Estate Planning Agreement Template free printable template

Show details

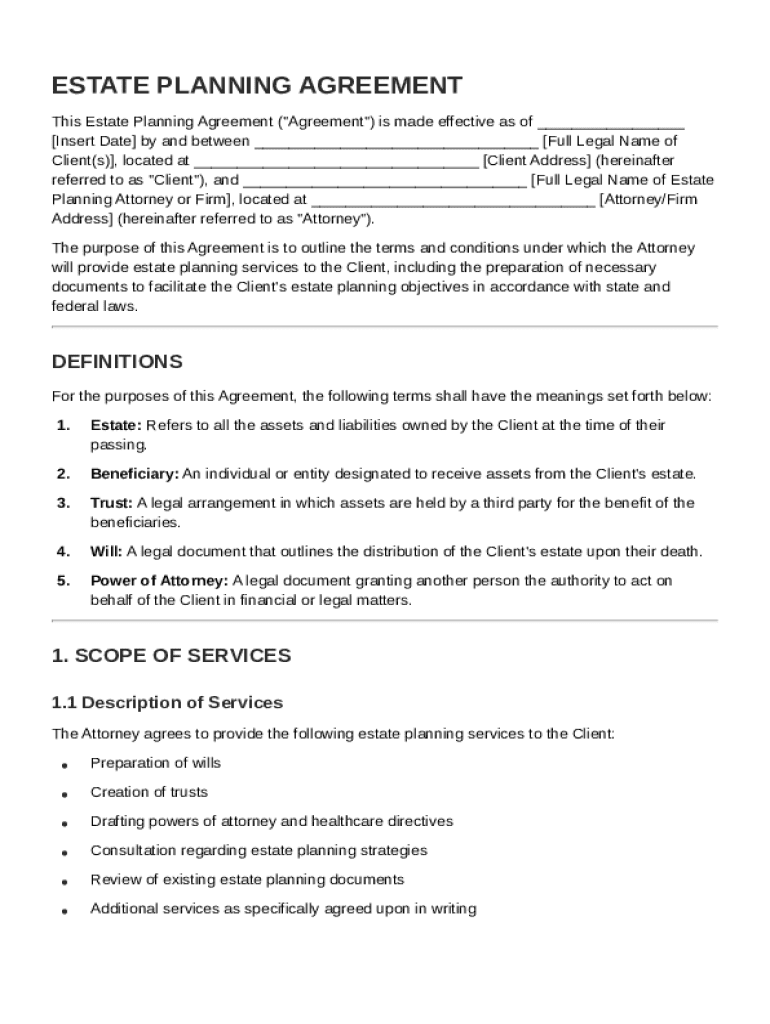

This document outlines the terms and conditions under which an attorney will provide estate planning services to a client, including necessary documents to facilitate the client\'s estate planning

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Estate Planning Agreement Template

An Estate Planning Agreement Template is a legal document that outlines the distribution of an individual's assets and management of their affairs after their death or incapacitation.

pdfFiller scores top ratings on review platforms

love it fast

If I had the option to put 100 stars, I would. This product is fantastic. There are small issues with reformatting, but I think the user can get over that.

very quick and learning process

Very helpful in finding documents related to importing to the US

Typing is easier to read than handwriting.

QUICK AND EASY TO USE

Who needs Estate Planning Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out an Estate Planning Agreement Template form on pdfFiller

Filling out an Estate Planning Agreement Template form can seem daunting, but it is crucial for ensuring your wishes are respected after your passing. This guide simplifies the process, guiding you through understanding, completing, and managing your Estate Planning Agreement effectively.

What is an estate planning agreement?

An Estate Planning Agreement is a legal document outlining how your assets will be distributed upon your death. Its primary purpose is to clarify your wishes and ensure that your beneficiaries are designated as per your intentions. Establishing a comprehensive estate planning strategy is vital for minimizing potential disputes and ensuring that your wishes are honored.

-

An Estate Planning Agreement serves to allocate your assets after death, specifying who receives what.

-

A thorough estate plan can prevent family disputes and ensure alignment with your wishes.

-

Estate planning is governed by various laws that vary by state, making local legal counsel essential.

What are the core components of an estate planning agreement?

A well-structured Estate Planning Agreement typically includes specific components that define its effects. These core components make the document comprehensive and legally sound, which is crucial for its validity.

-

Specifies when the agreement goes into effect. This is vital for clarity.

-

Identifies who is signing the agreement, which usually includes the client and their attorney.

-

Clarity is achieved by defining terms like estate, beneficiary, trust, will, and power of attorney.

What services do estate planning attorneys provide?

Estate planning attorneys offer a multitude of services to ensure your estate is managed according to your wishes. The services vary based on individual needs, providing tailored assistance in various aspects of estate planning.

-

Attorneys can assist you in drafting your will, which outlines how your assets will be distributed.

-

They can set up trusts, which provide benefits such as tax advantages and reduced probate time.

-

This legal document allows you to designate someone to make decisions on your behalf when you are unable.

-

Attorneys provide advice on estate planning strategies tailored to your personal situation.

-

They can audit your existing documents to ensure they align with your current wishes.

What limitations and considerations should you be aware of?

While estate planning attorneys provide valuable services, it's essential to understand their limitations. Consulting additional professionals like accountants or financial planners may be necessary to create a more robust planning strategy.

-

Clarifying the scope of services helps manage expectations regarding what your attorney can and cannot do.

-

Involving accountants and financial advisers can enhance your estate plan.

-

Laws vary widely by region; obtaining local legal advice is crucial for compliance.

How do fill out the estate planning agreement template?

Completing your Estate Planning Agreement Template can be straightforward if you follow a step-by-step process. Using pdfFiller’s user-friendly tools, you can easily navigate through the required fields.

-

Follow the structured approach provided in the template to ensure completeness.

-

Pay particular attention to key information that must be accurately filled out.

-

Utilize pdfFiller’s functionality to edit your document and eSign it for authentication.

How can manage my estate planning documents?

Once your Estate Planning Agreement is filled out and signed, managing it effectively is vital. Handling documents correctly ensures they are accessible, updateable, and secured.

-

Secure your agreements on pdfFiller to ensure they are safely stored in the cloud.

-

Collaboration tools allow you to share your plans with family members or advisors easily.

-

Regularly review and update your agreement as personal circumstances evolve.

How to fill out the Estate Planning Agreement Template

-

1.Access the Estate Planning Agreement Template on pdfFiller.

-

2.Click 'Fill' to start entering information.

-

3.Begin with personal information: your name, address, and contact details.

-

4.Enter family information, including spouse, children, and other beneficiaries.

-

5.Detail the assets you wish to include in the estate, such as property, bank accounts, and investments.

-

6.Specify how you want these assets distributed among beneficiaries.

-

7.Include any specific wishes regarding guardianship for dependents.

-

8.Review all entered information for accuracy and completeness.

-

9.Save your filled document and download it as a PDF or print directly from pdfFiller.

What are the six basic steps to the estate planning process?

The Estate Planning Process: 6 Steps to Take CREATE AN INVENTORY OF WHAT YOU OWN AND WHAT YOU OWE. DEVELOP A CONTINGENCY PLAN. PROVIDE FOR CHILDREN AND DEPENDENTS. PROTECT YOUR ASSETS. DOCUMENT YOUR WISHES. APPOINT FIDUCIARIES.

What does the estate planning include?

Estate planning may involve a will, trusts, beneficiary designations, powers of appointment, property ownership (for example, joint tenancy with rights of survivorship, tenancy in common, tenancy by the entirety), gifts, and powers of attorney (specifically a durable financial power of attorney and a durable medical

Who benefits most from estate planning?

Drawing up the appropriate documents now can provide important benefits, such as: Protecting your minor children. By designating a guardian, your family can avoid disagreements over who will step in if you're no longer able to care for them. Expressing wishes for your funeral.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.