Family Member Family Loan Agreement Template free printable template

Show details

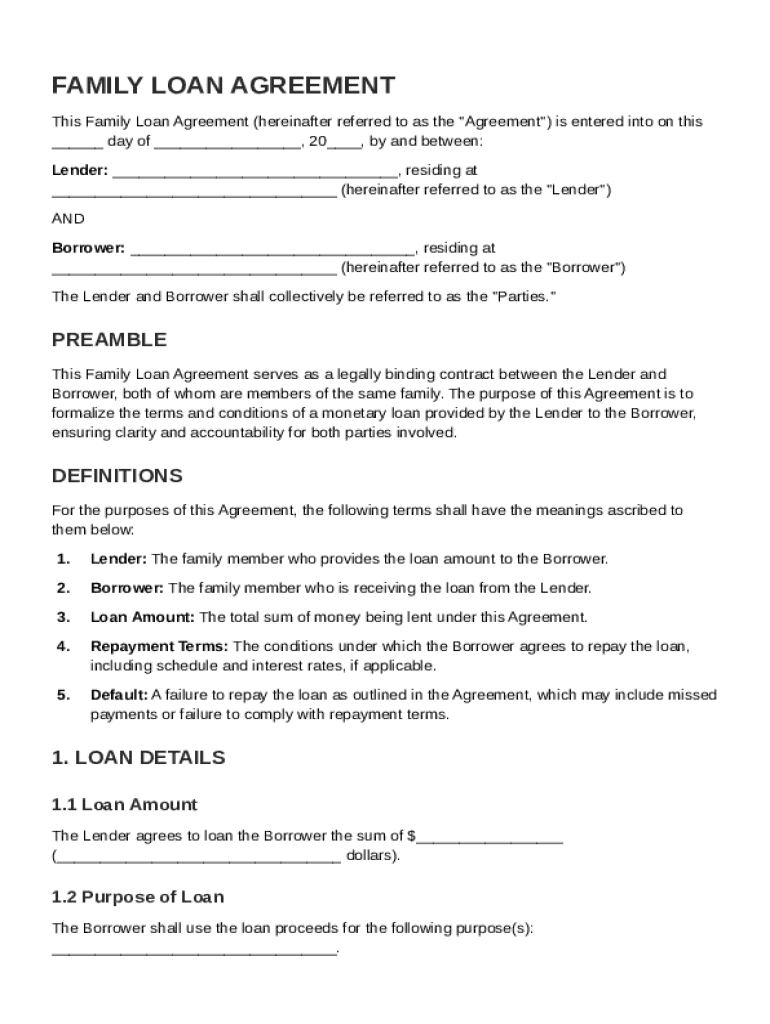

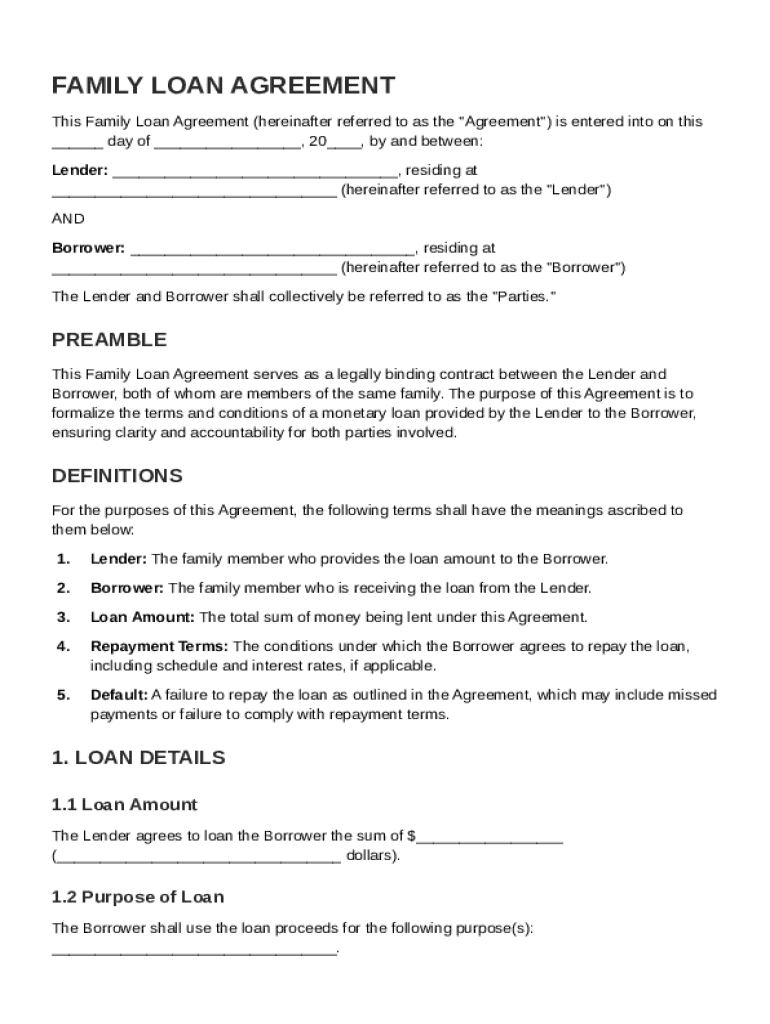

This document serves as a legally binding contract between family members outlining the terms and conditions of a monetary loan from a Lender to a Borrower.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Family Member Family Loan Agreement Template

A Family Member Family Loan Agreement Template is a legal document outlining the terms of a loan between family members, ensuring clarity and preventing disputes.

pdfFiller scores top ratings on review platforms

Misappropriation of Assets originated from Investment Loan Account in FRAUDULENT

This is to inform the Public readers, that the property of 20 Glen Dhu Road Kilsyth 3137 Victoria Australia, in illegal documents from conveyancing from August 2019 and the amount with Realestate.com.au in forgery and fraudulent. The House has two living areas and commercial/residential road (corner) and the value posted for one living areas only. The person who deal with State Trustees Victoria Australia is for 40 years imprisonment.

PDF combine

Worked well combining PDF's

GREAT SERVICE

GREAT SERVICE, PROFESSIONAL AND RESONABLY PRICED

Transport Premier Services

Great Experience so far ... keep it up!

First time user

First time user.

Just follow the line and enter and simple.

Works great!

Works great! But the placement of the text can be a bit glitchy. But it's a super handy tool

Who needs Family Member Family Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Family Member Family Loan Agreement Template on pdfFiller

TL;DR: To fill out a Family Member Family Loan Agreement Template, begin by assessing financial implications, utilize design tools provided by pdfFiller, and clearly specify terms such as loan amount and repayment conditions to protect both lender and borrower.

What is a family loan agreement?

A family loan agreement is a formal contract between family members regarding the lending and borrowing of money. This type of agreement is crucial for outlining clear terms, repayment schedules, and obligations between the lender and borrower. By formalizing the loan, families can help avoid misunderstandings and establish trust.

-

Family loan agreements serve as a legal framework, ensuring clarity on loan terms, which is essential for maintaining family harmony.

-

Formalizing loans within families helps to delineate expectations and responsibilities, preventing potential disputes down the line.

-

Using a family loan agreement can have legal implications, including enforceability in court, should disputes arise.

Why should you use a family loan agreement?

Opting for a written family loan agreement over verbal arrangements promotes accountability and enhances transparency. It can also protect the financial interests of both parties involved, ensuring that all essential details are captured legally.

-

Written agreements provide a legal reference point, making it easier to manage expectations and enforce terms if necessary.

-

Having everything documented reduces confusion among family members, creating a clear framework for financial obligations.

-

An agreement can prevent misunderstandings and disputes that may arise from verbal agreements, often keeping family relationships intact.

What are examples of family loan agreements?

Below are types of family loan agreement templates as well as key elements that should be included in any agreement. Analyzing real-life scenarios can provide insights into how these agreements function in practice.

-

This template includes essential sections like loan amount, duration, interest rates, and repayment schedules.

-

Each agreement should specify the lender, borrower, loan amount, interest rates, payment methods, and any consequences of default.

-

For example, a brother may lend his sister $5,000 to start a business and create an agreement specifying a repayment period of two years.

How can you create a family loan agreement?

Creating a family loan agreement can be done in a few essential steps, ensuring everyone involved fully understands their rights and responsibilities. Using tools from pdfFiller can streamline this process.

-

Before finalizing any loan, assess the financial implications and how it may affect family dynamics.

-

Utilize pdfFiller tools to create your agreement, filling in essential details like the loan amount and specifying repayment terms.

What key terms should you define in your family loan agreement?

Defining specific terminology within a family loan agreement is essential for mutual understanding between parties. Clarity on these terms helps prevent future disagreements.

-

Clarifying who the lender and borrower are in the agreement can prevent confusion regarding responsibilities.

-

Clearly stating how much money is being lent and when repayment is expected is crucial for both parties.

-

Defining what constitutes a default on the loan and outlining the ramifications can protect the lender's interests.

What are the loan details and structure?

The structure of your family loan, including the loan amount and repayment terms, plays a critical role in ensuring satisfaction for both lender and borrower.

-

Carefully consider how much money is needed and how it aligns with the borrower's financial capabilities.

-

Understanding the intention behind borrowing money can inform the loan structure and repayment plans.

-

Defining a clear repayment schedule helps establish accountability and ease financial planning for both parties.

What are the best practices for managing family loans?

Ongoing management of a family loan agreement is crucial, and establishing best practices can make this process easier for both the lender and borrower. Regular communication and documentation can help maintain healthy relationships.

-

Keep lines of communication open, allowing both parties to discuss any changes or updates regarding the loan.

-

Employ pdfFiller's tools to manage and edit the loan document efficiently as circumstances change.

-

Always record any changes or amendments to the agreement, ensuring that both parties remain informed and protected.

What is the conclusion of a family loan agreement?

In conclusion, a Family Member Family Loan Agreement Template serves as a vital tool in facilitating financial arrangements between family members. By formalizing loans, families can ensure clarity, accountability, and legal protection for both parties involved. Whether creating a new agreement or managing an existing one, utilizing tools like pdfFiller can improve the experience significantly.

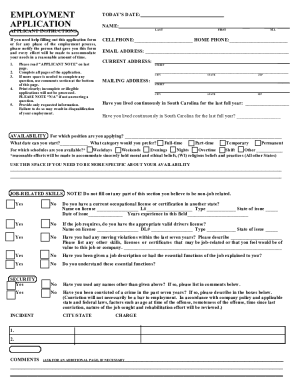

How to fill out the Family Member Family Loan Agreement Template

-

1.Download the Family Member Family Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller application.

-

3.Begin by entering the names and addresses of the lender and borrower at the top of the document.

-

4.Specify the loan amount in clear, bold text to establish the principal.

-

5.Outline the interest rate, if applicable, and indicate how often it will be charged (monthly, annually, etc.).

-

6.Determine the repayment schedule, including the start date and frequency of payments (e.g., monthly payments over a specified period).

-

7.Include any late payment penalties or conditions under which the loan should be repaid in full, such as a sale of property or changes in financial status.

-

8.Finalize the document by having both parties sign and date it at the designated space at the bottom of the agreement.

How do I write a loan agreement between families?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

Can you make a loan to a family member?

A family loan is a loan between family members. You could create a similar loan arrangement between friends, significant others or roommates. With this type of loan, it's up to you and the lender to decide how it's structured. A family loan can have interest or not and be repaid in installments or a lump sum.

How to write a contract with a family member?

Tips for Effective Family Contracts Use simple language and include visuals or charts to help them understand their responsibilities. Encourage Positive Behavior: Focus on positive reinforcement rather than just punishments.

How to write a promissory note for a family member?

To be thorough, a promissory note should include a core group of details: Total amount of money being loaned. Date of the loan. How the loan was delivered (cash, check, direct deposit) The name and address of the person loaning the money. The name and address of the person borrowing the money.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.