Equity Investor Agreement Template free printable template

Show details

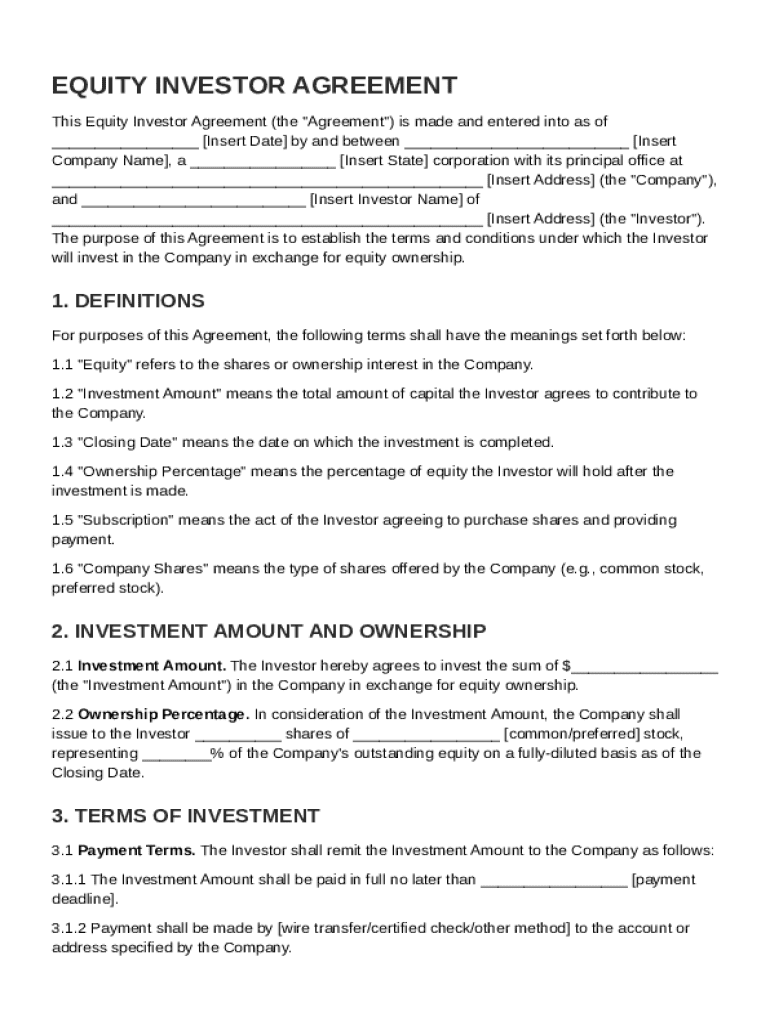

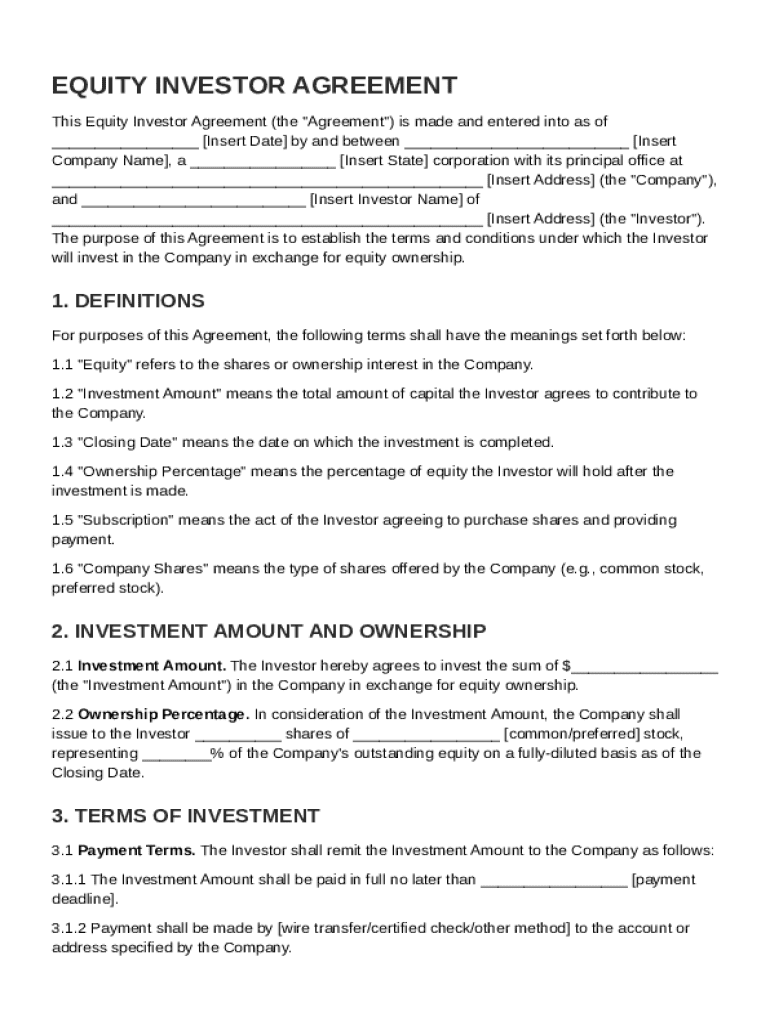

This document outlines the terms and conditions under which an investor will invest in a company in exchange for equity ownership.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Equity Investor Agreement Template

An Equity Investor Agreement Template is a legal document outlining the terms and conditions between a business and an investor regarding equity investment.

pdfFiller scores top ratings on review platforms

Fast and easy to get what was needed.

great

Very excellent

Great & Easy to use!

8 am tomorrow

Very good. Thank you.

Who needs Equity Investor Agreement Template?

Explore how professionals across industries use pdfFiller.

Equity Investor Agreement Template on pdfFiller

How can you understand the Equity Investor Agreement?

An Equity Investor Agreement is a formal arrangement between a company and its investors outlining investment terms, rights, and responsibilities. Understanding this agreement is pivotal for securing funds while establishing clear expectations. This ensures that both parties are aligned in their objectives and mitigates potential disputes.

-

Definition of an Equity Investor Agreement: This agreement defines the relationship between the investor and the company.

-

Importance of having a formal agreement: A well-crafted agreement serves as a legal reference, ensuring all parties are protected.

-

Key elements included in the agreement: Common elements include investment amount, ownership percentage, and profit-sharing methods.

What is the purpose of the Equity Investor Agreement?

The primary purpose of the agreement is to clarify the relationship dynamics between the investor and the company. This clarifies expectations regarding the investment and outlines the responsibilities and rights of both parties involved.

-

Clarification of the relationship between the Investor and Company.

-

Outlining the investment terms and conditions helps businesses articulate the rules governing the investment.

-

Benefits of a clear agreement for both parties include avoiding misunderstandings and ensuring all parties are aware of their obligations.

How to define Investment Amount & Ownership Percentage?

Outlining the investment amount and ownership percentage is crucial in any Equity Investor Agreement. This segment ensures clarity in what investors will receive in return for their capital investment.

-

Defining Investment Amount and Ownership Percentage: Stakeholders must agree on how much capital is being invested and what percentage of the ownership this capital translates into.

-

How to calculate Ownership Percentage post-investment is based on dividing the investment amount by the total valuation of the company.

-

Sample calculations for illustration can simplify complex exchange rates, making agreements easier to understand.

What are the detailed payment terms?

Payment terms in an Equity Investor Agreement detail how the investment must be executed. Clearly defining these processes enhances understanding and avoids conflicts.

-

Method of investment payment can vary, including wire transfer, certified check, etc.

-

Payment deadlines and their importance cannot be overstated, as they establish the timeline for the investment.

-

Consequences of late payments may lead to penalties or loss of rights as stipulated in the agreement.

What are key definitions in the agreement?

Understanding technical terms is vital when filling out any Equity Investor Agreement Template. This section provides clarity and ensures all parties comprehend their rights and responsibilities.

-

Clarification of terms like 'Equity', 'Investment Amount', 'Subscription', and 'Company Shares' is necessary for all parties.

-

Importance of understanding these definitions while filling the template oversees the effectiveness of communication.

-

Interactive tools on pdfFiller provide glossary support, making it easier to grasp complex terminology.

Who retains management in the investor agreement?

Management and control provisions in the agreement dictate who keeps management rights. These rights can significantly influence the company's future direction and success.

-

Who retains management rights post-investment can impact operational decisions.

-

Investor's rights regarding company decisions can often include approvals on major corporate actions.

-

How to write management clauses in the agreement ensures all parties understand their degree of influence.

How is profit sharing detailed in the agreement?

Distribution and profit-sharing agreements help dictate how profits are allocated among shareholders. This is crucial to ensure everyone understands their expectations.

-

How profits are distributed among shareholders is a central theme of any investor agreement.

-

Factors influencing distribution rights include the level of investment or ownership percentage.

-

Sample distribution plans provide clarity and help avoid conflicts in future profits.

What are the termination conditions in the agreement?

Termination clauses define the conditions under which the agreement can be voided. Understanding these is necessary for both parties to navigate dissolution scenarios effectively.

-

Conditions under which the agreement may be terminated should be clear and well-defined.

-

Effects of termination on investment and ownership vary and should be transparently communicated.

-

Publishing termination clauses clearly for better understanding aids in avoiding future disputes.

How can you edit and customize the template?

With pdfFiller’s tools, users can easily edit and tailor the Equity Investor Agreement Template. Customizing the agreement ensures that it aligns with individual needs and situations.

-

How to use pdfFiller tools to edit the agreement involves intuitive features that simplify modifications.

-

Adding specific terms unique to your situation enhances the agreement's relevance.

-

Saving versions and tracking changes on pdfFiller enables easy management of edits.

What are the legal aspects of signing the agreement?

Signing the agreement involves legal requirements that must be adhered to for validation. Understanding these requirements enables individuals to avoid common pitfalls.

-

Legal requirements for signing the agreement vary by region and should be researched.

-

How eSigning works on pdfFiller streamlines the signing process, making it efficient.

-

How to manage signatures for multiple parties ensures that no signature is overlooked.

What collaborative features does pdfFiller offer?

The interactive and collaborative features on pdfFiller provide stakeholders with tools to enhance agreement clarity. Understanding how to leverage these tools can facilitate smoother negotiations.

-

Overview of collaborative tools for editing with stakeholders promotes transparency.

-

Version control features on pdfFiller allow users to keep track of all changes made.

-

Using comments and feedback tools enhances the clarity of the agreement, providing insights from various perspectives.

Why are compliance considerations crucial?

Every Equity Investor Agreement must address compliance considerations to remain valid. Understanding local laws and standards ensures that the agreement can hold up in legal scenarios.

-

Understanding local laws related to equity investments is essential for all parties.

-

Compliance notes specific to the industry and region must be integrated into each agreement.

-

How to ensure agreements meet regulatory standards is pivotal in maintaining legality.

How to fill out the Equity Investor Agreement Template

-

1.Start by downloading the Equity Investor Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller, and review the document to understand the sections included.

-

3.Begin with the 'Parties' section and fill in the names and details of both the business (issuer) and the investor.

-

4.Proceed to the 'Investment Details' section where you will input the amount of investment, type of equity, and any other financial terms.

-

5.In the 'Terms and Conditions' section, specify the rights of the investor, including voting rights and profit-sharing arrangements.

-

6.Move on to 'Representations and Warranties', where both parties must affirm their ability to enter this agreement.

-

7.Finalize by reviewing the 'Signatures' section, ensuring that both parties date and sign the document as required.

-

8.Save the completed document securely and share it with all relevant parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.