Employee Corporate Credit Card Agreement Template free printable template

Show details

This document establishes the terms and conditions for the issuance and use of corporate credit cards to employees of the company, promoting financial responsibility and safeguarding the company\'s

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

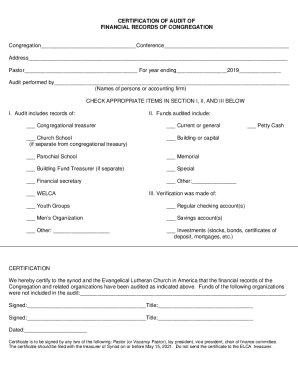

What is Employee Corporate Credit Card Agreement Template

The Employee Corporate Credit Card Agreement Template is a formal document that outlines the terms and responsibilities of employees authorized to use a corporate credit card.

pdfFiller scores top ratings on review platforms

This was easy to use and I liked it!

This was easy to use and I liked it!! I would have kept using it, if it were at a cheaper price.

Perfect

Perfect, easy and the most useful toll ever

It's a great tool

super

super,quick and tip top

Excellent service

Excellent service, easy to navigate and had all the functions required

SO FAR...I AM ENJOYING THIS PRODUCT.

Who needs Employee Corporate Credit Card Agreement Template?

Explore how professionals across industries use pdfFiller.

Employee Corporate Credit Card Agreement Guide

What is an employee corporate credit card agreement?

An Employee Corporate Credit Card Agreement is a formal document that outlines the terms under which an employee is authorized to use a corporate credit card. This agreement is pivotal as it sets the boundaries for acceptable use and responsibilities associated with the card. Understanding this document is essential for both employees and employers to ensure compliance and accountability.

What is the purpose of employee credit card agreements?

The primary purpose of these agreements is to provide clear guidelines for legitimate corporate spending while protecting the financial interests of the company. Such agreements delineate authorized expenses and establish consequences of misuse. Essentially, they are a vital tool for managing business finances effectively.

What are key terms and definitions in an employee credit card agreement?

-

A corporate card is specifically issued for business-related purchases and is not intended for personal use.

-

The individual designated to use the corporate card, responsible for following the terms outlined in the agreement.

-

Expenses that are pre-approved and suitable for reimbursement, typically related to business activities.

-

This defines actions that are not allowed including using the corporate card for personal transactions.

Who is eligible for corporate credit cards?

Eligibility for corporate credit cards typically requires full-time employment and may include minimum service requirements. Most organizations mandate that only employees in managerial roles or specific positions be issued corporate credit cards. This ensures that those entrusted with company funds have a proven track record and a clear understanding of responsible spending.

How do you apply for a corporate card?

-

Fill out the corporate card application accurately, providing all requested information.

-

Secure signatures and approvals from your department head and the finance department before submission.

-

Attend mandatory training sessions to understand the usage policies and financial responsibilities.

-

Once completed, submit your application to the finance department for processing.

What should be included in an employee credit card agreement?

-

Clearly outline the terms of use, including what constitutes authorized usage.

-

Detail the types of expenses that can be charged on the corporate card.

-

Provide clear guidelines on what constitutes personal use and the associated consequences for violations.

-

Specify the disciplinary actions for failure to adhere to the agreement, to ensure accountability.

How do employee credit cards impact personal credit?

The usage of employee credit cards can have varying effects on personal credit scores. While many corporate cards do not report to personal credit bureaus, if a personal guarantee is involved, this could impact one’s personal credit. Employees must be diligent in managing expenses responsibly to avoid any potential negative repercussions.

What are the best practices for using employee corporate credit cards?

-

Fully review the corporate card policy to avoid inadvertent violations.

-

Document expenses meticulously to ensure transparency and facilitate reimbursement processes.

-

Always be mindful of the spending limits imposed by the company to avoid overspending.

-

Use platforms like pdfFiller for managing and submitting documentation efficiently.

How to fill out the Employee Corporate Credit Card Agreement Template

-

1.Download the Employee Corporate Credit Card Agreement Template from your company's internal resources or the provided pdfFiller link.

-

2.Open the template in pdfFiller and review the introduction and agreement details to familiarize yourself with the content.

-

3.Enter the employee's name and contact information in the designated fields to properly identify the cardholder.

-

4.Fill in the department and job title of the employee to categorize the credit card issuer.

-

5.Specify the credit limit allowed for the account, ensuring it aligns with the company's policy.

-

6.Read and check the boxes for terms regarding appropriate usage, repayment responsibilities, and consequences for misuse.

-

7.Add the date of agreement in the provided field to ensure a clear record of when the terms were accepted.

-

8.Have the employee sign the agreement electronically using pdfFiller’s signing feature.

-

9.Finally, ensure the document is saved correctly, either by printing or emailing it to relevant stakeholders for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.