Family Memberfamily Loan Agreement Template free printable template

Show details

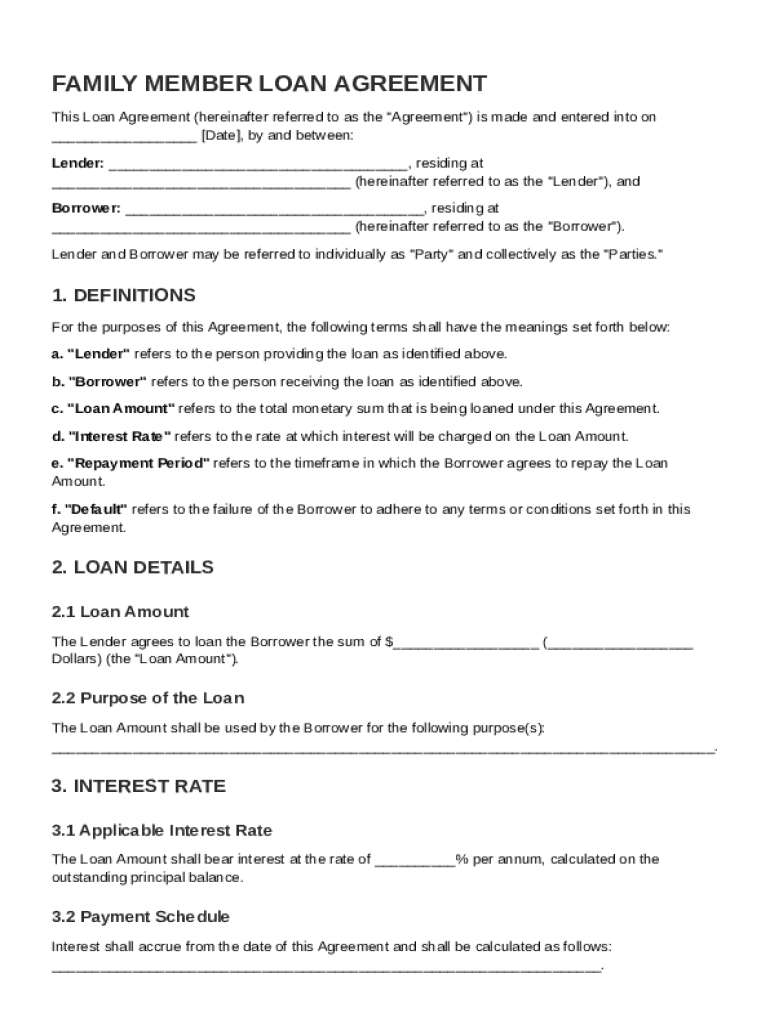

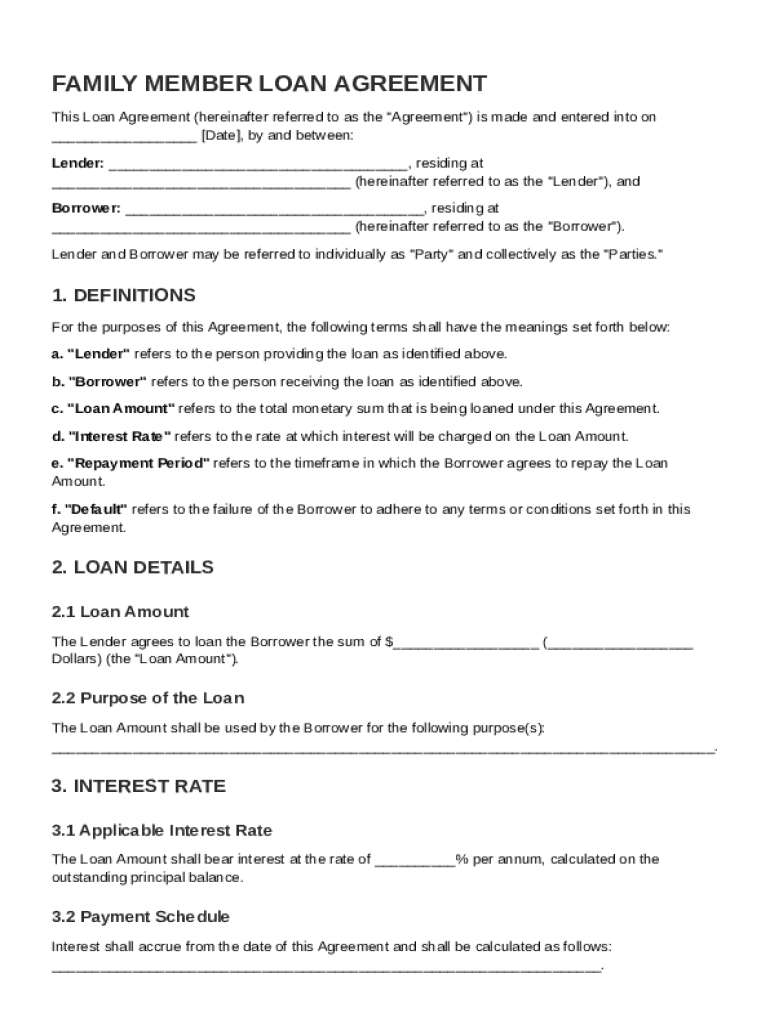

This document outlines the terms and conditions for a loan agreement between a lender and a borrower, including definitions, loan details, interest rates, repayment terms, default clauses, governing

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Family Memberfamily Loan Agreement Template

The Family Member Loan Agreement Template is a legal document designed to outline the terms for loaning money between family members.

pdfFiller scores top ratings on review platforms

N/A

all in one tools that i needed for my daily activity

Looks good program

It is a little confussing but I am new user

Great program

Great program, easy to use

Anna was very helpful in resolving my billing issue

Anna was very helpful in resolving billing issue. She was immediately responsive to my inquiry and I will definitely recommend PDF Filler friends and colleagues! Thank you very much.

so far so good

so far so good

Who needs Family Memberfamily Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Family Member Loan Agreement Template: A Comprehensive Guide

How to fill out a family member loan agreement form

To fill out a Family Member Loan Agreement form, start by defining the roles of the lender and borrower, followed by detailing the loan amount and interest rate. Establish a repayment period and include any conditions relevant to the agreement. Finally, ensure both parties sign the document and store it securely for future reference.

What are family loan agreements?

A Family Loan Agreement is a formal document that outlines the terms and conditions of a loan between family members. This agreement is significant because it provides clarity on expectations and helps prevent misunderstandings that could strain familial relationships.

-

Defines the amount being borrowed, interest rates, and repayment plans.

-

Provides a legal basis for resolving disputes if they arise.

What are the key components of a family loan agreement?

Understanding the key components of a Family Loan Agreement can notably enhance its effectiveness and reliability. This includes defining each role clearly, outlining the loan amount and specifying interest rates and repayment terms.

-

Identifies the lender and the borrower, including their legal names and contact information.

-

Specifies the exact dollar amount being loaned.

-

Indicates whether the loan will involve any interest charges and at what rate.

-

Establishes how long the borrower has to repay the loan.

How does a sample family loan agreement look?

A sample Family Loan Agreement typically features a structured layout outlining all necessary sections with clearly defined terms. Including sample language for each component can also be useful for those drafting their own agreements.

-

Usually includes a heading, parties involved, loan terms, and signatures.

-

Provides standard phrasing that can be modified according to specific needs.

-

Ensures that all terms used in the agreement are explicitly defined.

What are the steps in navigating the loan process?

Navigating the loan process can be straightforward if you follow a structured approach. By assessing the needs and risks, drafting the agreement, finalizing terms, and ensuring proper archival of the document, you can make the process smoother.

-

Evaluate potential benefits and risks before engaging in family lending.

-

Create a detailed and legally sound loan agreement.

-

Confirm that both parties agree on all terms before signing.

-

Ensure the document is signed and stored securely.

How to review a family loan agreement?

Reviewing the agreement before signing is crucial for avoiding future disputes. Utilize checklists to ensure all terms are in order and consider recommendations for enhancements.

-

Review all terms and ensure they match verbal agreements.

-

Utilize document tools for potential edits and improvements.

-

Be aware of local laws to ensure the agreement is compliant.

What should you know about repayment terms?

Repayment terms are essential in any loan agreement as they define how and when the borrower will pay back the loan. Structuring payment schedules can further elucidate expectations.

-

Consider options for weekly, monthly, or quarterly payments.

-

Clarify what constitutes a default and the potential consequences.

-

Use methods for tracking payments to maintain transparency.

How can pdfFiller help with family loan agreements?

Using pdfFiller can simplify the drafting and management of family loan agreements. This platform offers tools to create, edit, and securely eSign documents while facilitating collaboration among family members.

-

Utilize pdfFiller’s tools to create a polished loan agreement.

-

Provides a secure method for all parties to sign the agreement.

-

Encourage open communication and adjustments among family members.

How to fill out the Family Memberfamily Loan Agreement Template

-

1.Open the Family Member Loan Agreement Template in pdfFiller.

-

2.Start by entering the names and addresses of the lender and borrower at the top of the document.

-

3.Specify the loan amount in the designated section, ensuring that it is clearly marked.

-

4.Include the interest rate, if applicable, and explicitly state whether it is a fixed or variable rate.

-

5.Next, provide the repayment schedule, including payment dates and methods.

-

6.Include any collateral, if required, by detailing it in the appropriate section.

-

7.Review the terms and conditions section; modify it as necessary to suit both parties’ agreements.

-

8.Once all information is filled in, carefully review the entire document for accuracy.

-

9.After confirming all details are correct, have both parties sign the document at the bottom.

-

10.Finally, save the completed document and provide a copy to both the lender and borrower for their records.

How do I write a loan agreement between families?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

Can you make a loan to a family member?

A family loan is a loan between family members. You could create a similar loan arrangement between friends, significant others or roommates. With this type of loan, it's up to you and the lender to decide how it's structured. A family loan can have interest or not and be repaid in installments or a lump sum.

How to write a contract with a family member?

Tips for Effective Family Contracts Use simple language and include visuals or charts to help them understand their responsibilities. Encourage Positive Behavior: Focus on positive reinforcement rather than just punishments.

How to write a promissory note for a family member?

To be thorough, a promissory note should include a core group of details: Total amount of money being loaned. Date of the loan. How the loan was delivered (cash, check, direct deposit) The name and address of the person loaning the money. The name and address of the person borrowing the money.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.