Last updated on Feb 17, 2026

Deposit Account Control Agreement Template free printable template

Show details

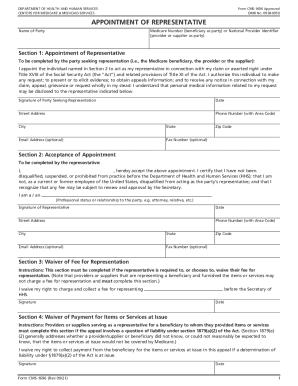

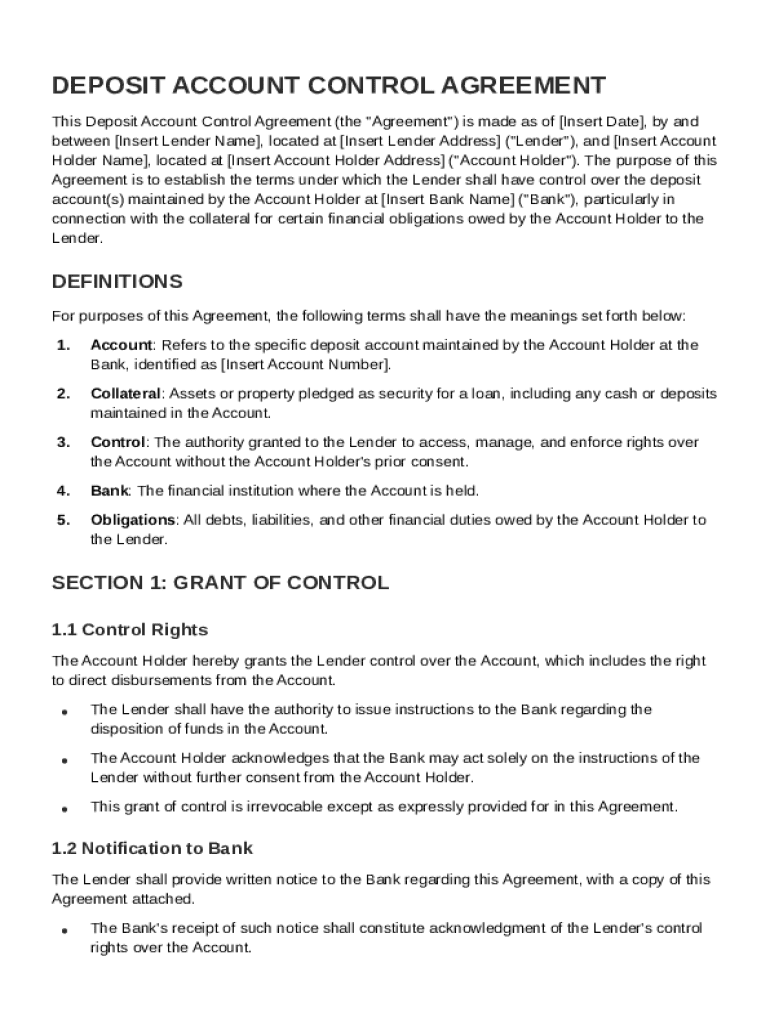

This Agreement establishes the terms under which the Lender has control over the deposit account maintained by the Account Holder at the Bank in connection with financial obligations.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Deposit Account Control Agreement Template

A Deposit Account Control Agreement Template is a legal document that establishes the rights and responsibilities of parties involved in the control of a deposit account.

pdfFiller scores top ratings on review platforms

For a new customer who has only used this program for a short time, It's a bit confusing to find all the necessary information. I am learning, but it's taken some navigation, and I haven't used the help line, because I don't even know the right questions to ask.

Just learning how to use it. I'm a paralegal with my husband's law firm and I think this will help manage my work flow and communication with clerical staff better.

PDFfiller has made it very easy for me to have business documents signed.

PDF Filler is crisp and fast. It took care of my needs seamlessly and productively. I would recommend and use it again and again!

Love it for small projects, but big ones are cumbersome!

Cannot find the most up to date HR104 form

Who needs Deposit Account Control Agreement Template?

Explore how professionals across industries use pdfFiller.

Deposit Account Control Agreement Guide

How do you understand the Deposit Account Control Agreement?

A Deposit Account Control Agreement is a legal framework that outlines the control and rights of lenders over deposit accounts owned by a borrower. Establishing control over deposit accounts is vital in securing a lender’s interests, particularly when providing loans. This agreement serves multiple stakeholders, primarily lenders and account holders, providing security and clear terms regarding account management.

-

It is an agreement that grants a lender control over a borrower's deposit account as collateral for a loan.

-

Control ensures that lenders can manage or access funds if the borrower defaults on the loan.

-

Both lenders and borrowers benefit; lenders secure their loans, and borrowers may negotiate better terms.

What are the key components of the agreement?

Understanding the key elements of a Deposit Account Control Agreement is crucial. The agreement typically involves two main parties: the lender, who provides financing, and the account holder, who secures this loan with their deposit account. Key terms outlined in the agreement define both parties' roles, responsibilities, and the legal authority granted.

-

The lender provides the financing while the account holder is the entity that manages the deposit account securing the loan.

-

Understanding these terms is essential, as they determine the framework and enforceability of the agreement.

-

The agreement defines the extent to which the lender can manage the account, including rights to withdraw or freeze funds.

How do you fill out the Deposit Account Control Agreement?

Completing a Deposit Account Control Agreement requires careful attention to detail. Start by including accurate dates and the personal details of the lender and account holder. Properly identifying the deposit account is crucial, as it ensures that the lender can exercise their rights effectively.

-

Make sure to include pertinent details, such as official names, addresses, and contact information.

-

Specify the account number and bank branch to avoid any confusion regarding which account is under the agreement.

-

Clearly state what constitutes collateral and outline the obligations of the account holder under the agreement.

What are the rights and responsibilities under the agreement?

The rights of the lender and responsibilities of the account holder are paramount. The lender retains the right to manage the deposit accounts in accordance with the agreement. Conversely, the account holder has specific responsibilities, primarily the obligation to maintain sufficient funds and comply with the terms set forth.

-

Lenders can access account information, withdraw funds, or freeze the account in accordance with the agreement.

-

Account holders must ensure that their accounts remain funded and comply with all notification requirements outlined.

-

Granting control can lead to loss of access to funds and potential legal consequences if terms are breached.

What is the notification process to the Bank?

Notifying the bank about the Deposit Account Control Agreement is a critical step that cannot be overlooked. It is essential to establish clear communication with the financial institution involved, as it ensures that they recognize the lender's rights over the account. This process typically involves submitting proper documentation.

-

Ensure the bank is informed in writing and provided with necessary copies of the agreement for their records.

-

Include the signed agreement and any additional forms as required by the bank’s policies.

-

Follow up with the bank to confirm receipt and compliance, ensuring their system reflects the agreement.

How do you manage changes and revocations?

Management of changes or revocations within a Deposit Account Control Agreement requires careful handling. Updating the agreement may involve a formal amendment process, while an outright revocation needs clear communication to all parties, including the bank. Ensuring legal compliance throughout is critical to avoid controversies.

-

Changes usually require written consent from both the lender and account holder alongside an amendment to the existing agreement.

-

Revocation should be formally documented and communicated to the lender and the bank promptly.

-

Ensure compliance with state laws regarding revocations, as failure to do so may lead to unintended legal consequences.

How does using pdfFiller enhance your Deposit Account Control Agreement process?

Utilizing pdfFiller can significantly streamline the process of creating, filling out, and managing a Deposit Account Control Agreement. The platform's user-friendly interface offers various features that make it easier to collaborate, sign, and share documents effortlessly. It is particularly beneficial for teams and individuals seeking efficient document management solutions.

-

Users can easily edit or sign their documents online, saving time and avoiding the hassle of printing.

-

Simply upload your form, fill out the necessary fields, and complete the process digitally.

-

Enable team collaboration where multiple users can access and edit the document collectively.

What are the legal implications to consider?

Understanding the legal implications of a Deposit Account Control Agreement is essential. Different states may have varying regulations that govern these agreements, which can impact enforceability. It is crucial to ensure compliance with both state and federal regulations to avoid possible legal pitfalls.

-

The legal landscape surrounding deposit agreements differs significantly across states, necessitating thorough research prior to execution.

-

Legal compliance protects all parties involved and reinforces the agreement's legitimacy.

-

Failing to comply with applicable laws can result in unenforceable agreements and potential legal issues.

How to fill out the Deposit Account Control Agreement Template

-

1.Open the Deposit Account Control Agreement Template in pdfFiller.

-

2.Review the document to ensure it meets your requirements and understand each section.

-

3.Begin by filling in the date at the top of the document where indicated.

-

4.Input the names and addresses of all parties involved in the agreement: the depositor, the secured party, and the bank.

-

5.Specify the details of the deposit account, including the account number and type of account, ensuring accurate information.

-

6.Outline the conditions under which the secured party can access or control the account in the dedicated section.

-

7.Include any necessary clauses regarding the rights to withdraw or transfer funds.

-

8.If applicable, provide information on any existing loans or obligations tied to the account.

-

9.Review the entire document for accuracy and completeness before finalizing.

-

10.Once all the information is filled out, save the completed document and distribute copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.