Last updated on Feb 17, 2026

Dynamic Equity Split Agreement Template free printable template

Show details

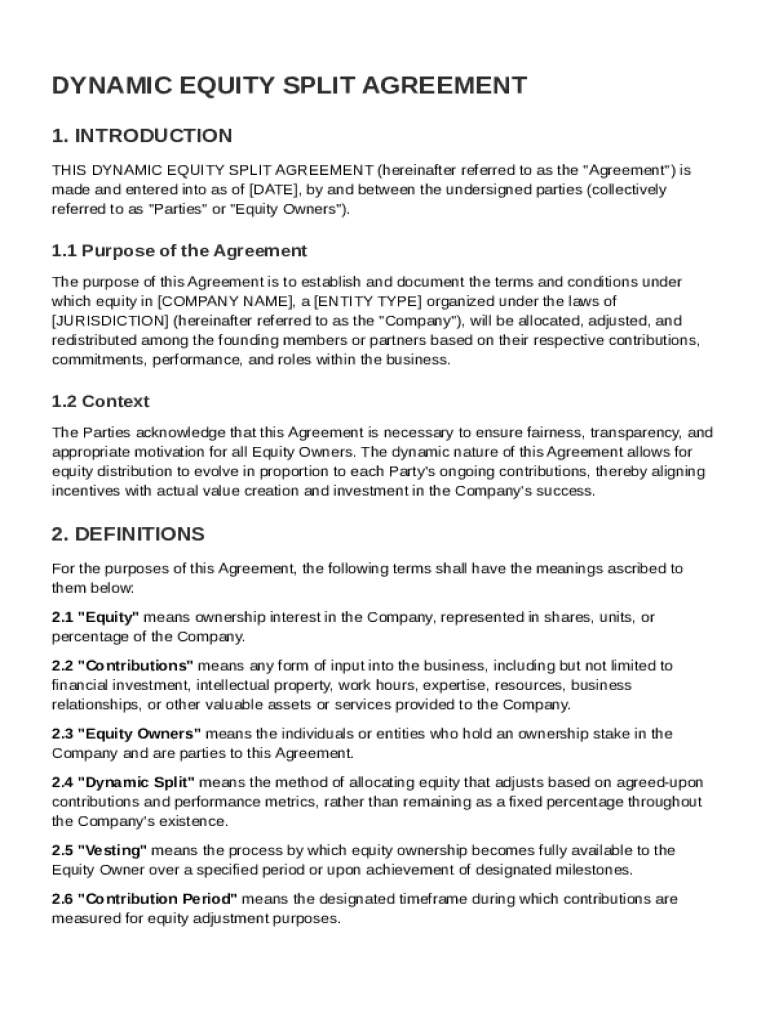

This document establishes the terms and conditions under which equity in a company will be allocated and redistributed among its founding members based on their contributions and performance.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

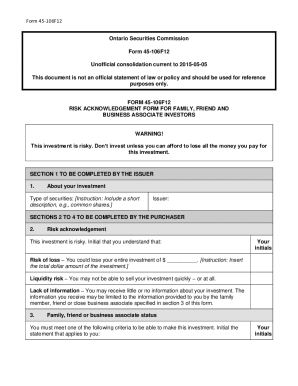

What is Dynamic Equity Split Agreement Template

A Dynamic Equity Split Agreement Template is a legal document that outlines how equity is divided among co-founders based on their contributions over time.

pdfFiller scores top ratings on review platforms

This form filler has been incredibly beneficial in aiding me to efficiently complete a number of form related tasks....I would unequivocally recommend this software to all college student!!!

I love this app and will use often. It does have some little issues when modifying text, but I can work with it.

2 hours of experience, I"m satisfied

Easier to use than any of the other PDF editors I have tried.

Buena Herramienta, perfecta para tareas.

Still in the learning curve. Works as expected.

Who needs Dynamic Equity Split Agreement Template?

Explore how professionals across industries use pdfFiller.

Dynamic Equity Split Agreement Guide

How to fill out a Dynamic Equity Split Agreement form

To fill out a Dynamic Equity Split Agreement form, begin by gathering relevant information about each equity owner's contributions. Use tools like pdfFiller to customize and digitally complete the form, ensuring clarity in roles and responsibilities. Finally, review the agreement collaboratively before signing.

Understanding dynamic equity split agreements

Dynamic Equity Split Agreements are frameworks that define how equity is distributed among co-founders based on their contributions over time. Unlike traditional fixed equity splits, which allocate ownership percentages at the onset of a business, dynamic agreements adjust allocations as circumstances change, making them increasingly popular.

-

Businesses choose dynamic agreements to accommodate varying levels of contributions, ensuring fairer equity distributions.

-

Dynamic splits can encourage founders to increase their contributions, knowing their equity may adjust accordingly.

-

By clearly defining how equity is earned, such agreements can prevent disputes among co-founders.

What is the purpose of the Dynamic Equity Split Agreement?

Establishing a Dynamic Equity Split Agreement is crucial for formalizing equity allocations. A well-structured agreement ensures transparency, fairness, and motivation among equity owners.

-

Dynamic agreements support equitable distributions based on actual contributions.

-

Clear terms help in mitigating misunderstandings about equity divisions.

-

Startups like Instagram and Airbnb successfully implemented dynamic equity splits, allowing for flexible founder contributions.

Key definitions in the agreement

Understanding fundamental terms is vital when drafting a Dynamic Equity Split Agreement. Key terms include Equity, which refers to ownership in a business; Contributions, which denote the efforts and resources brought by owners; and Dynamic Split, indicating an adaptable equity division.

-

Represents the ownership stake in the company.

-

Act of providing resources or effort to the business's success.

-

Describes the process through which equity ownership is gradually earned.

How to construct your Dynamic Equity Split Agreement

Drafting your Dynamic Equity Split Agreement requires incorporating essential elements like roles, contributions, and vesting schedules. Start with a clear outline of each owner's contributions and expected equity allocations.

-

Include clear definitions of equity and contributions.

-

Utilize tools such as pdfFiller for seamless formatting and collaboration.

-

Tailor the agreement to fit specific team dynamics and individual contributions.

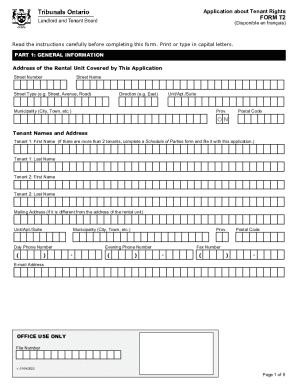

Filling out the agreement: A detailed walkthrough

Completing the Dynamic Equity Split Agreement form is simplified by a step-by-step walkthrough. Begin by entering the essential information of equity owners, their contributions, and agreed percentages.

-

Follow the guided sections in the template to ensure all necessary information is captured.

-

Leverage pdfFiller's features to expedite edits and ensure accuracy.

-

Be cautious of overlooking contribution details or clarity in roles.

What are vesting and adjustment mechanisms?

Vesting schedules and adjustments play a critical role in how equity is allocated as contributions evolve. A vesting schedule defines the timeline over which owners earn their equity, while adjustment mechanisms allow equity allocations to be updated based on performance.

-

Contributions must be met for owners to claim full equity, promoting commitment.

-

Equity distributions can change based on periodic evaluations of contributions.

-

If a co-founder decreases their involvement, their equity may be adjusted accordingly to reflect new contributions.

How to manage collaboration and signature management

Effective collaboration during the drafting and signing of the agreement is key to ensuring equity fairness. Using pdfFiller, multiple owners can review, comment, and sign the agreement seamlessly.

-

Utilize the interactive platform features for discussions and edits.

-

eSignatures can be gathered easily within the platform, ensuring all parties agree.

-

Timely updates and reviews help maintain clarity and fairness in equity distribution.

Related products and services

In addition to the Dynamic Equity Split Agreement Template, pdfFiller offers a variety of forms and templates suitable for company management. These resources can enhance collaboration and streamline document management for teams.

-

Access various forms specific to equity ownership and business management.

-

Features allow multiple users to manage documents collectively.

-

Use additional templates to help manage team dynamics and agreement modifications.

How to fill out the Dynamic Equity Split Agreement Template

-

1.Begin by opening the Dynamic Equity Split Agreement Template on pdfFiller.

-

2.Review the introductory sections that explain the purpose and key terms of the agreement.

-

3.In the designated fields, input the names and roles of all co-founders involved in the agreement.

-

4.Next, specify the initial equity percentages for each co-founder based on their respective contributions.

-

5.Once the initial splits are established, identify the criteria for future equity adjustments, such as additional investments or effort.

-

6.Fill in the timeline or milestones that will trigger these adjustments in equity distribution.

-

7.Make sure to include any provisions for resolution in case of disputes regarding equity adjustments.

-

8.Review the document for any legal terms and ensure all parties understand the implications of the agreement before signing.

-

9.When complete, save and share the document with all participating co-founders for review and signatures.

What is dynamic equity?

▪ Dynamic Equity targets excess returns versus broad equity benchmarks. through more risk-efficient portfolio construciton and dynamic. allocations.

How to write an equity agreement?

An equity compensation agreement typically includes the following key components: Grant of equity. The agreement will state the type of equity (such as stock options, RSUs, or SARs) and the number of shares/options being granted. Exercise price. Vesting schedule. Exercise expiration. Tax implications. Governing law.

What is the slicing pie model?

The Slicing Pie model is an innovative framework that has revolutionized the concept of startup equity. This dynamic model ensures that equity allocation is proportional to each team member's contributions, gauged by their fair market value.

Should you split equity equally between founders?

The founders should end up with about 50% of the company, total. Each of the next five layers should end up with about 10% of the company, split equally among everyone in the layer.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.