer to all who work with osha 300 log; thank you so much. Mahalo, and Aloha.

Kalani Whitford / Safety Officer

National Fire Protection Inc.

Excellent format. Easy to follow. Good results.

I'm able to get a ton of things done that I could never before.

It is a great program. Allows one to fill in so many forms. Works very easily.

Who needs Debt Waiver Agreement Template?

Explore how professionals across industries use pdfFiller.

Debt Waiver Agreement Template Guide

In this guide, we provide a comprehensive overview of a Debt Waiver Agreement Template form, detailing how to effectively create, fill out, and manage this crucial document.

A Debt Waiver Agreement is essential for both creditors and debtors, ensuring mutual understanding and legal clarity in financial dealings.

What is a Debt Waiver Agreement?

A Debt Waiver Agreement is a legal document that outlines the terms under which a creditor agrees to forgive a portion or all of a debtor's outstanding debt. This agreement serves as protection for both parties involved, preventing misunderstandings and providing clear terms.

-

It’s a formal contract specifying the arrangement between debtor and creditor regarding the forgiveness of debt.

-

Essential elements include the effective date, the acknowledged debt amount, and detailed terms of the waiver.

-

Waivers can alleviate financial pressure on debtors while protecting creditors from future claims.

Who are the parties involved in the agreement?

Identifying the parties involved is crucial for the validity of a Debt Waiver Agreement. The two primary parties are the debtor, who owes the debt, and the creditor, who is owed the debt.

-

The debtor is the individual or entity obligated to repay the debt, responsible for understanding the terms of the waiver.

-

The creditor has the right to specify terms for the waiver and enforce them if necessary.

-

Accurate information is vital to prevent legal disputes; this includes addresses, contact details, and identification.

How to structure the agreement's essential components?

Structuring the agreement carefully ensures clarity and legal enforceability. Each component must be outlined explicitly to avoid ambiguity.

-

The agreement should specify when the waiver takes effect, marking the start of the creditor’s relinquishment of debt.

-

The debtor must acknowledge the exact amount prior to the waiver to facilitate transparency.

-

Clearly define what part of the debt is being waived to prevent confusion in the future.

What are the implications of a waiver?

Understanding the legal implications of a Debt Waiver Agreement is crucial for both debtors and creditors. Each party must be aware of their rights and the consequences of the waiver.

-

Both parties may gain legal protection against claims that the debt remains unpaid after the waiver.

-

Debt release affects credit scores and may have tax implications for the debtor.

-

Waivers often arise during negotiations due to financial struggles, highlighting the need for mutual understanding.

What compliance and legal considerations are necessary?

Compliance with local laws is paramount when executing a Debt Waiver Agreement. This ensures that the waiver is legally binding and enforceable.

-

Different jurisdictions may have specific regulations regarding debt waivers that must be adhered to.

-

It's important to consult with local legal guidelines to ensure that all terms meet regulatory requirements.

-

Including a witness or a notary can bolster the validity and enforceability of the waiver.

How to fill out the Debt Waiver Agreement?

Correctly completing the Debt Waiver Agreement Template form is crucial for its validity. This section provides a step-by-step guide.

-

Follow each section carefully, ensuring all parties' details and terms are accurately recorded.

-

Mistakes such as incomplete information or incorrect dates can render the agreement invalid.

-

Leverage pdfFiller’s features to edit, sign, and manage your agreement seamlessly.

What are the best practices for managing and storing your agreement?

Proper management and storage of your Debt Waiver Agreement are vital to ensure accessibility and security.

-

Keep both digital and physical copies in secure locations.

-

Store documents on a cloud platform to ensure they are accessible from anywhere.

-

Utilize collaboration tools within pdfFiller to facilitate teamwork in managing waivers.

Where can you find additional resources for further assistance?

Another key aspect of managing a Debt Waiver Agreement is having access to additional resources for support.

-

Access a range of templates and tools to assist with further documentation needs.

-

Having legal expertise on hand is invaluable for navigating complex waiver agreements.

-

Supplement your debt waiver knowledge with guides on other important financial documents.

How to fill out the Debt Waiver Agreement Template

-

1.Open the Debt Waiver Agreement Template on pdfFiller.

-

2.Review the document to understand the sections provided: debtor information, creditor information, debt details, and agreement terms.

-

3.Begin by filling in the debtor's full name and contact information in the designated fields.

-

4.Next, enter the creditor's information including name and contact details.

-

5.Specify the amount of debt being waived and any relevant account numbers.

-

6.Detail the reason for the debt waiver in the appropriate section to provide clarity.

-

7.Include the date of the agreement and ensure both parties' names are typed at the end of the document where signatures are required.

-

8.If necessary, add any additional terms or conditions relevant to the waiver agreement in the provided sections.

-

9.Save your filled document, and consider downloading or emailing a copy to both parties involved for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.