Directors Loan to Company Agreement Template free printable template

Show details

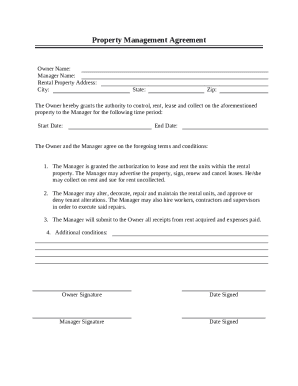

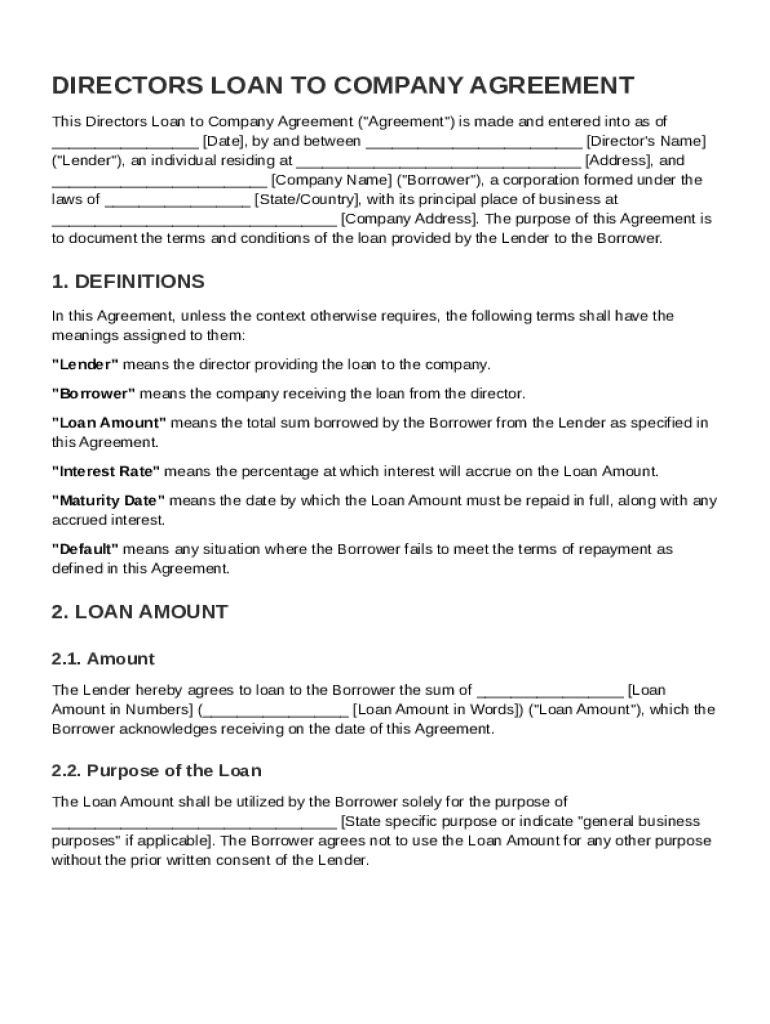

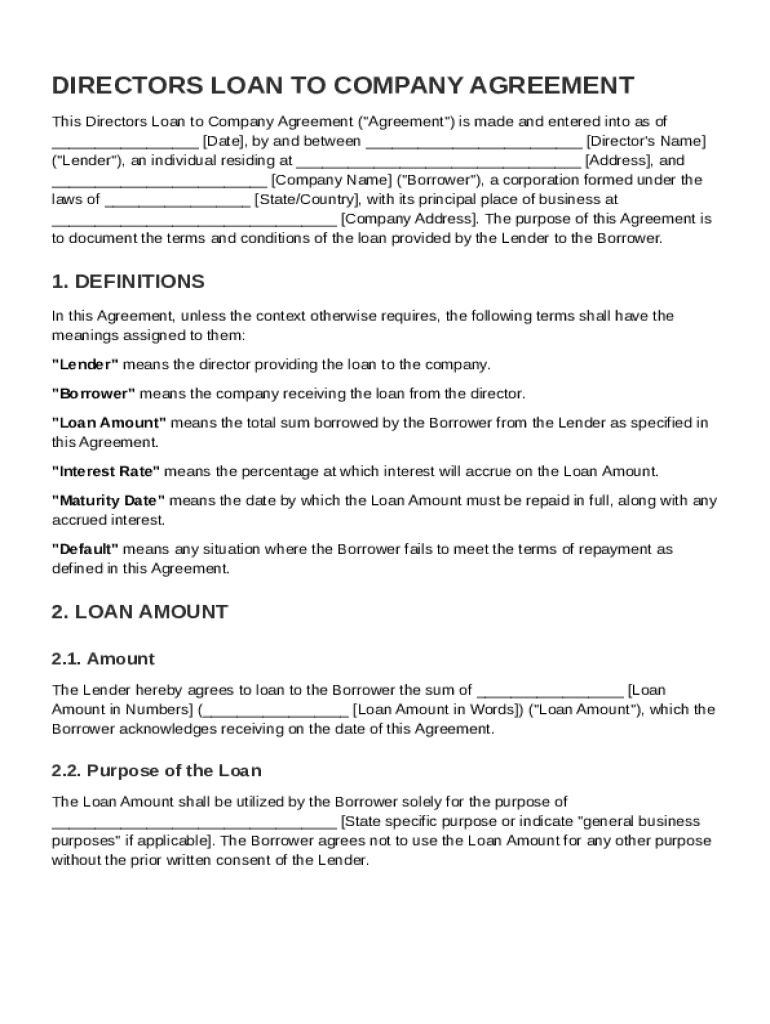

This document outlines the terms and conditions under which a director provides a loan to a corporation, specifying the rights and obligations of both the lender and borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Directors Loan to Company Agreement Template

A Directors Loan to Company Agreement Template is a legal document outlining the terms under which a director can lend money to their company.

pdfFiller scores top ratings on review platforms

The PDF filler is the very best it is quick and easy.

I was surprised that after Googling the form I needed and completing it thinking it was a govt web site that I had to pay to print the form. Your on-line Chat person gave me 30 days free which has restored my faith in your company.

I love that it has all the Action capabilities (e.g. Fill, Print, Email, Fax, and PDF) means of communications.

I have paid to print out forms but it is not printing out with the data I typed in it.

Great service

I would have preferred a quarterly or 6 month subscription renewed automatically.

AWESOME WEBSITE. Will be a lifetime member for sure.

Who needs Directors Loan to Company Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Directors Loan to Company Agreement Template

How to fill out a Directors Loan to Company Agreement Template form

Filling out a Directors Loan to Company Agreement Template requires careful attention to detail. Start by clearly stating the loan amount, interest rate, terms of repayment, and the roles of both the lender and borrower. Ensure all sections are accurately filled to maintain legal compliance.

Understanding the Directors Loan to Company Agreement

A Directors Loan Agreement is a formal document that outlines the terms and conditions under which a director can loan money to their company. It is essential to formalize such an agreement to safeguard the interests of both the company and the director. Key components include the loan amount, repayment terms, and interest rates.

-

It serves to clearly define the terms under which money is loaned, reducing disputes.

-

Formal agreements reduce misunderstandings and provide legal protection.

-

Typically includes loan terms, interest rates, and maturity dates.

Who are the lender and borrower?

In a Directors Loan Agreement, the lender is usually the director providing the loan, while the borrower is the company itself. Each party has distinct duties and responsibilities that must be understood to prevent conflicts.

-

The lender must ensure that all terms of the loan are clear and legally compliant.

-

The borrower must adhere to the agreed repayment schedule and conditions outlined in the agreement.

What are the key terms of the Directors Loan Agreement?

Understanding key terms in the agreement is crucial for both parties. These terms define the financial specifics and the legal responsibilities involved in the transaction.

-

Clearly articulate the total amount loaned to ensure transparency.

-

Set a fair interest rate that complies with legal standards.

-

Specify when the loan must be repaid to avoid ambiguity.

-

Detail the consequences for the borrower should they fail to repay.

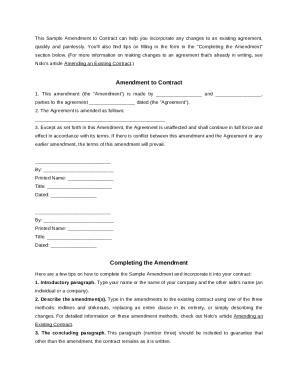

How to fill out the Directors Loan Agreement Template

Completing the Directors Loan to Company Agreement Template requires diligence and attention to detail. Follow our step-by-step guide, and utilize tools such as pdfFiller for editing, signing, and managing the document.

-

Begin by gathering required information and carefully filling in the fields.

-

Ensure all parties’ names are correctly spelled and dated.

-

Make use of editing features for customization and electronic signing.

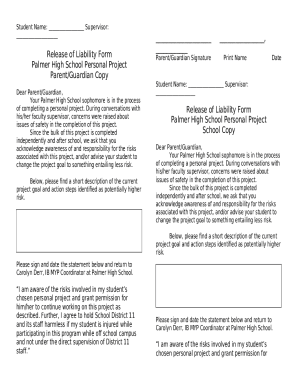

What are the legal compliance requirements?

While creating a Directors Loan Agreement, it’s essential to observe specific legal regulations. This includes considerations for tax implications and ensuring compliance with company laws.

-

Be aware of any laws within your region that may affect loan agreements.

-

Understand how the loan will be taxed and its potential impact on both parties.

-

Ensure adherence to any additional regulations relevant to your industry.

What are the post-agreement procedures?

After signing the Directors Loan Agreement, both parties should establish clear procedures for managing the loan. This includes reviewing terms periodically and maintaining thorough records.

-

Regularly assess the agreement to ensure it still meets the needs of both parties.

-

Have a plan in place if the borrower is unable to repay the loan.

-

Keep detailed records of all transactions and communications related to the loan.

Accessing the template via pdfFiller

To efficiently manage your Directors Loan Agreement, you can access the template through pdfFiller. This platform allows you to download, edit, and securely share your agreement.

-

Visit pdfFiller to download the template and start customizing it.

-

Utilize its collaborative features for seamless document management.

-

Follow the simple prompts to electronically sign and share the document with all relevant parties.

How to fill out the Directors Loan to Company Agreement Template

-

1.Download the Directors Loan to Company Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor to begin filling it out.

-

3.Start by entering the name of your company in the designated field at the top of the document.

-

4.Next, provide the director's full name and address, ensuring accuracy for legal purposes.

-

5.Specify the loan amount being provided, including currency, and ensure it matches any pre-agreement discussions.

-

6.Outline the repayment terms, including the duration of the loan, interest rates if applicable, and payment schedules.

-

7.Include any specifics about the loan terms, such as security or collateral if required.

-

8.Review the agreement for completeness, ensuring all fields are accurately filled.

-

9.Once reviewed, have the appropriate parties sign the document within pdfFiller.

-

10.Lastly, save and download the signed agreement for your records, and provide copies to all relevant parties.

Can a director give a loan to the company?

Directors can offer loans under specific conditions defined by the Companies Act, 2013, but these loans are subject to various compliance requirements, tax implications, and legal provisions.

How to document a director's loan?

Documenting and Reporting Loans You should use a comprehensive director's loan agreement that outlines the loan terms, repayment schedule, and interest rate. Regularly update the directors' loan account to reflect all transactions. This ensures clarity in financial records and aids in tax compliance.

How do you write a loan agreement between companies?

A well-structured loan agreement should follow established practice and include these key sections in order: parties' details (names and addresses), loan amount and purpose, interest rates and calculation method, repayment schedule, security provisions (if applicable), and default conditions.

What is a declaration by director for loan given to company?

A company accepting a loan from directors of the company or a relative of the director shall comply with the following: The Director of the company or his/her relative, shall furnish in writing a declaration to the effect that the amount is not being given out of borrowed funds; and.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.