Equipment Finance Agreement Template free printable template

Show details

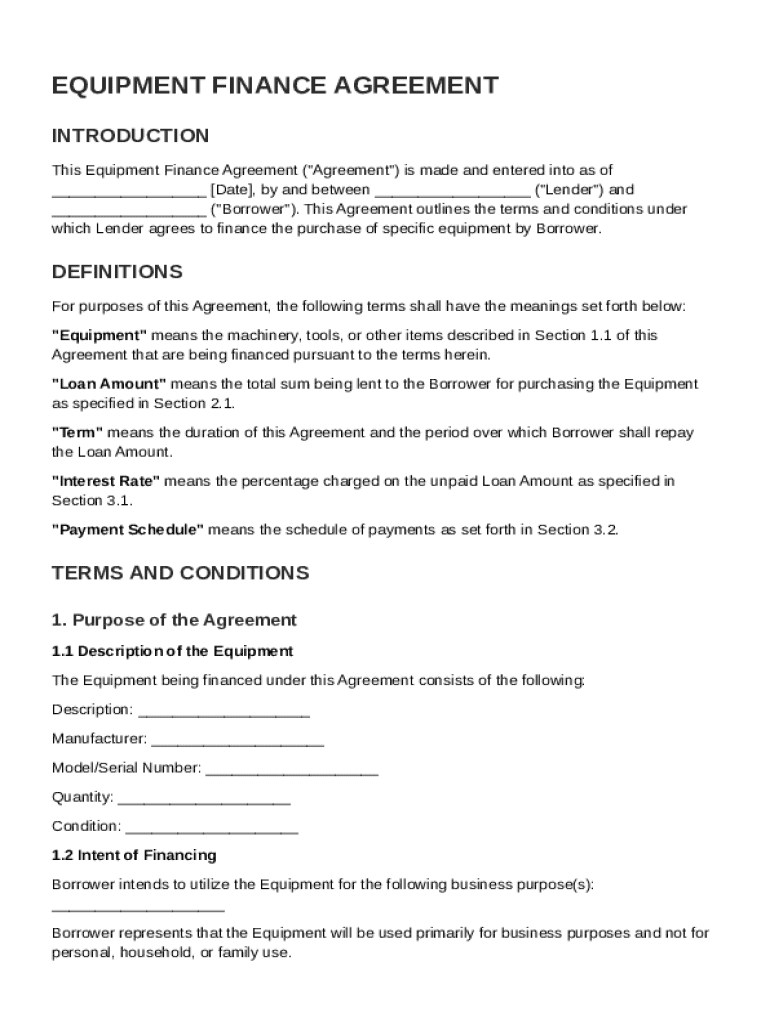

This Agreement outlines the terms and conditions under which a lender agrees to finance the purchase of specific equipment by a borrower, including the definitions, payment terms, collateral security,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Equipment Finance Agreement Template

An Equipment Finance Agreement Template is a customizable document used to outline the terms and conditions under which equipment is financed, including payment schedules and ownership details.

pdfFiller scores top ratings on review platforms

AWESOME service!

Seriously, fantastic customer service and very user friendly! Well done PDFfiller!

Phenomenal Software!

Phenomenal Software!! Met all of my needs

It was helpful

It was helpful, but you need to create an option to edit the text without it being obvious that something was erased

PDF FIll IN GOOD EXPERIENCE

It was a excellent site I love it.

Very good web environment

Very good web environment. A lot of useful tools and options but yet, still simple. The on and only thing you could improve is the speed, loading times. Great Work, Great site good job to your team.

sometimes when i save my pdf everything…

sometimes when i save my pdf everything is out of alignment. even though in the preview everything is in place. when i save it seems some lines and words are shifted

Who needs Equipment Finance Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the Equipment Finance Agreement Template form

TL;DR: How to fill out an Equipment Finance Agreement Template form

Filling out an Equipment Finance Agreement Template form requires providing essential details about the equipment, the lender, and the borrower. It is important to accurately state the loan amount, repayment terms, and intended use of the equipment, ensuring compliance with all relevant regulations.

What is an Equipment Finance Agreement?

An Equipment Finance Agreement (EFA) is a legally binding contract between a lender and a borrower that outlines the terms under which equipment is financed. This agreement helps businesses acquire necessary tools and machinery without having to pay the full purchase amount upfront.

-

This document details the terms of financing for equipment purchases, including payment schedules and responsibilities.

-

The lender provides the financing while the borrower uses the equipment for business purposes, agreeing to repay the loan.

-

The main intent is to enable businesses to finance equipment purchases, improving operational efficiency.

What are the essential components of the Equipment Finance Agreement?

An effective Equipment Finance Agreement includes several crucial components that ensure clarity and compliance. Understanding these components is vital for both the lender and borrower.

-

Common terms include Equipment, Loan Amount, Term, Interest Rate, and Payment Schedule, each defined within the agreement.

-

The Loan Amount is generally based on the equipment's purchase price and any associated fees.

-

The Term refers to the duration of the loan and affects repayment schedules and interest calculations.

How to detail the equipment description in the agreement?

Providing a detailed description of the equipment is essential to avoid misinterpretation and legal issues. This ensures that both parties are aware of exactly what is being financed.

-

Commonly financed items include machinery, tools, and vehicles essential for business operations.

-

Records should include Manufacturer, Model, Serial Number, Quantity, and Condition for clarity.

-

Accurate descriptions minimize disputes and ensure compliance with financing terms.

What is the intent behind financing: business vs. personal use?

The borrower must declare whether the equipment will be used for business or personal matters, which significantly impacts the agreement's terms.

-

The borrower must transparently declare their primary use for the equipment to align with the financing agreement.

-

Misuse of the equipment could breach the contract, leading to penalties or loan recall.

-

It's essential to comply to avoid legal repercussions and ensure adherence to the financing terms.

How is the loan amount structured and proceeds utilized?

The structuring of the loan amount involves how it will be disbursed and any restrictions on its usage. This setup directly influences the financial management of the loan.

-

Details regarding how and when the loan amount will be disbursed to the borrower.

-

Loan proceeds are often restricted to ensure they are used solely for the agreed-upon equipment purchases.

-

Clarifies how payments to vendors will be handled and any agreement terms regarding borrower fund usage.

What are the interest rate and payment terms?

Understanding interest rate computation and payment terms is critical for effective financial planning. These factors can significantly impact overall borrowing costs.

-

Interest rates are affected by factors such as creditworthiness and market conditions, and they should be clearly defined in the agreement.

-

A defined payment schedule helps borrowers manage their finances, ensuring timely payments and avoiding penalties.

-

Issues such as late payments can incur penalties, so understanding these terms is vital for compliance.

How to choose the right template for your agreement?

Using a suitable Equipment Finance Agreement Template can streamline document creation and help ensure compliance. pdfFiller offers a variety of customizable templates.

-

Templates provide a framework that simplifies the process of creating customized agreements.

-

Different templates may offer specialized features for various industries, improving functionality.

-

pdfFiller's tools allow users to easily edit, sign, and manage their equipment finance agreements online.

What compliance considerations apply to Equipment Finance Agreements?

Compliance with legal standards is crucial when drafting Equipment Finance Agreements to avoid potential disputes. Knowledge of regional regulations can aid in meeting these requirements.

-

Compliance with local and federal regulations might differ and should be a priority when creating the agreement.

-

Adhering to established industry standards can ensure fairness and transparency in the agreement.

-

Awareness of frequent mistakes can help lenders and borrowers draft effective agreements.

How to fill out the Equipment Finance Agreement Template

-

1.Access pdfFiller and upload the Equipment Finance Agreement Template.

-

2.Begin by entering the names and contact details of both parties involved in the agreement: the lender and the borrower.

-

3.Fill in the description of the equipment being financed, including make, model, and serial numbers.

-

4.Specify the total cost of the equipment and the financing amount.

-

5.Include the interest rate applicable to the financing as well as any additional fees.

-

6.Define the payment schedule, including the frequency of payments and the duration of the loan agreement.

-

7.Outline any collateral requirements and terms of ownership transfer at the end of the financing period.

-

8.Review the terms to ensure accuracy and compliance with legal standards.

-

9.Once completed, save the document and share it with the involved parties for signatures or further processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.