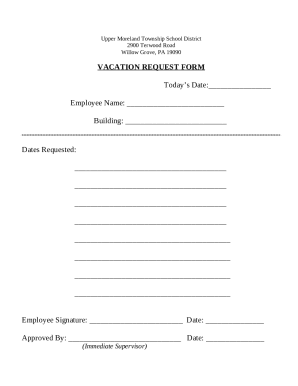

Directors Loan Agreement Template free printable template

Show details

This document establishes the terms and conditions under which a director may lend funds to the company, protecting the interests of both parties and detailing loan amount, repayment terms, and other

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Directors Loan Agreement Template

A Directors Loan Agreement Template is a legal document outlining the terms and conditions of a loan given by a director to their company.

pdfFiller scores top ratings on review platforms

It did not convert the complicated…

It did not convert the complicated forms to meet my requirements. Regular doduments it worked well

Good

Good service. Very usefull

GREAT FOR WHAT I NEED

AMAZING PROGRAM!!!

i GAVE THE HIGHEST RATING BECAUSE I HAD…

i GAVE THE HIGHEST RATING BECAUSE I HAD NO IISSUES SO FAR.

Great program!

Who needs Directors Loan Agreement Template?

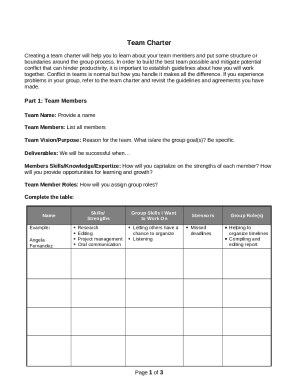

Explore how professionals across industries use pdfFiller.

How to fill out a Directors Loan Agreement Template form form

Completing a Directors Loan Agreement Template form involves understanding the agreement's purpose, detailing the loan terms, and ensuring compliance with legal obligations. This guide provides clear instructions on creating and managing this essential document.

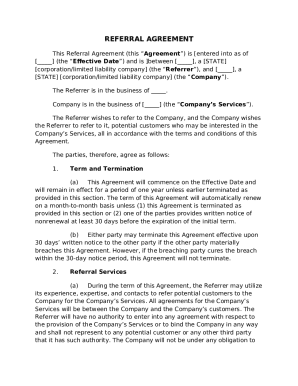

Understanding the Directors Loan Agreement

A Directors Loan Agreement is a formal contract that outlines the terms and conditions under which a director can lend money to their company. This agreement is crucial as it protects both the interests of the director and the company, specifying loan terms, repayment details, and responsibilities.

-

It's a legal document that clarifies the lending relationship between a director and their company.

-

This agreement aids in financial management and ensures that all lending activities are accounted for, which is essential for compliance audits.

-

Failing to document a loan appropriately can lead to tax liabilities and legal challenges for both parties involved.

What are the key components of the agreement?

Understanding the key components of a Directors Loan Agreement is necessary for clear communication of terms and responsibilities. Each element serves a specific purpose.

-

Define the total amount being lent and its significance to the company's cash flow.

-

Detail what the funds will be used for, such as operational expenses or expansion projects.

-

Specify the interest rate, if applicable, and under what conditions it is charged, promoting transparency.

-

Establish a clear timeline for repayment to manage expectations regarding loan fulfillment.

-

Outline consequences of non-compliance, protecting both parties if the loan terms are not met.

How to customize your Directors Loan Agreement

Customizing your Directors Loan Agreement is crucial to meet specific business needs. Adapting the template can be executed following structured steps.

-

Identify and replace template fields with specific details relevant to your agreement.

-

Make use of pdfFiller’s editing features to easily modify text, add terms, and adjust layouts.

-

Include unique conditions specific to your company that may not be covered in a standard template.

What are practical steps for implementation?

Effective implementation involves filling out the agreement accurately and managing the document throughout its lifecycle. Adopting a systematic approach ensures all steps are covered.

-

Provide all necessary information in the designated fields to create a comprehensive document.

-

Utilize pdfFiller’s features to manage both traditional signatures and electronic signatures efficiently.

-

Take advantage of cloud storage solutions offered by pdfFiller to securely save and easily retrieve your document when needed.

How to ensure legal compliance and best practices?

Legal compliance is paramount in drafting and executing a Directors Loan Agreement. Understanding local regulations helps safeguard your company against potential legal issues.

-

Research specific laws in your region concerning loan agreements to ensure compliance.

-

Draft clear terms and obtain necessary approvals to endorse the agreement officially.

-

Schedule periodic evaluations of the agreement to adapt it to any regulatory changes or business shifts.

What resources and tools does pdfFiller offer?

pdfFiller provides numerous resources to enhance your document management experience, making it easier to handle a Directors Loan Agreement effectively.

-

pdfFiller streamlines document creation, editing, and sharing, reducing the time spent on paperwork.

-

Leverage various forms available on pdfFiller to complement your documentation needs.

-

Utilize collaborative features for effective teamwork, especially for businesses with multiple stakeholders involved in the agreement.

How to download your Directors Loan Agreement Template?

Accessing your Directors Loan Agreement Template is straightforward. Here’s how you can do it quickly using pdfFiller.

-

Visit pdfFiller to locate various templates, including the Directors Loan Agreement Template.

-

Follow on-screen prompts to download and save your template for easy editing and usage.

-

Now that you know the steps, take action and create your Directors Loan Agreement with our user-friendly tools.

How to fill out the Directors Loan Agreement Template

-

1.Download the Directors Loan Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editor to begin filling it out.

-

3.Insert the date of the agreement at the top of the document.

-

4.Provide the names and addresses of the parties involved: the director and the company.

-

5.Specify the loan amount clearly in the designated section.

-

6.Outline the interest rate, if applicable, and repayment schedule.

-

7.Include terms such as repayment method and consequences of default.

-

8.Review all entered information for accuracy.

-

9.Save the filled document and share it with all involved parties for signatures.

-

10.Keep a copy for your records as confirmation of the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.