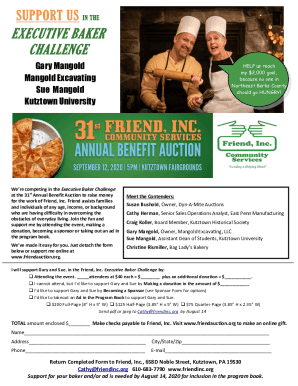

Deed of Loan Agreement Template free printable template

Show details

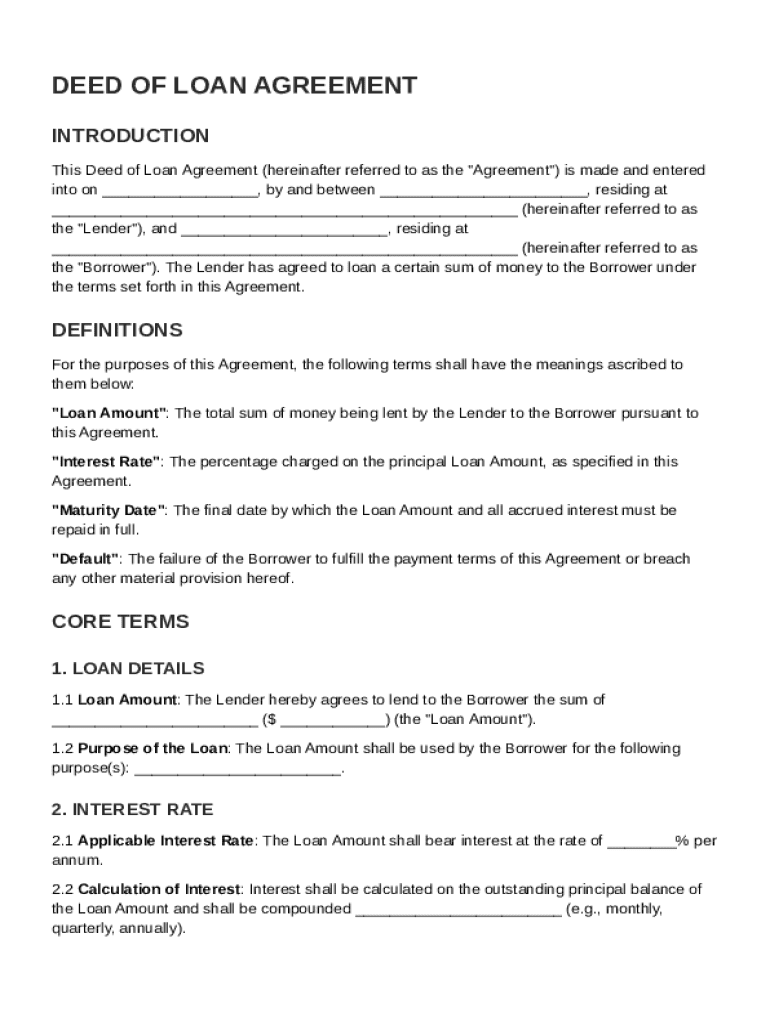

This document outlines the loan agreement between a lender and a borrower, detailing loan terms, interest rates, repayment schedules, and default conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

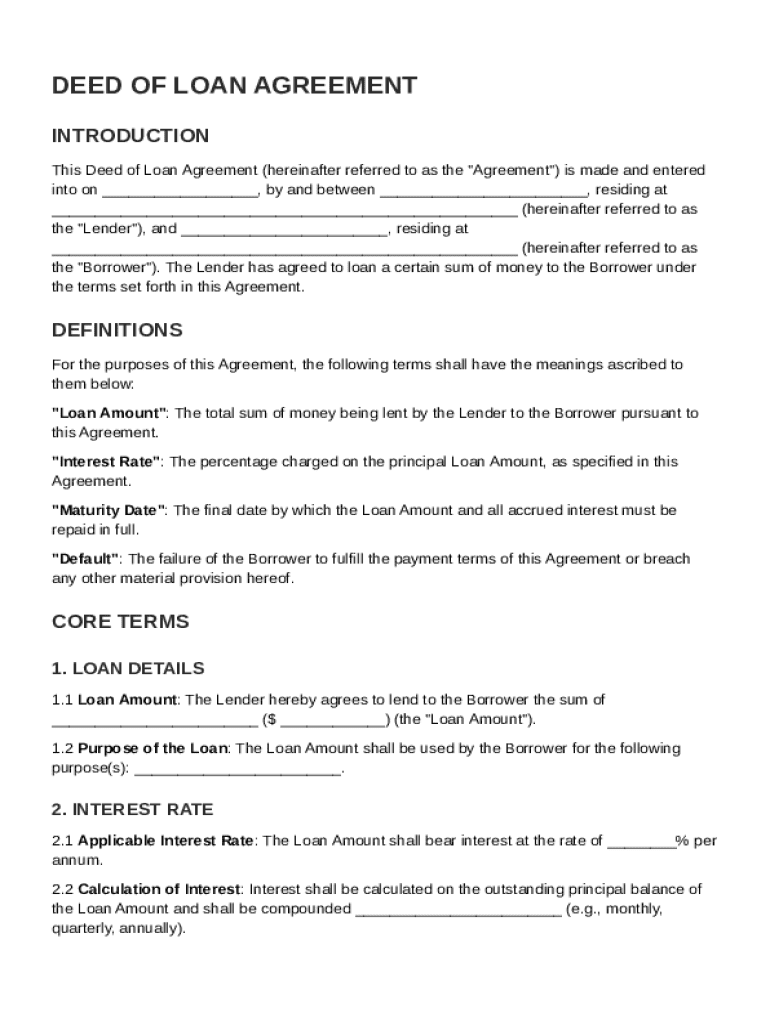

What is Deed of Loan Agreement Template

A Deed of Loan Agreement Template is a legal document outlining the terms and conditions of a loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

So far its a pretty impressive peace of software.

Great! I can save the changes and continue at any time. Also share my documents

A lot easier than writing everything in. Very helpful.

good so far, want to remove the 'next' button, it's annoying, very annoying.

It is surprising how many PDF forms get sent and this tool allows you to fill them in easily.

Love it.

Im surprised there was a website like this. I just happen to look it up, but I didn't think this was available.

Who needs Deed of Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Deed of Loan Agreement Template Guide

How to fill out a Deed of Loan Agreement Template form

To fill out a Deed of Loan Agreement Template form, start by defining the lender, borrower, loan amount, and terms clearly. Ensure you include the interest rate, payment methods, and relevant dates. Use pdfFiller for easy editing, eSigning, and collaborating with others on your document.

Defining your Deed of Loan Agreement

A Deed of Loan Agreement is a legally binding contract between a lender and a borrower outlining the terms of the loan. It typically includes the loan amount, interest rate, and repayment schedule. A well-structured agreement can prevent misunderstandings and disputes.

-

This document serves as a record of the lending arrangement and protects the interests of both parties.

-

Clearly identify each party involved in the loan transaction and articulate how much is being borrowed.

-

Specify the intended use of the loan, helping both parties align their expectations.

What are the core terms of the agreement?

Core terms are critical as they outline the financial and legal obligations of both parties. Understanding these elements is essential for successful loan management.

-

Clearly specify the total amount being loaned to prevent ambiguity.

-

The interest rate determines the cost of the loan; it can be fixed or variable.

-

Set a clear date for when the loan must be repaid in full.

-

Outline what constitutes a default and the actions that will follow.

How should loan details be articulated?

Being explicit about loan details ensures both parties have a mutual understanding, enhancing trust and accountability.

-

Clearly state why the loan is being taken, which can help in future reassessment.

-

List specific planned uses for the loan to maintain transparency.

-

Transparent terms can prevent legal complications and encourage compliance.

How are interest rates structured in loan agreements?

Interest rates play a significant role in loan agreements as they determine the loan's total cost to the borrower. Understanding how interest is calculated and applied can empower borrowers.

-

Specify the actual interest rate applicable to the loan to avoid confusion.

-

Provide clear definitions and examples to illustrate how interest impacts repayment.

-

Explain how often interest is compounded, as this affects the total amount payable.

What are effective repayment strategies?

Establishing a clear repayment strategy is vital for both lenders and borrowers to ensure obligations are met timely.

-

Create a clear payment schedule to help manage cash flow.

-

List available payment methods for flexibility and convenience.

-

Clearly defined terms minimize the risk of defaults through mutual understanding.

How to keep your template relevant?

Periodic updates to your agreement template are crucial to reflect changes in laws or personal circumstances.

-

Regular reviews help ensure compliance and relevance as situations change.

-

Identify elements that typically do not change to simplify the update process.

-

Understanding changes helps both parties maintain their rights and protections.

What interactive tools are available?

pdfFiller offers a range of interactive tools to help users manage their loan documents effectively.

-

Easily edit your Deed of Loan Agreement Template form with user-friendly features.

-

Securely sign your documents online, making it convenient and efficient.

-

Work with colleagues and clients effortlessly through collaborative tools.

How to ensure compliance with local regulations?

Understanding local regulations governing loan agreements is essential for validity and enforcement.

-

Research local laws to ensure your agreement is enforceable.

-

Clarify necessary legal terms to avoid misinterpretation.

-

Regular reviews of compliance materials provide assurance of legality.

How to fill out the Deed of Loan Agreement Template

-

1.Download the Deed of Loan Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editor.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Fill in the names and addresses of both the lender and the borrower in the designated sections.

-

5.Specify the loan amount in the relevant field, ensuring it matches the agreed-upon sum.

-

6.Outline the interest rate applicable to the loan, if any, and detail the repayment terms, including the due date and payment frequency.

-

7.Include any additional provisions or clauses relevant to the agreement, such as collateral requirements or consequences of default.

-

8.Review the completed document for accuracy, ensuring all necessary fields are filled out correctly.

-

9.Sign and date the document to validate the agreement and ensure both parties retain a copy for their records.

Can I make my own loan agreement?

While you can write a personal loan agreement yourself, you may consider many available templates online with the necessary clauses. You may consider having your loan reviewed or drafted by a reputable lawyer for more complicated loan agreements.

How to write a loan agreement between family members?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

Does a loan agreement need to be notarized?

No, a personal loan agreement does not need to be notarized to be legally binding — it simply needs to be signed by each party to the agreement.

How to structure a loan agreement?

A written loan agreement should include details of: the full names and addresses of the parties. the principal amount of the loan. the term of the loan, for example 12 months. the amount and frequency of repayments. the rate of interest payable, if interest is being charged.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.