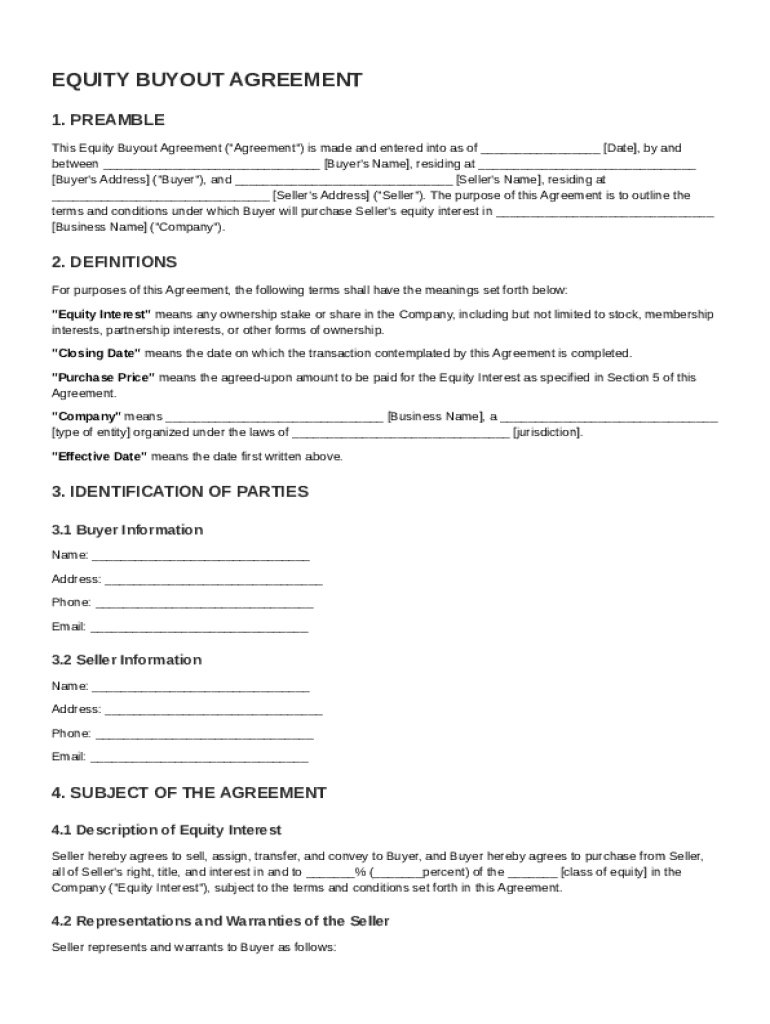

Equity Buyout Agreement Template free printable template

Show details

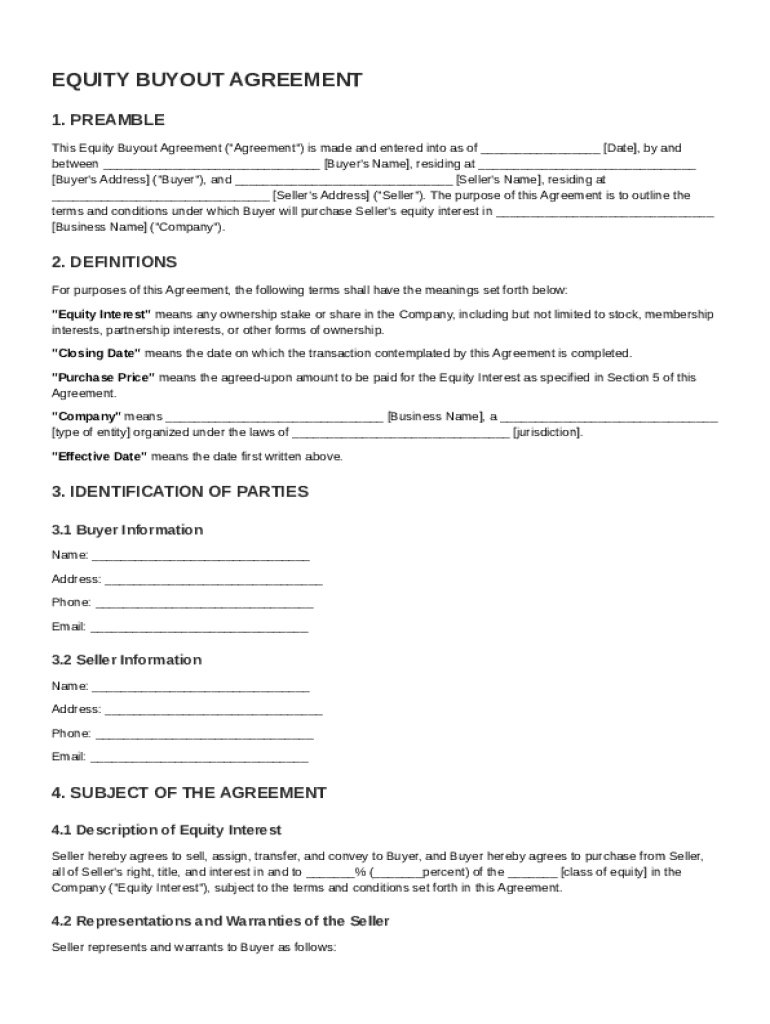

This document outlines the terms and conditions for the purchase of a seller\'s equity interest in a company by a buyer.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Equity Buyout Agreement Template

An Equity Buyout Agreement Template is a legal document that outlines the terms and conditions for the purchase of an equity interest in a business.

pdfFiller scores top ratings on review platforms

good service

good service

VERY GOOD TO USED

VERY GOOD TO USED

Simplicity

Easy to use.

Good

no

CHill

Who needs Equity Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Guide to Equity Buyout Agreements

TL;DR: To fill out an Equity Buyout Agreement Form, gather necessary details about the buyer, seller, and the equity interest. Ensure clarity in terms, including the purchase price and obligations.

What is an equity buyout agreement?

An Equity Buyout Agreement is a legal document outlining the terms under which one party agrees to purchase an ownership interest in a business from another party. These agreements are crucial in ensuring smooth transitions in business ownership and can help prevent misunderstandings. They detail essential components such as the purchase price, payment structures, and obligations for both parties involved.

-

This refers to the precise language that describes the agreement and its purpose.

-

Important elements include the purchase price, payment terms, and representations made by the seller.

-

Clarity in terms reduces disputes and provides both parties with a clear understanding of expectations.

How is the structure of the agreement organized?

The structure of an Equity Buyout Agreement is essential for setting the framework of the transaction. It often begins with a preamble, providing context and purpose, followed by sections that define terms critical to understanding the agreement.

-

This section explains the intent and background of the buyout.

-

Clarifies specific terms used throughout the agreement to avoid ambiguity.

-

Includes crucial details of the buyer and seller, such as legal names and contact information.

What are the steps for filling out the agreement?

Filling out the Equity Buyout Agreement should be approached methodically to ensure all necessary information is covered. This process typically includes several key sections, each requiring detailed information.

-

Clearly state the date of the agreement and the full legal names of the parties involved.

-

Specify the percentage of equity being transferred and any specific rights that accompany it.

-

Set a final date for the transaction and clearly outline the total purchase price.

-

Incorporate detailed backgrounds for both parties, including addresses and basic business information.

What financial considerations should be included in an equity buyout?

Financial considerations play a pivotal role in shaping the terms of an Equity Buyout Agreement. Establishing a fair purchase price is essential, and various payment structures can significantly influence the transaction's success.

-

Create guidelines for evaluating business value and determining the purchase price.

-

Common structures include lump-sum payments, installment plans, or equity in exchange.

-

Outline any ongoing responsibilities that the buyer or seller might have regarding financial matters.

What are the seller's representations and warranties?

Seller's representations and warranties are declarations made by the seller regarding the validity and condition of the business being sold. Understanding these obligations can help both parties navigate obligations and potential liabilities post-agreement.

-

Sellers must guarantee the accuracy of representations about the business and its financial health.

-

Potential liabilities may arise from inaccurate claims about business assets or debts.

-

If any warranties are breached, it can lead to significant legal and financial repercussions for the seller.

What compliance and legal considerations apply?

Compliance with local laws is crucial for any Equity Buyout Agreement. Each party should understand what regulations affect buyout agreements in their jurisdiction.

-

Research local regulations that may impact the buyout process.

-

Ensure the agreement conforms to all applicable laws to avoid future disputes.

-

Include mechanisms for conflict resolution to handle legal challenges efficiently.

How to finalize and execute the agreement?

Finalizing an Equity Buyout Agreement requires careful negotiation and proper execution of the document. Using efficient document management tools can streamline this process significantly.

-

Engage in open dialogue to ensure both parties feel satisfied with the terms.

-

Make sure all signatures are obtained and witnessed where required.

-

Utilize pdfFiller's comprehensive document tools for easy editing, eSigning, and document storage.

What to consider post-agreement?

After executing the Equity Buyout Agreement, both parties have responsibilities that may extend beyond the initial transaction. It’s vital to monitor compliance with the agreed terms.

-

Both parties should regularly check adherence to the contract's terms to prevent breaches.

-

Establish a plan for transitioning ownership and operations smoothly.

-

Be flexible and ready to adapt to shifts in circumstances surrounding the agreement.

How to fill out the Equity Buyout Agreement Template

-

1.Open the Equity Buyout Agreement Template in pdfFiller.

-

2.Fill in the section for the names and addresses of the buyer and seller at the top of the document.

-

3.Specify the equity percentage being sold and the total purchase price in the designated lines.

-

4.Detail the payment terms, including any deposit amount and deadlines for remaining payments, in the payment terms section.

-

5.Include any conditions precedent that must be met before the transaction is finalized.

-

6.Review the clauses related to representations and warranties to ensure they accurately reflect the agreement.

-

7.Add any additional terms needed specific to your agreement, ensuring they comply with applicable laws.

-

8.Finally, check for completeness and accuracy before saving or printing the filled-out agreement.

How to structure a buyout agreement?

A well-crafted buyout agreement should contain the following: A recent valuation of business assets and interests. A comprehensive list of business partners or owners and their contact information. Non-compete clauses and confidentiality agreements. Dispute resolution mechanisms. Payment terms and funding instruments.

How to write an equity agreement?

An equity compensation agreement typically includes the following key components: Grant of equity. The agreement will state the type of equity (such as stock options, RSUs, or SARs) and the number of shares/options being granted. Exercise price. Vesting schedule. Exercise expiration. Tax implications. Governing law.

What is an equity purchase agreement?

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.

What is a buy-out agreement?

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.