Equity Purchase Agreement Template free printable template

Show details

This document outlines the terms and conditions under which one party (the Buyer) agrees to purchase equity from another party (the Seller). It includes definitions, purchase details, representations

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Equity Purchase Agreement Template

An Equity Purchase Agreement Template is a legal document used to outline the terms of purchasing equity in a company.

pdfFiller scores top ratings on review platforms

Easy to use. Wish the auto fill from the 1120s worked for 2018

i like it i would recommend this to someone else..

I've had some problems with the application but overall it meets my business needs.

Easy to use and very useful in today's business world

This is a great tool (and I design systems similar to this). However, I'm just not sure I will use it enough in order to justify the annual price.

I have just started using this program but so far I am happy with it. It is great for completing documents that have been scanned in.

Who needs Equity Purchase Agreement Template?

Explore how professionals across industries use pdfFiller.

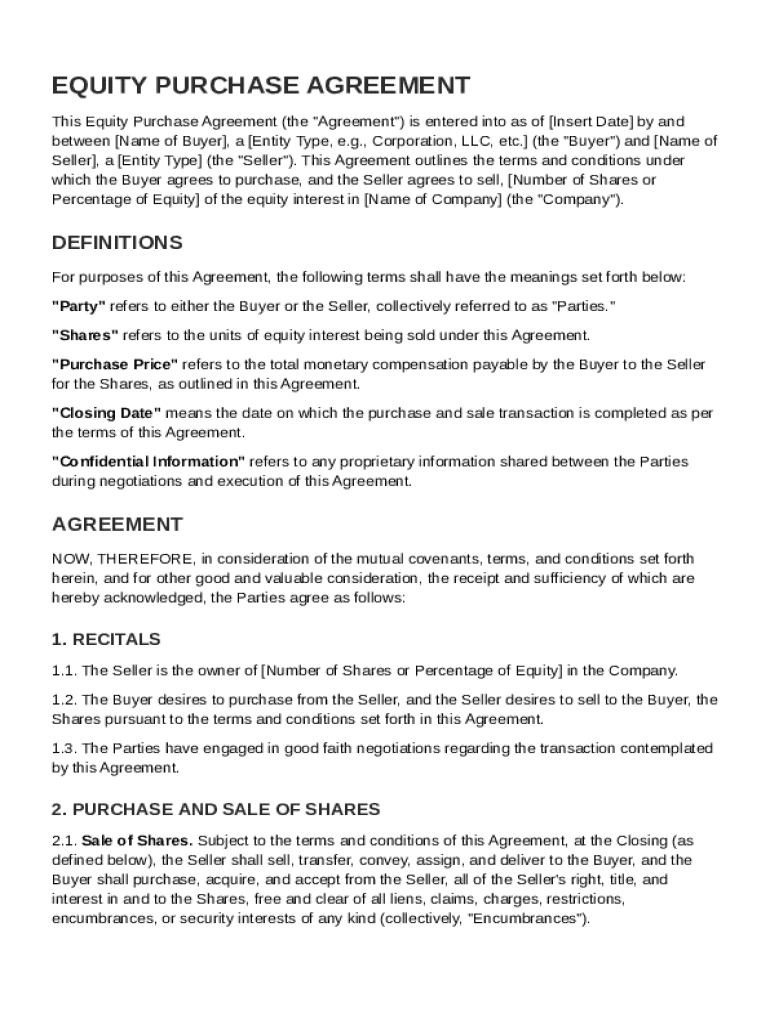

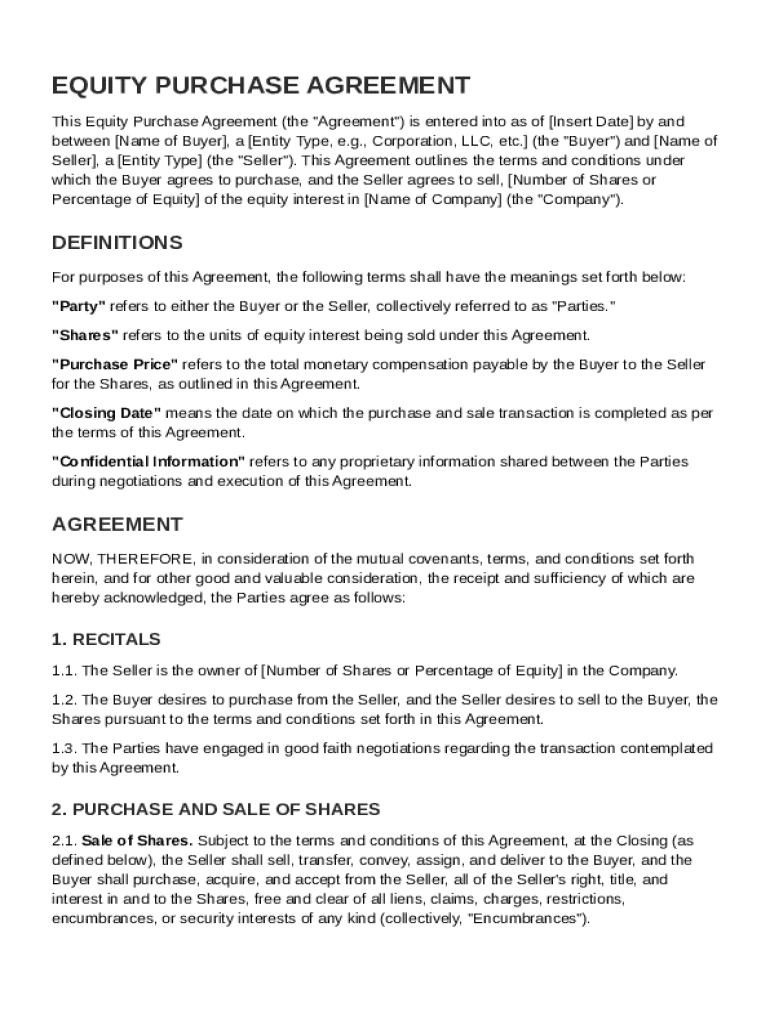

Equity Purchase Agreement: A Comprehensive Guide

Creating an Equity Purchase Agreement requires careful attention to detail and understanding of legal terminology. This guide will walk you through the process, ensuring that both the buyer and seller are adequately protected. By following this template, you can craft a comprehensive agreement that meets all parties' needs.

An Equity Purchase Agreement is essential for those involved in buying or selling equity in a corporation. It outlines the terms and conditions of the sale, ensuring clarity and mutual understanding.

What is an Equity Purchase Agreement?

An Equity Purchase Agreement serves to formalize the sale of shares between a buyer and a seller. It specifies the terms under which the transaction will take place, including the types of shares involved and their pricing.

-

An Equity Purchase Agreement details the rights and obligations of both parties involved in the transaction.

-

Important elements include the parties to the agreement, share details, purchase price, and conditions of transfer.

-

A well-structured agreement minimizes disputes and protects the interests of both the buyer and seller.

How to create an Equity Purchase Agreement?

Crafting an Equity Purchase Agreement may seem daunting, but it can be broken down into simple steps that anyone can follow.

-

Begin by specifying the date the agreement takes effect, which is crucial for the timeline of the transaction.

-

Clearly identify the buyer and seller by including their legal names and addresses.

-

Provide the exact number of shares being purchased or the percentage of equity involved.

-

Clearly define the purchase price to ensure both parties are aware of the compensation expected.

What are the key terms in an Equity Purchase Agreement?

Understanding the terminology used in an Equity Purchase Agreement is vital for ensuring that both parties are on the same page.

-

Refers to the buyer or seller involved in the transaction.

-

The equity ownership being exchanged through the transaction.

-

The agreed amount for which the shares will be sold.

-

The date on which the transaction is finalized.

-

Details regarding proprietary information that must remain undisclosed.

How to engage in the sale of shares effectively?

Entering into negotiations for the sale of shares requires careful planning and consideration.

-

Begin by clearly outlining the terms and conditions that will govern the sale.

-

Conduct all negotiations honestly and with the aim of reaching a fair agreement.

-

Consider using pdfFiller for electronic signatures and document management to streamline the process.

Leveraging pdfFiller's Document Management Solutions

pdfFiller offers several tools to aid in the creation and management of legal documents.

-

Users can easily edit PDF files within the pdfFiller platform, ensuring accuracy in documents.

-

Share documents with relevant parties and collaborate in real-time for enhanced efficiency.

-

Utilize pdfFiller’s features to best manage your equity purchase agreements and other financial documents.

What compliance and legal issues should you consider?

Understanding regional compliance requirements is fundamental to the legality of your Equity Purchase Agreement.

-

Thoroughly review local laws on securities to ensure that all requirements are met.

-

Certain industries have specific regulations; be aware of these if applicable.

-

Seek expert advice when uncertain about the terms or implications of your agreement.

How to fill out the Equity Purchase Agreement Template

-

1.Open the Equity Purchase Agreement Template in pdfFiller.

-

2.Review the document to understand each section, including parties involved, purchase price, and equity details.

-

3.Begin by entering the names and contact information of the buyer and seller in the designated fields.

-

4.Specify the type and amount of equity being purchased in the appropriate section.

-

5.Fill in the purchase price, warranty clauses, and any conditions of the sale as applicable.

-

6.Complete any additional clauses that pertain to the specific transaction, such as conditions precedent or representations.

-

7.Review the entire agreement for accuracy and ensure that all necessary terms and conditions are included.

-

8.Once completed, save the document and either print it for signatures or send it electronically for approval.

What is an equity purchase agreement?

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.

How to write an equity agreement?

An equity compensation agreement typically includes the following key components: Grant of equity. The agreement will state the type of equity (such as stock options, RSUs, or SARs) and the number of shares/options being granted. Exercise price. Vesting schedule. Exercise expiration. Tax implications. Governing law.

What is the difference between a STA and a spa?

While an SPA includes comprehensive representations, warranties, covenants and indemnification provisions, an STA contains fewer clauses and may be suitable for simpler transactions.

What is the difference between APA and spa?

The biggest difference is that an SPA is the sale of all shares, and an APA is the sale of selected assets. Therefore, they are both different transactions and have different procedures. 2. With a SPA, all shareholders in the company must be consulted and agree to sell their shares in the company.

How to write up an equity agreement?

When you draft an employment contract that includes equity incentives, you need to ensure you do the following: Define the equity package. Outline the type of equity, and the number of the shares or options (if relevant). Set out the vesting conditions. Clarify rights, responsibilities, and buyout clauses.

What is the difference between a STA and a spa?

While an SPA includes comprehensive representations, warranties, covenants and indemnification provisions, an STA contains fewer clauses and may be suitable for simpler transactions.

How to make a share purchase agreement?

Share Purchase Agreements typically include: Seller and purchaser details, including names and addresses. Share details, including number and class. Payment details, including purchase price. Closing date. Additional clauses, if necessary.

What is the basic stock transfer agreement?

The Share Transfer Agreement is a standard document required for transferring shares in a company from one party to another. The agreement outlines the particulars of the transferor to the transferee. The document should also include the number of shares to be transferred and the cost or value of each share etc.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.