Last updated on Feb 17, 2026

Equity Vesting Agreement Template free printable template

Show details

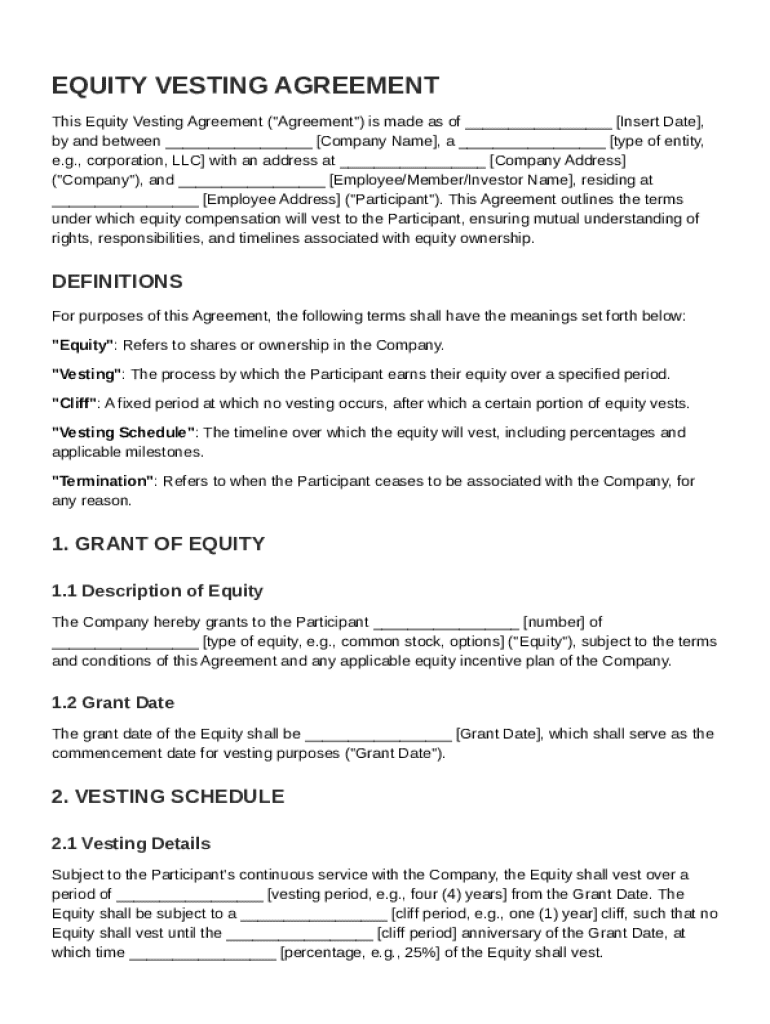

This document outlines the terms under which equity compensation will vest to the Participant, ensuring mutual understanding of rights, responsibilities, and timelines associated with equity ownership.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Equity Vesting Agreement Template

An Equity Vesting Agreement Template is a legal document that outlines the terms under which equity is awarded to employees or contractors over a specified period.

pdfFiller scores top ratings on review platforms

Nice app

Love this app

I had an excellent experience with this service. The product itself was very useful and allowed me to save and send my forms in a variety of formats, as well as esign, add text, dates, Xs, etc. I had an issue this morning with my account due to an error on my end, and was able to use the chat feature, which provided nearly instant support. They fixed the issue and sent me a confirmation email within seconds.

I am really satisfied over the support I have experienced - outstanding!

Best customer service, very quick to respond. Professional and understanding.

Slow upload.then issues with conversion. Don't thinks it the program.

I am still trying to navigate the software

Who needs Equity Vesting Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Equity Vesting Agreement Template on pdfFiller

When creating an Equity Vesting Agreement Template, a company ensures clarity in ownership rights and compensation structures. This guide will help users understand what an equity vesting agreement is and how to utilize pdfFiller to create a customizable and legally compliant document.

What are Equity Vesting Agreements?

Equity vesting agreements are legal contracts that outline how and when equity, such as stocks or shares, is granted to employees or partners. These agreements are crucial in setting the expectations and responsibilities tied to equity ownership, enabling businesses to align employee interests with corporate goals.

-

A legal document specifying the terms under which equity is granted to an individual, detailing the conditions for ownership.

-

To incentivize employees to stay with the company longer, fostering commitment and performance.

-

Avoids misunderstandings and disputes over equity distribution, providing clear guidelines on rights and obligations.

What key terms should be defined in Equity Vesting Agreements?

Understanding specific terms within an equity vesting agreement is essential for all parties involved. Start by familiarizing yourself with the common vocabulary used in these agreements.

-

Refers to shares or ownership interest in a company, which can appreciate in value over time.

-

The process through which employees earn their equity ownership over time, rather than receiving it all at once.

-

An initial period, often one year, during which no equity vests, typically creating a waiting period.

-

The timeline that dictates when and how much equity vests, usually laid out as a percentage that accrues over time.

-

References the end of the employment relationship, which can affect vested and unvested equity.

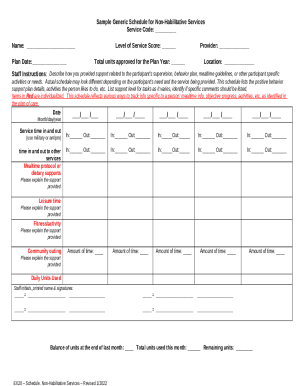

What are the components of an Equity Vesting Agreement?

An effective equity vesting agreement should include several critical components to ensure that all parties have a clear understanding of the terms. Learning to identify these elements is key to successful agreement drafting.

-

Information about the issuer and recipient, providing context for the agreement.

-

Details regarding the types and amounts of equity being awarded.

-

The official date when the equity starts to vest, essential for tracking the agreement timeline.

-

A clear outline of the vesting timeline and percentages that dictate how equity is earned over time.

-

An explanation of the duration during which no equity will vest, crucial for understanding entitlement.

How can you create your Equity Vesting Agreement on pdfFiller?

pdfFiller offers a user-friendly platform for creating and customizing your Equity Vesting Agreement. By following a few simple steps, you can ensure your document meets all legal requirements and reflects your company's needs.

-

Start by locating the Equity Vesting Agreement template directly on the pdfFiller website.

-

Fill in the necessary details about the company and the recipient of the equity.

-

Specify the equity amounts and establish any relevant terms to govern the agreement.

-

Tailor the vesting schedule to fit the company's needs, including the length and specific percentage details.

-

Once completed, make sure to review your document carefully and utilize pdfFiller’s eSignature features for secure signing.

Why are Equity Vesting Agreements important?

Equity vesting agreements are fundamental to modern compensation structures, as they establish legal frameworks that ensure fairness and accountability. When properly utilized, these agreements can contribute to a more stable and committed workforce.

-

Customizable agreements allow businesses to adapt vesting schedules that suit their operational goals.

-

Clearly defined equity terms incentivize employees to remain with the company longer.

-

By having a formal agreement, potential disputes regarding ownership can be minimized.

-

Employees become more invested in the company's success when they have a personal stake in its growth.

What should you consider when navigating legal aspects?

Legal considerations are critical to ensure that your equity vesting agreement complies with local laws. Being informed about these laws can prevent legal complications that might arise later.

-

Review applicable state and national laws that govern equity compensation structures to ensure your agreement is enforceable.

-

Recognize the tax responsibilities that both the company and employees may incur, which can impact their financial outcomes.

-

Ambiguities in agreements may lead to legal disputes. Always consult legal counsel for precise language.

What are acceleration clauses within Equity Vesting Agreements?

Acceleration clauses are essential provisions designed to expedite the vesting of equity under certain conditions, providing further protection and incentives for employees.

-

These clauses allow for faster vesting of equity if specific events occur, such as mergers or acquisitions.

-

Common triggers include changes in company control, layoffs, or termination without cause.

-

Employees may gain immediate access to their equity, which can significantly affect their financial planning.

What are the next steps after drafting your Equity Vesting Agreement?

After creating your Equity Vesting Agreement Template on pdfFiller, it is crucial to manage it effectively. Utilizing pdfFiller’s comprehensive document management tools can streamline workflow and ensure compliance.

-

Leverage pdfFiller’s features for organizing and securely storing your agreements as part of your business documents.

-

Make use of pdfFiller’s editing tools to easily adapt agreements as your business evolves.

-

Further educate yourself through pdfFiller's knowledge base and user-friendly tutorials.

In conclusion, using an Equity Vesting Agreement Template is a strategic move that provides clarity and legal assurance for all parties involved. Make use of the pdfFiller platform to create an effective and compliant document in a few easy steps.

How to fill out the Equity Vesting Agreement Template

-

1.Download the Equity Vesting Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller platform.

-

3.Fill in the company name and address in the designated fields.

-

4.Enter the details of the employee or contractor receiving the equity.

-

5.Specify the type of equity being granted (stock options, restricted stock, etc.).

-

6.Determine the vesting schedule, including the total amount of equity and the duration until full vesting is achieved.

-

7.Include any conditions that may affect vesting, such as performance milestones or terminations.

-

8.Review the agreement for accuracy, ensuring all terms are clearly stated.

-

9.Save the document and download it as a PDF.

-

10.Have both parties sign the agreement electronically to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.