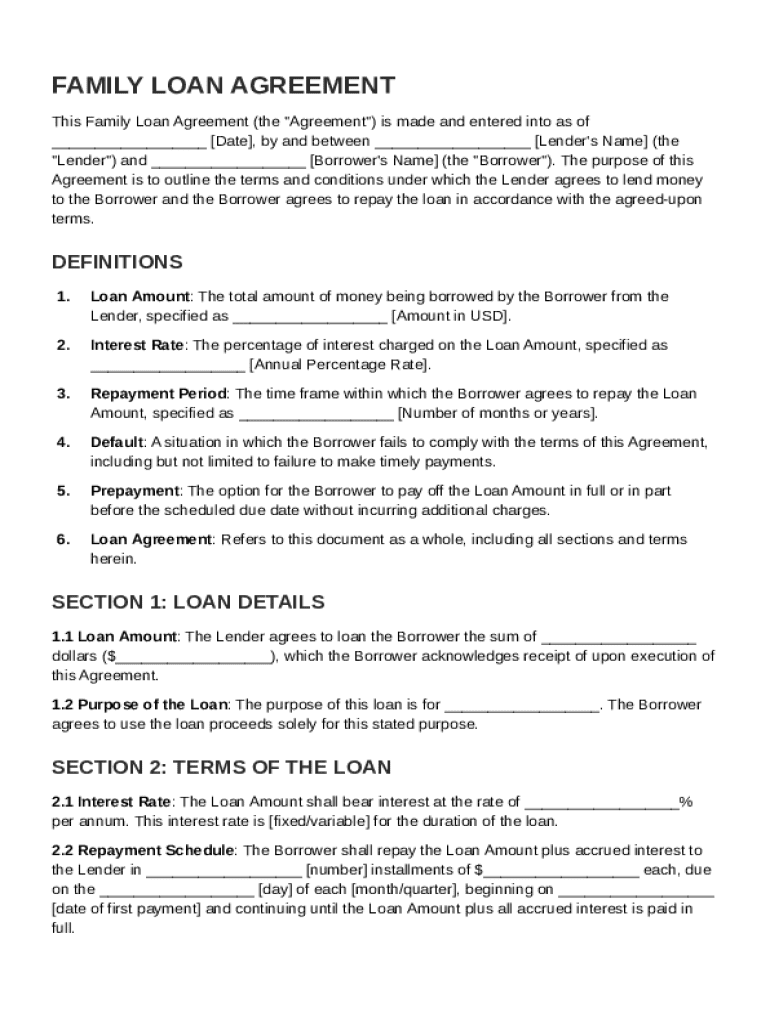

Family Loans Agreement Template free printable template

Show details

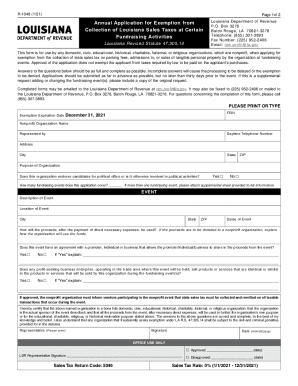

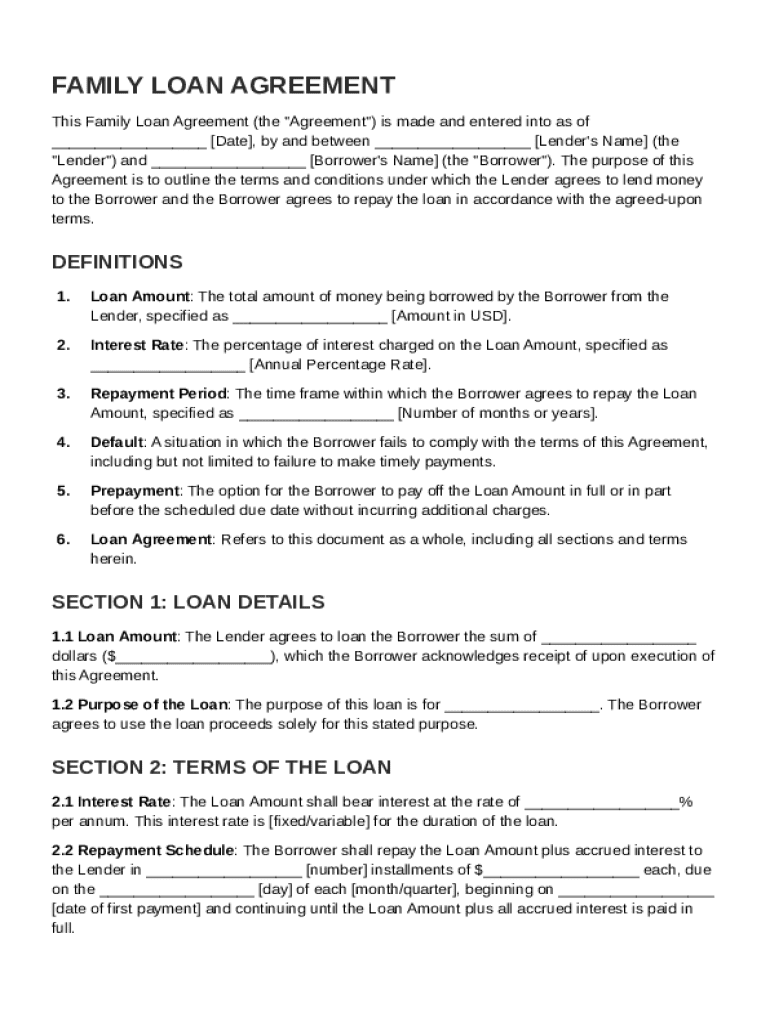

This document outlines the terms and conditions between a lender and a borrower concerning a family loan, including loan amount, interest rate, repayment terms, and provisions for default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Family Loans Agreement Template

A Family Loans Agreement Template is a legal document that outlines the terms and conditions of a loan between family members.

pdfFiller scores top ratings on review platforms

Need more filing opportunities.

Very Good

I haven't dived into all the…

I haven't dived into all the features....and takes a little bit to learn...but worth the effort!

This is really cool

This is really cool

Had a little trouble finding sites I…

Had a little trouble finding sites I needed but chat "Paul" helped me and everything ran smoothly after that.

I will use this app every time I need…

I will use this app every time I need to fill pdf's. I use a macbook and it works perfectly.

Who needs Family Loans Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Family Loans Agreement Guide

Creating a Family Loans Agreement Template form involves understanding the loan's nature and structure. This document formalizes the lending process among family members, ensuring clarity and minimizing potential disputes. It’s crucial to ensure that all parties are informed and agree to the terms set forth in the agreement.

What are family loans?

Family loans refer to financial arrangements where one family member lends money to another. These loans serve various purposes, from helping cover a large expense to assisting with a significant life event, such as buying a home or funding education.

-

Family loans are informal yet can be structured similarly to traditional loans. They allow for flexible repayment terms while providing financial help without the high-interest rates associated with commercial loans.

-

Benefits include lower interest rates and trust among family members. However, risks involve strained relationships if repayment issues arise or if expectations are not clearly defined.

-

Before proceeding, consider the borrower’s ability to repay, potential impact on relationships, and the need for a formal agreement to avoid misunderstandings.

What are the key components of a family loan agreement?

A well-structured family loan agreement should include specific components that detail the arrangement.

-

Clearly define all parties involved, the loan amount, and the purpose of the loan. Clear terminology helps avoid confusion later on.

-

Specify how much money is being lent, whether there’s an interest charge, and the timeline for repayment. This clarity provides both parties with a solid framework.

-

Outline the intended use of the loan funds. This can help manage expectations and ensure that the borrower uses the money as agreed upon.

How do you create a family loan agreement?

Creating a comprehensive family loan agreement involves several steps to ensure clarity and legality.

-

Before lending, evaluate the necessity of the loan and the borrower's financial situation to avoid future complications.

-

Utilize tools like pdfFiller to create a clear, editable document that includes all agreed-upon terms and conditions.

-

Ensure both parties sign the document, preferably using eSigning for added legitimacy and convenience.

-

Establish a repayment schedule that satisfies both parties and track payments to maintain healthy communication.

What common issues arise in family loans?

Understanding potential pitfalls in family loans can prepare you to handle disputes effectively.

-

If a borrower fails to repay, it can lead to financial strain and emotional conflict. Knowing the implications of default can help mitigate risks.

-

Discussing whether prepayment will incur penalties is essential to avoid misunderstandings in the future.

-

Establishing a clear channel for communication and a process for resolving disagreements can prevent long-term relational damage.

How do you finalize your family loan agreement?

Finalizing your family loan agreement ensures all terms are clearly defined and agreed upon.

-

Both parties should review the agreement to ensure that the terms are understood and considered equitable.

-

Take advantage of pdfFiller's features to maintain a digital record of the agreement for easy access and updates.

How to fill out the Family Loans Agreement Template

-

1.Start by downloading the Family Loans Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller’s editor to access the fillable fields.

-

3.Enter the names and addresses of both the lender and borrower at the designated fields.

-

4.Specify the loan amount clearly, stating the currency.

-

5.Outline the interest rate, if applicable, ensuring it complies with any local regulations.

-

6.Indicate the loan duration by specifying the repayment period.

-

7.Detail the repayment schedule, including due dates and installment amounts.

-

8.Include any collateral terms, if the loan is secured.

-

9.Read through all entered information for accuracy.

-

10.Once completed, save your document and consider printing it for signatures.

-

11.Both parties should sign and date the agreement.

-

12.Store the signed agreement in a safe place for future reference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.