Last updated on Feb 17, 2026

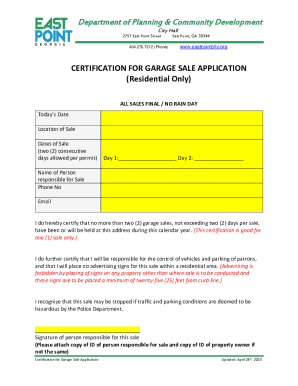

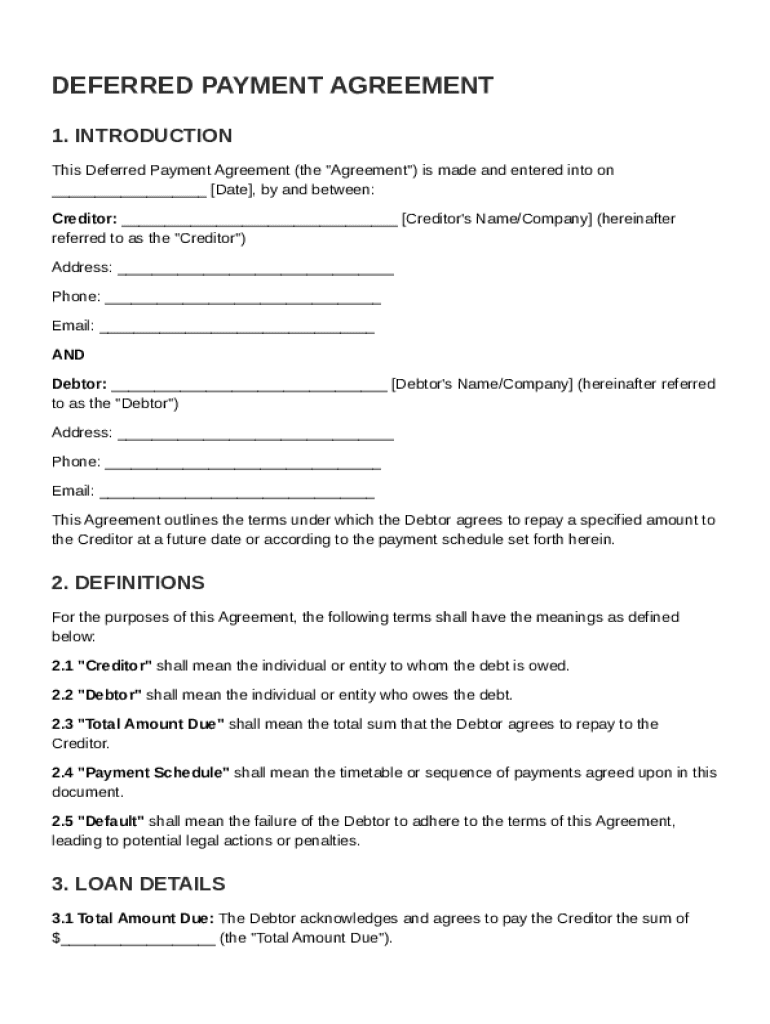

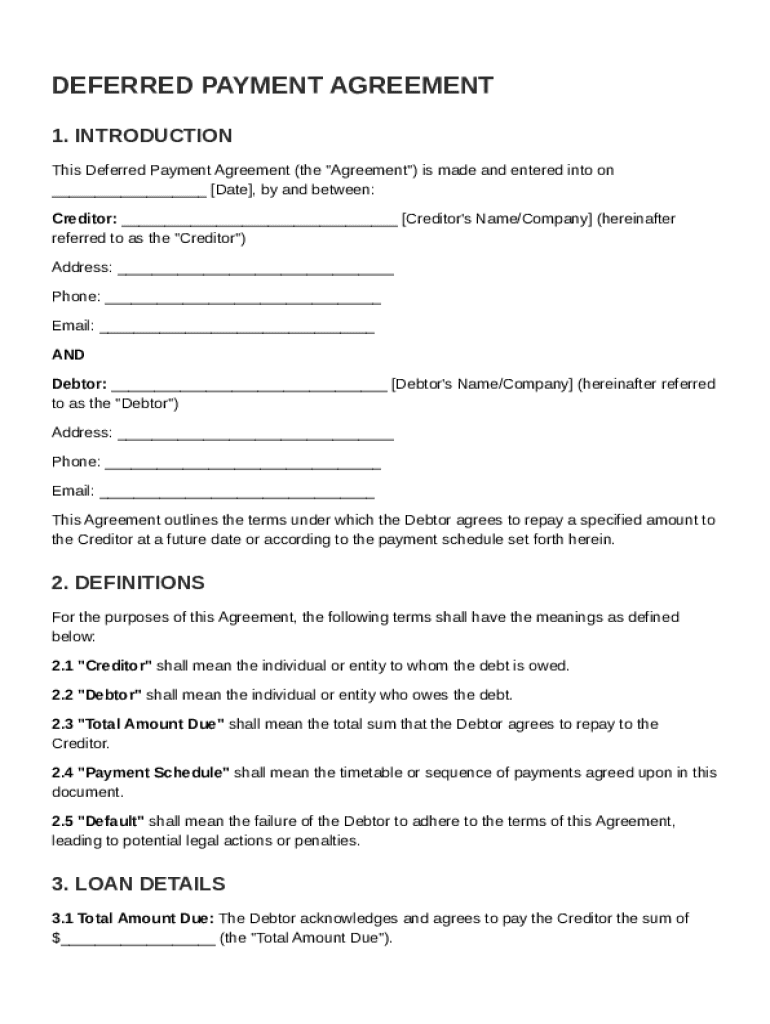

Deferred Payment Agreement Template free printable template

Show details

This document outlines the terms under which a debtor agrees to repay a specified amount to a creditor at a future date or according to an agreed payment schedule.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Deferred Payment Agreement Template

A Deferred Payment Agreement Template is a legal document outlining the terms under which payments will be delayed or made in installments.

pdfFiller scores top ratings on review platforms

I have yet to have any issues with using PDF Filler. I love how user friendly it is!

I had no trouble filling out my form. I am very happy and satisfied with PDFfiller.

Made filling out a PDF the most easiest experience ever!

Awesome and very easy to navigate aroud system

Easy to use, not a lot of instruction needed to get started.

Working great but would like to learn shortcuts, etc...

Who needs Deferred Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

Complete Guide to a Deferred Payment Agreement Template

TL;DR: How to fill out a deferred payment agreement template

To fill out a Deferred Payment Agreement Template, begin by clearly identifying the creditor and debtor, specifying the total amount due, and detailing the payment schedule. Ensure you include any applicable late payment penalties and default clauses to protect both parties. Ultimately, this structured approach can help ensure clarity and compliance.

What is a deferred payment agreement?

A Deferred Payment Agreement is a formal arrangement between a creditor and a debtor that allows repayment of debt to be postponed to a later date. Understanding the significance of having a structured plan is vital as it protects both parties legally and financially.

-

A legal document outlining the terms of debt repayment between the creditor and debtor.

-

Helps in clarifying expectations, protects parties' rights, and serves as a reference in case of disputes.

-

Generally includes the creditor, debtor, and total amount due, which are crucial for effective management of the debt.

What elements should be included in the agreement?

The effectiveness of a Deferred Payment Agreement relies on including critical details that mitigate misunderstandings and future disputes. Ensuring that all relevant information is provided in clear terms guarantees that both parties understand their obligations.

-

Include the name, address, phone number, and email of the creditor to facilitate communication.

-

Similar information should be collected for the debtor, ensuring all avenues for contacting them exist.

-

Clearly state the total amount being deferred to keep all parties aligned on the financial responsibilities.

-

Outline whether payments will be made in one lump sum or through installments, and specify due dates.

How should you fill out the template?

Completing the Deferred Payment Agreement Template can seem daunting but breaking down the process into manageable steps simplifies it. Here’s a concise guide to effectively using the form.

-

Fill in the necessary information for both parties, ensuring all contact details are correct and up to date.

-

The total debt amount should reflect the actual figures agreed upon, while clarifying the purpose aids in understanding the context of borrowing.

-

Clearly define the manner and schedule of payment to prevent any ambiguity later.

-

Incorporating these clauses serves as a deterrent against defaulting on payments and secures the interests of the creditor.

How can you customize the template using pdfFiller?

Using pdfFiller to customize your Deferred Payment Agreement Template allows for enhanced functionality. This cloud-based platform not only facilitates the editing of documents but also offers a variety of collaborative tools.

-

Users can add electronic signatures, making it easier to finalize agreements without physical presence.

-

Multiple users can work simultaneously on the document, enabling quick and efficient updates.

-

Store, organize, and retrieve all related documentation from a single dashboard, simplifying the management process.

What common mistakes should you avoid?

Avoiding common pitfalls during the process of creating a Deferred Payment Agreement is crucial to ensuring both legality and clarity. Understanding these errors will keep the agreement effective and enforceable.

-

Double-check all inserted details to avoid errors that could lead to disputes.

-

Always articulate the terms of the payment plan to prevent misunderstandings later.

-

Both parties should have correct contact details listed to facilitate easy communication.

-

Including penalties might encourage punctual payments and safeguard the creditor's interests.

What legal considerations should you be aware of?

A Deferred Payment Agreement must comply with local laws to be enforceable. Understanding these regulations will shield you from potential legal ramifications associated with non-compliance.

-

Legal obligations vary by region; familiarize yourself with local laws governing debt repayment agreements.

-

Ensuring adherence to applicable laws guarantees the legality of the agreement.

-

Failure to comply can lead to disputes, legal challenges, and unenforceable agreements.

How to fill out the Deferred Payment Agreement Template

-

1.Download the Deferred Payment Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Enter the date at the top of the document in the specified format.

-

4.Fill in the parties' names and contact information in the designated fields.

-

5.Specify the total amount owed clearly in the appropriate section.

-

6.Detail the payment terms, including the amount, frequency, and due dates of the payments.

-

7.Outline any late fees or penalties for missed payments under the terms section.

-

8.Include instructions for how the payments should be made (e.g., bank transfer, check).

-

9.Add any additional clauses relevant to the agreement, such as dispute resolution or default terms.

-

10.Review the document for accuracy and ensure all necessary fields are completed.

-

11.Save the completed agreement and share it with the involved parties for signatures.

What is an example of a deferred payment plan?

Examples of a deferred payment agreement A credit card that offers zero interest rates is an example of a deferred payment arrangement, since the bank that supplies the line of credit will collect the monthly payments without the revenue that would normally be guaranteed by the interest added.

What is a deferred payment online?

In effect, online deferred payment is an arrangement between a supplier and its web customers in which customers are provided with credit on agreed terms so they can acquire goods or services immediately and pay for them by a set date.

What are examples of standard of deferred payment?

Most forms of money can act as standards of deferred payment including commodity money, representative money and most commonly fiat money. Representative and fiat money often exist in digital form as well as physical tokens such as coins and notes.

What is a deferred payment agreement?

A deferred payment agreement is a type of loan that homeowners can use to pay for their care home or nursing home. It's designed for people who cannot afford their weekly care costs because most of their money is tied up in the value of their home and they don't want to sell their home straight away.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.