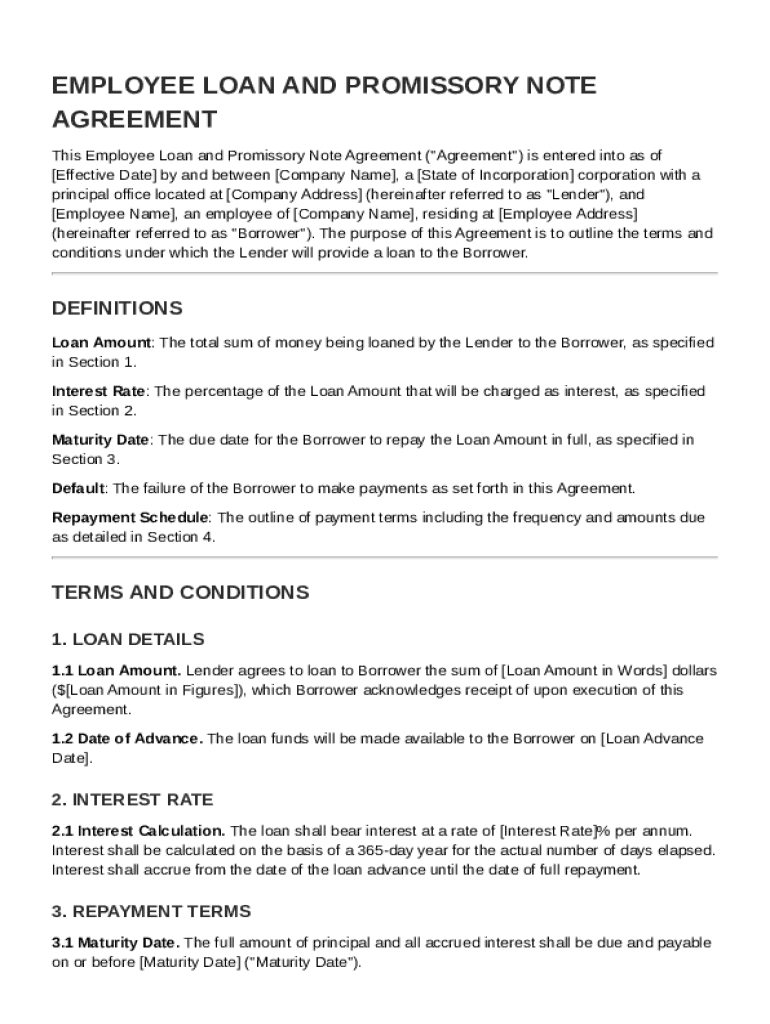

Employee Loan and Promissory Note Agreement free printable template

Show details

This document outlines the terms and conditions for a loan agreement between an employer and an employee, detailing loan amount, interest rate, repayment terms, and default consequences.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Employee Loan and Promissory Note Agreement

An Employee Loan and Promissory Note Agreement is a legal document outlining the terms under which an employee borrows money from their employer, detailing repayment obligations and conditions.

pdfFiller scores top ratings on review platforms

easy to use, easy to maneuver!

I love how effective it is and makes my job 10 times easier!

hkknhjkmhijukjgjhklhhjjjjmgnfhfhhkjhjkjkkjljhkhjgjhkjkjl

Easy and awesome !!

PdfFiller allowed to to complete an important document

A+++

Who needs Employee Loan and Promissory Note Agreement?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to the Employee Loan and Promissory Note Agreement Form on pdfFiller

What is an employee loan agreement?

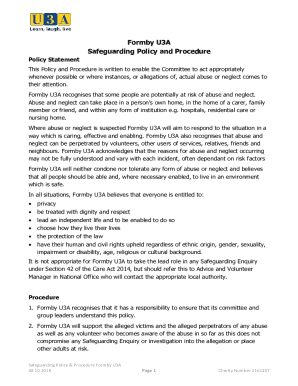

An Employee Loan Agreement is a formal document outlining the terms between an employer and an employee regarding a loan. This agreement delineates the conditions under which the loan is provided, ensuring that both parties are protected legally and financially.

-

The primary purpose of an employee loan agreement is to govern the transaction clearly, minimizing misunderstandings.

-

This agreement must comply with relevant laws governing loans to avoid potential liabilities.

-

Using a standardized template can help streamline the lending process, making it easier for both parties to understand their rights and obligations.

What are the key components of the employee loan agreement?

-

The total sum borrowed by the employee, which should be documented effectively.

-

Details how interest is calculated, whether it's fixed or variable, and any applicable rates.

-

The due date of the loan, including conditions for extensions or renewals.

-

Specifies how often repayments should occur and the total duration of the loan.

How do you create an employee loan agreement?

Creating an employee loan agreement through pdfFiller makes the process efficient and straightforward. The tool allows for easy customization of templates and provides features that ensure compliance and security.

-

Determine the loan amount and interest rate based on employee needs.

-

Use pdfFiller's toolkit to draft the loan agreement, utilizing templates as necessary.

-

Ensure the draft complies with your company's lending policies before finalizing.

-

Employ pdfFiller's eSignature feature to have both parties sign the agreement digitally.

What are the best practices for lending to employees?

-

Establishing clear lending procedures can prevent potential misunderstandings.

-

Consider the employee's financial situation and ability to repay when determining loan terms.

-

Maintain open dialogue regarding terms and potential changes to avoid disputes down the line.

What are the pros and cons of employee loan agreements?

Employee loan agreements can facilitate financial assistance for employees while providing businesses a way to support their workforce, enhancing loyalty and retention. However, there are potential risks, including the possibility of default or strained employee-employer relationships.

-

Benefits include improved employee satisfaction and reduced turnover.

-

Challenges include financial risk if the employee defaults and potential bias perceptions.

-

Companies need to consider how lending impacts cash flow and overall financial health.

How to manage the employee loan: ongoing responsibilities?

Managing an employee loan requires ongoing attention to ensure compliance with the terms agreed upon in the loan agreement. Regular monitoring can help prevent defaults and maintain clear communication with employees.

-

Keep track of repayments to ensure compliance and address issues promptly.

-

Be prepared to adjust loan terms if there's a legitimate need reflected by the employee's circumstances.

-

Have proactive measures in place for negotiating solutions in the event of missed payments.

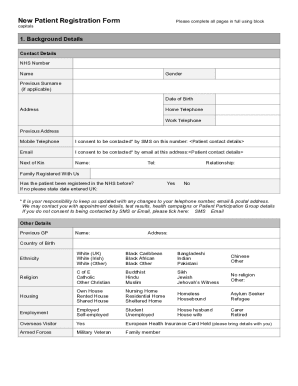

How to fill out the Employee Loan and Promissory Note Agreement

-

1.Open pdfFiller and upload the Employee Loan and Promissory Note Agreement template.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the employee's name and identification details in the designated fields.

-

4.Specify the loan amount clearly in the appropriate section.

-

5.Outline the interest rate applicable to the loan, if any, ensuring it complies with legal standards.

-

6.Set the repayment schedule, indicating the frequency of payments (e.g., weekly, biweekly, monthly).

-

7.Clearly define the total number of payments to be made by the employee.

-

8.Include any conditions for default, outlining the consequences of late or missed payments.

-

9.Ensure all parties are aware of any specific terms, such as penalties for early repayment or forgiveness clauses.

-

10.Finally, provide spaces for both the employer and employee signatures along with the date of signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.