Family Member Loan Agreement Template free printable template

Show details

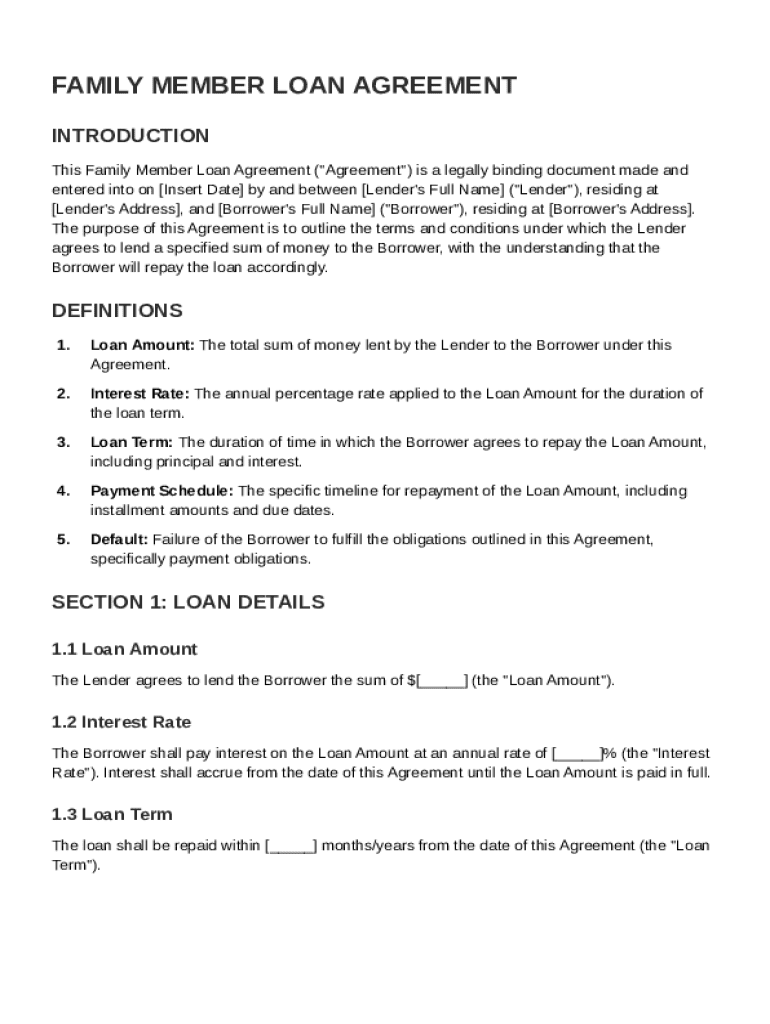

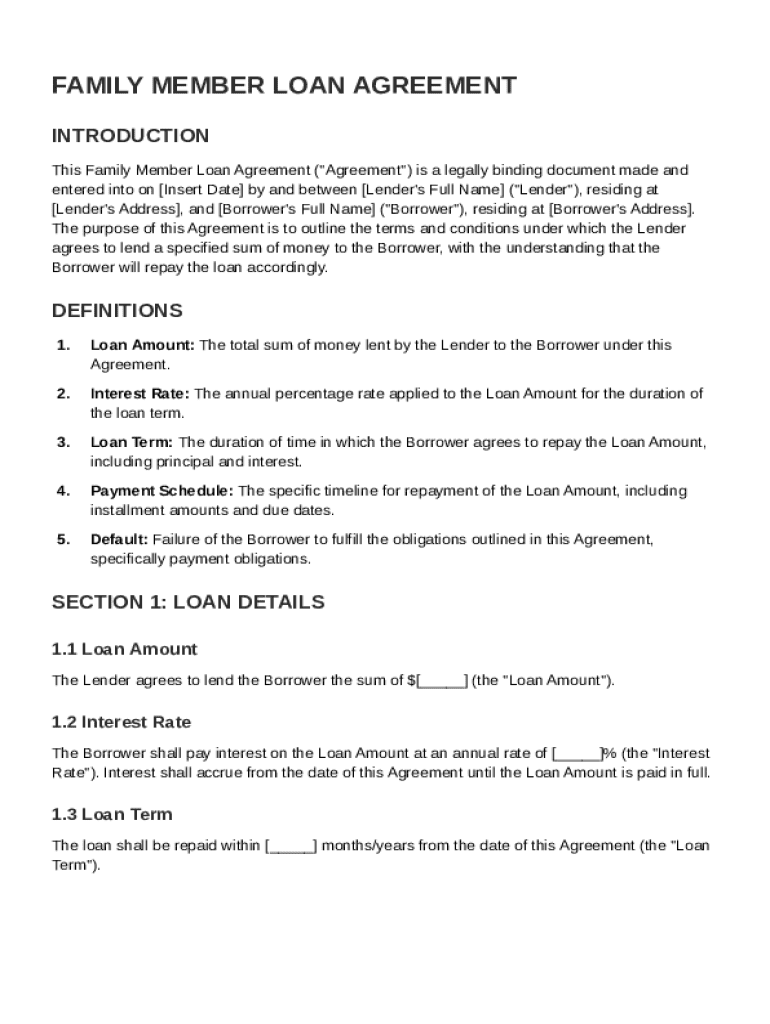

This document outlines the terms and conditions for a loan agreement between family members, detailing loan amount, interest rate, payment schedule, and default remedies.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Family Member Loan Agreement Template

A Family Member Loan Agreement Template is a formal document outlining the terms and conditions of a loan between family members.

pdfFiller scores top ratings on review platforms

PDFfiller helps me in most of my business correspondence with great accuracy.

Good experience with completing documents so far.

Excellent Application to do my contracts

Great program! Easy, effective and quick!

Exactly what I need to work with PDF docs

This is great for my property management ability as a landlord.

Who needs Family Member Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to Create a Family Member Loan Agreement Template Form

How do understand the Family Member Loan Agreement?

A Family Member Loan Agreement is a formal written document that outlines the terms of a loan between family members. This type of agreement is crucial, as it minimizes misunderstandings and establishes clear expectations for both the lender and the borrower. Without a formal agreement, leniency may lead to conflicts or financial strain on family relationships.

-

A Family Member Loan Agreement is a legally binding contract between two or more family members regarding loan terms.

-

Having a formal agreement helps protect both parties legally, ensures transparency, and reduces the risk of disputes.

-

While lending within families can foster trust and support, it may also create tension if repayment terms are not met or if the agreement is vague.

What are the key components of the Family Member Loan Agreement?

When drafting a Family Member Loan Agreement, it's essential to include specific components that will govern the loan. These components are critical for ensuring that all parties understand their rights and responsibilities.

-

Specify the total amount being lent to avoid any discrepancy.

-

Clearly outline if and how interest will be charged on the loan.

-

Define the duration of the loan, which sets expectations for repayment deadlines.

-

Detail how and when payments will be made, such as weekly or monthly.

-

Clarify what constitutes a default on the loan (e.g., missed payments, late payments).

How can create a Family Loan Agreement?

Creating a Family Member Loan Agreement is straightforward, especially with a template. Below you will find a step-by-step guide to help you effectively create this essential document.

-

Gather all necessary information such as names, addresses, and specific loan details.

-

Visit pdfFiller to download a Family Loan Agreement Template that you can customize.

-

Using editing tools, accurately fill in all relevant details of the agreement.

-

Discuss the terms openly with all parties to ensure everyone is in agreement and understands their obligations.

What considerations should have when lending money to family?

Lending money to family is not just a financial transaction; it can also significantly influence personal dynamics. Understanding these implications will help guide your approach.

-

Be aware of family dynamics, as lending money can create conflicts if not handled properly.

-

Review the legal considerations specific to your region, as laws surrounding personal loans can vary.

-

Consider how this loan could affect your relationship with the borrower, especially if problems arise.

-

Ensure the agreement is signed and dated to add validity and more enforceability.

How do fill out the Family Member Loan Agreement template?

Filling out the template correctly is critical to ensuring clarity and legality in the agreement. Here’s a breakdown of how to complete this document effectively.

-

Start by entering the lender and borrower details accurately to avoid confusion.

-

Enter the agreed loan amount and ensure both parties consent to it.

-

Fill in the interest rate according to previous discussions between the parties.

-

Select a loan term that is feasible for the borrower and acceptable for the lender.

-

Establish a payment schedule that works for the borrower’s financial situation.

How do manage the Loan Agreement?

Post-agreement, managing the loan is vital to avoid misunderstandings and ensure that the repayment process flows smoothly.

-

Regularly review the payment history to stay updated on any payments made or missed.

-

Utilize features from pdfFiller for reminders and updates to stay organized.

-

Be prepared with a strategy for late payments, including any late fee provisions.

-

Know your options for handling defaults amicably while maintaining family relationships.

How can finalize and sign the Family Member Loan Agreement?

Finalizing the Family Member Loan Agreement is essential to ensure that both parties are committed to the outlined terms. It involves several important steps.

-

Choose an electronic signature method that suits both parties, ensuring legality and security.

-

Make sure both parties retain signed copies of the agreement for their records.

-

Set a reminder to review agreements annually or if personal circumstances change.

How to fill out the Family Member Loan Agreement Template

-

1.Download the Family Member Loan Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by entering the names and addresses of both the lender and borrower in the designated fields.

-

4.Specify the loan amount clearly, writing it in both numerical and written form to avoid confusion.

-

5.Indicate the interest rate (if applicable) and repayment schedule, detailing the due dates for payments.

-

6.Include any additional terms or conditions that both parties agree upon, such as late fees or prepayment options.

-

7.Review all entered information for accuracy and completeness before finalizing the document.

-

8.Once satisfied, save the document and share it with the other party for their review and signature.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.